Irrational Market Optimism and the Week Ahead | Daily Market Analysis

Key events:

- Australia – Retail Sales (MoM) (Oct)

- Eurozone – ECB President Lagarde Speaks

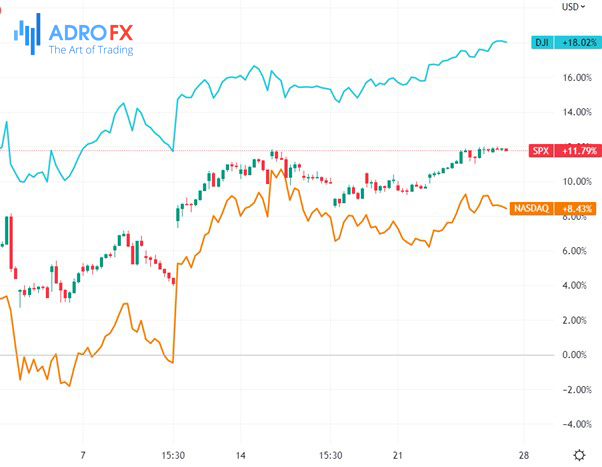

Despite the fact that it was a holiday week in the USA, the Dow Jones index rallied further into new multi-month highs, even topping its previous high of 34,282 on August 16. The S&P and NASDAQ were also up rather nicely last week, but neither made it past their highs of the prior week and are still well below their prior primary cycle highs of mid-August. If the latter two indices fail to surpass their highs of November 15, it would signal an intermarket bearish divergence in the reversal zone.

Similar divergences have been seen in other global equity indices. In Europe, the German DAX climbed to its highest level since early June. However, the Zurich SMI, Dutch AEX, and London FTSE are still below their August highs.

In Asia & Pacific, the leader was India's NIFTY, which soared to 18,534 on Friday, November 24, very close to its all-time high of 18,604 set on October 19, 2021. But not so in Japan, where the Nikkei rally missed its high of August 17 and neither the Shanghai Composite nor the Hang Seng made its highs of the prior week. China continues to lag the rest of the world's indices in its relentless struggle to control COVID through lockdowns. This struggle is hurting the country's economy and, as a result, causing economic problems for other countries around the world as well.

In other markets, the collapse of the FTX cryptocurrency exchange continues to have a strong impact on the cryptocurrency universe. the cryptocurrency crisis continues, with bitcoin falling to a new two-year low of 15,479 last week and Ethereum holding above its November 10 low of 1071. Both cryptocurrencies are holding on to these support zones, but are not yet able to rise above resistance zones.

The week ahead is full of economic data releases. First up today is Reserve Bank of Australia Governor Philip Lowe, who is scheduled to testify before the Senate Economic Legislation Committee in Canberra.

Australia will start today with the October retail sales report. The Eurozone publishes data on private loans to companies. The UK follows with CBI trade volume data for November.

Canada opens North America with Q3 current account data. In the U.S., the November manufacturing activity index from the Dallas Fed comes out.

Other important economic data coming out this week: the Australian Consumer Price Index, Canada's Q3 GDP and employment report, U.S. ISM manufacturing index, personal income and spending, Q3 revised GDP, Beige Book summary of current economic conditions, ADP private sector employment, and finally, U.S. Non-Farm Payrolls, Unemployment, and Wage data.

After falling for much of last week as speculative longs declined, the U.S. dollar went back up early in Asian trade as risk appetite waned. Further declines in Chinese industrial profits between January and October due to increased outbreaks of disease amid new virus restrictions in many cities, including plant closures, dampened economic activity. The risk-off stance in Asia is expected to persist today, with markets keeping a watchful eye on developments in the world's second-largest economy. The U.S. dollar is expected to remain on the plus side, maintaining its advantage over all competitors.