Ichimoku Trading Guide — How To Use The Ichimoku Indicator

Even novice traders, let alone professionals have heard of Ichimoku, but not everyone uses it and not that often, although the indicator is included in many programs for analytical trading.

In fact, it is one of the most effective and multifunctional indicators that is meant to determine the price movement, support/resistance levels, and trend zones. So, today we will dive into the Ichimoku indicator: learn how to interpret its readings and apply that information to trading.

A Little Bit of History

Ichimoku was created by a Japanese journalist and economist under the pseudonym of Sanjin Ichimoku. Conversion line - his invention, one of the methods for analyzing charts. The author devoted 7 years of work to its development and improvement. Throughout this period, Ichimoku gathered the experience of economists around the world.

Recall that this was the era of the '70s. At that time there were no computers, not even electronic calculators. This makes the product's innovation even more evident. Initially used to predict the Nikkei 225 index on the Tokyo stock market, in time it became actively used on other exchanges around the world, as we can see even now.

The term Ichimoku is the property of the Japanese Economic Research Institute, an officially registered trademark. By the way, the institute nowadays is managed by the descendants of the late journalist, talented economist, and creator of the Ichimoku indicator.

The author himself called the method the equilibrium chart, and despite the apparent complexity, in practice, it is quite easy for an experienced trader to use. One look at the chart is enough to make the right decision.

Ichimoku Indicator Description

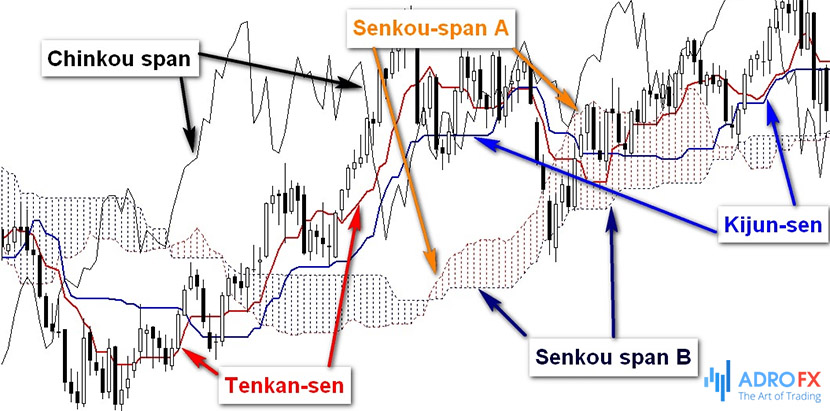

Ichimoku can be called a trend indicator, it is quite complex, it consists of lines, each of which is itself an indicator that marks the middle of the price range over a period of time.

Roughly speaking, the Ichimoku indicator is a set of combinations of indicators with different types of approaches to the analysis of price movements. Each line divides the price range into equal parts in a separate time interval. That is, the line indicates the boundary of the strength of "bears" or "bulls" in the market.

To measure the parameters traders use two pairs of intervals, different in length. The lines forming the indicator are based on each of them:

1. Tenkan-sen is a reversal line. It shows the average price value for the first time interval in the settings. Being a short-term trend line, it shows a "fast" trend and the current direction of the short-term trend. To draw the Tenkan-sen line, the last nine (by default in Metatrader) candlesticks (bars) of the chart are used, or to be more precise, the local maximum and minimum of this period. The average value of this price range is the point of the Tenkan-sen line for the current candlestick.

The line Tenkan-sen performs the role of a trend line. If it is moving up, it indicates that the market is in an uptrend; if it is moving down, it indicates that the market is in a downtrend. If the line Tenkan-Sen is parallel to the time axis (moves horizontally sideways), then most likely the market is in a flat condition. Also by the slope angle of the line "Tenkan-sen" is possible to determine the strength of the trend.

It is calculated by the formula:

Tenkan-sen=(Max(High,N)+Min(Low,N))/2

where,

Max(High, N) - the highest price for a period, equal to N intervals (candlesticks, bars)

Min(Low, N) - the lowest price in the period of N - intervals (candlesticks, bars)

N - period length (number of candlesticks, bars).

2. Kijun-sen is the main line. It shows the average price value for the second time interval in the settings. It is a long-term trend line, which is plotted on 26 (by default) candlesticks (bars). The formula for calculating this line is similar to the Tenkan-sen line, but because of the larger range, the Kijun-sen line is shifted to the right and looks smoother.

Kijun-sen shows longer price trends. In low time frames, the price seldom reaches the Kijun-sen line. For this reason, it is often used as a Stop Loss reference point.

It is calculated by the formula:

Kijun-sen = (Max(High,M)+Min(Low,M))/2 M - period length

3. Chinkou Span is a lagging line (green line). This line shows the closing price of the current candle and is shifted along the time axis by the number of candlesticks equal to the time period of the Kijun-sen indicator (by default, 26). There is no need to set parameters for it in the settings of the Metatrader trading terminal because the program calculates them automatically from other set parameters.

We can say that Chinkou Span repeats the movements of the price chart. The fact that this line is a more independent unit and does not depend on other trend lines of the indicator Ichimoku Kinko Hayo, gives it some advantages and the ability to build an independent trading system based on its intersection with the price chart.

It is calculated by the formula:

Chinkou Span = Current Close, shifted backward by M

4. Senkou Span A (Up — this is the leading line. It reflects the midpoint of the distance between the Tenkan-sen and Kijun-sen and is shifted forward on the time axis by the number of candles, equal to the time period of the Kijun-sen indicator. It is not set in the settings of the Metatrader trading terminal, because the program calculates it automatically. Senkou Span A line is the upper boundary of the "cloud". It often acts as a support or resistance level.

It is calculated by the formula:

Senkou Span A = (Tenkan-sen+ Kijun-sen) shifted forward by M intervals

5. Senkou Span B (Down Kumo) is a leading line. This line reflects the average price value for the third time interval in the settings and is shifted forward on the time axis by a certain number of candlesticks (bars). The Senkou-Spin B line is the lower boundary of the cloud. It often acts as a support or resistance level and often serves as a level for setting Stop Losses.

It is calculated by the formula:

Senkou Span B = (Max(High,Z)+Min(Low,Z))/2, shifted forward on M intervals

Z – interval length

The method for drawing Senkou Span B is identical to the principle of calculation and construction of Tenkan-sen and Kijun-sen lines, but in contrast to them, the line Senkou Span B has the longest period equal to – 52.

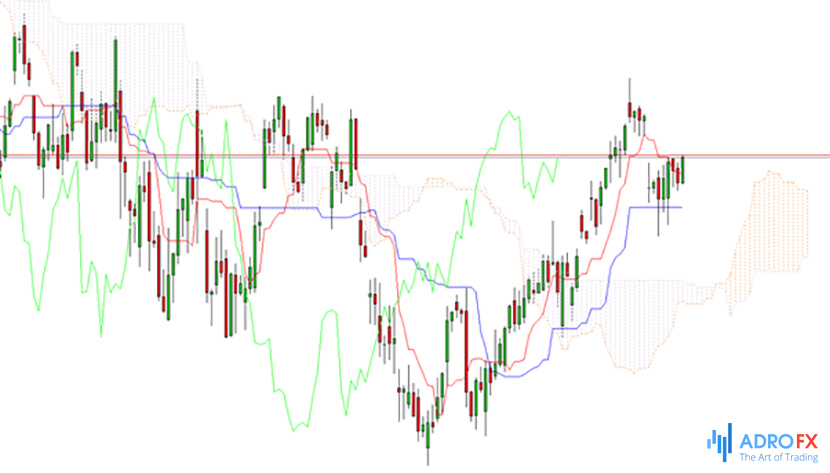

The lines Senkou Span A and Senkou Span B form a "cloud" (in Japanese: "Kumo"), which changes color when crossing these lines. The distance from one edge of the cloud to the other is usually shaded by lines, at that Senkou Span A and Senkou Span B lines form support and resistance levels.

By the position of the price chart relative to the "cloud" you can determine the market situation:

- if the price chart is above the "cloud" — then the trend is bullish (upward), with the upper line of the "cloud" forming the first support level, and the lower line forming the second support level.

- if the price chart is below the "cloud" — the trend is bearish (downward), thus the lower line of the "cloud" forms the first resistance level, and the upper one — is the second resistance level.

- If the price chart is directly inside the "cloud" – then the market is flat (sideways).

In Japanese, the term Senkou Span means "running ahead". Therefore, it is not difficult to understand that the way the "cloud" is built by the lines Senkou Span A and Senkou Span B allows forecasting the price behavior for some periods ahead. For example, the width of the "cloud" shows the market volatility and, correspondingly, the strength of the current trend. The price more often bounces off the broad "cloud", whereas a narrowing "cloud" shows the reduction of interest in the trend and its possible reversal.

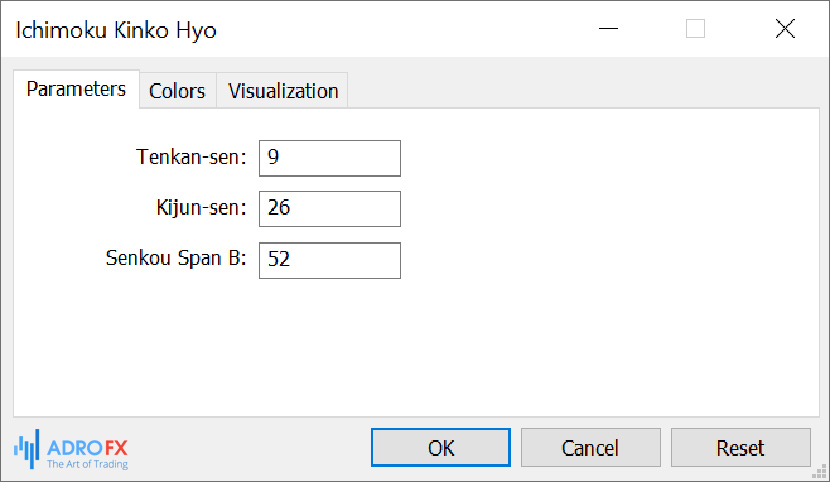

The number of – N, M, and Z specified by the author for use is 9, 26, and 52, respectively. These indicator parameters are set by default in Metatrader 4.

The Ichimoku Cloud

The space between Senkou Span A and Senkou Span B is called a cloud. On a chart, it is usually shaded blue when B is above A or red when A is above B.

If the price is in the cloud, there is no trend.

Depending on the state of the market, the boundaries of the space represent resistance or support levels. The price line below the Ichimoku cloud means that the limits form the first and second resistance levels. If it is above it, then they are, correspondingly, support levels.

By the way, initially, the author of the indicator recommended using the indicator on the candlestick chart, and the signals from the indicator and from the Japanese candlesticks and their patterns together to use in trading. This gives unquestionable advantages in trading.

Ichimoku Periods

Three different time periods are used to construct the indicator:

Long (t l ) – equal to 52 periods.

Middle (t m ) – 26 periods.

Short (t s ) – 9 periods.

In the opinion of the tool's creator Sangin Ichimoku, such a duration of periods is optimal for Nikkei when trading on weekly bars.

Many analysts think that this ratio is close to the optimal one for most other markets and time frames. However, a trader may choose any other variant that is more convenient.

How to Set Up the Ichimoku Periods

The periods of the 3 Ichimoku lines are of great importance:

Senkou Span – 52 in the classic version, as there are 52 weeks in a year.

Kijun-Sen – 26 (correction or pullback on the market is often half a wave).

Tenkan-Sen – 9: this number is derived empirically based on many years of calculations by the discoverer. The parameter reflects short-term price movements, so it can be used to suggest the formation of a local trend and the correction of the cryptocurrency price.

The classic variant "9-26-52" is mainly used for weekly forecasts, when traders analyze higher time frames D1, W1, and M1, i.e. daily, weekly and monthly. However, such trading strategies will not suit all.

Therefore, it is allowed to use Ichimoku with other periods:

"2-24-120": Applied to low time frames from M1 to M30. Suitable for scalping strategies, i.e., getting small profit by means of many market entries during the day (on small trends and pullbacks).

"24-60-120": Applied to M30 and H1 time frames. These are slower cycles, which allow you to make several entries per week. There are days when it is impossible to open a position, so it is worth either waiting for the next trading session or moving on to consider lower time frames.

"120-240-480": Used on H1 and H4 intervals. These are medium-term strategies (both intraday and over several consecutive days).

Beginners are advised to start with the classic combination of "9-26-52", and then adjust the values to the particular strategy. It should be preliminarily tested on a demo or cent account.

Ichimoku Indicator Readings

Indicator Ichimoku generates fairly accurate signals to buy and sell, but the interpretation of signals requires proven skills.

Ichimoku signals may be relatively weak or strong. To the weak signals we can refer to the crossing of the price and the cloud lines, for example, when the price enters the cloud zone - for some traders, it is a signal to quickly open a position. A strong signal is when price breaks out of the cloud, which signals the start of a new trend, at which point traders recommend opening a position as quickly as possible.

As for specific signals, for example, when the line Tenkan-sen crosses Kijun-sen from the bottom upwards, it is regarded as a signal to buy (pattern of "Golden Cross"). If Tenkan-sen crosses Kijun-sen from top to bottom, it is a signal to sell (pattern "Dead cross"). This type of indicator signal is considered weak and it is not recommended to react to it for novice traders. But it is believed that it is advisable to buy when prices are below the cloud and to sell when prices are above the cloud.

The crossover of Senkou Span lines is a strong signal; it shows that a trend change is approaching. The breakout of the Senkou Span B line by the price chart is also a strong signal, which shows a high probability of approaching a new long-term trend. An important signal of the indicator is the so-called "three lines signal", which is interpreted as a signal of a missed trend start. Within the "three lines" signal, the price chart, Tenkan, Kijun lines, and the cloud from top to bottom are lined up consecutively.

The order of the lines can accurately confirm the direction and strength of the trend, for example, lined up sequentially, one-way lines: price, Tenkan-sen, Kijun-sen, Senkou Span B, – confirm the uptrend, which is a signal for buying. The reverse order confirms the downtrend and is a sell signal.

Chinkou Span signals are quite rare and strong, for example, if Chinkou Span crosses the price chart from top to bottom, it is likely to form a downtrend, if the line crosses the price chart from bottom to top, it may be a signal of an uptrend.

Despite the complexity of the Ichimoku indicator, the number of signals it gives is limited, so you can learn to identify them quickly and with minimal errors over time. Virtually any of the signals from the Ichimoku indicator can become the basis for a separate forex trading strategy.

Ichimoku Trading Strategies

There are a number of peculiarities that must be considered when implementing strategies based on the Ichimoku indicator. Particularly, the Ichimoku indicator works optimally in high time frames, it shows too many signals in lower ones.

The Kijun and Tenkan lines crossover rather accurately predicts the price movement direction. The line Chinkou performs the role of confirming when the crossover of the Kijun and Tenkan lines occurs. The strength of the trend is confirmed by movement out of the Ichimoku cloud, i.e. breakout of support and resistance lines, and increases the probability of a profitable trade. The cloud breakout strategy is based on the price position towards the cloud - if the price is above the cloud at the close, an uptrend is formed, if it is below it, a downtrend is formed. This strategy implies working with a distinct trend.

You enter the trade when the price closes and open a trade in the direction of the price movement that breaks out of the cloud. The main difficulty when implementing the strategy is to identify the exact signal, the trend direction, and the optimal moment to enter, you can use the Chinkou Span line for this. To work on a breakout strategy, it is necessary to set Stop Losses at the points where the trend is expected to end. When the price reaches the Stop Loss, perhaps the trend changes direction and you need to rearrange your Stop Loss or exit the trade.

Even though Ichimoku is an informative indicator, some strategies are implemented with the help of additional indicators. For example, Stochastic allows preventing trades when Ishimoku detects a trend too late.

Stochastic is an indicator showing the position of the current price to prices for a certain period of time in the past. When working with Stochastic, short positions are opened when the Ichimoku lines line up in order: Kijun — Tenkan price, when the price breaks out the cloud line, and Stochastic readings are not in the oversold area.

Also, the Awesome Oscillator, one of Bill Williams' indicators, is used with the Ichimoku, it measures the trend strength. It is plotted on the chart as a histogram with green and red bars.

Accordingly, to open a buy order, the oscillator should be above the zero line, and the column should be green, but only when the candlestick closes above the upper line of the Ichimoku cloud.

An order to sell is opened when the candlestick closes below the cloud, at that the Awesome Oscillator column must be red and located below the zero line. In the implementation of this strategy, we should pay attention to the crossover of Tenkan-sen and Kijun-sen, — it is not recommended to open a position if there is one.

The strategy on the intersection of Senkou Span lines takes into account the location of the lines to the cloud. Follow the crossover line Senkou Span A line Senkou Span B. If the crossing is directed from the bottom up, then the trend is upward, if crossing from the top down, then the trend is downward. The direction of the trend should be set before the crossover, that is, it has a confirming character.

The probability of the desired result is higher when the price is placed on the cloud side, in the direction of the crossover - this is a strong signal. If the price is placed on the side of the cloud opposite to the direction — this is a weak signal, you should be cautious when implementing the strategy. If the price is placed inside a cloud, it is a stronger signal, and trade forecasts can be quite good.

Conclusion

The Ichimoku indicator is a complex tool, which shows a large number of signals, allowing it to determine quite accurately the direction and strength of the trend, the dynamics of the price, to show entry and exit points.

It is not the most popular indicator, because it is difficult to understand and is meant for high time frames, but it has a stable group of followers successfully implementing this indicator in trading.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any trader's needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all of the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.