How to Learn to Trade Forex (from 0) - Forex Education for Beginners Part I

If you have decided to try your hand at trading, you first need to know how to learn how to trade forex from scratch. There are many pitfalls in trading, and claiming that it is easy money is not right at all. But if you are ready to learn how to trade the currency market, and you are not just looking for a new game, then a chart with quotes will bring you profit.

The main thing is to take this kind of earnings seriously, and learning to work on the forex market is sure to give a positive result.

Forex is the largest financial market - now the daily volume of currency trading can reach 7 trillion US dollars. This figure is growing every year. It is not possible to take them all, but you can try to take your bit, but you have to learn how to earn on forex.

What You Need to Trade Forex

From the very beginning of your trader's journey don't set unrealistic goals. There are a lot of ads on the Internet saying that you can make $10,000 a month from $100. It is possible, but not at once. Learning forex trading will take more time. If in the process of learning you can keep your deposit with minimal deviations in any direction - this is very good. Of course, be prepared for the fact that there may be losses. This is normal! There are no traders in the world who trade without losses. The main thing is to learn to draw certain conclusions.

Trading is risky, and that is why every professional trader will never take a loan for trading, no experienced and adequate trader will sell an apartment to replenish a broker's account. Successful traders withdraw their profits and invest in real estate and other projects, creating a financial cushion and passive income sources.

There is no need to linger on the training virtual accounts. It will become a toy for you, and it won't bring any real money. What beginner traders don't realize is that they treat a real account and a demo account differently. When a demo deposit is playfully increased by 10 times, you will deposit real money, but the result is unlikely to be repeated.

Take learning to trade forex online as seriously as possible. This is not a game, but a serious kind of earning, which you need to study. We all understand that to get a college degree you need to study long and hard, but for some reason, everyone wants everything at once.

If you approach trading wisely, you can expect that some profit will be waiting for you long after you learn how to trade forex.

Forex Trading Guide

It is important to understand that learning to trade forex is not about learning how the terminal works - the technical part, where it all comes down to opening a currency pair chart, specifying the volume, and clicking Buy or Sell.

Learning forex trading should not be about how to open trades, but about when to open, on which currency pair, and most importantly, what direction to trade at the moment.

As you understand, learning forex is very conditional, because knowing when and what to buy is a daily workflow - analytics and market forecasting. That's why it's considered that learning to trade forex lasts a lifetime. It would be more correct to call it not learning, but research, because market situations often do not repeat themselves and there are always new facets.

This is the reason why there are no faculties or professional courses because the market changes every day.

If someone is going to teach you on current data - they are not just going to teach you, they are going to work at the same time. In fact, every trader can teach someone by showing them how they work and research the market.

Start learning to work on the forex market on your own, it is not necessary to attend courses or learn from trainers because all work on the currency market comes down to studying and predicting quotes on your own. This is how you can gradually start earning.

Learn to Trade Forex: Where Do You Start?

To systematize, you need to learn how to analyze the market. There are two types of analysis - technical and fundamental.

The phrase "technical analysis" you will meet frequently. It can also be referred to as "graphical analysis". This type of analysis only examines the price chart itself and uses past prices to predict future ones. This includes tools such as:

- Indicators;

- Candlestick patterns;

- Chart patterns.

Most often, these methods overlap and combine.

Education in forex trading is mainly focused on technical analysis, but there is also a fundamental analysis. It is often forgotten, but it is better not to do so. Fundamental analysis means working not with the chart itself, but with the factors that can influence its behavior. The main one of these factors is economic news.

Changes in the direction of trends are constantly occurring in the market, and the main task of the trader "jump into" this trend at the earliest stage of its formation.

This seems to be a simple task, especially when you are looking at the history of the chart. Only during real trades, you cannot be sure for sure that this is the very moment when a new trend starts or when it is a continuation of an existing trend. In order to determine these moments, indicators are used.

Indicators

Indicators are special algorithms and show auxiliary lines. They help the trader to most effectively analyze the chart changes in currency pairs quotes.

It is worth noting that the trading terminal already has several dozens of built-in indicators, allowing you to immediately start working.

Everything is simple - in the trading terminal, you choose the indicator that will be displayed on the chart. Each indicator works differently, but the essence is the same - to show the critical moments when the price changes its trend.

All indicators can be roughly divided into three main categories:

Inertial (oscillators). Their task is to measure the size and speed of quote fluctuations. These indicators are displayed at the bottom of the chart in a separate window. The leaders in popularity: the Relative Strength Index (RSI), Momentum, and several types of Stochastics.

Volumetric. Their purpose is to inform a trader about the volume of trading deals on the market.

As a rule, they are used as a filter for strong oscillator signals. The Volume and Open Interest indicators provide the clearest signals.

Trend indicators. Indicators show the presence or absence of strong market price movements.

The most famous indicator is considered a Moving Average. The MA indicator is set by default in the trading terminal.

For example, one of the strategies, is two moving averages with length settings of 5 and 20 are opened. The intersection of the indicator lines on the chart will signal the beginning of the change in the trend, and that is when you should open trades:

The first crossing on the chart says that you can open a long position (place a Buy order).

A long position means buying, because growth in the market is not limited, unlike the fall. Therefore, buy trades are known as longs, and sell trades are known as shorts. This slang comes from the stock market, where the stock price cannot fall below zero, so the fall in price is always limited.

Chart Patterns

Patterns, formed by the movement of prices on the chart, are the basis of technical analysis of the forex market. Studying the history of price behavior, experts noticed how it regularly repeats the direction of movement, after the formation of certain shapes on the chart. The relationship began to be studied carefully and a theory about three types of figures appeared:

- Signaling the continuation of the current market trend;

- Signaling of the soonest reversal of the price movement;

- Signals of market uncertainty before a strong move begins.

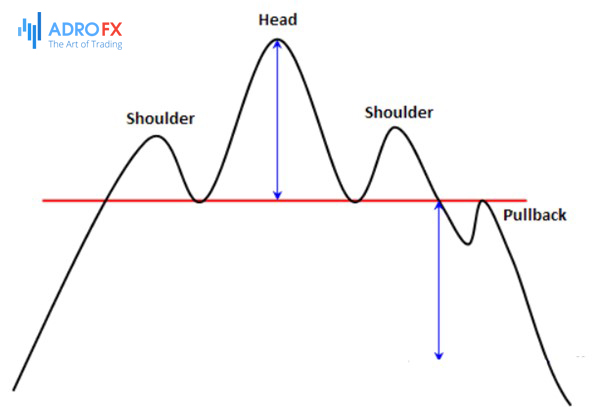

U-turn patterns warn of an imminent change in trend. The strength of the price movement decreases and doubts arise in the market. In most cases, the appearance of reversal patterns is followed by a sharp change in the price chart movement on the opposite. Examples: "Head and shoulders", "Murphy's saucer", "Spike" and "Double top".

Patterns of continuation of the price movement trend confirm that the trend that existed before the formation of the pattern will continue. The "Flag" pattern is a perfect example of it.

Japanese Candlesticks

The Japanese candlesticks became a popular method of charting the price movements in the market long ago. For example, in the screenshot above with the flag pattern, the price is depicted not as a line, but in Japanese candlesticks.

This graphical image was first used in the market by a Japanese exchange specialist, who traded rice. Each candlestick has an interval of a minute (or 5 minutes, 15 minutes, or an hour - as the trader chooses). The opening and closing positions form the body of the candle - the rectangle itself, and the values of the maximum and minimum of its shadow - the pins at the top and bottom. White or green candles mean growth, that is, the closing price of the candle is higher than the opening price. Black or red candles mean the opposite.

Over time, traders began to notice patterns in the behavior of prices, after the formation of several combinations of candles. Candlesticks became an integral part of technical analysis, forming an entire direction - the candlestick analysis.

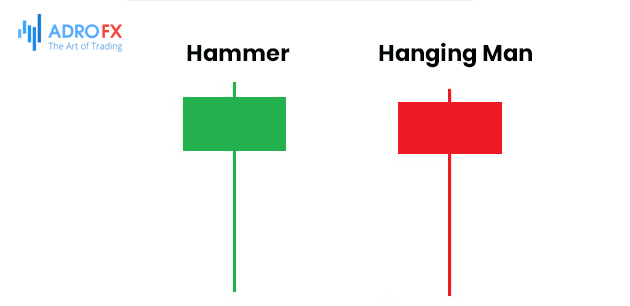

The most distinctive patterns which give traders a signal of good entry points into the market are the "Hammer" and "Hanging Man" candlesticks.

This signal consists of just one candle with a small body and the longest shadow on one side. If it is formed in a downtrend, it is a "Hammer" candlestick, and if it is formed in an uptrend, it is the "Hanging Man" candlestick. Both figures indicate that the forces that are pushing the trend have been exhausted. A bounce, correction, or complete change of trend is waiting for the price, at least.

Understanding Forex Trading Strategies

Before you start trading forex online, you need to identify and study the main working strategies. Most of them are a combination of patterns, candlesticks, and indicators. Thus, there is a clear filtering that sifts out a lot of false signals.

By combining different signals and patterns, it is possible to identify a full-fledged trading strategy.

It is worth saying that a trading strategy is a specific sequence of actions, in which orders are opened and closed. This can also include the rules of financial management when you control the volumes (amounts) of orders and do not exceed the norms.

Strategies depend on your trading style, if you like to trade within the day, then you will open a chart with a time frame of 1 minute to 30 minutes, these are the values that will be assigned to each candle on the chart or to a segment of time.

You can combine the indicators of different types of indicators on the chart, such as the Bollinger Bands and the CCI indicator:

When a price moves out of a channel boundary, it means that it should move back into the channel. The CCI indicator helps to avoid false signals and indicates when it is time to open a trade.

Trading times, trade timing, closing moments, and fundamental analysis can be entered into the strategy elements.

Summary

In conclusion, forex trading is a profitable venture that requires patience, discipline, and continuous learning. As a beginner trader, it is important to approach trading with a realistic mindset and avoid unrealistic expectations. Learning how to trade forex requires an understanding of technical and fundamental analysis, as well as the use of indicators to identify critical moments when prices change trends. The forex market is constantly changing, and it takes a lifetime of research and analysis to master it. Therefore, new traders should take the time to learn and not treat forex trading as a game. With the right approach, one can expect to make a profit from trading forex.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.