How to Use Momentum Indicator

One of the key concepts of technical analysis is a trend. Many strategies are based on determining where the market is moving and whether it is at the beginning or the end of that process. Such information is extremely useful for the trader. The likelihood of the continuation of the trend can be predicted by evaluating the intensity of trading. The strength of the market movement is often referred to as momentum, and there are several indicators created to determine it. One of them is Momentum, and today we will learn about its readings, settings, and application in forex trading.

What Is a Momentum Indicator?

The Momentum indicator is one of the simplest, most obvious, and most popular tools of technical analysis in forex trading. It represents just one curve line on the price chart that shows the speed of price change and can be used to determine the direction of the trend. At the same time, it smoothes out the volatility indicators a little.

Since Momentum does not imply averaging, this indicator shows synchronous dynamics with the price and can be leading, but not always. The tool is more effective in high time frames.

Momentum is displayed in a separate window below the chart, that is, it looks like an oscillator. It is measured in levels from 0 and 100, practically, it is a percentage that shows the ratio of the current price to the price of the previous one. The standard period for calculation is 14. If the period is more than 20, the indicator can be used as a trend indicator.

The Momentum Indicator in MetaTrader 4

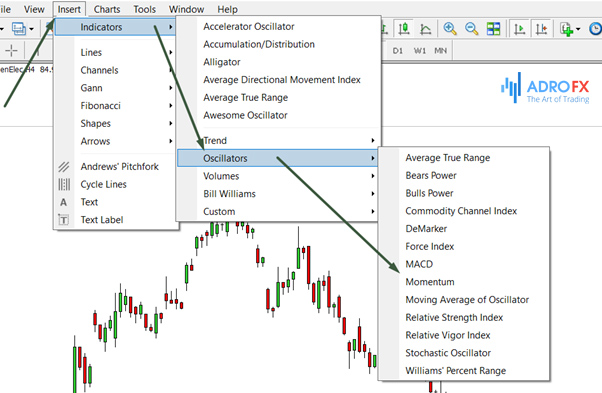

The Momentum indicator is available on all major forex terminals. It is optimal to install it with the Moving Average to determine the signals more accurately. In the MT4 trading terminal Momentum is placed in the section of indicators:

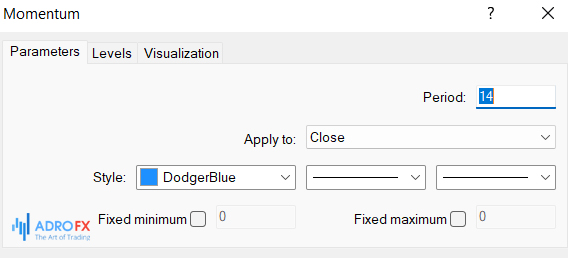

Preset parameters allow the tool to work as an oscillator.

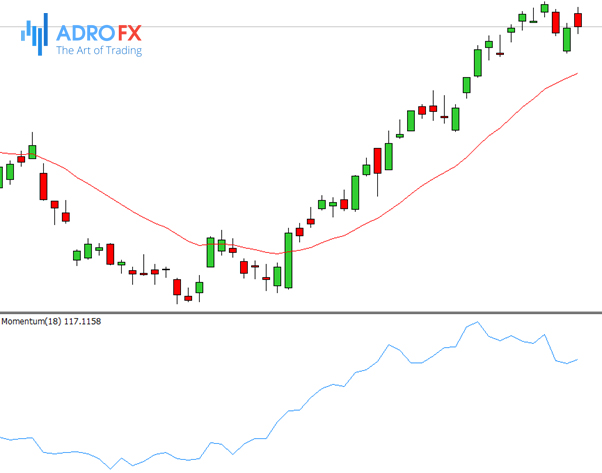

Momentum in the form of a blue line is located at the bottom of the main chart. To make its indicators more reliable, an MA is added to the chart:

Settings of the Momentum Indicator

The Momentum indicator settings are very simple - there are practically none. The calculation formula is included in the code, and all a trader needs to do is to choose the period according to the asset volatility, time frame, and the trading system objectives.

There are three tabs in the settings window:

- Period – number of candlesticks taking part in the calculation. The longer the period, the slower the indicator reacts to price changes and the smoother the line gets. The smaller the period, the sharper the indicator's fluctuations.

- Apply to – type of price used in calculations. For example, the closing or opening price of a candle, the arithmetic average between the maximum and minimum price of a candle, etc.

- Levels. By default, the indicator levels are not set. But for the convenience of a visual search of the indicator resistance/support levels or identification of key zones, you can specify levels. They will appear on the chart as a horizontal line. You can specify any number of levels, thereby forming the range of the indicator movement in different market situations.

For example, a breakout of a level can be regarded as a signal to open a position. This level at reduced scaling is built on local minimums of the first half of the chart. And an increase in the indicator movement amplitude in its second half indicates the appearance of strong short-term trends.

- Visualization. Here you specify one or more time frames, on which the indicator is displayed. For example, if only the M30 time frame is enabled, the Momentum will be removed from the chart when moving to another time frame.

The code of the indicator is open. You can make any changes to it and turn it into your unique modified version. If you know how to code, use the MetaEditor, built into MT4. If you don't, you can order a modification of the indicator according to your algorithm from the freelance service of the MQL5 analytical portal.

How to Use the Momentum Indicator?

Momentum is a good auxiliary indicator that combines well with patterns and trend indicators. It can be used in many ways, including:

- Preliminary market analysis. Zoom out and see where the indicator is relative to its median. And in which direction the current movement is going. Pay attention to the number of extrema, and their sharpness or smoothness. If Momentum is at the bottom, has drawn an extremum, and goes upward, you can consider opening a long position.

- Confirmation of the signal of the beginning of the trend. The indicator is used with trend indicators such as Moving Averages, and Ichimoku, with oscillators MACD, ADX, etc.

Searching for trend reversal points and defining levels of closing a trade. The signal is when the indicator reaches its overbought/oversold area. The indicator is good at confirming reversal patterns.

How To Read the Momentum Signals

Momentum shows an uptrend if the price ratio is above 100 and continues to rise. Correspondingly, if the ratio is less than 100 and decreasing, the trend is downward. If at the same time the indicator extremums are updated, the trend is strong, and, probably, the price change is accelerating. The advantage of the indicator is that the trend line can be broken earlier than on the chart, which makes Momentum a leading indicator.

When analyzing the market with the tool, much attention is paid to extrema. Extremely high as well as extremely low values of the indicator confirm the continuation of the trend. If Momentum has reached the highest extremum and is directed downward, prices will likely continue to rise. In any case, if the indicator shows a sharp jump, it is a signal for a reversal.

An important feature of the indicator is the divergence of its values with the price. If the minimums or maximums of the price chart diverge from the indicator, it can signal the forthcoming trend reversal. However, in this case, there is a high probability that Momentum may show a lot of false signals.

If the indicator has a period between 5 and 14, it will tell you if the price is going higher or lower than the previous one, functioning as an oscillator. If the period is more than 20, Momentum can display the change of extremums or their absence, and thus shows the trend direction. It is necessary to select the indicator period taking into account the time frame, a longer period is used for a longer trade, but it is necessary to consider the strategy requirements because the wrong period can lead to a lag of the indicator signals.

Momentum is mainly used for trend trading, which is more effective when market volatility is high. But with additional tools and with enough experience Momentum can be used for counter-trend trading. In this case, the oversold and overbought areas are preliminary determined and marked on the chart with lines parallel to the 100 level. When the indicator leaves the overbought area, it is a signal to sell, when it leaves the oversold area, it is a signal to buy. But this approach is risky enough, that's why it is used only with additional indicators.

Momentum Trading Strategies

The combination of Momentum and the Moving Average is the basis for many trading strategies in most time frames. A period of MA corresponding to the periods of the indicator is set. The signal to sell is a downward crossing of the MA if the indicator also crosses the zero level downwards. The signal to buy is a crossing of the indicator and MA from bottom to top.

Thomas Demark also developed a strategy with Momentum. It is fairly simple, carried out in the hourly chart, it requires EMA 9 and EMA 30:

Signal to buy – crossing of 9 EMA and 30 EMA upwards and Momentum index above 100, the price should break the trend line up. Signal to sell – crossing of 9 EMA and 30 EMA downwards, when Momentum is below 100. This forex strategy implies the mandatory use of Stop Loss.

Momentum can also be applied with a single Exponential Moving Average. For example, the indicator is set for a period of 18, and EMA – for a period of 19:

Momentum should cross the level of 100 upwards, the price crosses the EMA - this is considered a signal to buy. On the contrary, if Momentum crosses the 100 level from the top downwards, as well as the price crosses the EMA, we open a short position.

Also, Momentum is used in Elder strategies. In particular, such as Triple Screen in which the Alligator and the Stochastic oscillator are used together with the Momentum indicator. Two time frames are used for trading: the higher time frame H4, which shows the trend direction, and the lower time frame H1 shows the entry points with Stochastic confirmation of the data - overbought, oversold, the direction of the impulse:

Alligator signals the creation of a new trend, Stochastic shows the strength of the impulse in the lower time frame, and Momentum shows the entry point.

Momentum is used in the strategy with Traders Dynamic Index and Rainbow, multi-colored Moving Averages. The buy signal involves identifying an uptrend by the MA fan, the price should be closer to one of the MAs, preferably the one with the longest period, and Momentum should be directed upwards. If the conditions are reversed, a sell signal appears. Of the three MAs, the slowest one represents the support and resistance level and should be used as a reference when closing a trade. Momentum confirms the signal if there is a divergence between its indicators and the price.

This indicator is also used in the momentum trading strategy, which is an asset that shows strong movement. The strategy is based on a simple buy on an uptrend and a sell on a downtrend. In this strategy, Momentum is used together with MACD and RSI indicators:

Another popular strategy in which the Momentum indicator is used is "20 pips a day" on the candlestick chart. It is believed to bring stable results when trading forex. The strategy is implemented when no news is expected to affect the rate of the asset. Most likely, it is better to work with it some time after the release of important news.

It is assumed to work with sufficiently volatile pairs in the time frame M30. It is necessary, in addition to the Momentum indicator, to add a simple MA with a period of 20 on the chart. The signal to buy - Momentum is higher than the MA line if the candle closed above the midline. Signal to sell - the candle closes below the MA, and Momentum is below the midline. It is necessary to put stop-losses and monitor the news background and price behavior. If even a very weak movement against the trend is visible, the trade should be closed.

Momentum works better in a volatile market, but there are strategies in which it works effectively in a flat, such as the strategy "Momentum+RSI", where the best time is considered the minute time frame. Momentum is set for a period of 7, RSI for a period - of 5, and levels - between 25 and 75. It is also necessary to set the support and resistance levels.

On the indicator RSI level 50 is marked, Momentum approximately defines the boundaries of volatility, within which we should trade. Buy trades are opened when the price pushes away from the support line, at the same time Momentum is pointing up, like the RSI. Conversely, a sell trade is opened when the price rebounds from the resistance line, with Momentum pointing downward, like the RSI.

Although Momentum is considered more suitable for scalping strategies, it is rarely used in scalping. For example, in combination with RSI, MAs, simple and exponential with the following parameters: EMA with a period of 7, SMA with a period of 21, Momentum period - 21, RSI period - 14:

Signal for entering the market - a crossover of MAs. Positions to buy are opened when the EMA is crossed by SMA from below and the Momentum is above 100, and RSI is directed upward. Short positions are placed when the EMA crosses the SMA from top to bottom, Momentum is below 100 and RSI is pointing downwards.

The next one is a fairly common strategy with ADX (Average Directional Index) and Momentum. The ADX trend indicator is on the list of standard tools on trading platforms. The strategy is carried out in a five-minute chart, most often with the EUR/USD pair. The Momentum indicator is set to a period of 14, ADX is set to 14, and the level of 25:

In this strategy, ADX acts as a trend indicator and Momentum acts as an oscillator, respectively, ADX shows the direction and Momentum shows the entry points. The strategy is to wait for the ADX to be above 25 and the Momentum to be above 100, this is a buy signal, and if the Momentum is below 100 this is a sell signal.

Conclusion

The momentum indicator is one of the easiest to learn and use, it shows fairly accurate signals and in some cases can work as a leading indicator of price trend changes. It can be used as an oscillator determining entry points and as a trend indicator showing the trend direction and strength.

Momentum is used in many strategies and shows good results. But it has disadvantages: it can show inaccurate signals during sharp trend changes, especially in the low time frame the indicator can react too quickly and incorrectly to changes in the situation. Therefore, Momentum is used as an auxiliary tool. However, there are strategies in which it is applied as the main indicator, trading using only this indicator is also possible.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.