The High Cost of Ignoring Economic Indicators in Forex Trading

Many traders fall into the trap of overlooking economic indicators, unaware of the significant consequences. Interest rates, inflation, and other crucial metrics profoundly impact currency values, making these data points essential for successful trading. Neglecting them can result in costly errors and missed opportunities.

Did you know that traders who ignore economic indicators are more than twice as likely to face sudden market losses? While technical analysis often gets the spotlight, understanding key economic metrics is equally critical. These indicators offer a comprehensive view of a country’s economic health, shaping your trading decisions and helping avoid disastrous outcomes. Failing to incorporate them into your strategy leaves you vulnerable to unpredictable market movements and financial losses.

The Importance of Staying Informed in Forex Trading

In the fast-moving world of forex, currency values shift based on global economic events. Key indicators like interest rates, inflation, and employment data give traders insight into a nation’s economic performance and the potential for currency fluctuations. Ignoring these indicators increases your exposure to market risks, leading to poor decisions and unpredictable trading results.

This article will break down the importance of integrating economic indicators into your trading strategy for long-term success.

Understanding Economic Indicators

Economic indicators are data points that give a snapshot of a country's economic health. These statistics cover different aspects of economic activity, helping traders anticipate currency movements. By tracking metrics such as inflation and employment, traders can better understand the economic outlook of a nation and make informed decisions.

Let’s explore the key economic indicators every forex trader should monitor:

- Gross Domestic Product (GDP)

This measures the total economic output of a country. A rising GDP generally signals a strengthening currency, while a declining GDP indicates economic contraction and a potential currency drop. - Inflation

Inflation measures how quickly prices rise in an economy. Central banks manage inflation by adjusting interest rates. High inflation often triggers rate hikes, strengthening the currency, while low inflation can lead to rate cuts, weakening it. - Interest Rates

Central banks raise or lower interest rates to control inflation and stabilize the economy. Higher rates attract foreign investment, increasing the currency’s value. Lower rates have the opposite effect, often weakening the currency. - Unemployment Rates

High unemployment signals economic weakness and can negatively impact a currency. Low unemployment suggests a stronger economy, potentially boosting the currency. - Trade Balance

This metric tracks the difference between a country’s exports and imports. A trade surplus strengthens a currency, while a deficit generally weakens it.

These indicators are crucial for forex traders, offering insights into what drives currency prices. For example, a spike in inflation may prompt central banks to raise interest rates, leading to a stronger currency. By staying informed about these trends, you can fine-tune your strategies and minimize costly mistakes.

How Economic Indicators Fit into Forex Analysis

Fundamental analysis in forex trading revolves around understanding the economic factors that drive currency markets. Economic indicators are the backbone of this analysis, helping traders forecast potential market movements by assessing the state of an economy.

For example, an increase in US interest rates typically boosts the US dollar against other currencies like the euro or yen. Conversely, high inflation in Europe might weaken the euro, creating opportunities for traders looking to capitalize on a strong US dollar. Understanding how specific economic reports impact currency pairs is critical for making well-timed trades.

Moreover, economic indicators shape market sentiment. Positive data, like strong GDP growth, can boost investor confidence, leading to bullish forex markets. Negative indicators can create bearish sentiment, prompting traders to sell off currencies. By following these signals, traders avoid emotional decisions and improve their overall trading discipline.

The Consequences of Ignoring Economic Indicators

Neglecting economic indicators can have severe consequences for forex traders, such as:

- Uninformed Decisions

Traders who ignore economic data rely solely on technical analysis, lacking an understanding of market fundamentals. This can lead to poorly timed trades or misinterpretation of market signals. - Sudden Market Volatility

Key reports like interest rate announcements or unemployment figures often cause sharp market movements. Traders unaware of these events may be caught off guard by sudden volatility, leading to significant losses. - Missed Opportunities

Ignoring economic indicators can mean missing out on favorable market conditions. For example, improving GDP or decreasing unemployment can present profitable opportunities, but traders must track these data points to capitalize on them.

Incorporating both technical and fundamental analysis into your trading strategy is essential. Understanding how economic indicators shape the forex market helps traders reduce risk and increase profitability.

Also read: Influence and Challenges of Market Sentiment

Case Study: The Impact of Economic Indicators on Forex Markets

A notable example illustrating the importance of economic indicators occurred in 2016, during the Brexit referendum. Leading up to the event, many traders ignored key economic warnings, such as weakening consumer confidence and slowing GDP growth in the UK, which hinted at potential instability. When the unexpected "Leave" vote was announced, the British Pound (GBP) plummeted by over 10% in a single trading session, marking one of the largest one-day drops in forex history.

Traders who had closely monitored these economic indicators could have anticipated heightened volatility and adjusted their positions accordingly. In contrast, those who relied on consumer confidence and trade balance forecasts were better prepared to take advantage of the sharp currency movements. Some traders who shorted the GBP based on economic data experienced significant gains, while those who ignored the fundamentals faced steep losses. This case demonstrates the crucial role economic indicators play in informing trading decisions and underscores the risks of neglecting these key signals. By staying on top of economic data, traders can avoid unnecessary losses and capitalize on market opportunities.

How to Incorporate Economic Indicators into Your Trading Strategy

Effectively using economic indicators can significantly improve a forex trader’s performance. Here are some strategies for incorporating these data points into your trading routine:

Building a Trading Routine

To stay ahead in forex trading, it’s essential to establish a routine for regularly tracking economic indicators. Start by identifying the most relevant indicators for the currency pairs you trade. For instance, if you focus on the US dollar, monitor US interest rate decisions, inflation reports, and employment data. Set aside time each day or week to review the latest data releases and incorporate them into your market analysis. By building a structured process for evaluating economic reports, you can make informed decisions and avoid reacting impulsively to market news.

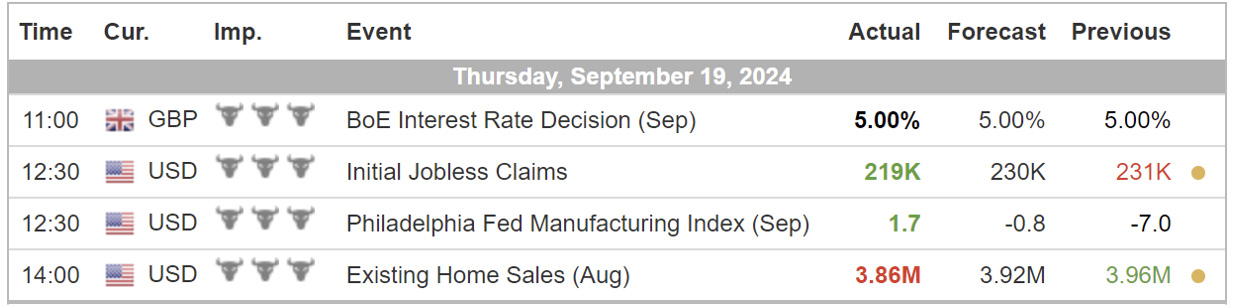

Using Economic Calendars

An economic calendar is an essential tool for forex traders, offering a schedule of upcoming economic events, such as interest rate announcements, inflation reports, and employment figures. Most brokers provide access to an economic calendar that highlights key events likely to impact currency markets. Use these calendars to stay informed about upcoming data releases and plan your trades accordingly. For instance, if you know that the US nonfarm payrolls report is due on the first Friday of the month, you can prepare for potential volatility in the USD by setting Stop Loss orders or adjusting your positions.

Monitoring Market Sentiment

Economic indicators play a crucial role in shaping market sentiment, influencing the overall mood and behavior of market participants. Positive data - such as strong GDP growth or declining unemployment - often leads to bullish market reactions, while negative data can result in bearish sentiment. By keeping an eye on how these indicators impact market sentiment, traders can gain a clearer understanding of emerging trends and make smarter trading decisions. This approach also helps traders avoid emotional, knee-jerk reactions to short-term price fluctuations, fostering a more disciplined and strategic approach.

Staying Flexible

Although economic indicators offer valuable insights, they aren't always predictable. Unforeseen events - like natural disasters or geopolitical conflicts - can disrupt even the most thorough analysis. To be successful in forex trading, it’s essential to remain adaptable and adjust your strategy as new information emerges. By staying flexible and continually refining your approach, you’ll be better equipped to handle the uncertainties and complexities of the forex market.

Also read: Trading the Headlines: Strategies for Capitalizing on Market-Moving News

Conclusion: Don’t Overlook Economic Indicators

In forex trading, ignoring economic indicators can lead to avoidable losses and missed opportunities. These key data points provide essential insights into a country’s economic health and the potential direction of currency markets. By integrating economic indicators into your trading strategy, you’ll make more informed decisions and improve your chances of long-term success.

Traders who stay informed and adapt their strategies based on economic data are better positioned for success. Don’t let ignorance hold you back - start tracking economic indicators today and take your trading to the next level.

Ready to take your forex trading to the next level? Start integrating economic indicators into your strategy and see the difference. Explore AdroFx today to access powerful trading tools and insights that can help you make informed decisions and succeed in the forex market.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.