Inflation: What It Is, How It Can Be Controlled, and How To Invest During a Period of High Inflation

The economy is one of the most popular topics in the media these days. No wonder: our income, the interest we pay on loans, and the overall financial well-being of the country depend on whether the economy is growing and inflation is falling. But this connection is not always obvious, nor is the usefulness of all the financial information out there. Let's try to sort it out and learn more about inflation, its causes, and its consequences.

What Is Inflation?

Inflation is the increase in prices over time and a decrease in the purchasing power of money. The rate of inflation varies from country to country and currency to currency.

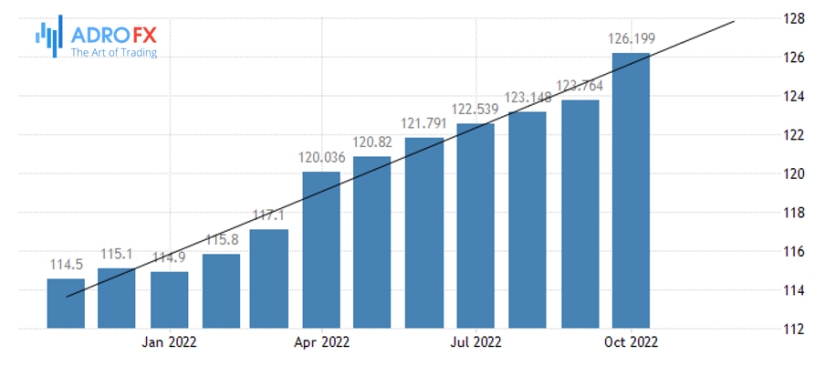

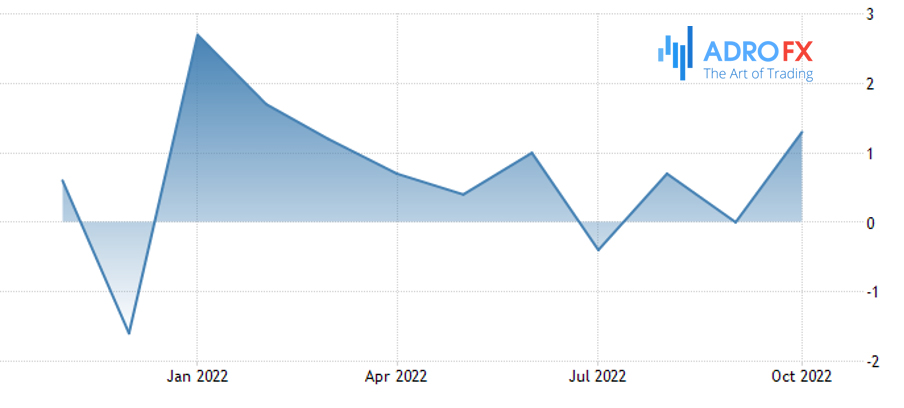

For example, the dollar has weakened by only 22.96% over the past 10 years. That is, $1 in 2011 is equivalent to $1.25 in early 2022. On average, dollar inflation has been 2.05% per year, but it has varied from year to year. For example, in 2011 inflation was 3.16%, and in January 2022 it reached 7.5% annualized.

It also happens that prices are falling, but the purchasing power of money is growing. In this case, we speak of deflation. This is what the Japanese economy has faced in recent decades. If you look from 2011, the annual average inflation in Japan has been 0.56%, but in some years it has been negative. It was -0.27% in 2011 and -0.02% in 2021.

Inflation is necessary for economic development, but of course, if prices are rising moderately and not at a galloping rate. Thus, while people regard inflation as a known negative factor, experts agree that moderate price growth is necessary for economic development. But it becomes a problem when inflation gets out of control and rises sharply, as is happening now in the world.

Understand the Different Types of Inflation

Inflation can be classified as follows:

- Deflation. Basically, it is negative inflation. That is, prices are not rising but falling. Deflation slows down the economy. Consumers stop buying things in the hope that they will get even cheaper, and companies stop producing because of it.

- Low inflation. Such inflation allows the economy to develop and is comfortable for both consumers and entrepreneurs.

- Moderate inflation is 6 to 10% a year. This one is dangerous because it can get out of control and turn into galloping when prices grow by dozens of percent a year. Such inflation creates instability in the market.

- Hyperinflation. Upon hyperinflation prices rise by hundreds or thousands of percent, in particularly severe cases people give up money and switch to barter.

There are cases of rapid depreciation of money, usually in times of severe crises and armed conflicts.

More recent examples of hyperinflation are Venezuela and Zimbabwe: in 2020, the price increase there was 2355% and 557.2% respectively. And for Zimbabwe, this is a chronic problem: back in 2000, a massive outflow of labor led to the collapse of the country's financial system.

To support spending on government projects, the government began ean dollars actively. And money, like any other commodity, loses value when in excess. This set in motion a process of hyperinflation.

How Inflation is Measured

In the U.S., inflation is measured by various price indexes, including the Consumer Price Index, and the Producer Price Index.

The way these indices are calculated varies, which helps determine where price pressures are present.

The Federal Reserve (Fed) is responsible for the stability of inflation in the United States. The regulator has determined that an annual inflation rate of 2% is the best way to maintain upward price pressure without substantially reducing purchasing power.

During economic growth, prices often rise as demand for goods and services increases. During an economic downturn, prices usually fall as income and consumption decline. However, the average inflation rate for economic calculations and modeling is more commonly used for practical purposes.

What Causes Inflation

Macroeconomics distinguishes between demand inflation and supply inflation.

Demand-pull inflation develops when supply cannot fully meet demand. This happens when citizens have free money to spend on goods and services, but companies cannot keep up with demand and raise prices. For example, a company releases a new series of limited edition gadgets. The gadget becomes popular, but it is not enough for everybody, and the last models are sold out at higher prices.

This development is caused by:

- Mass lending. This is when banks lend not out of savings but out of unsecured currency. Its value is not backed by gold or other precious metals, so much money is often called token money. But it can be used to buy goods, accelerating inflation.

- Additional money issuance. When government spending grows, more money is issued without regard to commodity turnover. Economists believe that the amount of money should increase in the same way as the growth of goods. If more money is issued, residents have a surplus.

- There is a shortage of goods with the same amount of money in the population.

- Supply inflation is an increase in the cost of production. When companies are forced to spend more money to produce goods and provide services, they end up passing their costs on to customers by raising prices.

This results in:

- An increase in world market prices. If a company uses imported raw materials or products, its costs will increase.

- The monopoly right of some companies to set prices and determine production costs.

- Increase in wages. For example, when a company has to increase wages because of employee or union demands and other costs remain the same.

- Increase in taxes, duties, and excise taxes when the money supply is more or less stable.

- It is difficult for a business to plan for the future. When the inflation rate is unknown, manufacturers and retailers find it difficult to determine the future cost of materials and labor. This discourages investment and economic growth.

- Loss of inventories. For example, in a drought, a producer loses part of his crop, but he still needs to pay workers and put money aside for a future harvest.

- Prices can also rise because of inflationary expectations. This is when consumers, for whatever reason, expect higher prices or shortages of goods and buy in advance. So they create a rush of demand, and the cost of goods really goes up.

Peculiarities of Combating Inflation

Methods of controlling inflation are divided into direct and indirect. The help of direct methods directly affects the amount of money supply that causes inflation. Such methods include:

- State regulation of prices and wages;

- Regulation of foreign economic activity and exchange rates;

- Direct withdrawal of part of the money supply by the central bank.

Indirect methods make it possible to regulate the money supply through financial instruments available to the authorities:

- The central bank's key rate (appreciation of credit);

- Required reserves of commercial banks,

- Government debt obligations.

These measures help to reduce inflation but can have a negative impact on other macroeconomic parameters. Economists talk about the existence of a "magic quadrilateral" consisting of sustainable economic growth, low inflation, high employment, and a balanced balance of payments. Achieving optimal values of all four variables is hardly possible.

Some experts add that government policy aimed at structural economic change and the formation of a market-based infrastructure independent of government help to fight inflation. According to their view, as long as output grows and the market is far from saturation, prices remain stable.

Modern Anti-Inflationary Policy

The anti-inflationary policy is implemented by most capitalist states. The most common methods to combat rising prices include a fixed exchange rate regime and inflation targeting.

The first method is usually used in small developing countries with strong foreign trade partners. Countries in the Caribbean and Latin America often peg national currencies to the U.S. dollar.

Inflation-targeting policies are widespread in economically developed countries and developing countries. Central banks, enjoying the trust of the population, keep inflation under control and target its level to the announced value. A distinction is made between pure inflation targeting when inflation is regulated only by changing the central bank's discount rate, and hybrid targeting, when an additional instrument of regulation is the exchange rate.

Why Rising Interest Rates Pressures Inflation

U.S. history is full of cycles of both raising and lowering rates. The most important one for investors is the rate hike cycle because historically they raise rates to keep the economy healthy. A rate hike is in response to a rise in inflation well above the target "normal" level.

A rate hike inevitably leads to a rise in the deposit rate and a rise in the lending rate. Rising deposit rates cause households and ordinary people to move money from high-risk assets to safe deposits, as the latter begins to offer more attractive returns.

Due to rising rates, banks begin to attract more expensive money (increasing compensation to depositors), so the rate of credit also increases. In turn, lending is declining, because more and more borrowers cannot borrow money at high interest rates.

It is the deceleration of the economic cycle through the reduction of credit issuance that leads to the deceleration of inflationary processes in the economy.

Why Rising Rates Scare Investors

Rising rates are also affecting U.S. bond yields. As the deposit rate rises, to entice investors to buy U.S. government debt, the government must also offer a higher rate.

In the underlying asset valuation, the risk-free discount factor is the yield on the 10-year Treasuries. As risk-free yields rise, so does the required return on investments in risky assets, so investors are revaluing them downward. While this applies to all stocks, the most at-risk companies that are not yet earning EBITDA or FCF are usually fast-growth techs and biotechs, where the bet is on the long-term potential of the company.

Right now, the market is priced high. The forward P/E of the S&P 500 Index has exceeded the level of 17, although historically in normal times the figure has been below that level.

It is also noteworthy that the index reached 25 once during the dot-com crisis.

Good and Bad Inflation

Most economists agree that a slight rate of inflation is useful - it encourages businesses and individuals to spend more, invest more, or save more.

At the same time, a high level of inflation leads to a decrease in the purchasing power of economic agents, and therefore to a slowdown in economic growth. In short, there is a depression both economically and socially. When prices soar, the share of income going to savings falls. Investments fall as well.

Even worse, final consumers and firms continue to wait for inflation, even when the economy has already begun to recover. This effect is called inflationary expectation.

How To Invest During a Period of High Inflation

Even when inflation is moderate, on the horizon for many years, it can be very damaging to capital. So investors want their assets to yield at least as much as inflation. In other words, their real rate of return should be positive.

To protect against the devaluation of the national currency, it is recommended to keep at least 50% of the portfolio in assets in hard currencies: dollars, euros, yen, and Swiss francs. In this case, no matter where the currency pair moves, capital will retain its purchasing power.

In the conditions of progressive inflation, some kinds of assets can show themselves well.

Physical assets such as real estate, automobiles, and luxury goods. In the U.S., for example, used car prices have risen 25 percent in one year and are thus fueling overall inflation.

A particular piece of real estate can appreciate faster than inflation depreciates money, or it can appreciate more slowly, depending on the type of property, its location, and other factors. Rent or rental fees don't always rise in proportion to inflation, either.

Variable Coupon Bonds. In the U.S. these are TIPS (Treasury Inflation-Protected Securities). If inflation rises, coupon payments on such bonds will rise, but the debt securities themselves won't fall in price.

Commodities – oil, gas, aluminum, and wheat. One can invest in commodities through stocks of commodity and agricultural companies.

Experienced investors and traders can use futures and options on commodities, but these are more complicated and risky tools.

Gold often rises in value along with inflation and when the stock market falls, but it is not guaranteed. It is also a volatile instrument in and of itself and does not generate any passive income.

The good thing about gold is that it has a weak correlation to stocks and bonds, meaning it is a good diversifier. Adding it to an investment portfolio usually reduces the latter's volatility and improves its risk/reward ratio.

Shares of companies from safe-haven sectors. These are telecoms, utilities, manufacturers, and sellers of basic necessities: food, hygiene products, and medicines. The prices of these companies products will rise along with overall inflation.

But in the case of utility companies, you have to be careful: these companies usually have large debts on their balance sheets, and their business margins are weak. If rates go up, their debt service costs will rise.

The financial sector can also benefit from higher rates, as the interest on loans issued will be higher.

As for the real estate sector, evidence of its protective nature in inflation is contradictory, at least in the U.S. NAREIT claims that dividend growth in REIT funds has outpaced consumer price growth in the U.S. over the past 20 years, while Vanguard calculated that over the past 50 years REITs have performed worse than gold, commodities and inflation-linked bonds in that sense.

No Need to Be Afraid of Inflation

It may seem that such a phenomenon as inflation gradually consumes our savings. But if you look into it, everything is not so scary.

Inflation is quite normal. It has always been and will always be. In those countries where inflation becomes negative, the authorities begin to miss it and take various measures to bring it back. For example, in December 2014, the Swiss National Bank (SNB) introduced a negative interest rate on deposits (0.25%). It explained its decision by the fact that this measure will prevent the further excessive strengthening of the national currency, as well as create incentives for investment in the Swiss economy.

It is important to know that inflation of 10% is bad, but 0% also harms the economy. This indicates that the country is not developing. The normal inflation rate is 2-4% per year.

After all, people also do not stand still: we are developing, gaining experience, creating new technologies, and reducing the cost of production. Tesla has launched the production of electric cars, and Mark Zuckerberg is developing his project "Smart Home". All we can do is diversify investment risks, create additional value and contribute to progress.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.