Forex Trading: The Dangers of Over-Leveraging

Imagine you’ve just made a high-stakes bet in the forex market, leveraging your position to the maximum. The potential for tremendous gains is exhilarating - $1,000 could quickly balloon to $10,000. But here’s the catch: the same leverage that promises such rewards can also lead to catastrophic losses. In fact, data reveals that over 70% of retail forex traders lose money, with excessive leverage being a significant contributor to these losses.

Over-leveraging occurs when traders use borrowed funds to take on larger positions than their trading account can safely support. In the context of forex trading, this means amplifying your exposure to market fluctuations well beyond your actual capital. While leverage allows traders to control substantial amounts of currency with a relatively small initial investment, it also magnifies the impact of market movements, potentially leading to significant losses if the market doesn’t move in the desired direction.

Although leverage can amplify potential returns in forex trading, it also significantly increases the risk of substantial losses. Effective leverage management is essential to mitigating these risks and achieving long-term trading success. Understanding the dangers of over-leveraging and employing disciplined strategies to manage leverage are crucial for safeguarding your trading capital and achieving your investment goals.

Understanding Leverage in Forex Trading

Leverage in forex trading refers to the ability to control a large position in the market with a relatively small amount of capital. For example, with a 100:1 leverage ratio, a trader can control $100,000 worth of currency with just $1,000 of their own money. This means that a relatively modest initial investment can command a significant position in the market, allowing traders to potentially benefit from small price movements.

When used responsibly, leverage can enhance trading opportunities and increase potential profits. It allows traders to open larger positions than their account balance would otherwise permit, making it possible to capture more significant market moves with a smaller upfront investment. In markets characterized by narrow spreads and low volatility, leverage can be a powerful tool for maximizing returns.

However, the potential for higher returns comes with an equally high risk of significant losses. Over-leveraging occurs when traders use more leverage than their trading strategy and risk tolerance can comfortably handle. This can lead to severe losses, sometimes exceeding the initial investment. It’s crucial for traders to understand how to manage leverage effectively, employing strategies that align with their risk tolerance and trading goals. Proper leverage management is essential for navigating the volatile forex market and avoiding the pitfalls of over-leveraging.

Also read: Forex Trading Without Leverage: Is It Right for You?

The Risks of Over-Leveraging

Leverage can be a powerful tool in forex trading, but it comes with substantial risks when used excessively. Over-leveraging magnifies both the potential for gains and the likelihood of significant losses. As traders push their leverage to its limits, they expose themselves to severe financial consequences that can jeopardize their entire trading capital. Understanding the specific risks associated with over-leveraging is crucial for protecting your investments and maintaining a balanced trading strategy.

Increased Loss Potential

Over-leveraging can dramatically magnify losses in forex trading. When traders take on excessive leverage, even small adverse movements in the market can lead to disproportionately large losses. For instance, if a trader uses 100:1 leverage, a 1% move against their position can wipe out 100% of their invested capital. This means that while leverage can amplify potential gains, it also has the power to erase an entire trading account if the market moves unfavorably.

Psychological Impact

The stress and emotional strain of over-leveraging can be immense. Traders who are over-leveraged may experience heightened anxiety, fear, and panic, especially when faced with significant losses. This psychological pressure can lead to poor decision-making, such as holding onto losing positions in the hope of a market reversal or doubling down to recover losses. The mental toll of dealing with the high stakes of over-leveraging can undermine a trader’s judgment and discipline, further exacerbating the risk of substantial losses.

Margin Calls and Forced Liquidations

Over-leveraging increases the likelihood of margin calls and forced liquidations. A margin call occurs when a trader’s account equity falls below the required margin level due to adverse market movements. In such cases, the broker may demand additional funds to maintain the position or liquidate it to cover the losses. Forced liquidations can happen even with minor fluctuations in the market, potentially leading to sudden and severe losses. This risk underscores the importance of managing leverage carefully and maintaining sufficient margin to avoid these potentially devastating scenarios.

Case Studies of Over-Leveraging

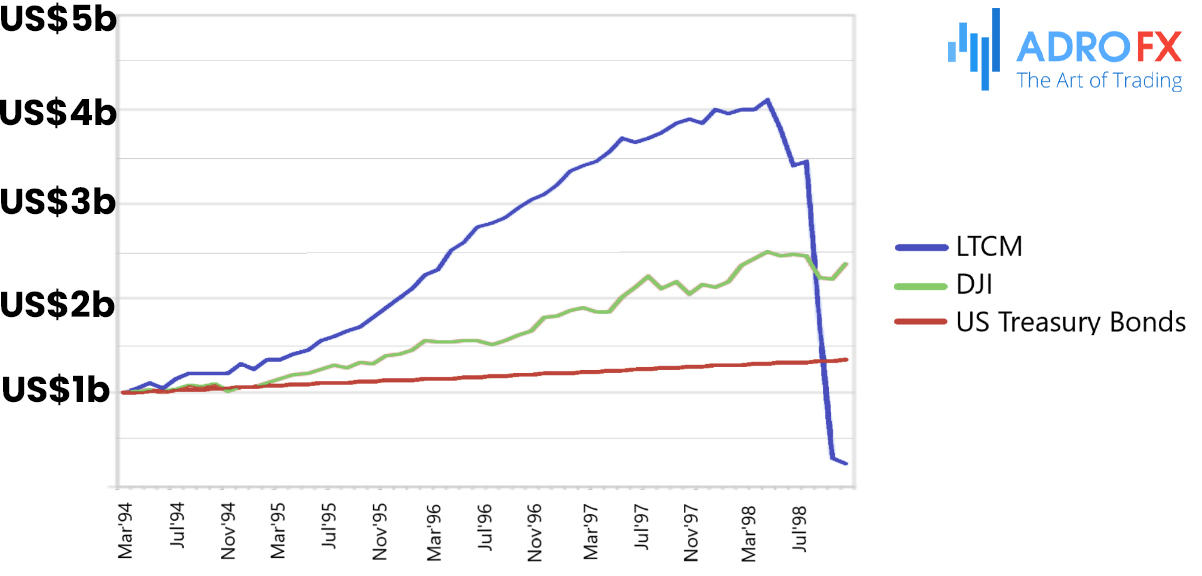

Several high-profile cases illustrate the dangers of over-leveraging. For instance, the infamous collapse of the hedge fund Long-Term Capital Management (LTCM) in 1998 was partly due to excessive leverage. LTCM used leverage to amplify its trades, but when global financial turmoil hit, the fund faced massive losses, leading to its eventual bailout by major banks. Another example is the case of a retail trader who, using 200:1 leverage, experienced a sudden market swing that obliterated their entire trading account, demonstrating how swiftly and dramatically losses can accumulate when leverage is mismanaged.

These case studies highlight several crucial lessons about the risks of over-leveraging. Firstly, excessive leverage can lead to catastrophic losses that far exceed the initial investment. Secondly, traders must be aware of the psychological strain and potential for impaired decision-making when dealing with high leverage. Finally, the risk of margin calls and forced liquidations underscores the necessity of maintaining adequate margin and using leverage cautiously. By learning from these examples, traders can better understand the dangers of over-leveraging and adopt strategies to manage leverage effectively, protecting their capital and ensuring more sustainable trading practices.

Signs You’re Over-Leveraging

Over-leveraging can often be identified through several key indicators. One of the most obvious signs is reliance on high leverage ratios, where traders use excessive amounts of borrowed funds relative to their own capital. If you find yourself frequently facing margin calls, it may indicate that your leverage is too high and your trading positions are at risk of liquidation. Other signs include a constant sense of financial stress and difficulty in managing trades effectively due to the high stakes involved. Monitoring these indicators can help you recognize when you’re over-leveraged and take corrective action before substantial losses occur.

To assess whether you might be over-leveraged, consider the following checklist:

- Leverage Ratio

Are you using leverage ratios that exceed your risk tolerance and trading strategy? - Margin Calls

Have you experienced multiple margin calls in recent weeks or months? - Financial Stress

Do you feel constant stress or anxiety about your trading positions and potential losses? - Trade Size

Are you taking on positions that are disproportionately large compared to your account size? - Risk Management

Are you struggling to maintain effective risk management practices due to high leverage? By regularly reviewing these questions, you can evaluate your leverage practices and make adjustments to ensure they align with your trading goals and risk tolerance.

Also read: Best Leverage Ratio for Forex Trading

How to Avoid Over-Leveraging

Effectively managing leverage is vital to avoiding the detrimental effects of over-leveraging. One of the first steps in preventing over-leverage is to establish a leverage ratio that aligns with your personal risk tolerance and trading strategy. Instead of opting for the highest leverage offered by your broker, which might seem tempting due to the potential for higher returns, choose a more conservative level that allows you to manage risks with greater ease. High leverage ratios can amplify gains, but they also magnify losses, making it essential to find a balance that you can handle comfortably.

Regularly reviewing and adjusting your leverage is also crucial. Markets are dynamic, and what might have been a suitable leverage ratio at one time may not be appropriate as market conditions change. Continuously evaluate your trading performance and the impact of leverage on your positions. By doing so, you can make informed adjustments to your leverage to ensure it remains in line with your evolving trading strategy and market conditions.

Maintaining a trading journal can significantly aid in managing leverage effectively. Documenting your trades, including the leverage used and the outcomes, provides valuable insights into how different leverage levels affect your trading results. This practice not only helps in recognizing patterns and refining your strategy but also in making necessary adjustments to your leverage management approach. Over time, a well-maintained journal can offer a comprehensive overview of your leverage practices and their effectiveness, guiding you in making better-informed decisions.

Incorporating Stop Loss orders into your trading strategy is another essential measure. Stop Loss orders automatically close a position when it reaches a specified loss threshold, helping to prevent losses from spiraling out of control. By setting Stop Loss orders at strategic levels based on your risk tolerance and market conditions, you can protect yourself from excessive losses. This mechanism ensures that you stay within your predefined risk parameters and avoids the potentially catastrophic effects of high leverage.

Maintaining a balanced portfolio is also crucial in managing leverage. Avoid putting all your capital into a few high-risk trades. Instead, diversify your investments across various assets and trading strategies. Diversification reduces the impact of any single position on your overall portfolio, helping to manage risk more effectively. A well-balanced portfolio not only spreads risk but also enhances the stability of your trading performance, providing a cushion against adverse market movements.

Also read: Thriving in Day Trading: A Holistic Approach to Building Success

Benefits of Conservative Leverage

Adopting a conservative approach to leverage brings several benefits that contribute to more sustainable trading practices. When leverage is kept at manageable levels, traders are better positioned to handle the inherent volatility of the forex market. Lower leverage reduces the potential for dramatic losses, allowing for a steadier and more controlled trading experience. This approach helps in avoiding the high-risk scenarios associated with excessive leverage, leading to a more consistent growth trajectory.

Conservative leverage also supports a balanced risk-reward profile. By using lower leverage ratios, you limit your exposure to market fluctuations, which can lead to more predictable and manageable outcomes. This balanced approach enables you to make well-considered trading decisions, as the risk of significant losses is reduced. Achieving a proper risk-reward balance helps in maintaining a stable trading strategy and enhances the likelihood of long-term success.

Furthermore, embracing conservative leverage fosters disciplined trading habits. With lower leverage, traders are encouraged to be more selective and strategic in their trades, as they must manage their positions more carefully. This discipline leads to better risk management and improved trading practices, contributing to a more robust and resilient trading strategy. In the long run, conservative leverage supports sustainable trading by mitigating the risks of over-leveraging and promoting a steady path to profitability.

Also read: Tailored Investments: Leveraging Your Risk Tolerance for Optimal Return

Conclusion

In summary, over-leveraging in forex trading poses significant risks that can lead to substantial financial losses and undermine trading success. The key dangers of over-leveraging include the potential for amplified losses, heightened psychological stress, and the risk of margin calls and forced liquidations. Effective leverage management is essential to mitigate these risks and maintain a balanced approach to trading. By setting appropriate leverage ratios, utilizing Stop Loss orders, and diversifying your portfolio, you can better manage leverage and protect your trading capital.

As you reflect on your trading practices, consider evaluating your current leverage usage and making adjustments where necessary. Embracing safer trading practices and adhering to disciplined leverage management can help you avoid the pitfalls of over-leveraging and contribute to long-term trading success. Take the time to review your strategies and ensure they align with your risk tolerance and trading goals.

FAQs

What is over-leveraging in forex trading?

Over-leveraging occurs when traders use borrowed funds to take on positions that exceed their trading account’s capacity to absorb losses. In forex trading, this means amplifying exposure to market movements beyond what is manageable with one’s own capital. Excessive leverage can lead to significant losses if the market moves unfavorably.

Why is over-leveraging dangerous?

Over-leveraging is dangerous because it magnifies both potential gains and losses. With high leverage, even minor adverse movements in the market can lead to substantial losses, potentially wiping out an entire trading account. This risk is exacerbated by the psychological stress and decision-making challenges that come with managing high leverage.

How can I manage leverage effectively?

Effective leverage management involves setting leverage ratios that align with your risk tolerance and trading strategy. Avoid using the maximum leverage available and regularly review and adjust your leverage based on market conditions. Utilizing Stop Loss orders to limit potential losses and maintaining a diversified portfolio are also key strategies for managing leverage effectively.

Are you managing your leverage effectively? Evaluate your trading practices today and take steps to avoid over-leveraging. Start by setting realistic leverage ratios, utilizing Stop Loss orders, and diversifying your portfolio. Protect your trading capital and enhance your success by implementing these safer trading practices now!

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.