How to Use Stop Loss and Take Profit in Forex Trading

In forex, risk management is really important. The currency market is often unpredictable and even successful traders are forced to suffer losses. One of the most effective ways to protect your trading account is using Stop Loss (SL) and Take Profit (TP) orders.

The ability to automatically close a winning trade on a fixed number of pips is also very important. So let's learn more about using Stop Loss and Take Profit orders.

What are Stop Loss and Take Profit orders?

Stop Loss is an order to close a position when the current price falls/rises by a critical number of points below/above the entry point. In this case, the position will be closed. Take Profit works the other way around. This is an order to collect a fixed profit.

How to Calculate Take Profit and Stop Loss

To make it clearer to you what Take Profit and Stop Loss are in long and short positions, consider the following examples.

SL/TP for a long position (Buy):

Take Profit = entry price + price change in pips;

Stop Loss = entry price - price change in pips.

SL/TP for a short position (Sell):

Take Profit = entry price - price change in pips;

Stop Loss = entry price + price change in pips.

How to calculate? You can do it manually, using the appropriate formulas, but we advise you not to rack your brains and use online calculators to determine exactly how much you can potentially lose or gain.

In this case, you just need to choose a currency pair, specify the account currency and position size, choose whether your position will be long or short, and then enter the desired Stop Loss/Take Profit levels.

The calculator will accurately determine all our potential losses and profits expressed in the account currency. Today there are desktop solutions as well as iOS and Android applications. So there shouldn't be any problems with searching and using it.

Pros and Cons of Using Stop Loss and Take Profit

Stop Loss and Take Profit are fixing trading targets. Most traders follow this approach, especially those who like fast trading.

Its main advantage is the elimination of the emotional aspects of trading. A trader who sets his goals when entering a trade is less likely to react emotionally to market movements. Determining goals before entering a trade is often done with greater objectivity and without nervous tension.

The only disadvantage of setting Stop Loss/Take Profit is that a fixed target limits the trading potential. Simply put, the trader catches the trend but lets it go just a little pinch away. And leaves a lot of potentially unearned money on the table.

Ways to Place a Stop Loss

Traders are always looking for ways to find the best strategy for placing SL/TP orders to minimize risk and avoid false triggering of limiting orders. Let us consider some ways to determine the Stop Loss and Take Profit levels.

At a local low when opening a long position

It's easier to find a point for a Stop Loss using local lows and highs.

This technique is used by traders who prefer to use the power of technical analysis. It is recommended to set the Stop Loss level by at least 10-15 points. Yes, there will be losses, but this way there is a higher chance that the trade will not be closed due to a false momentum. The price moves in an ascending or descending channel, bouncing off support/resistance levels. Our job is to find the rebound and catch the trend.

At the resistance level when opening a position

This method is similar to the previous one, but as you can see from the name, the main reference point here is levels. This is an attempt to make the market more predictable and therefore make the Stop Loss and Take Profit orders work as intended.

We can find levels directly on the chart or use indicators ( Moving Averages, oscillators). Therefore, even novice traders will have no problems.

On the marker of a Parabolic placing a long position

This variant is also often used. By standard, a ready-made Parabolic SAR indicator is used. Many can set up a combination of Moving Averages themselves if they think it will give more accurate results.

It is most effective to set a Stop Loss in this way when trading in large trends.

Ways to Place a Take Profit

If a trader cannot control everything in real-time, it is better to sacrifice a portion of the profit and lock in a guaranteed return with a Take Profit order.

Take Profit at the support level

The principle is the same as with Stop Loss. Only if Stop Loss is set below the entry point, Take Profit is higher.

When we predict a rebound, we open the order and wait for the reversal.

Take Profit is 2x Stop Loss.

A common profit-taking scheme is to set the ratio of potential profit and loss. According to the standard, one profitable trade should be enough to cover 2/¾ loss-making trades, all other conditions being equal.

Strategies with Mandatory Use of Take Profit

In some strategies, placing Take Profit is a necessary condition. For example, in momentum trading news. A few minutes before the publication two pending orders should be opened for the "envelope breakout". The average value is 10 to 20 pips (it is possible to focus on the news strength). Stop Loss — the minimum possible.

Further, everything is clear: the market reacts to the publication of news and quotes jump. Because of the short Stop Loss, a losing trade is relatively inexpensive, and the profit from the other trade covers it several times over. The main thing - do not be greedy, so that the Take Profit worked out before the correction.

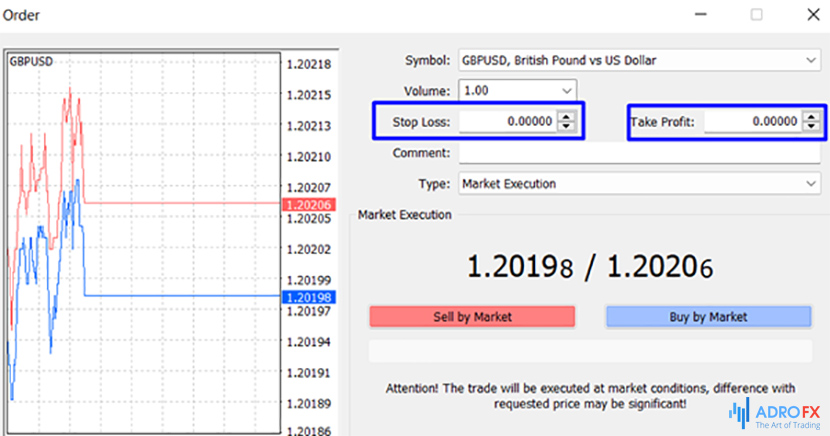

How to Set Stop Loss in MetaTrader 4

It is only necessary to find an order in the Trade tab at the bottom of the platform and click on it with the right mouse button. Now choose here Edit.

A field with the data which we need to fill in will appear. We confirm the action and begin to hope that the market will go where it should.

Take Profit is set the same way.

How to Track Take Profit in Metatrader 4

To make tracking the results easier, as soon as the price approaches the set levels, the order field will change color, turning green. This warning can be used by the trader to change the Stop Loss and Take Profit levels if the trend allows squeezing more.

This is a signal to us that we can, if necessary, change the Stop Loss/Take Profit parameters and make as much profit as possible.

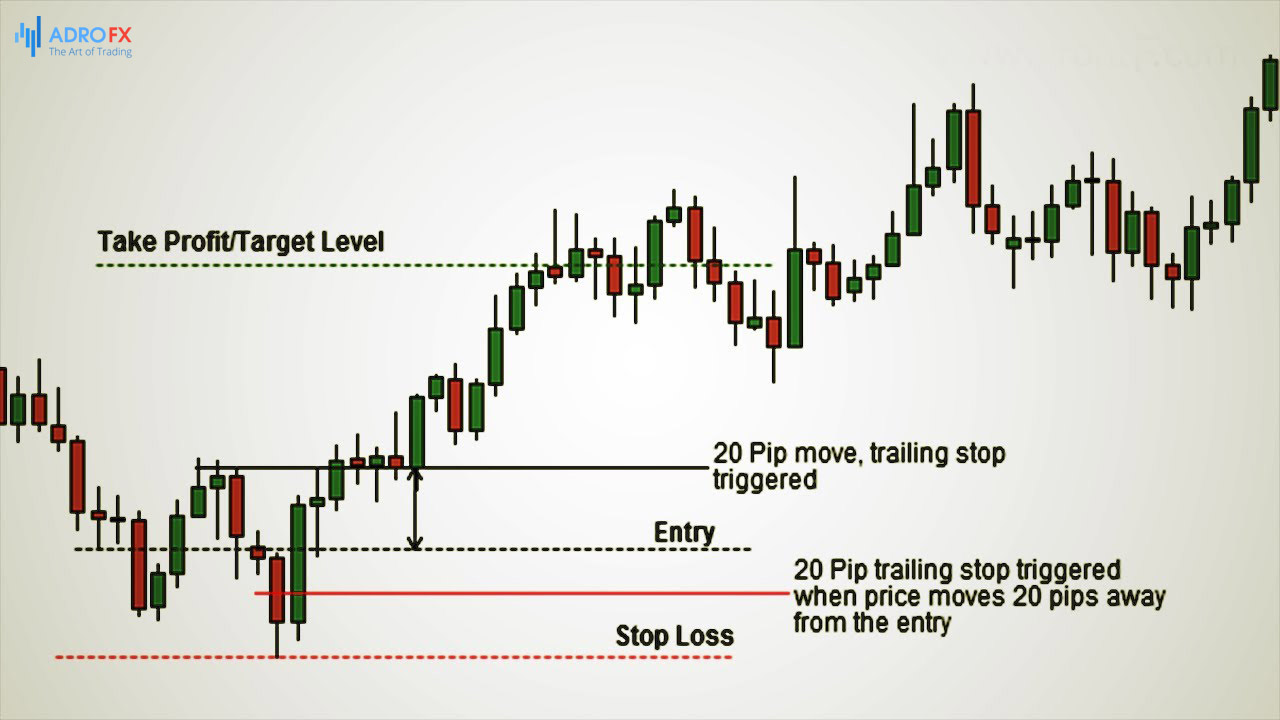

What is Trailing Stop?

Trailing Stop is included in the basic package of all popular trading platforms to make Stop Loss and Take Profit dynamically changeable, depending on the development of the current market situation. If the trade develops in the positive direction, it starts moving Take Profit/Stop Loss on the specified amount of points. Thus, we obtain a double benefit: taking more and more profit in the automatic mode, while reducing the potential losses, up to the shifting to breakeven, when Stop Loss is guaranteed to leave the trader with a profit.

This method is popular among automated Expert Advisors, as at first glance, it seems to be the best way to guarantee, at least, a return to zero. Indeed, you can often see situations when the price after the rapid movement makes a sharp "drawdown", squeezing out small and medium players. In order to set a proper Trailing Stop there are several problems:

The floating spread prevents you from picking the best dynamic Stop Loss for the whole day or trading session. And it does not matter whether it is a built-in Trailing Stop or a custom one, in such a situation unpredictable losses are guaranteed. The built-in MetaTrader tester works only with a fixed spread, take it into account when analyzing the results.

The volatility is constantly changing, and the trailing parameters that worked well in a quiet market can behave unpredictably during an active trading period. However, when the volatility increases and the average possible profit level is higher, you can try to increase the fixed take profit by 5-10 points!

Limitations of a broker. Each change of parameters of an open trade means sending a new trade order to the server, where actually two operations take place: closing of the current position and opening of a new position with new data. If there are too many such transactions from one account or if the size of Trailing Stop is small, resulting in constant adjustments, the broker may apply sanctions: from the hidden increase of slippage for new Stop Loss to complete shutdown of quoting stream with forced closure.

Common Mistakes When Setting Stop Loss and Take Profit

In our opinion, the most unforgivable mistakes are:

- Not deciding in advance where to place levels. The trader should clearly know where the Stop Loss and Take Profit will be before he opens the trade.

- Placing orders based on random numbers. There are popular schemes like 20% profit on 2% risk or placing Stop Loss and Take Profit levels ½/3/etc % of the entry price. One of the grossest mistakes you can make is trying to stretch the market to your perceptions of it, rather than adapting to its structure yourself.

- Never move limiting orders. Of course, gray-haired gurus like to criticize the entry into the orders with the already set Stop Loss and Take Profit levels. But the truth is that there can be no dogmas here by definition. There are no contradictions. If the trend is reliable and everything indicates its stability, the manual correction is quite acceptable in order not to lose the potential profit.

Why May Take Profit not Work?

You should distinguish between types of possible reasons — market reasons, and technical reasons.

Market reasons:

There is no counterparty to the trade at the set price. You opened a long position with the volume of 1 lot. Take Profit is an order to sell the entire asset when the set price is reached. The price reaches the specified level, but there are no buyers for such volume due to the low liquidity of the market, and the implementation of a partial sale is not provided in MT4. There are no buyers, the asset becomes cheaper. While the broker is trying to ask you whether you agree to sacrifice the price, the price falls further. Take Profit on a specified level has not been triggered.

The price did not reach the Take Profit level. When the gap between the extremum and Take Profit is visible, it is logical and there are no questions. But it happens that the price seems to have touched Take Profit on the chart but it has not been triggered. Here it is necessary to examine the quotes. Most probably, the price has really fallen short by just a couple of pips. When placing Stop Loss and Take Profit orders, you should also keep in mind that there are two prices - Bid/Ask. Stop Loss and Take Profit orders on a long position, will be triggered when the current market price Bid reaches the order level. Short position - when the current price reaches the Ask level. To avoid confusion, at which price the order will be executed, it makes sense to show them both on the chart.

The technical reasons:

Problems on the broker's side. The broker has not executed the order due to some internal problems. These situations need to be screenshots, copy the history of transactions and contact the support team.

Problems with the platform. For example, the question of the order execution sequence. All errors on the platform can be found in the "Journal" tab of the "Terminal" window. The reasons for errors can be either the fault of the trader or the broker or have an objective nature.

What to do if the pending order did not work. We see the error code, open the trades journal, and look at the quotes for the debatable moment. We try to close the trade manually and set the pending order again. We take a screenshot of each action and contact the support team with these screenshots. If the reason is the lack of liquidity, consider this situation in the future.

Statistics of Take Profit Usage by Forex Traders

The surveys among traders show that novice traders are not very eager to use Take Profit. The most frequent reasons are:

"I don't want to limit my profits". The beginning traders admit that their goal is to quickly increase deposits. But due to lack of experience, they are not willing to risk leaving trades unchecked. And since they constantly monitor the market, they don't need Take Profit.

"I don't want to waste time calculating." Beginners prefer to use the "One-Click Trading" feature and do not consider it necessary to specify additional numbers in the order.

"Take Profit gets in the way of the chart." Traders open several positions and end up confused as to which Take Profit refers to which trade.

Conclusion

Take Profit and Stop Loss are incredibly important tools in forex trading. Of course, if you learn how to use them effectively. And the best way to do this is to determine your expectation level in advance and set Stop Loss and Take Profit levels based on your trading style and time frame.

It will be especially useful for scalpers and intraday traders, when due to the high volatility of currency pairs a trader may not have enough time to react to the changes in the forex market.

About AdroFx

Being a well-established brokerage company, AdroFx offers the best trading conditions to its clients from 200 countries. Founded by experts with a couple of decades of overall experience, AdroFx is one of the best platforms on the market for shares trading. Either a newbie or experienced trader, both will find here what they are looking for since the company provides various trading accounts for different trading styles and goals.