The Forex Rollercoaster: Understanding and Managing Drawdowns Effectively

In the fast-paced world of foreign exchange trading, where fortunes can change in the blink of an eye, understanding the concept of drawdown is akin to wielding a compass in a stormy sea. Drawdown, the measure of decline from peak to trough in investment value, serves as a guiding light for traders navigating the tumultuous waters of the forex market. From unexpected market shifts to misjudged trades, drawdown reflects the setbacks faced by traders, illuminating the path toward risk assessment and capital preservation.

In this comprehensive guide, we embark on a journey through the labyrinth of forex trading, unraveling the significance of drawdowns, exploring their various types, mastering measurement techniques, and unveiling strategies for effective drawdown management. Join us as we delve into the heart of drawdowns, empowering traders to weather market storms and steer their trading endeavors toward long-term success.

What Is a Forex Drawdown?

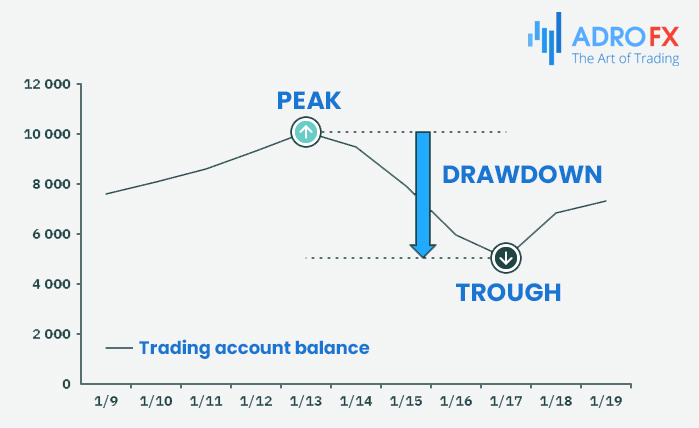

Drawdown stands as a pivotal concept, signaling the decline in an investment's value from its peak to its lowest point. This metric is akin to a financial rollercoaster, tracing the ups and downs of a trading account's performance over a specific period.

Forex drawdown, in essence, reflects the setbacks faced by traders, manifesting as a reduction in account balance due to losses incurred from open positions. These losses can stem from various sources, including adverse market movements, misjudged trades, or unforeseen geopolitical events impacting currency markets.

As traders navigate the dynamic landscape of forex markets, understanding drawdown becomes paramount. It serves as a compass, guiding risk assessment and providing insights into the potential downturns a trading strategy may encounter. Effectively managing drawdown is not merely about weathering market storms but ensuring the preservation of capital and the sustainability of trading endeavors.

Why Are Drawdowns Important in Forex Trading?

Drawdowns occupy a central position in the world of forex trading, serving as crucial barometers of a trader's journey through the markets. These troughs in account balance, tracing the valleys amidst peaks, hold profound significance for several reasons:

- Risk Evaluation

Drawdowns offer a lens through which traders assess the risk associated with their strategies. By understanding the magnitude and frequency of drawdowns, traders gauge the potential losses they might face during adverse market conditions.

- Performance Measurement

Drawdowns provide a yardstick for evaluating the performance of trading systems or strategies. A lower drawdown signifies smoother equity curves and a more stable approach to trading, whereas high drawdowns may indicate riskier strategies or systems.

- Psychological Preparedness

Knowing the drawdown potential of a trading strategy prepares traders psychologically for the inevitable downturns in their trading journey. This awareness can help traders stay disciplined and resilient during challenging market phases.

- Capital Preservation

Effective drawdown management is essential for preserving trading capital. By keeping drawdowns within acceptable limits, traders mitigate the risk of significant capital erosion and increase the longevity of their trading endeavors.

- Strategy Refinement

Analyzing drawdowns allows traders to identify weaknesses in their strategies and make necessary adjustments. Whether it involves tweaking risk parameters or refining trade execution, understanding drawdowns aids in continuous improvement.

In essence, drawdowns serve as vital compasses in the intricate landscape of forex trading, guiding traders toward prudent risk management, robust performance evaluation, and sustainable trading practices.

Types of Drawdowns

In forex trading, drawdowns manifest in various forms, each offering unique insights into a trader's performance and risk exposure. Here are the primary types of drawdowns that traders encounter:

Equity Drawdown

Equity drawdown represents the decline in the value of a trading account from its peak to its lowest point. It reflects the actual monetary losses incurred during unfavorable market conditions and is a fundamental measure of risk in forex trading.

Relative Drawdown

Relative drawdown, also known as percentage drawdown, expresses the decline in account equity as a percentage of the account's peak value. This metric standardizes drawdown across different account sizes, allowing for meaningful comparisons between traders with varying capital bases.

Peak-to-Valley Drawdown

Peak-to-valley drawdown measures the largest percentage decline in equity from a previous peak to the subsequent lowest point before a new peak is reached. It offers insights into the depth of losses experienced by a trader during a specific trading period.

Maximum Drawdown

Maximum drawdown represents the most substantial percentage decline in account equity from a peak to a trough over a specified period. It serves as a key risk metric, indicating the worst-case scenario for a trader and helping establish risk tolerance levels.

System Drawdown

System drawdown assesses the decline in equity specifically attributable to a trading system or strategy. By isolating drawdowns associated with individual systems, traders can evaluate the effectiveness of their strategies and make informed decisions about their trading approach.

Understanding these various types of drawdowns equips traders with valuable tools for assessing risk, evaluating performance, and refining trading strategies in the dynamic landscape of forex markets.

Exploring Drawdown Measurement Techniques

Understanding drawdowns and how to measure them accurately is paramount in forex trading, offering insights into performance and risk exposure. Let's delve into effective methods for gauging drawdowns:

Identify Peak and Trough Points

Start by pinpointing the peak and trough points on your trading account's equity curve. The peak marks the highest account value, while the trough signifies the lowest point after a decline.

Calculate Equity Drawdown

Equity drawdown is determined by subtracting the trough value from the peak value. This calculation reveals the absolute monetary decline in the trading account during the drawdown period.

Compute Relative Drawdown

Expressed as a percentage, relative drawdown is calculated by dividing the equity drawdown by the peak value and multiplying by 100. This standardizes drawdown across various account sizes, enabling meaningful comparisons between traders.

Determine Peak-to-Valley Drawdown

This measure involves assessing the largest percentage decline in equity from a previous peak to the subsequent lowest point before a new peak is reached. It offers insights into the depth of losses experienced during a specific trading period.

Assess Maximum Drawdown

Maximum drawdown indicates the most substantial percentage decline in account equity from a peak to a trough over a specified period. It serves as a critical risk metric, outlining the worst-case scenario for a trader's account.

Evaluate System Drawdown

System drawdown focuses on evaluating the decline in equity attributed to a specific trading system or strategy. By isolating drawdowns associated with individual systems, traders can assess their effectiveness and make informed decisions.

By following these steps to measure drawdowns accurately, traders gain valuable insights into their trading strategies' performance, risk exposure, and resilience. This understanding empowers them to make informed decisions, manage risk effectively, and pursue sustainable trading practices in the dynamic forex markets.

The Significance of Drawdown Measurement

Measuring drawdowns is crucial for forex traders, providing insights into performance, risk exposure, and strategy refinement. Here's why it's essential:

- Risk Assessment

Drawdowns serve as vital tools for assessing trading strategy risk. By quantifying potential losses during adverse market conditions, traders can adjust their risk management strategies accordingly.

- Performance Evaluation

Measuring drawdowns allows traders to evaluate trading system or strategy performance. A lower drawdown indicates smoother equity curves and more stable performance, while higher drawdowns may signal riskier approaches needing refinement.

- Capital Preservation

Understanding drawdowns is key to preserving trading capital. By monitoring drawdown levels and implementing appropriate risk controls, traders can protect their investments over the long term.

- Psychological Preparedness

Measuring drawdowns prepares traders mentally for the challenges inherent in forex trading. Acknowledging and accepting drawdown possibilities cultivates discipline, resilience, and emotional stability during difficult market periods.

- Strategy Refinement

Analyzing drawdowns helps traders identify strategy weaknesses and make necessary adjustments. Whether tweaking risk parameters or adapting to market changes, understanding drawdowns fosters continuous improvement in trading approaches.

- Long-Term Sustainability

Measuring drawdowns and implementing effective risk management strategies enhance trading sustainability. Maintaining drawdowns within acceptable limits ensures consistent profitability, longevity in the markets, and achievement of long-term trading goals.

In essence, measuring drawdowns is essential for forex traders navigating market complexities. Leveraging drawdown analysis enables informed decision-making, prudent risk management, and resilience in the dynamic world of forex trading.

Strategies for Drawdown Management in Forex Trading

Controlling drawdowns in forex trading is not merely a preference but a strategic necessity for safeguarding capital and ensuring long-term profitability. Drawdowns, the troughs in an account's equity curve, can significantly impact a trader's financial standing and psychological well-being. Fortunately, there are effective techniques and practices traders can employ to manage drawdowns:

- Implement Rigorous Risk Management Protocols

One fundamental strategy for drawdown control involves establishing maximum acceptable risk per trade as a percentage of account equity and consistently adhering to this limit. By limiting capital exposure in each trade, traders can mitigate the adverse effects of market movements on their overall portfolio.

- Embrace Diversification

Diversifying across multiple strategies, timeframes, and currency pairs rather than relying on a single approach can help spread risk and reduce the likelihood of significant drawdowns affecting the entire portfolio. Diversification also offers opportunities for uncorrelated returns, enhancing portfolio resilience.

- Utilize Risk-Limiting Tools

Incorporating risk-limiting tools such as Stop Loss orders and position sizing techniques is crucial for drawdown control. Stop Loss orders automatically exit trades at predetermined price levels, while position sizing techniques adjust trade size based on account size and risk tolerance, preventing any single trade from disproportionately impacting the account during drawdowns.

- Regular Monitoring and Analysis

Continuous evaluation of trading performance, identification of drawdown patterns, and adjustment of strategies are indispensable for effective drawdown control. By understanding the root causes of drawdowns, traders can refine their approach, optimize risk management practices, and minimize future drawdowns.

- Maintain Discipline and Emotional Control

Discipline and emotional stability are paramount for drawdown control. Emotions like fear and greed can lead to impulsive decision-making during drawdown periods, exacerbating losses. By adhering to pre-defined trading plans, staying rational, and avoiding emotional trading, traders can navigate drawdowns with resilience and confidence.

In conclusion, drawdown control is integral to successful forex trading. By implementing robust risk management practices, diversifying portfolios, utilizing risk-limiting tools, conducting regular performance analysis, and maintaining discipline, traders can effectively manage drawdowns and position themselves for long-term trading success.

Conclusion

As we draw the curtains on our exploration of drawdowns in forex trading, it's imperative to reflect on the critical insights gained along the way. From evaluating risk and performance to preserving capital and refining strategies, drawdown management emerges as the cornerstone of sustainable trading practices.

In the dynamic landscape of forex markets, where uncertainty reigns supreme, mastering drawdown is not merely a choice but a strategic imperative. By implementing robust risk management protocols, embracing diversification, utilizing risk-limiting tools, and maintaining discipline, traders can chart a course toward long-term profitability and resilience.

As you navigate the intricate web of forex trading, may the lessons learned here serve as a beacon of guidance, empowering you to harness the power of drawdowns and emerge victorious in the ever-evolving world of trading.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.