Forex Chart Patterns: Your Roadmap to Informed Trading

In the ever-evolving domain of forex trading, chart patterns serve as a distinctive language, articulating insights into market sentiment and potential future price trajectories. These patterns act as imprints left behind by market participants, revealing recurring formations that traders and analysts decipher to make well-informed decisions.

Imagine a chart as a canvas capturing the constant flux of currency prices over time. Within this canvas, various patterns emerge, each narrating a unique story - patterns such as the Head and Shoulders, Double Tops, Triangles, and more. Far from being arbitrary, these formations mirror the collective actions of buyers and sellers in the market.

For example, the Head and Shoulders pattern, reminiscent of its namesake, often signals a potential reversal in the trend. Conversely, a Double Bottom formation, much like a market finding its support, suggests a shift from a downtrend to an uptrend.

The significance of chart patterns lies in their capacity to provide a visual framework for traders. Recognition of these patterns can furnish practical insights into potential trend reversals, continuations, and the strength of existing trends. They essentially serve as navigational aids, guiding traders through the intricate landscape of forex markets.

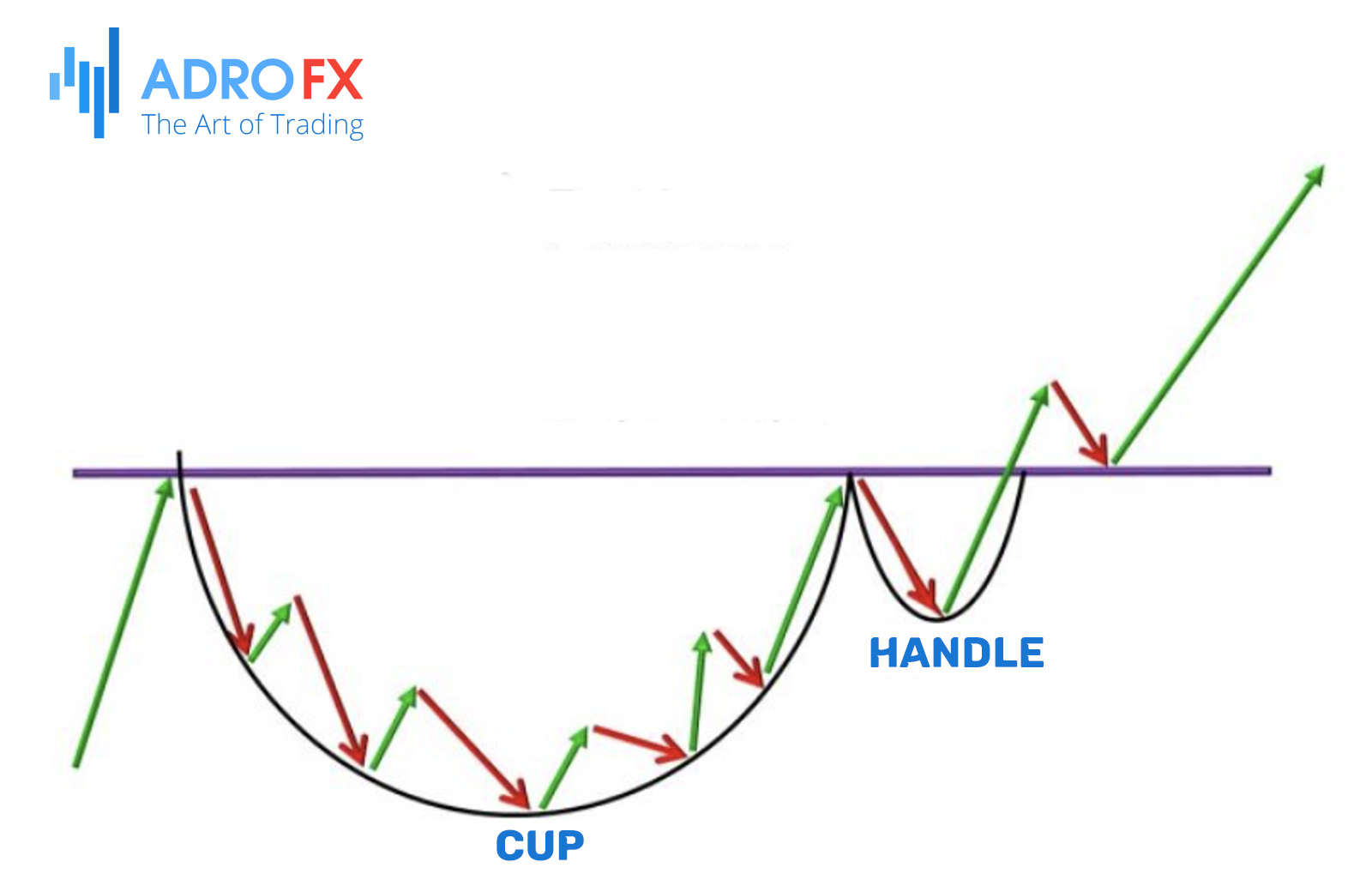

Take, for instance, the Cup and Handle pattern, portraying a rounded bottom followed by a consolidation phase, resembling the handle of a teacup. This formation indicates a potential bullish continuation after a consolidation period.

Furthermore, the relevance of chart patterns extends beyond mere identification; they transform into potent tools for anticipating market movements. Traders often integrate these patterns with other technical analysis tools to augment the likelihood of successful trades. The adept interpretation of chart patterns equips traders with a profound understanding of market psychology, empowering them to navigate the complexities of forex trading with increased confidence.

As we venture into the subsequent sections, let's scrutinize various chart patterns meticulously, unraveling their distinctive characteristics, implications, and exploring how traders leverage them to secure a competitive advantage in the dynamic world of forex.

The Most Common Forex Chart Patterns

Now, let's immerse ourselves in the intriguing domain of the most prevalent forex chart patterns. Each of these patterns unravels unique market dynamics and equips traders with valuable insights into price movements. We will delve into five of the most frequently encountered patterns, scrutinizing their characteristics, significance, and how traders leverage them to make astute decisions in the ever-changing forex landscape.

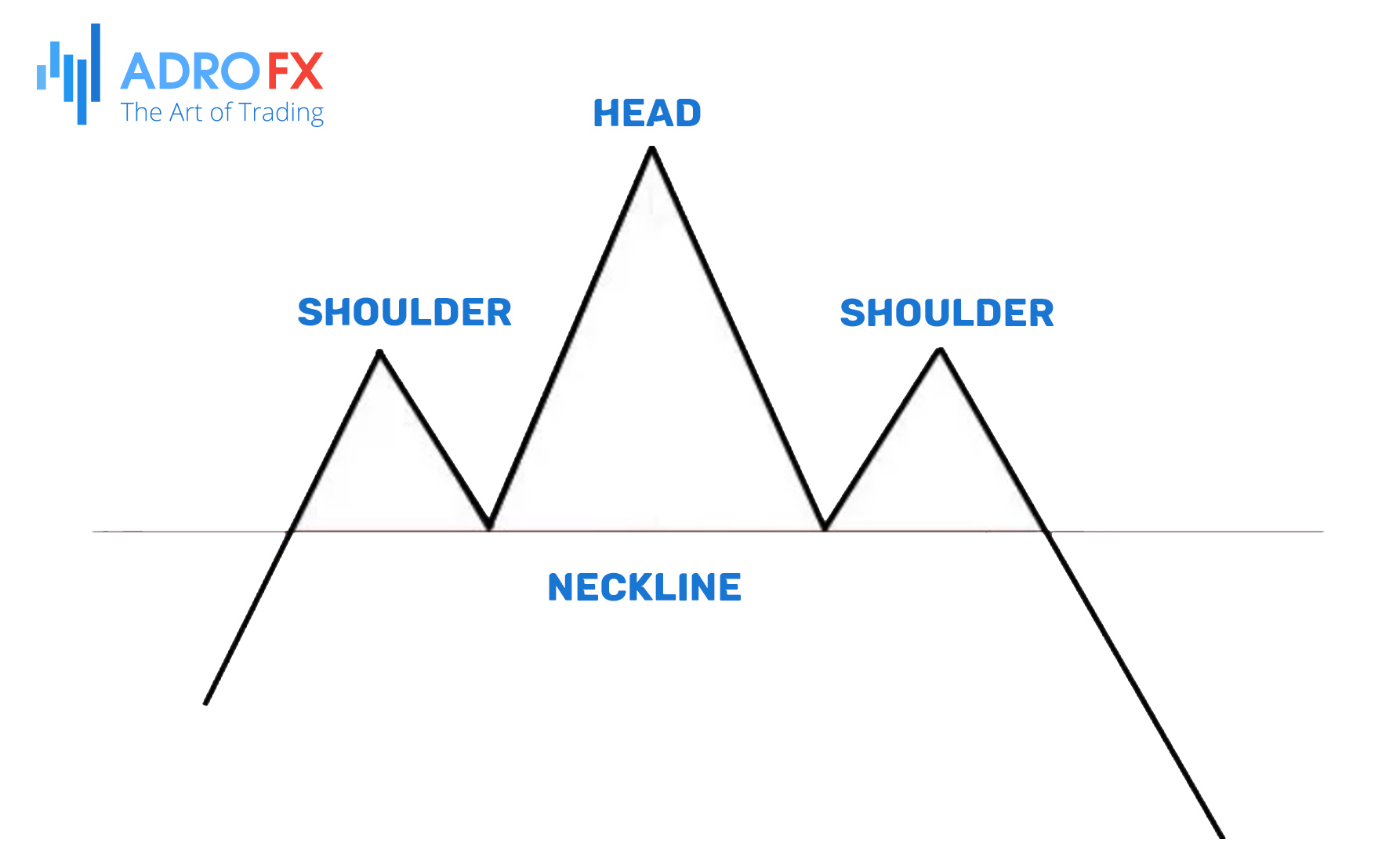

Head and Shoulders Pattern

As a potent indicator of potential trend reversals, the Head and Shoulders pattern showcases three distinctive peaks – a higher peak (referred to as the head) positioned between two lower peaks (known as shoulders). This pattern serves as a signal for a transition from an ongoing uptrend to a downtrend or vice versa.

Traders often look for a neckline, a support or resistance line connecting the lows of the pattern. The confirmation of a decisive break below the neckline validates the pattern, indicating a bearish continuation.

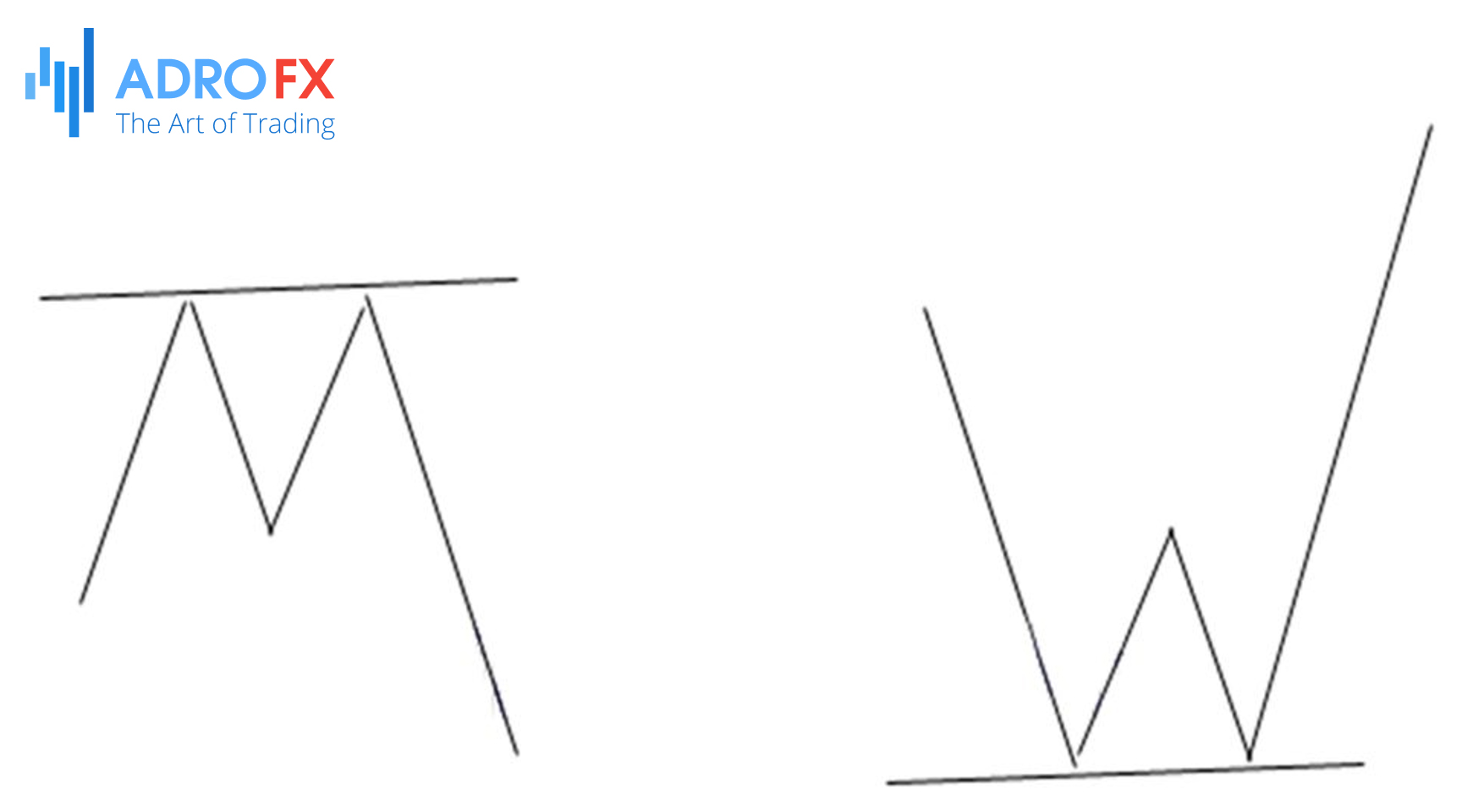

Double Top and Double Bottom Patterns

Emerging after an uptrend, Double Top patterns manifest as two consecutive peaks, suggesting a potential reversal towards a downtrend. Conversely, Double Bottom patterns surface following a downtrend, featuring two troughs and hinting at an impending change towards an uptrend.

Traders exercise patience, awaiting confirmation through the observation of a breakout or breakdown from the neckline.

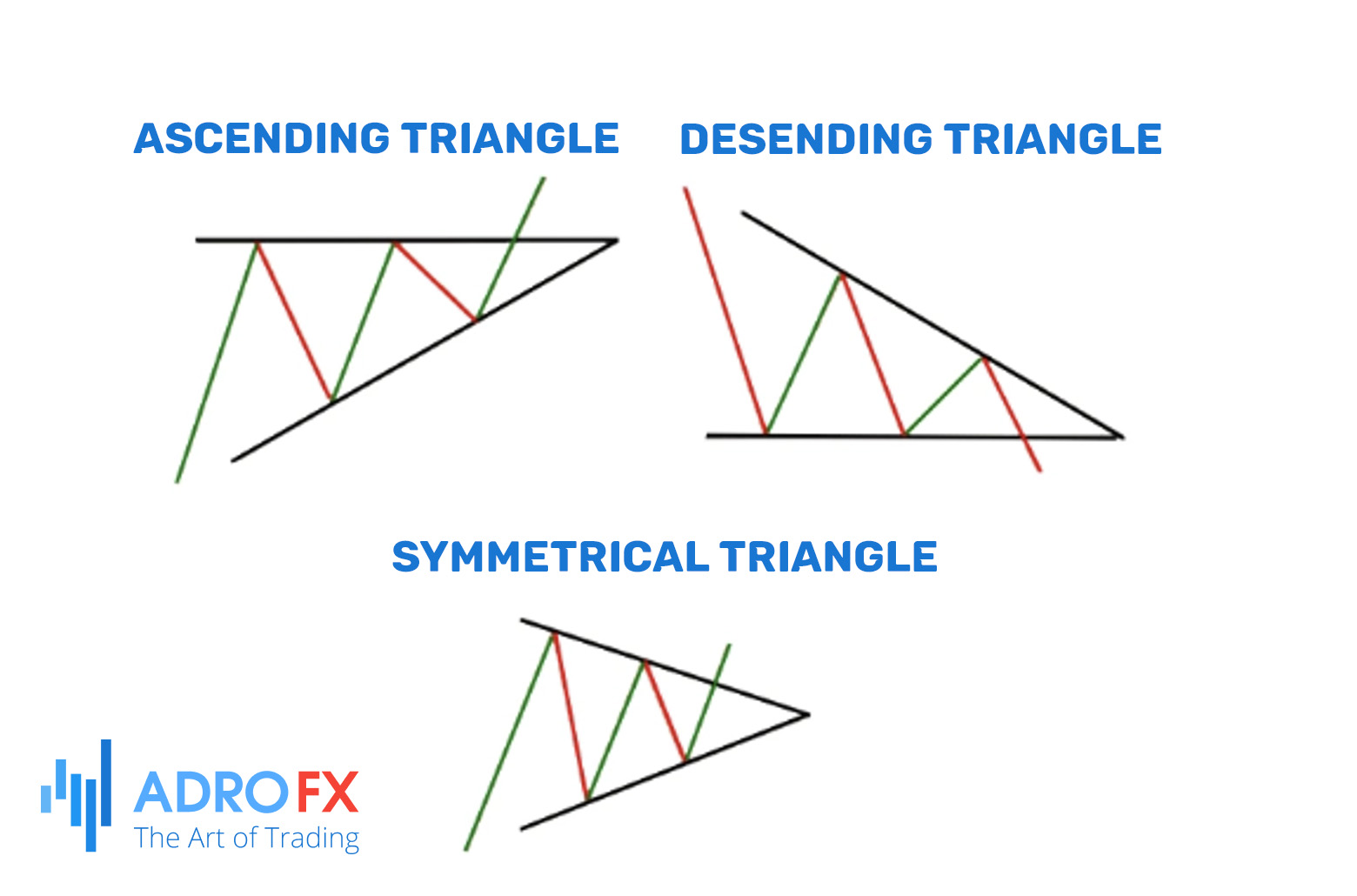

Triangle Patterns

Triangles, depicting a consolidation period before a likely breakout, manifest in various forms such as symmetrical triangles, ascending triangles, and descending triangles.

Symmetrical triangles suggest the continuation of an existing trend, while ascending triangles point to potential bullish breakouts, and descending triangles imply potential bearish breakouts. Traders keenly anticipate a breakout aligned with the direction of the prevailing trend.

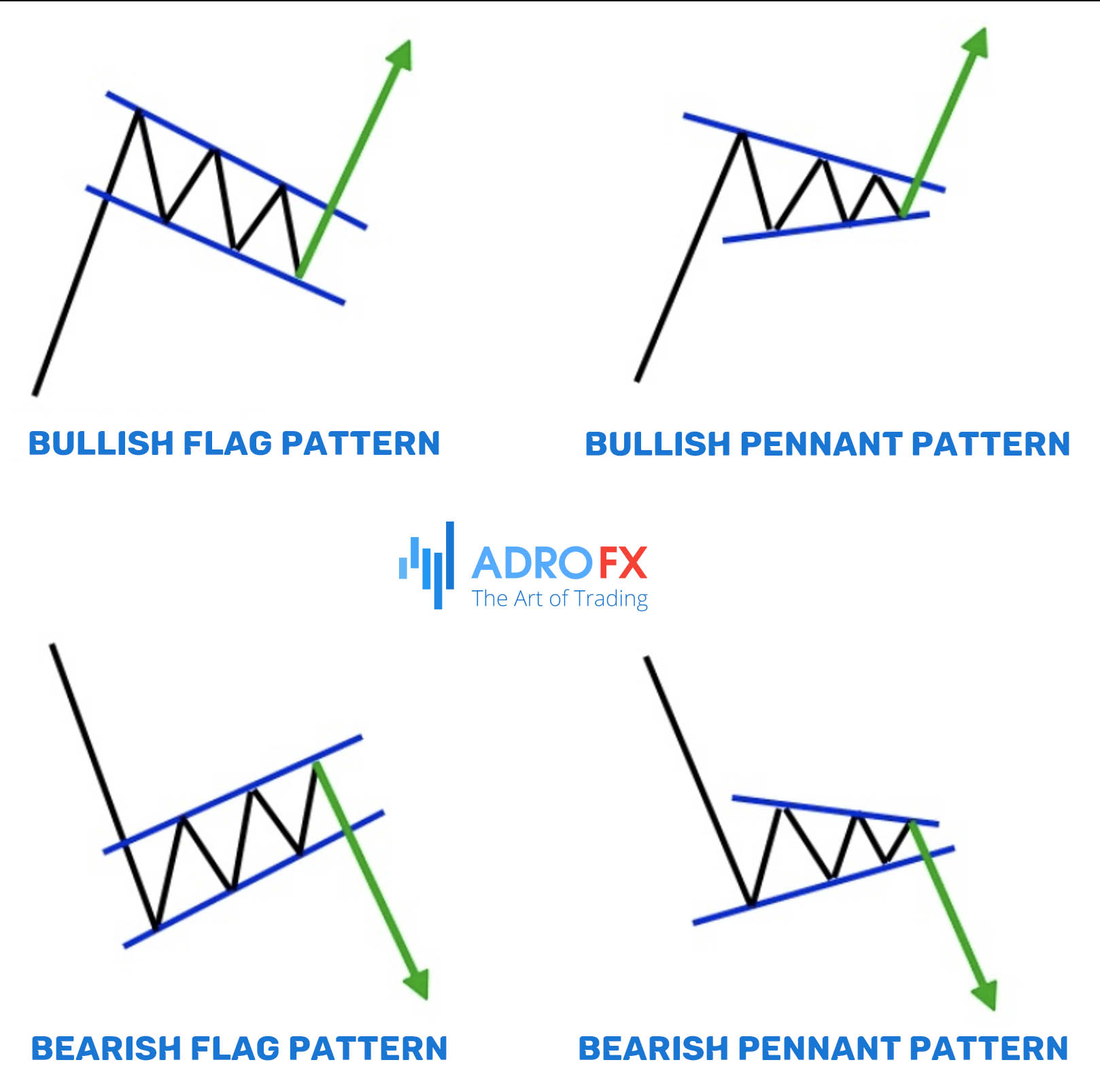

Flags and Pennants

Categorized as short-term continuation patterns, Flags and Pennants materialize after robust price movements. Flags, resembling rectangles akin to a flag on a pole, and pennants, featuring small symmetrical triangles, both indicate a brief consolidation before the prior trend resumes. Traders often make entry decisions when the price breaks out of the flag or pennant formation.

Cup and Handle Pattern

Illustrating a bullish continuation pattern, the Cup and Handle pattern mimics the shape of a tea cup. It comprises a rounded bottom (cup) followed by a consolidation period (handle). Traders interpret this pattern as a signal of temporary consolidation before a potential upward movement. The validation of the pattern occurs with a breakout from the handle, confirming a bullish continuation.

Understanding these prevalent forex chart patterns equips traders with a comprehensive toolkit for analyzing price action and formulating strategic decisions. As we delve into the intricacies of each pattern, reflect on how traders integrate these formations into their analyses to gain a deeper understanding of market dynamics and enhance their trading strategies.

Why Are Forex Patterns Important for Traders?

Understanding and identifying forex patterns holds paramount importance for traders across all experience levels. These patterns serve as invaluable tools that significantly contribute to a trader's ability to make well-informed decisions and navigate the intricacies of the dynamic forex markets. Here's why forex patterns play a crucial role for traders:

- Enhanced Predictive Analysis through Pattern Recognition

Forex patterns, such as Head and Shoulders, Double Tops, and Triangles, visually represent historical price movements. Recognizing these patterns empowers traders to anticipate potential future price movements, thereby enhancing the accuracy of predictive analysis. - Insights into Market Psychology

Chart patterns act as reflections of the collective behavior of market participants, representing a blend of buyers and sellers. Studying these formations provides insights into market psychology, assisting traders in understanding prevailing sentiment and potential shifts in market dynamics. - Identification of Trend Reversals and Continuations

A primary function of forex patterns is to signal potential trend reversals or continuations. Patterns like Double Bottoms suggest a reversal from a downtrend to an uptrend, while Flags and Pennants indicate a temporary consolidation before the resumption of the existing trend. Recognizing these signals enables traders to align their strategies with the prevailing market direction. - Risk Management and Timely Entries

Forex patterns assist traders in implementing effective risk management strategies. Understanding the potential implications of a pattern allows for setting appropriate stop-loss levels and determining optimal entry points, contributing to more disciplined trading practices. - Confirmation of Technical Analysis Signals

Traders often combine chart patterns with other technical analysis tools, such as trendlines, support and resistance levels, and oscillators. The confirmation provided by chart patterns adds robustness to technical analysis signals, enhancing the overall reliability of trading decisions. - Time Efficiency in Decision-Making

In the fast-paced world of forex trading, quick and accurate decision-making is crucial. Chart patterns offer a concise and visual representation of market conditions, enabling traders to efficiently assess potential opportunities and act promptly. - Versatility Across Time Frames

Forex patterns exhibit versatility and applicability across various time frames. Whether a trader focuses on short-term intraday trading or longer-term swing trading, the principles of pattern recognition remain relevant, providing a consistent framework for analysis. - Enhanced Confidence and Discipline

Successfully identifying and interpreting forex patterns contributes to traders' confidence in their analyses. This confidence, combined with discipline in adhering to trading strategies based on pattern recognition, fosters a more resilient and successful trading mindset.

In essence, forex patterns serve as a cornerstone for traders, offering a structured framework to interpret market behavior and make well-informed decisions. The ability to recognize and leverage these patterns empowers traders to navigate the complexities of the forex market with precision, adaptability, and a strategic edge. As traders incorporate pattern analysis into their toolkit, they unlock a deeper understanding of market dynamics and enhance their overall trading proficiency.

Tips for Determining Chart Patterns

Successfully navigating the complexities of forex chart patterns requires a discerning eye and a nuanced understanding of market dynamics. Here are valuable tips for determining and interpreting chart patterns:

- Patience and Confirmation

Exercise patience and wait for confirmation before acting on a potential chart pattern.

Confirmatory signals, like a breakout or breakdown from a neckline, enhance the credibility of the pattern and reduce the risk of false signals. - Volume Analysis

Analyze trading volume when identifying chart patterns.

A surge in volume during the formation or confirmation of a pattern adds conviction to the signal, indicating stronger market participation. - Multiple Time Frame Analysis

Employ multiple time frame analysis to confirm chart patterns.

Viewing the same pattern in different time frames provides a more comprehensive perspective, aiding traders in making informed decisions. - Pattern Symmetry

Pay attention to the symmetry and proportionality of chart patterns.

Well-defined and symmetrical patterns are generally more reliable, while deviations from expected shapes may be less trustworthy. - Pattern Duration

Consider the duration of the chart pattern.

Longer-term patterns tend to have stronger implications for price movements, while short-term patterns may result in more immediate, though potentially less significant, price changes. - Fundamental Analysis

Integrate fundamental analysis with chart pattern analysis for a holistic approach.

External factors such as economic releases, geopolitical events, or central bank decisions can influence the validity of chart patterns. - Trend Confirmation

Ensure that chart patterns align with the prevailing trend for optimal effectiveness.

Confirm that the pattern complements the overall market trend to enhance the odds of successful trades. - Continuation Patterns

For continuation patterns like flags, pennants, or triangles, prioritize trading in the direction of the prevailing trend.

These patterns often indicate a temporary pause before the trend resumes. - Pattern Failure Recognition

Be prepared to recognize when a chart pattern fails to materialize.

Not all patterns lead to the expected outcomes, and acknowledging a pattern's failure promptly can help limit potential losses. - Combine with Other Indicators

Enhance the power of chart patterns by combining them with different technical indicators.

Using indicators such as moving averages, oscillators, or Fibonacci retracements in conjunction with chart patterns provides a more comprehensive view of market conditions.

By incorporating these tips into your analysis, you can navigate the nuances of chart patterns with greater confidence. Successful trading requires a blend of technical skill, strategic thinking, and a disciplined approach to risk management. As you delve deeper into specific chart patterns, keep these guidelines in mind to refine your ability to interpret and act upon market signals.

Final Thoughts

In conclusion, mastering the intricate world of forex trading demands a nuanced understanding of chart patterns, acting as a visual language that imparts valuable insights into market dynamics. These patterns, resembling footprints left by market participants, unfold on the canvas of price charts, revealing stories of potential trend reversals, continuations, and the strength of prevailing trends.

As we've delved into the most common forex chart patterns, including the Head and Shoulders, Double Top, Triangles, Flags, Pennants, and Cup and Handle, traders now possess a profound understanding of the diverse formations at their disposal. Each pattern unveils distinct market dynamics, providing traders with the insights needed to make informed decisions in the ever-evolving forex landscape.

Chart patterns go beyond mere recognition; they are potent tools that, when combined with other technical analysis tools, furnish traders with a comprehensive toolkit for analyzing price action. These patterns act as roadmaps, guiding traders through the complexities of forex markets and aiding them in anticipating potential market movements.

The journey doesn't conclude with pattern recognition. The subsequent tips for determining chart patterns offer practical advice to traders, emphasizing the importance of patience, volume analysis, multiple time frame analysis, pattern symmetry, and fundamental analysis. These tips function as a compass, assisting traders in navigating the intricacies of chart pattern analysis with greater confidence and precision.

Successful trading, as underscored, necessitates a blend of technical skill, strategic thinking, and disciplined risk management. By incorporating the insights gained from understanding chart patterns and applying the provided tips, traders can refine their approach, gaining a competitive edge in the dynamic and ever-challenging world of forex trading.

As you embark on your trading journey armed with the knowledge of chart patterns, remember that continuous learning and adaptability are keys to success in the dynamic and ever-evolving forex markets. May your charts be clear, your analyses insightful, and your trades prosperous. Happy trading!

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.