Fed Mega-Hike Expected On September 21 | Daily Market Analysis

Key events:

Japan - National Core CPI (YoY) (Aug)

Australia - RBA Meeting Minutes

The upcoming Federal Open Market Committee (FOMC) meeting on September 21 will be two-fold important. It's not because the central bank will raise interest rates sharply. It's because of the new FOMC forecasts. Since the July meeting and the release of the higher-than-expected CPI in the debt and term markets, there have been significant revisions to the estimates. This gives special weight to the Fed's guidance as it will probably set the direction for monetary policy for the remainder of 2022 and 2023. If the Fed's forecasts are too low, there is a risk of easing financial conditions, which the central bank does not want.

Jerome H. Powell, Chair of the Federal Reserve of the United States

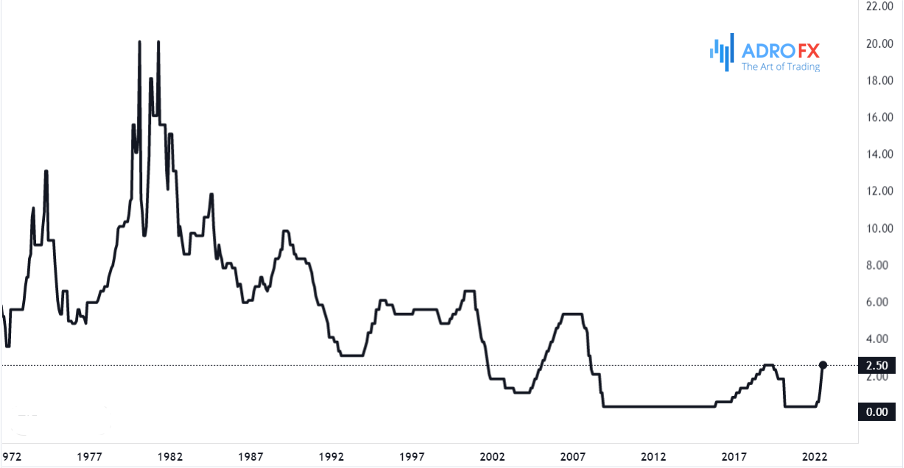

The market may have made it easier for the Fed, as federal funds rate futures now indicate the likelihood that the overnight rate will rise to a final level of 4.45% by April. Less clear is what will happen next. At the moment, quotes are pricing in a rate cut to 4.0% by December 2023. Such a level may be too low for the Fed, given the higher-than-expected CPI and calls to keep rates unchanged for some time.

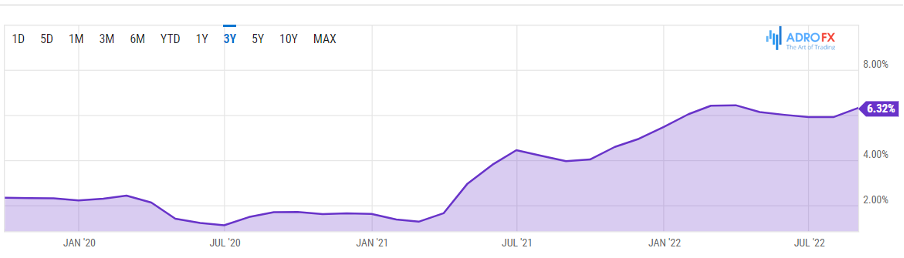

Inflation remains too high

According to June FOMC estimates, the key rate was expected to rise to 3.4% by December 2022 and to 3.8% by December 2023. But the CPI data released since then indicated extremely heated inflation. While the annual growth rate of the overall CPI remained around 8%, the core CPI accelerated from 5.9% to 6.3%. The Federal Reserve Bank of Atlanta's (FRB) so-called "sticky" 12-month CPI accelerated to 6.2% from 5.6%. On top of that, the Federal Reserve Bank of Cleveland is now forecasting a rise in core CPI in September to 6.6%.

US Core CPI chart

All of this means that core and sticky inflation are accelerating, while lower energy prices have helped smooth out fluctuations in overall CPI. These indicators are likely to be of concern to the Fed because there are no signs of them slowing down yet. On top of that, employment continues to grow strongly, as evidenced by the Kansas City Fed's labor market conditions index.

The Fed needs to be even more hawkish than expected

All of this suggests that the Fed is likely to be even more hawkish than it was at its June meeting. To prevent an easing of financial conditions, the Fed will need to set an even more hawkish direction for monetary policy than the federal funds rate futures market now suggests. It is possible that the new forecast would require the rate to be at 4.5% at the end of 2023.

US Interest Rate Chart

The Fed has made it clear that once rates are at their final level, it will keep them there until it sees enough evidence of slowing inflation. This means that the market's current expectation of a 4% rate in December 2023 is probably 50 basis points lower than it should be, and the Fed could use its projections to raise the back end of the futures curve.

Either central bank could sound estimates that coincide with market expectations, but in that case, it would be vulnerable to the market's backward-looking thinking. If the Fed is less hawkish than expected, it will be perceived as soft, allowing risky assets to rally, which in turn would lead to a loosening of financial conditions.