Fear of a Global Banking Crisis Is Fading, US GDP and EU CPI in Focus | Daily Market Analysis

Key events:

- Eurozone – ECB Economic Bulletin

- UK – BOE Inflation Letter

- USA – GDP (QoQ) (Q4)

- USA – Initial Jobless Claims

U.S. stock indices closed yesterday's trading with growth due to strengthening sectors of technology, finance, and consumer services as concerns about the banking crisis in the U.S. weakened. Shares of the leading financial institutions rose from 0.1 percent to 0.9 percent.

Fed Vice Chairman of Banking Supervision Michael Barr said Silicon Valley Bank failed because its management did not properly address the clear risks. These risks are related to high interest rates and liquidity problems. According to Barr, Silicon Valley Bank's crisis may be an isolated incident.

The bank turmoil has changed the market's view of the direction of interest rates. Futures traders are now divided over whether the Fed will raise rates another quarter of a percentage point when it meets in May or leave rates unchanged.

According to the Fed's own economic forecasts, the benchmark rate will reach 5.1% this year, suggesting another increase from the current target level of 4.75% to 5% is possible.

Pending home sales data showed U.S. home prices rising 0.8% in February, a stronger-than-expected 2.3% decline even amid rising mortgage rates.

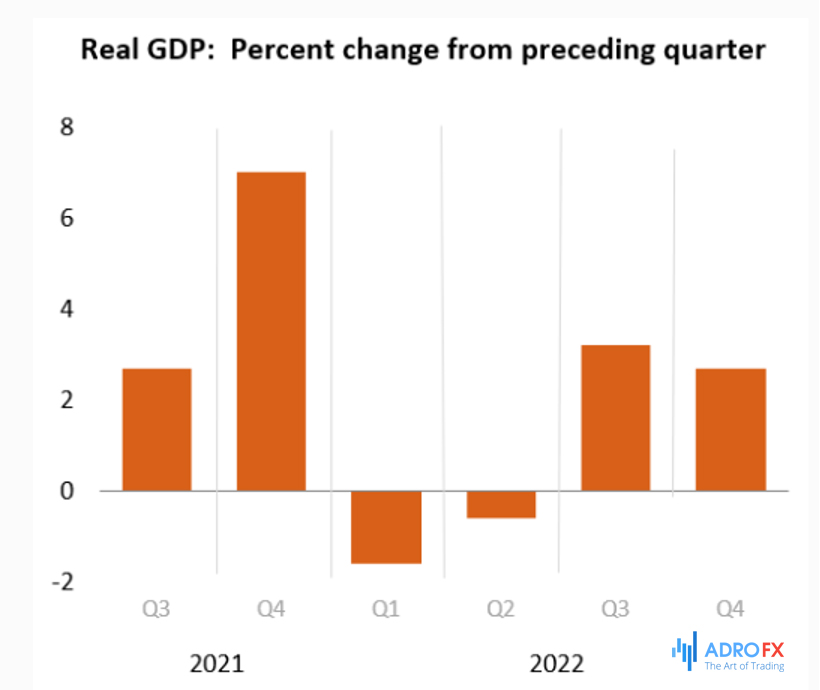

Today, the U.S. is scheduled to release its latest GDP update, expecting a 2.7% growth in Q4 and a stable GDP price index of around 3.9%. While higher-than-expected inflation could have negative effects, strong growth could prompt a positive market reaction, indicating that Fed rate hikes are almost over and the economy is in a better position than anticipated. This could lead to higher sovereign yields without necessarily impacting equity appetite.

However, weak data could drive away Fed hawks and increase equity appetite based on lower Fed expectations. Still, building long positions anticipating a recession is not recommended in the medium term.

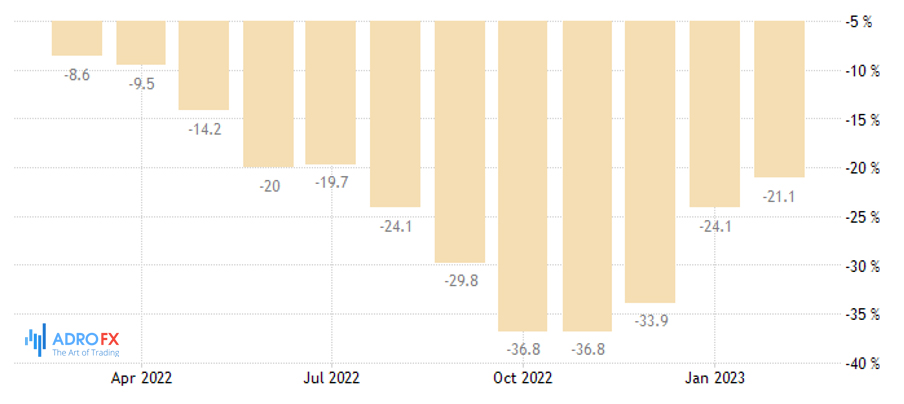

Meanwhile, the Eurozone is set to release March CPI data from today until Friday. The March numbers are significant because they will compare consumer prices only to war months, which is expected to have a cooling effect on inflation data. While eurozone inflation is predicted to decrease from 8.5% to 7.1%, core inflation, which filters out energy and food prices, is expected to increase, keeping the ECB hawks prepared for a potential rise towards 1.10 against the U.S. dollar.

In energy markets, tensions in the Kurdish region of Iraq led to a 500,000 barrel decline in supply, and the surprise 7.5 million barrel decrease in US crude inventories last week pushed American crude prices to $74 per ounce, levels seen before the Silicon Valley Bank (SVB) collapse. However, the bank stress is not yet resolved, and the impact on the real economy is still uncertain, so we could face significant resistance in the $75/77 range, where the 50 and 100-DMA are located.

Overnight, official Chinese PMIs for March are set to be released, with expectations of a slight moderation following the initial post-Covid boost to activity. However, both manufacturing and services indices are anticipated to indicate above-trend growth rates.