Europe to Open Higher After U.S. Strong Performance Last Week | Daily Market Analysis

Key events:

- Eurozone – ECB President Lagarde Speaks

After two weeks of strong gains, European markets returned some of the momenta from earlier this year with a subdued pullback last week, with some suggesting that we may have seen highs in the short term, similar to what we saw last year.

In the U.S. markets, the week was more mixed, with the Dow posting its worst week since early December, while the Nasdaq 100 ended the week higher.

While there is some logic to the claim that we may have seen a peak in U.S. markets given the way they have behaved over the past few months, there is less argument when looking at markets in Europe, which look set to open higher this morning.

Valuations in Europe are initially lower, and from an earnings/dividend perspective much more attractive than in the U.S., with the FTSE100 and DAX trading at projected dividend yields of 3.77% and 3.36%, respectively.

Nevertheless, there is a growing belief in financial markets that central banks are on the verge of a significant change in monetary policy later this year. This view seems to be gaining further support now that some Fed policymakers do not seem to be opposed to the idea of another step in the central bank's cycle of raising rates by up to 25 bps next week.

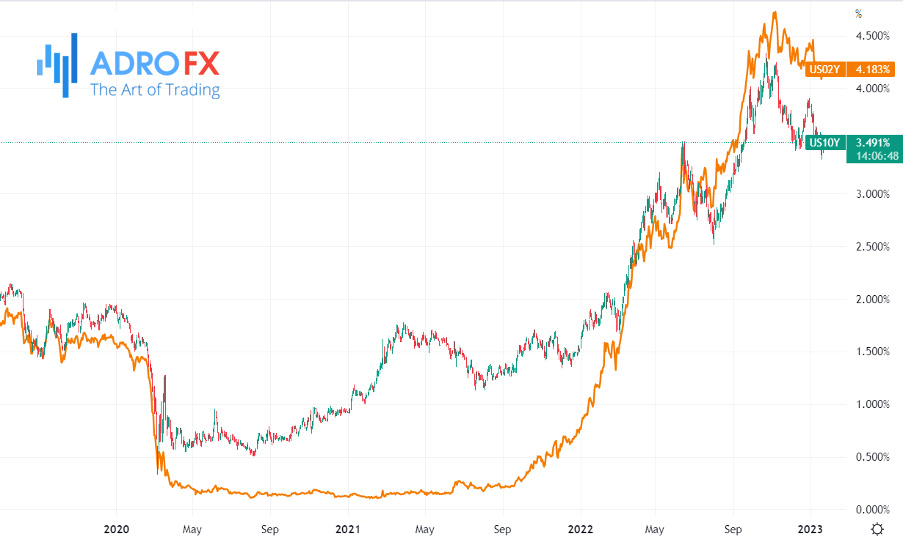

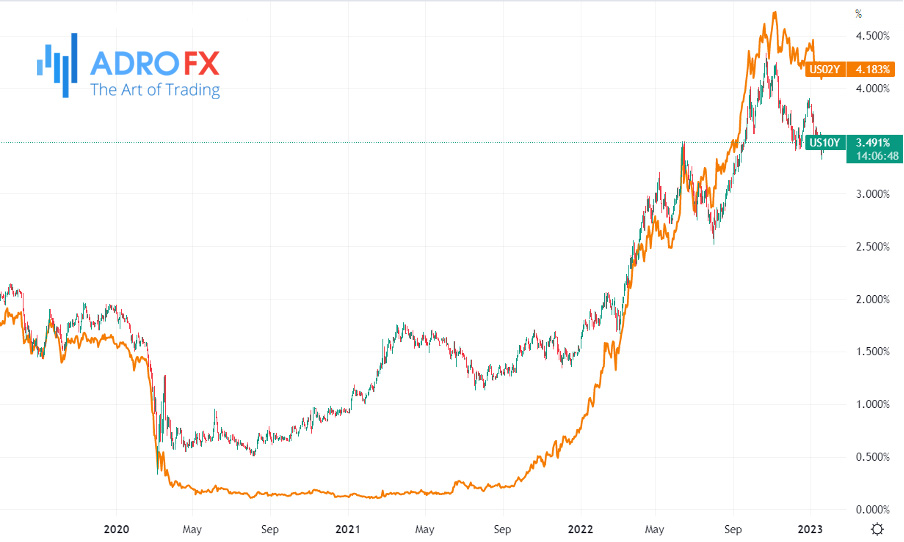

This view continues to be reflected in the U.S. bond market, where yields continue to hit new multi-week lows, with 2-year U.S. bonds closing lower for the third week in a row, as did 10-year bond yields.

The U.S. dollar dynamic was equally nuanced, hitting a new 8-month low as various European Central Bank officials continued to make more hawkish statements. The pound also held up well last week, closing higher against the U.S. dollar for the 4th week in a row.

Looking ahead to the new week, the focus will be on the latest company reports as investors will decide whether the current growth momentum can continue and how far central banks are willing to go to curb inflation.

Last week, markets seemed to find some solace in the fact that amid the uncertain outlook for the global economy, companies have become more focused on preserving margins, cutting costs, and cutting jobs.

This assumption is based on the assumption that any slowdown in economic growth would lead to a pause in the central bank's plans to raise rates, and then to a rapid rate cut. This assumes, of course, that the aforementioned central banks would be happy to start cutting rates when inflation is still well above target.

This seems highly unlikely, and while markets seem used to this way of thinking since the financial crisis cut rates sharply, it is by no means what it seems to the markets.

Unemployment is still low not only in the U.S., but also in Britain and Europe, and after Fed Chair Lael Brainard, usually considered "dovish," said last week that she thinks inflation is still too high, at this point, it is hard to imagine a scenario in which a rate cut this year would be likely.