Earnings Season — Meaning, How to Make Its Best Use?

Traditionally, the earning season is a favorite time of year for active traders. This is a time when the potential for making profits increases many times over.

The end of each quarter ends with the publication of corporate reports. This is a period of high market volatility, and traders try to make the most of it. As surfers catch a wave, traders try to join the movement, caused by the market's reaction to the publication.

It is a very important period for intraday, medium, and long-term traders.

Short-term traders trade stocks on the day of the report and a few days after the report is released, taking advantage of the momentum, and the emotional reaction of the market.

Long-term investors analyze some financial and economic indicators in dynamics and conduct comparative analysis. Not only a specific company's indicators taken into consideration but also the indicators of other representatives of the industry and sector of the economy; the state and prospects of the industry in general, and the competitive environment are evaluated. After the research, a decision is made on whether to include the securities in the investment portfolio.

The reporting season provides good opportunities for trading. According to statistics, traders have the best results exactly in these months.

What Is Earnings Season?

Corporations report their quarterly results in January-February, April-May, July-August, and October-November.

Reporting includes the Statement of Financial Performance, Balance Sheet, Statement of Cash Flows, Statement of Changes in Equity, Explanatory Notes and Management Commentary.

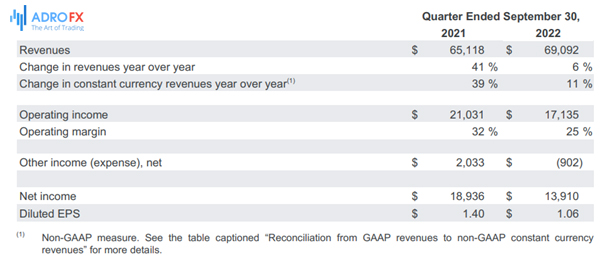

The main financial indicators that investors focus on are - revenue, net income, net income per share (EPS - Earnings per share), the amount of free cash flow, profitability ratios, liquidity, and the amount of dividends per share.

However, the figures themselves are not very informative.

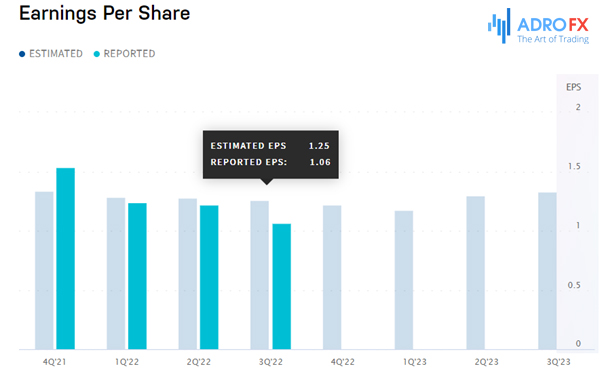

Before the release of the report, experts give their estimates of future performance. The coincidence or divergence of actual indicators with forecasted values most often determines the price movement. Even if the company has shown growth in revenue or profit, but the values were lower than expected, the stock is likely to begin to fall.

The company's forecast for the next reporting period may have a significant impact on investor sentiment. An improved outlook supports positive sentiment, while a lowered outlook or lack thereof may be a negative signal to investors and provoke sales.

The report indicators are examined in dynamics – concerning the previous reporting period or similar periods of the previous years. Absolute values do not tell much, what is more, important is how they change over time.

The result of young companies may be a loss because while they have not yet occupied their niche in the market, their revenues are not so high, and the costs are higher due to significant capital investments, loan obligations, etc. In this case, the dynamics are interesting. If a company is increasing revenues from quarter to quarter and the loss amount is decreasing, it is potentially interesting.

When Does Earnings Season Come?

Earnings season does not necessarily coincide with the calendar year. Companies' fiscal years usually depend on when they hit the market.

In general, each earnings season begins one week after the end of a quarter.

Quarters are three-month periods:

- January, February, and March = Q1;

- April, May, and June = Q2;

- July, August, and September = Q3;

- October, November, and December = Q4.

Reporting seasons are usually beginning in the middle of the following months:

- January;

- April;

- July;

- October.

Previously, in the U.S., the earnings season opened with the publication of Alcoa Corporation's report. But now, the largest American banks – JPMorgan, Wells Fargo, Bank of America Corporation, Citigroup – are at the forefront of reporting.

Each company has different reporting periods and deadlines, and there are no set dates. But each company alerts you to the release date of the next report.

Why Are Companies` Reports So Important?

Reports help to understand how well a company is doing. To decide on a long-term investment, it is worth looking at the statements not only for the last quarter, but earlier: companies have profitable and unprofitable periods, and this may depend on the time of year, external events, bad management, investments in new projects of the company - all this is stated in the statements and should help decide how successful the purchase of this stock will be.

Usually, the big banks and rating agencies publish their expectations for future earnings, and the companies themselves also make projections. Sometimes they are even more important to investors than the actual financial results: If the company's management sees a decrease in future profits, investors get rid of the company's shares, and their price goes down.

This was the case, for example, with Adobe in the middle of June: the report came out better than expected, but the stock lost 10% due to pessimistic management forecasts.

And, of course, the price will fall if the company did not meet the experts' expectations and the report came out worse than expected. The share price changes not only during the report, but the publication of financial results is always important news that you should follow if you have already chosen some shares.

What Data Can Be Found in the Report?

Companies report quarterly earnings, including net income, sales numbers, earnings per share, and other important metrics. Analysts view these numbers as powerful indicators of the overall economic health of each company, industry, and the economy as a whole.

A fair valuation of companies usually depends on earnings per share, which can also be found in reports. You can tell if a company is overvalued or undervalued compared to its competitors.

Most U.S. stocks are still overvalued, despite the market decline since the beginning of the year.

Companies usually publish additional data as well. For example, Netflix often reports the number of new subscribers and the budget allocated to create new content, and Apple shares the number of iPhones sold in the last quarter.

Earnings Season Opportunities

U.S. company reports are the hottest time in the market for day traders.

The stocks, for which reports are released, are the most volatile on the day of the release and the next few days.

Preparing for the day's work is similar to the strategy of trading stocks on the news.

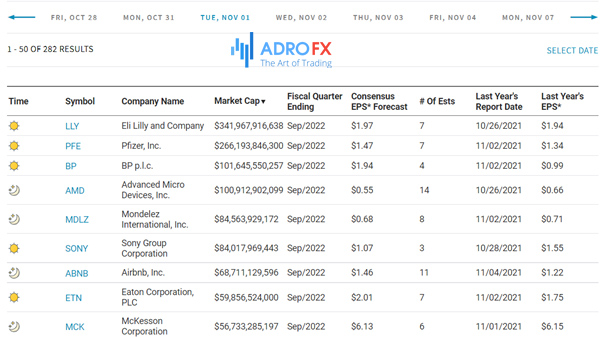

So, work begins with studying the list of companies that report today and reported the day before. Many resources, such as Nasdaq.com, FinanceYahoo.com, and Briefing.com, post data on the date and time of the report and forecast indicators.

Peculiarities of Trading During the Reporting Period

Traders watch the stock not only on the day of the report but also on the following days. Often, on the second day, emotions calm down a little, and the stock looks more technical and easier to trade.

If a company reports before the market opens, traders look at the stock's movement in the premarket, determine key levels, examine the technical picture, and make an algorithm for action.

If the report comes out after the market closes, then potential trades in such stocks occur the next day. And what matters here is whether or not there was a reaction in additional sessions. Active trading in the post-market and pre-market is a signal that the stock will also be of interest in the main session.

Follow the leader

The market situation cannot be considered literally and unequivocally - not always good numbers in a report are a guarantee of growth in quotations. The market is a complex mechanism, driven by a multitude of multidirectional factors. There are cases when a good report does not cause the expected positive reaction because of strong bearish sentiment in general or, on the contrary, a stock takes off for no apparent reason.

During the reporting period, it is possible to use the collective following of the leader. The market reaction to a report of a large company may be so powerful and vivid that it will provoke the movement of the whole sector. Therefore, you can use this factor and join the common ring. It is noteworthy that assets that follow the leader can be more understandable and predictable.

Top Tips For Trading Earnings Season

Want to face the earnings season fully prepared? Here are some tips to help you:

- Study previous reports

One of the most useful tools in your arsenal is analyzing a company's previous reports and financial statements. If a company reports higher sales or publishes positive reports throughout the year, you can expect the next report to be favorable as well. Spend some time studying - it will be worth it.

- Set up notifications

A unique tool is notifications from financial websites. Add a stock ticker or company name to the list and get notifications about publications on the Web site and app. You can also set to be notified one trading day in advance. Now you won't miss any news for sure.

- Check the reporting calendar

After setting up your notifications, examine the reporting calendar. Here you'll find accurate information about where the companies you're interested in are publishing their reports. You can use a filter by specific stock as well as by country, importance, or sector. We recommend setting up notifications for the companies you are interested in, so you don't miss the publication of reports.

- Join the community

Market sentiment is hard to measure or gauge, but you can spot trends and follow discussions in investment communities to understand what's happening with the stocks you're interested in. Read the opinions of other investors on the forums and join the discussions. Financial institutions often use market sentiment data to make investment decisions. You can also join discussions on other Web sites where many participants also gather.

- Follow the opinions of the experts

Whether you're an experienced investor or a novice, you don't have to reinvent the wheel. You don't have to figure it all out on your own - there's so much information that you wouldn't have a lifetime to study it. Instead, subscribe to knowledgeable people who can quickly answer your questions, even anticipating them.

What to Expect from This Earnings Season

It's no secret that the world is currently being interrupted by a serious crisis. High inflation - a record for decades in most developed countries - logistics disruptions, waves of illness, and the war in Ukraine have had an impact on company earnings. Most companies could likely show a decline in revenues over this period. But all is not so sad: oil has fallen heavily in the past two weeks on recession expectations, and this could calm inflation in the third quarter, return optimism to markets and even push back the recession into next year.

Conclusion

As you can see, preparing for the earnings season takes a lot of time and effort. Get ready to do a lot of reading. But don't let that scare you. Think about the fact that you will be better prepared than most investors. Trust your intuition and don't forget to set up notifications.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.