Dow Secures 10th Consecutive Weekly Gain, Fed's Interest Rate Decision and Central Bank Actions in Focus | Daily Market Analysis

Key events:

- UK - S&P Global/CIPS UK Manufacturing PMI

- USA - S&P Global US Services PMI (Jul)

On Friday, the Dow managed to secure a victory, achieving its 10th consecutive weekly gain and extending its longest winning streak since 2017. The positive performance was driven by gains in defensive sectors of the market, particularly utilities. Traders were cautious ahead of the upcoming quarterly results from major tech companies.

The Dow Jones Industrial Average saw a marginal increase of 0.01%, equivalent to 3 points, marking its longest daily winning streak since August 7, 2017. In contrast, the Nasdaq experienced a slight decline of 0.2%, while the S&P 500 edged up by 0.1%.

As the new week began, gold prices dipped slightly due to investors' wariness in anticipation of a significant Federal Reserve meeting. At the same time, copper prices suffered notable losses due to concerns over weakening demand in China.

Adding to the metal market's pressures was the recovery of the dollar. The greenback strengthened, distancing itself from the 15-month lows recorded earlier in July.

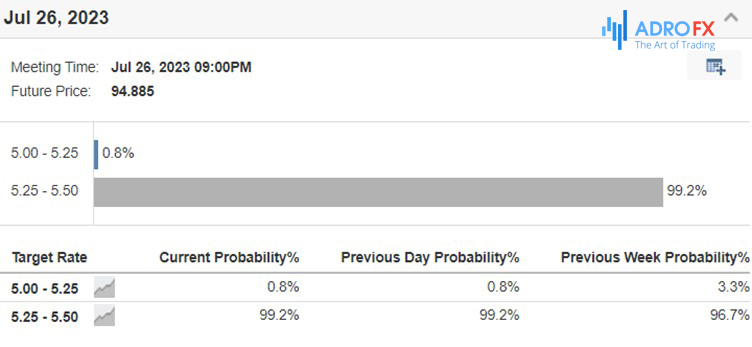

The focus of the markets recently has been on the Federal Reserve's decision regarding interest rates, which is expected to be announced at the conclusion of a two-day meeting on Wednesday. The consensus among investors is that the central bank will raise interest rates by 25 basis points.

However, there's also a strong belief among investors that the Fed might signal an extended pause in future rate hikes. This is because the central bank is nearing the end of its nearly 16-month-long rate hike cycle. If such a scenario unfolds, it could be favorable for gold as rising interest rates typically increase the opportunity cost of investing in the precious metal.

Nevertheless, it remains uncertain whether gold will be able to reach record highs, considering that US interest rates are projected to remain higher for an extended period.

The market is still uncertain whether the Fed will pause its rate hike cycle, especially because US inflation continues to trend above the central bank's target of 2% annually. This inflationary pressure could influence the Fed's decisions in the coming months, making the situation more complex and uncertain for investors.

In recent months, there has been a shift towards a more "hawkish" reaction function from the European Central Bank (ECB), and this sentiment has been reflected in the pricing of Euro forward rates. Despite weak economic activity and slowing inflation, Euro forward rates have remained relatively unaffected.

However, this trend is now changing, and the EUR forward curve is starting to adjust for two key reasons. Firstly, foreign exchange traders are realizing that they may have been overly aggressive in pricing lower US real rates in the long-term forwards after the Consumer Price Index (CPI) report. Secondly, due to weaker economic data and slowing inflation in the Eurozone, ECB commentary may lose some of its impact, and moderation could occur swiftly.

Another significant point of interest is whether the Bank of Japan will continue to maintain its current interest rates, which have been held at 0% or in negative territory for many years, making it a somewhat expected decision.

Furthermore, there's a notable observation regarding China's 0% Consumer Price Index (CPI) rate, and if this trend spreads, Japan would be the first to be affected. This development could have far-reaching implications and add to the significance of the week ahead for stock markets and the future trajectory of the dollar. Investors will be closely monitoring these central banks' actions and statements as they could potentially set the tone for future market movements.

On another note, the US earnings season is entering a crucial phase this week, with major companies like Meta Platforms, Microsoft, and Alphabet set to report.

Their earnings results must meet market expectations and justify the current S&P 500's earning multiple, which stands at 20 times, and its year-to-date gains of 19%. Investors will closely scrutinize these reports to gauge the health and potential direction of the market.