Dow Jones Slumps Amid Healthcare Stock Struggles and Rising Treasury Yields | Daily Market Analysis

Key events:

- Eurozone - CPI (YoY) (Mar)

- USA - ADP Nonfarm Employment Change (Mar

- USA - S&P Global Services PMI (Mar)

- USA - ISM Non-Manufacturing PMI (Mar)

- USA - ISM Non-Manufacturing Prices (Mar)

- USA - Crude Oil Inventories

- USA - Fed Chair Powell Speaks

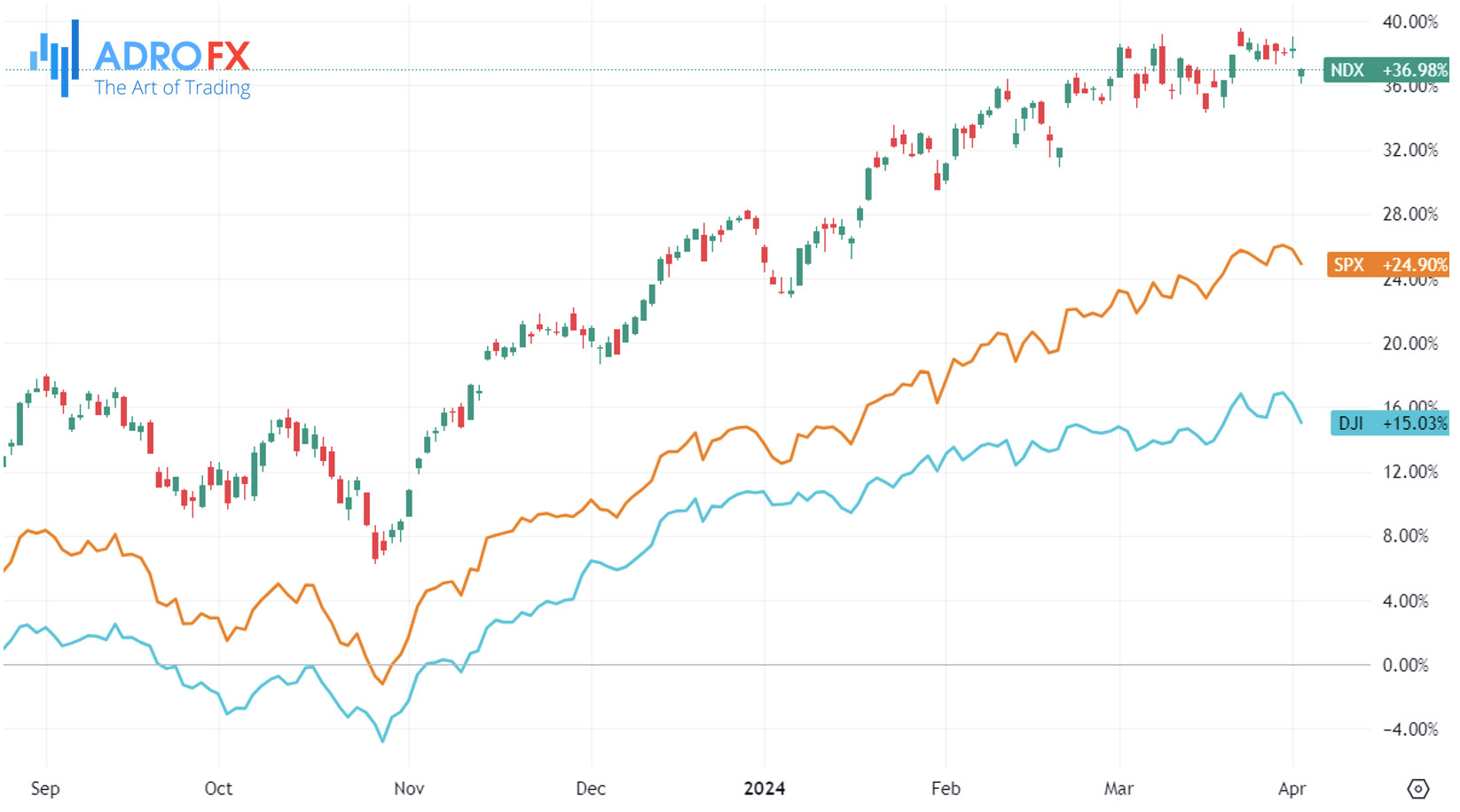

On Tuesday, the Dow Jones Industrial Average experienced a significant decline, extending its sluggish performance into the second quarter. This downward movement was largely attributed to the underperformance of healthcare stocks and a notable increase in Treasury yields. Remarks from several Federal Reserve officials emphasizing the necessity of maintaining higher interest rates for an extended period further weighed on investor sentiment.

The Dow Jones Industrial Average dropped by 396 points, equivalent to a 1% decline, while the S&P 500 saw a decrease of 0.7%, and the NASDAQ Composite fell by 220 points, representing a 1% decline as well.

The rise in Treasury yields persisted from the previous day, fueled by a string of robust economic data releases and comments from Fed officials tempering expectations of imminent rate cuts. San Francisco Fed President Mary Daly reiterated on Tuesday that there was no immediate need to reduce rates, citing inflation levels still above the central bank's 2% target. Her sentiments echoed those of Cleveland Fed President Loretta Mester, who acknowledged the possibility of rate cuts later in the year but cautioned against premature easing, emphasizing the risk of maintaining rates at higher levels for an extended period.

The CME's FedWatch tool currently indicates a roughly 62% probability of a Fed rate cut in June, a slight decrease from the approximately 70% probability observed a week earlier.

These remarks coincided with the release of data revealing that job openings increased to 8.756 million in February, up from 8.748 million in January, albeit slightly below the anticipated figure of 8.760 million.

Meanwhile, Tesla (NASDAQ: TSLA) shares experienced a notable 5% decline following the company's announcement of first-quarter delivery numbers, which fell significantly short of expectations. Tesla delivered 386,810 vehicles, falling short of the estimated 449,080 according to Bloomberg consensus.

This shortfall was described by Wedbush as an "unmitigated disaster" and represents a pivotal moment in Tesla's trajectory. Analysts emphasized the importance for CEO Elon Musk to address this setback promptly to avoid potential disruptions to the company's long-term narrative.

The Australian Dollar maintained its upward trajectory on Wednesday for the second consecutive session, driven by a weakening US Dollar influenced by declining US Treasury yields. Furthermore, the decline in the ASX 200 Index exerted additional pressure on the AUD/USD pair.

Positive indications emerged in the Australian Industry Group Industry Index for February, marking an improvement from the previous month's reading of -14.9 to -5.3. Similarly, the Manufacturing PMI displayed signs of progress, registering a rise from -12.6 to -7. According to Westpac's summary of the Reserve Bank of Australia's March meeting minutes, the current cash rate level is deemed appropriate for the existing conditions, although future adjustments might be warranted.

Meanwhile, the price of gold entered a bullish consolidation phase after reaching a fresh all-time high in the Asian session on Wednesday, hovering around the $2,288-2,289 range. This surge indicates the potential for further appreciation, driven by geopolitical tensions arising from conflicts in regions like Russia-Ukraine and the Middle East. Uncertainty surrounding the Federal Reserve's interest rate plans has also contributed to a heightened demand for the safe-haven precious metal. Investors view any significant corrective pullbacks in gold prices as buying opportunities due to the supportive fundamental backdrop.

Conversely, the USD/CAD pair continued its downward trend for the second consecutive session, remaining near 1.3560 during the Asian session on Wednesday. The strength of crude oil prices lent support to the Canadian Dollar, consequently exerting downward pressure on the USD/CAD pair. WTI oil prices remained elevated at around $84.80, supported by a weakening US Dollar and concerns over geopolitical uncertainties affecting the oil supply.

The Japanese Yen experienced modest fluctuations against the US Dollar during the Asian session on Wednesday, maintaining a range held over the past two weeks. While there is a possibility of intervention by Japanese authorities to prevent excessive depreciation of the domestic currency, cautious sentiment in the equity markets has provided some support for the safe-haven JPY. However, the Bank of Japan's dovish stance, signaling a delay in the next rate hike, failed to attract significant buyers for the JPY.

Market participants are anticipating the release of Canadian Import and Export data on Thursday, along with labor data scheduled for Friday. In the United States, focus will be on the ADP Employment Change and ISM Services PMI data on Wednesday, as well as Federal Reserve Chairman Jerome Powell's speech on the US economic outlook at the Stanford Business, Government, and Society Forum in Stanford.