Dow Ends Higher Amid Disney Boost Despite Treasury Yield Pressure; Inflation Data Points to Fed Comfort | Daily Market Analysis

Key events:

- UK - GDP (YoY) (Q2)

- UK - GDP (MoM) (Jun)

- UK - GDP (QoQ) (Q2)

- USA - PPI (MoM) (Jul)

The Dow Jones Industrial Average concluded with gains on Thursday, buoyed by a surge in Disney shares that helped recover much of its earlier losses, even as climbing Treasury yields cast a shadow over market sentiment. This occurred alongside the release of data indicating further signs of abating inflation.

The Dow Jones Industrial Average advanced by 0.2%, equivalent to a 52-point increase. Meanwhile, the S&P 500 remained relatively unchanged, and the Nasdaq saw a modest 0.1% uptick.

European markets secured their second consecutive day of gains yesterday, receiving an additional boost from China's announcement to lift its ban on overseas travel groups. This decision has notably spurred growth in the travel, leisure, and luxury sectors.

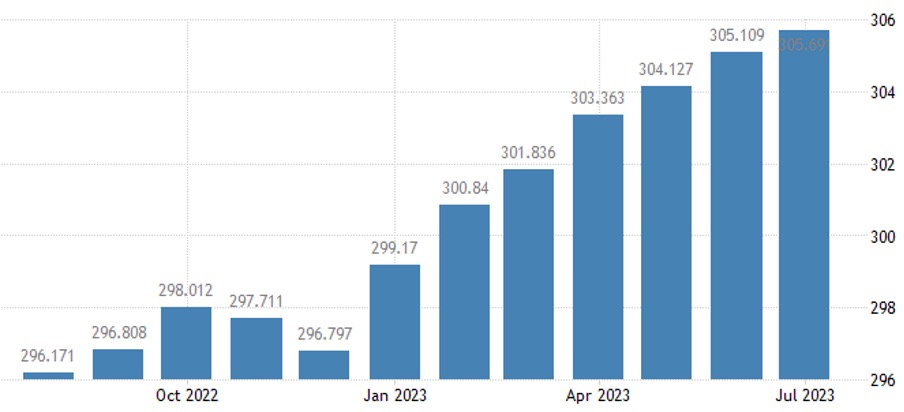

Furthermore, the market upswing was influenced by a US Consumer Price Index (CPI) increase of 3.2%, falling below expectations. Core prices receded to 4.7%, fueling speculation that the Federal Reserve's cycle of interest rate hikes might have concluded.

The trajectory of the consumer price index is gradually converging towards a more acceptable range for the Federal Reserve, which is likely to continue its ongoing interest rate pause.

Initially dipping below the flatline, Treasury yields experienced a rebound as a deeper analysis of the inflation report unveiled an increase in core services ex-housing inflation. This measure, closely monitored by the Fed, saw a 0.2% rise following a flat performance in June.

In another development, Walt Disney (NYSE: DIS) unveiled intentions to raise the price of its ad-free streaming tier in October. This sparked investor enthusiasm for potential margin growth, alleviating concerns regarding streaming weaknesses. Notably, this followed Disney's Q3 revenue report, which fell short of Wall Street estimates. Consequently, Disney's shares surged by over 4%.

However, Disney+ subscribers dwindled to 146.1 million, falling short of estimates projecting 151.1 million. This decline was attributed to a 24% reduction in Disney+ Hotstar subscribers.

On Thursday, Alibaba (NYSE: BABA), the prominent e-commerce powerhouse based in China, reported higher-than-expected adjusted core income for fiscal Q1. This increase was driven by robust consumer expenditure during a significant shopping event in China that took place in June.

Additionally, the major tech player announced its intention to execute the division of the company into six separate businesses, a strategy slated to commence from the quarter concluding on June 30.

In parallel, Alibaba's cloud division witnessed a rise to 25.12 billion yuan, attributed in part to the strong demand for its artificial intelligence computing products. This development underscores the growing fascination with emerging technologies in the technology landscape.

A slight majority of economists surveyed by Reuters predict that the European Central Bank (ECB) will put a halt to its over-a-year-long campaign of increasing interest rates come September. However, there remains a possibility of another rate hike by the end of the year due to persistently high inflation.

The ECB has implemented nine consecutive rate hikes since July 2022. Nevertheless, Christine Lagarde, the President of the bank, initiated the groundwork for a pause in this pattern. Following a 25 basis point increase last month, she remarked during a press conference, "Do we have more ground to cover? At this point in time I wouldn't say so."

Given the backdrop of decelerating economic activity, especially evident in Germany, the leading economy within the 20-member bloc, Lagarde emphasized that forthcoming data would play a pivotal role in shaping future decisions. Consequently, the outcome in September, whether it be another rate hike or a pause, remains uncertain but significant, described by Lagarde as a "decisive maybe".

Apart from that, gold prices stabilized near their lowest point in a month, as recent data presented a somewhat mixed perspective on US inflation. The market response to the inflation figures led to significant volatility in stocks and other risk-driven assets, prompting many investors to gravitate towards the dollar as a safe haven, rather than gold.

Despite Thursday's inflation data not strongly influencing expectations of the Federal Reserve keeping rates unchanged in September, doubts are increasing within the market regarding the likelihood of the central bank cutting rates this year. This sentiment paints a subdued picture for the outlook of gold.

Both the prices of bullion and broader metal markets felt the pressure from a stronger dollar. The dollar's ascent was driven by turmoil in the bond market and uncertainty surrounding interest rates, which triggered a flow of funds into the dollar.

Throughout the week, the greenback experienced an upswing and has consistently outperformed gold as a safe haven in recent months. This trend has gained momentum due to growing speculations that US interest rates will remain elevated for an extended period.

The prospect of higher interest rates casts a shadow over gold and other metals, as it raises the opportunity cost associated with holding assets that don't yield returns.

In the upcoming Friday session, market observers will pay close attention to the producer price index data, along with the preliminary Michigan consumer sentiment and expectations data.