BOJ Policy Change and Europe's Gas Price Cap Stun Markets | Daily Market Analysis

Key events:

- Canada – Core CPI (MoM) (Nov)

- USA – CB Consumer Confidence (Dec)

- USA – Existing Home Sales (Nov)

- USA – Crude Oil Inventories

The Bank of Japan has begun to tighten policy little by little, and the yen has soared. The European Union has finally agreed on a mechanism to cap natural gas prices, raising doubts about its ability to get enough gas next year. The U.S. stock market is showing mixed dynamics, unable to shake off the moping over tightening monetary policy and an impending recession, which is likely to intensify after the release of data on the housing market in the country. Here's what to know about the financial market on Wednesday, Dec. 21.

- Bank of Japan

The yen soared as the Bank of Japan made a tentative move to tighten monetary policy for the first time in years.

With inflation now above 3.5%, the Bank of Japan decided to loosen its grip on the 10-year government bond yield, allowing it to rise to 0.5%. Previously, it had capped yields at 0.25%.

The yen rose 3.3 percent against the dollar, a huge step for such standards, to a four-month high. This also caused the dollar index to fall 0.7 percent to 103.69, and it tested a six-month low.

The Bank of Japan was the only major developed-country central bank not to raise interest rates this year, preoccupied with a 30-year battle with deflation that began after the housing market bubble burst in the 1990s. The minimum interest rate available in Japan has made the yen the preferred funding currency for all those engaged in "carry trades," and the deployment of such operations is likely to put upward pressure on bond yields and downward pressure on other risky assets around the world.

- EU finally agrees on gas price cap

European Union energy ministers have finally agreed on a mechanism to cap wholesale gas prices. This measure may curb inflation next year but risks leaving the continent short of gas when it comes time to refill storage in spring and summer.

The final agreed limit was €180 per megawatt hour, which will be imposed if the underlying TTF contract in the Netherlands trades above that level for more than 3 days, and is more than €35 above the reference prices for liquefied natural gas.

TTF futures fell to its lowest level in six weeks on Tuesday, testing the 100 euro mark, but then recovered and were trading at 104.00 euro/MWh. The contract for June, when storage pumping will be in full swing, followed suit, falling 2.6%.

In the absence of peace in Ukraine, the EU will have to buy much more gas from alternative suppliers next year, as supplies from Russia have been almost normal for half of 2022.

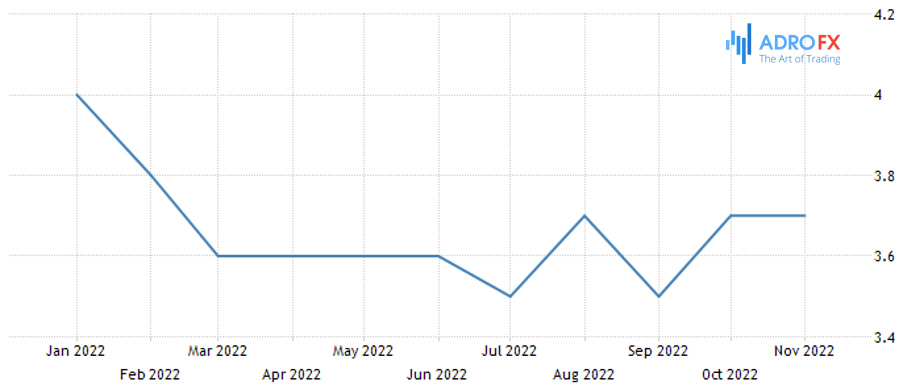

- The housing market has fallen from its peak

November data on U.S. housing starts and building permits will continue the theme of this week's real estate news, which began Monday with the National Association of Home Builders (NAHB) monthly survey.

The NAHB housing market index fell to 31, which, not counting the previous pandemic-induced downturn, is the lowest in more than a decade. In contrast, actual construction activity is still at historically high levels, although the entire industry feels like it's in a recession because of this year's sharp slowdown. Last month's figure of 1.425 million home starts is still higher than between the subprime boom and the pandemic boom.

In Europe, the only economic data also point to easing inflationary pressures, as German producer prices fell 3.9% month-over-month in November due to a surge in energy prices.