All Attention Is Riveted to the FOMC Meeting | Daily Market Analysis

Key events:

- UK - Manufacturing PMI (Jan)

- Eurozone - CPI (YoY) (Jan)

- USA - ADP Nonfarm Employment Change (Jan)

- USA - ISM Manufacturing PMI (Jan)

- USA - JOLTs Job Openings (Dec)

- USA - Crude Oil Inventories

- USA - FOMC Statement

- USA - Fed Interest Rate Decision

- USA - FOMC Press Conference

- New Zealand - Employment Change (QoQ) (Q4)

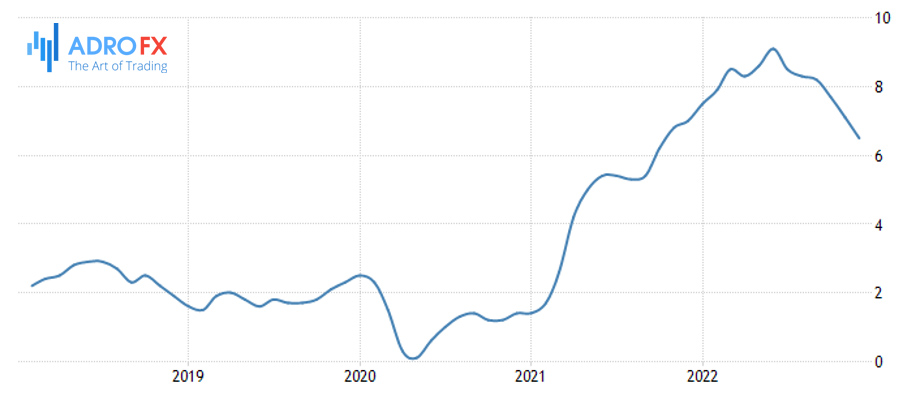

We are in the midst of a new U.S. interest rate decision and it is not yet 100% accounted for. Before the FOMC members went silent, we saw St. Louis Fed President James Bullard say that U.S. interest rates must continue to rise in order for inflationary pressures to abate. He is likely to vote for 0.50%, and he is generally well known as a "hawk."

While FOMC member Christopher Waller frankly stated on January 20 before his silence that he supports a 0.25% rate hike at this meeting.

Others can be named in between, such as Loretta Mester, president of the Federal Reserve Bank of Cleveland, who welcomed action to rein in inflation. She said earlier that her assessment of interest rates is higher than her colleagues and that the central bank needs sustained tight policy to beat inflation.

While Fed spokeswoman Esther George said the central bank should restore price stability, "which means a return to 2% inflation rising annually," expecting the Fed rate to rise to 5%. This is in line with the median forecast of Fed members.

Another FOMC member, Neel Kashkari of the Minneapolis Fed, also noted before the silence that he wants to be sure inflation has stopped rising before he supports ending tightening.

While the Fed chairman, shortly before the usual two-week silence of committee members before the meeting, indicated that "there are likely to be fewer interest rate hikes in the near future, and if progress on inflation is seen so far, we still have an opportunity to restore price stability."

Powell said there is no talk among Commissioners about the possibility of lowering interest rates before there is evidence of inflation returning to the 2% annual rate target in the medium term.

Thus, there are currently no plans to cut rates before the end of 2023, although the rate of inflation was expected to fall until mid-2023, largely as a result of lower demand in the real estate sector caused by the Federal Reserve's tightening steps.

Powell expects economic growth to fall below its usual pace in the medium term in the coming period after it had already fallen significantly in 2022 from 2021, and he also made clear that the committee expected labor market pressures in the coming period from efforts to contain inflation, but he avoided calling it a "recession or recession fabrication" to disrupt economic activity to keep inflation in check.

Powell reiterated, as he did after the last meetings, that "no one knows whether these efforts will lead to a recession or not, just as no one knows to what extent that recession if any, will occur.

But the most important thing right now is to keep inflation in check," and the level or interest rate we will set to achieve that goal, not the rate of recovery we will pursue in pursuing that goal.

Thus, monetary policy will only get tighter and tighter over time to contain inflation, as the Fed sees even the need to tighten it considerably over time to contain inflation.

Minutes from the last meeting last December generally showed that the committee members maintained their hawkish stance and said that more rate hikes were on the horizon.

The statement from FOMC members at the last meeting also showed a willingness to slow economic activity to rein in inflation, despite expectations that the labor market was still performing very well.

The FOMC members' published median quarterly forecast again underscored their expectation of increasing inflationary pressures and their willingness to raise rates to combat these pressures, despite the downward pressure on growth and higher unemployment that could result from this struggle.

On the other hand, we are also seeing a succession of promises to tighten measures to contain EU inflation.

ECB Governing Council member Olli Rehn recently said that rates will have to be raised significantly over the next two meetings to contain inflation, and ECB member Pablo Hernandez has indicated that they will have to keep raising interest rates at a steady pace in order to lock in the risk of higher expected inflation.