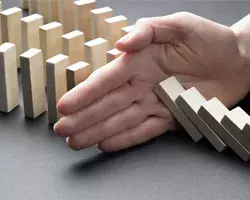

The Dangers of Holding Onto Losing Positions: Why Letting Go Can Save Your Portfolio

Holding onto a losing position is a common mistake that can severely impact your portfolio. Many traders, influenced by loss aversion - a tendency to avoid losses at any cost - hope for a market turnaround instead of cutting their losses. This mindset not only increases losses but also limits future opportunities. Understanding the risks of holding losing trades is essential for maintaining a disciplined and successful trading approach.

Chasing Losses: The Dangerous Game of Trying to Recover Quickly in Trading

Have you ever found yourself desperately trying to win back what you’ve lost in a trade? It’s a scenario many traders know all too well. The adrenaline kicks in, and suddenly, the focus shifts from strategic decision-making to an almost reckless pursuit of breaking even. According to studies, nearly 80% of traders succumb to the temptation of chasing losses after a losing trade. This behavior, driven by the emotional reaction to loss, can quickly spiral into a dangerous cycle of bad decisions and mounting financial setbacks.

From Pitfalls to Profits: Learning from the Mistakes of Forex Traders

The forex market, with its promise of substantial gains and the allure of financial freedom, attracts traders from all walks of life. However, beneath the surface of success stories lie the harsh realities of significant losses encountered by many traders. Despite its potential for profit, navigating the forex market is fraught with challenges that can lead to financial setbacks for the unprepared. Understanding the prevalence of losses among forex traders is paramount for those aspiring to thrive in this dynamic and complex environment.

Why Do Forex Traders Lose Money?

The forex market, also known as the foreign exchange market, is the largest financial market in the world. It operates 24 hours a day, five days a week, and facilitates the trading of currencies from different countries. With a daily trading volume exceeding $6 trillion, forex offers ample opportunities for traders to profit from fluctuations in currency exchange rates.

Dip Buying Mastery: A Strategic Approach to Capitalizing on Market Dynamics

The Buy the Dip strategy transcends mere reaction to short-term price declines; it embodies a comprehensive mindset of opportunistic investing. Rooted in the belief that market fluctuations, especially downward movements, are intrinsic to the financial landscape, this strategy represents a broader investment philosophy. At its core, it reflects the conviction that quality assets, be it stocks or cryptocurrencies, will encounter occasional setbacks in their upward trajectory.

Stress in Day Trading: Strategies for Success and Well-Being

Engaging in day trading, whether independently or within an institutional setting, can be an inherently demanding path to financial gain. Various factors contribute to the stress and potential for depression in this field, such as underperformance and ineffective strategies. This underscores the significance of prioritizing your psychological well-being. Within this article, we will explore the sources of stress and offer strategies for mitigating its impact.

Highs and Lows of Day Trading: Strategies for Recovery and Success

Day trading presents a substantial risk-reward dynamic, where the potential for significant gains coexists with the looming specter of substantial losses. The industry is notorious for seeing prominent day traders and hedge fund managers suffer steep financial setbacks, yet they persist, adapting to adversity, and ultimately reaping substantial annual profits. It's a testament to their resilience and adaptability.

Why Do Forex Traders Experience Losses?

In the dynamic world of forex trading, where currencies are bought and sold on the global market, traders often seek to unlock the potential for substantial returns. However, the reality is that a significant number of forex traders end up losing funds instead. Understanding the reasons behind these losses is crucial for aspiring traders to avoid common pitfalls and enhance their chances of success. In this article, we delve into the key factors contributing to forex traders' losses and provide valuable insights on how to navigate the forex market with caution and skill.

How to Cut Losses and Become a Profitable Day Trader

Day trading can be an exhilarating and potentially rewarding endeavor, attracting individuals seeking to profit from short-term market fluctuations. However, like any high-stakes venture, day trading comes with inherent risks, and one of the most crucial skills for a successful day trader is knowing how to cut losses effectively. Embracing the art of minimizing losses while maximizing gains is a fundamental aspect of profitable day trading.

Stop Loss in Trading: How to Say No

Almost all experienced traders of the forex market agree that it is necessary to set stop losses in any style of trading. Beginners, newcomers to the market, often neglect this rule, but with time they also come to understand it (or they simply stop trading because of the constant losses). Let's try to figure out why a Stop Loss is so important for successful trading and sustained profits.