Market Surges as S&P 500 and Nasdaq Reach Record Highs, Investors Await Inflation Data and Fed Meeting | Daily Market Analysis

Key events:

- UK - Unemployment Rate (Apr)

- UK - Average Earnings Index +Bonus (Apr)

- USA - Core CPI (MoM) (May)

On Monday, the S&P 500 and the Nasdaq experienced a surge, reaching their highest closing levels since April 2022. Additionally, Oracle (NYSE: ORCL) achieved a record high in anticipation of its quarterly results. Investors were eagerly awaiting inflation data and the Federal Reserve's interest rate decision scheduled for later in the week.

The market heavyweights Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), and Tesla (NASDAQ: TSLA) played a significant role in driving the gains, contributing to the S&P 500's recovery of 21% from its lows in October 2022. Some investors perceive this as a bullish phase in the Wall Street market.

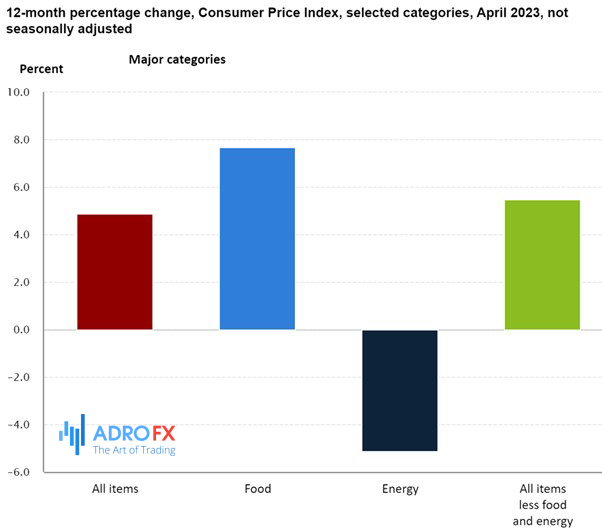

Today, the US is set to release its inflation data as the Federal Reserve initiates its two-day policy meeting. Expectations for inflation are relatively subdued, which makes surpassing them more challenging. Projections suggest that US headline inflation will have eased from 4.9% to 4.1% in May, while core inflation (excluding food and energy) is anticipated to have softened from 5.5% to 5.3%. On a monthly basis, core CPI is expected to have increased by 0.4%, matching the previous month's pace, primarily driven by sticky price increases in services and rents.

One positive aspect of the data is the declining inflation expectations. The latest survey conducted by the New York Fed revealed a decrease in the one-year inflation expectation to 4.1%. However, there was a slight uptick in the three-year expectation to 3%.

What's intriguing is the notion that consumers are adapting to the idea that inflation will decelerate from current levels, but a return to the era of 2% inflation is unlikely in the near future. Both the US and Europe may need to accept and adapt to inflation levels closer to 3-4%, rather than the 2% or lower levels observed in the past decade. Various factors such as the trade war with China, the conflict in Ukraine, energy crises, energy transition, reindustrialization, and onshoring all contribute to inflationary pressures, making it more challenging for the Federal Reserve to achieve a 2% inflation target.

While equity traders appear optimistic about the conclusion of the Fed's tightening measures, bond traders remain skeptical. The trajectory of the US 2-year yield remains positive, and the outlook for US sovereign bonds will remain negative until there is a strong indication that the Fed's rate hikes are over.

The US dollar is showing weakness, and if US inflation turns out to be sufficiently soft, it could push the EUR/USD currency pair beyond its 100-day moving average, near 1.08.

Ahead of the release of US inflation numbers this afternoon, the European market is poised for a positive opening following the upward movement in the US market. The Nikkei 225 has also reached a new 33-year high. Additionally, the latest unemployment and wages data for the UK economy will be released, coinciding with expectations of an upcoming interest rate hike from the Bank of England at their next meeting.

Although the challenges in the UK economy are well-known, one factor that has mitigated the impact of the cost of living crisis is the robustness of the labor market. Unemployment remains near 40-year lows, although it did tick higher to 3.9% in the three months leading up to March, compared to a low of 3.5% in August of the previous year. It could potentially reach 4% in today's report.

On Tuesday, gold prices experienced a modest increase but remained within a narrow trading range as traders adopted a cautious approach in anticipation of crucial US inflation data and a series of significant central bank meetings scheduled for the week.

Gold has encountered difficulties in breaking out of its trading range over the past three weeks due to mixed signals regarding the global economy and US monetary policy.

The market was eagerly awaiting the conclusion of the two-day Federal Reserve meeting on Wednesday, with the majority of participants anticipating a pause in the central bank's cycle of interest rate hikes.

However, despite the potential pause, concerns remained among investors due to inflation persisting above the Fed's target of 2% annually and the robustness of the US labor market. Any unexpected hawkish surprises from the Fed could impact investor sentiment.

This week also included interest rate decisions from the Bank of Japan and the European Central Bank. The ECB was expected to raise rates, while the BOJ was anticipated to maintain its ultra-loose policy.

Increasing interest rates typically have a negative impact on non-yielding assets like gold, which faces additional pressure as global monetary conditions tighten.

Nevertheless, if the Fed signals a pause, it could lead to renewed strength for gold, as the recent strength of the US dollar has weighed heavily on the yellow metal.