US Stocks Rise as Tech Rebounds; Gold Set for Second Week of Gains | Daily Market Analysis

Key events:

- Eurozone - ECB's De Guindos Speaks

- Eurozone - ECB's Enria Speaks

- Canada - Unemployment Rate (May)

On Thursday, US stocks experienced a modest uptick, recovering some of their momentum, primarily driven by a resurgence in technology stocks. Concurrently, market volatility reached record lows, as indicated by the CBOE Volatility Index, commonly referred to as Wall Street's fear gauge, which dipped to a new pre-pandemic low of 13.66. This decline in volatility occurred in anticipation of an eventful economic and policy calendar scheduled for the upcoming week.

S&P 500 index made gains as the technology sector resumed its upward climb. This was in response to a decrease in Treasury yields, prompted by data revealing a surge in jobless claims to their highest level in 20 months. Market participants interpreted this as a potential indication of a Federal Reserve pause in its policy actions scheduled for the following week. Concurrently, major stock indixes regained their stability with the help of a rebound in technology and megacap stocks, despite relatively low trading volumes.

Specifically, the S&P 500 rose by 0.6%, the Dow Jones Industrial Average increased by 0.5% (equivalent to a 180-point rise), and the Nasdaq climbed by 0.9%. Noteworthy technology companies such as Amazon.com Inc (NASDAQ: AMZN) saw a gain of 2.06%, aided by Wells Fargo (NYSE: WFC) initiating coverage on the company with an "overweight" rating. Furthermore, stocks like Apple Inc (NASDAQ:AAPL), and Tesla (NASDAQ:TSLA) Inc experienced increases ranging from 1% to 3.5%.

In terms of economic data, there was an unexpected rise in initial jobless claims by 28,000 to reach 261,000, marking the largest jump since October 2021. This data point suggests a potential slowdown in the labor market.

Additionally, in the Eurozone, the first-quarter Gross Domestic Product (GDP) figures underwent revisions, revealing a contraction of -0.1% compared to the initial estimate of 0.1% growth. Furthermore, the fourth-quarter growth was also revised downward to -0.1%.

Despite this downbeat economic data indicating a potential recession in the Eurozone, the Euro displayed strength on Thursday. It appreciated by 0.65% in the early US session, primarily driven by a weakened US dollar stemming from uncertainty surrounding the US interest rate outlook. The market overlooks the negative GDP figures from the Eurozone as the focus shifted toward the uncertain rate environment in the United States.

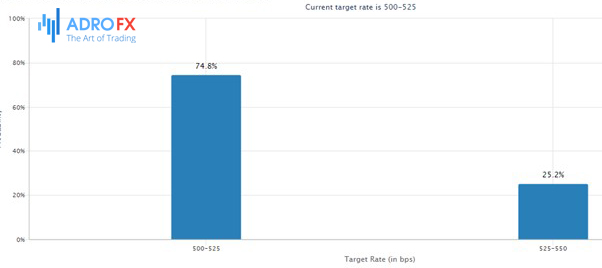

According to the CME FedWatch tool, the probability of an interest rate pause at the June meeting currently stands at 71%. The tool also indicates a nearly 70% likelihood of rate increases by July. These probabilities have remained relatively stable in recent days, reinforcing the belief that a pause in interest rate changes is probable next week.

The upcoming Federal Open Market Committee (FOMC) meeting is scheduled to commence next Tuesday, coinciding with the release of the critical May Consumer Price Index (CPI) report. The Fed's decision regarding interest rates will be announced on Wednesday afternoon following the meeting.

The dollar index, which gauges the currency against six major counterparts, experienced a decline of 0.67% to reach 103.33, reaching its lowest level since May 23, with a temporary dip to 103.29.

Following the surprise interest rate hike by the Bank of Canada to 4.75%, a 22-year high, the Canadian dollar exhibited slight strength. The greenback was down 0.09% against the Canadian dollar, trading at C$1.3358.

The Australian dollar also saw gains after the Reserve Bank of Australia raised the cash rate to a level not seen in 11 years, reaching 4.1%. It rose by 0.91% to $0.6714.

Anticipation is building for the upcoming European Central Bank meeting, where an interest rate increase of 25 basis points (bps) is expected. Another 25-bps hike in July is also projected, bringing rates to 3.75%.

Against the Swiss franc, the dollar experienced a significant decline of 1.20% to 0.899, reaching its lowest point since May 23.

On Friday, gold and the broader metal markets stabilized and were poised for a second consecutive week of gains. This was attributed to the decline in the dollar, driven by expectations that the Federal Reserve will pause its rate hike cycle in the upcoming week.

Gold, in particular, recorded its strongest intraday gain in two weeks on Thursday, reaching the upper end of a trading range observed since mid-May. The positive momentum in the precious metal market was fueled by anticipating a potential pause in the Federal Reserve's interest rate hikes.

Looking ahead, Friday and Monday hold no significant data releases, leaving market watchers eagerly awaiting the upcoming wave of data scheduled for later next week.