US Stocks Trim Early Gains as Apple Outlook and Economic Data Weigh on Investors; Bitcoin Stabilizes Within Range After Weekend Gains | Daily Market Analysis

Key events:

- Australia - RBA Interest Rate Decision (Jun)

- Australia - RBA Rate Statement

- UK - Construction PMI (May)

- Canada - Ivey PMI (May)

- USA - EIA Short-Term Energy Outlook

US stocks edged lower on Monday, trimming early gains, as investors weighed the near-term outlook for Apple while sifting through the economic data and plotting the slope for the Fed's final glide path as we near the end of their aggressive rate hike cycle.

After popping through 4300, briefly taking it into the technical bull-market territory, the S&P 500 rally train was slightly derailed when US stocks turned lower after a weaker-than-expected ISM Services survey and slightly uncertain investor take of a much-anticipated product launch from tech giant Apple.

Considering that investors have a strong inclination towards anticipating a recession, it is widely acknowledged that the services sectors are primarily responsible for driving the overall recovery across different asset classes after the COVID-19 pandemic. Hence, the negative services print was seen as somewhat pessimistic when viewed from a multi-cross-asset perspective, especially with the approach of the summer lull.

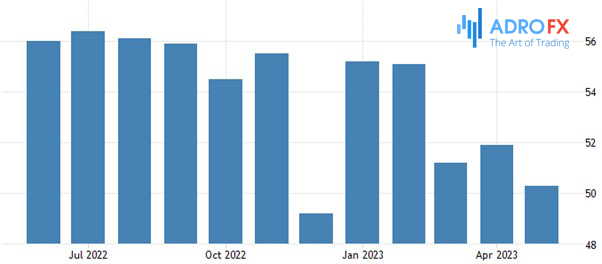

ISM services index came in at 50.3, significantly below the consensus estimate, falling short of expectations from numerous forecasters. The predicted range had been projected to be between 50.5 and 53.7.

Furthermore, given the concentrated nature of the mega-cap artificial intelligence-driven rally, which has propelled the S&P 500 to a year-to-date increase of 12%, any instability in the heavyweight tech stocks (such as AAPL, MSFT, GOOGL, AMZN, NVDA, TSLA, META) could naturally cause a downward tilt in the overall market. These tech stocks have achieved a remarkable 53% return year-to-date, in contrast to the remaining components of the S&P 500, which have seen a flat 0% return.

However, the deteriorating sentiment in the services sector might provide the Federal Reserve with a reason to finally halt its cycle of interest rate hikes at the upcoming meeting next week. Additionally, the diminishing business sentiment could contribute to a "Goldilocks" environment, characterized by optimal conditions, which has been emerging since the resolution of the March Regional Banks turmoil.

Ultimately, if the Fed decides to pause the rate hike cycle during the June meeting, it may pave the way for a continued environment that is neither excessively hot nor excessively cold, favoring selective stock-picking strategies.

The USD has exhibited a slight weakening following the disappointing ISM services data, but this can be regarded as a temporary adjustment in intraday positions as the market slightly reduces the probabilities of a Fed rate hike in July.

However, it is crucial to note that for any possibility of medium-term Dollar depreciation to resurface, there needs to be a reduction in the pattern of weaker economic data from Europe and China. The current scenario calls for an improvement in the economic performance of these regions before any hope of a sustained decline in the Dollar can be considered.

Gold is experiencing a recovery at the beginning of the week, having faced challenges following the release of Friday's US jobs report. The overall nonfarm payroll (NFP) figure was significantly disappointing, making it difficult to dismiss its impact. However, there were certain aspects of the report that showed more positive signs, such as the increase in the unemployment rate, a slight decrease in annual earnings, and a higher-than-expected participation rate. Nonetheless, the robust job creation figures cannot be easily disregarded.

The upcoming inflation report scheduled the day before the Federal Reserve's meeting, holds significant importance. If the report indicates promising signs, it could provide justification for the Fed to pause its rate hikes. Conversely, if the report falls short of expectations, policymakers may find it easier to proceed with another hike, hoping for improved data in the coming months. This prevailing uncertainty has the potential to generate considerable volatility in the short-term performance of gold.

Meanwhile, bitcoin experienced a slight decline of nearly 2% after showing marginal gains over the weekend. Initially, the price dipped in response to the jobs report released on Friday, but it swiftly rebounded and is currently trading at a level close to its pre-release value. Bitcoin has been moving within a range of $26,000 to $28,000 for the past month, exhibiting a lack of significant movement in either direction. As of now, there are no clear indications of a breakout above or below this range.