How To Trade With Hammer Candlestick Patterns

The hammer candlestick pattern is frequently encountered in various markets and provides important information about a possible trend reversal. It is extremely important not only to identify it on the chart but also to use the information effectively. Let's consider in more detail this candlestick pattern, its types, and its features.

What Is the Hammer Pattern and What Are Its Types

Visually, this candlestick reminds the hammer hanging on the clamps with the handle down: the lower shadow - the handle, the body - the striking part, the upper shadow - the end of the handle, protruding from the striking part.

The hammer pattern may appear inverted on the chart – as a hammer hanging upwards with the handle and the striking part downwards.

The inverted hammer appears under exactly the same conditions as the regular hammer and gives identical (oddly enough) signals as the pattern hammer. Therefore, the inverted hammer is considered to be a variation of the usual hammer.

The hammer candlestick and its types appear only in a downtrend. The pattern can be formed by both rising (with a light-colored body) and falling (with a dark-colored body) candlesticks.

- In intraday and short-term trading, the lighter color of the hammer pattern gives a stronger signal.

- In long-term trading, the color of the body of the hammer candle does not matter.

The psychology of the hammer candlestick pattern is simple – the length of the lower shadow is due to the considerable power of the sellers to direct the downward movement, but at a certain moment, the buyers' power became higher, and they reversed the downward trend.

The hammer pattern is applicable in the common technical analysis as well. It allows you to confirm the oversold nature of the instrument in the market and determines the support levels and trend reversal points.

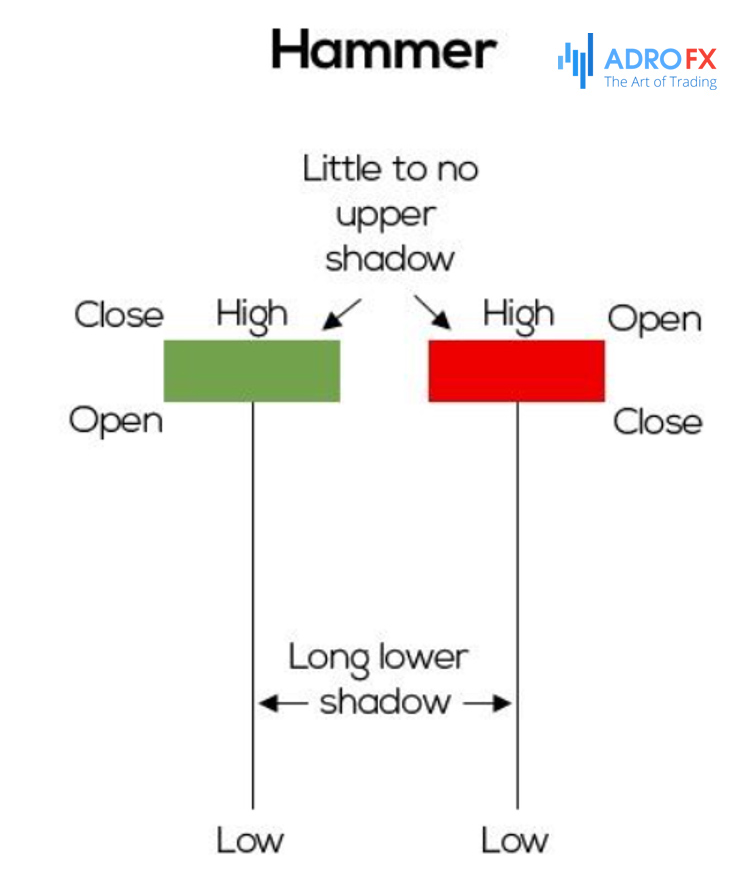

Hammer Candlestick

A hammer represents a candle with a small square body of whatever color, the upper shadow being absent or very small (no more than 10% of the body) and the lower shadow being big (more than 2 times the body length).

This candlestick pattern is located only at the bottom of the downtrend and is the end of the movement/beginning of the uptrend. It predicts the beginning of an upward movement in no other way (the pattern cannot signal a bearish trend under any conditions).

One must be careful, if a candlestick pattern similar to a hammer appears in the growing market, it is the Hanging Man – a totally different pattern from the Japanese candlestick analysis, which has other signals.

The hammer candlestick is a bullish candlestick, which predicts an upward movement, or rather the change of the downward movement to an upward one, the victory of bulls over the bears.

The pattern has the following characteristics:

- The body of the candlestick is small in the form of a square;

- The lower part of the figure is extended and a couple of times longer than the body;

- The upper shadow is missing or very short;

- Appears only with a downtrend;

- The spread on the daily price maximums/minimums is higher than that of neighboring candlesticks.

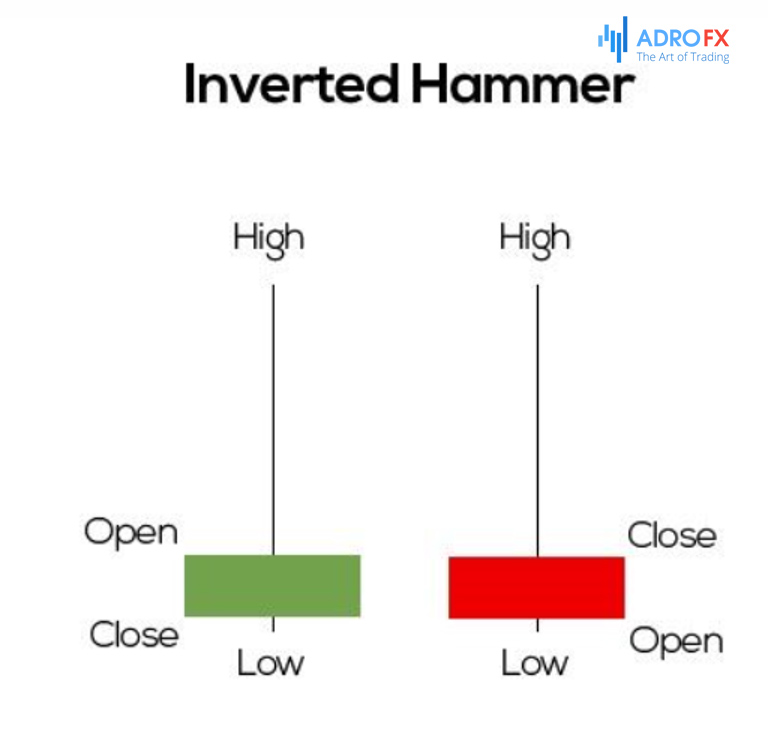

Inverted Hammer Candlestick

It is a Japanese candlestick with a small square body, of any color, a large upper shadow (2 or more body lengths), and a missing or small lower shadow (no more than 10% of the body).

This pattern, as well as its original variant, is encountered only at the end of the downward trend, it is a reversal pattern and indicates the beginning of an uptrend.

Pay attention that in case you see a similar pattern in an uptrend, then it is another pattern – a shooting star.

The inverted hammer pattern has the following features to look for:

- The body of the candlestick is small in the shape of a square;

- The upper part of the pattern is extended and couple of times longer than the body;

- There is no lower shadow, or it is very short;

- It can be formed only during a downtrend;

- The spread on the daily price maximums/minimums is higher than that of neighboring candlesticks.

How to Trade Using the Hammer and Inverted Hammer Candlesticks

As we have mentioned, the hammer pattern in candlestick analysis is a bullish signal to buy.

If this candlestick pattern appeared on the price chart, the trader should consider opening a long position. Before placing an order, it is advisable to check the reliability of the pattern signal, for example, the MACD indicator also gave a signal to buy, after the figure was formed a large bright candlestick with a long lower shadow, intraday prices have a large variation.

The strength and reliability of the signals of the hammer pattern can be assessed by the following signs:

- A light-colored candlestick (rising candlestick) has more strength than a dark-colored candlestick (falling one);

- The candle touched/crossed the support line on the chart, and the closing of the candlestick occurred above the level of the line;

- The larger the size of the body of the light hammer candlestick (the bigger, the better);

- The smallest size of the body of a dark-colored hammer candlestick (up to the formation of a Doji-cross);

- The length of the upper shadow of a candlestick - the shorter, the better (the ideal hammer pattern has no upper shadow at all);

- The lower shadow's length of the pattern - the longer, the better (but a long candlestick length, in this case, too, may indicate the extreme instability of the market).

It is not advisable to open a long position when the hammer pattern appears, if bearish patterns were formed right before it (for example, Marubozo closing), or if a hammer candlestick with the dark body crosses the support level, having closed under it.

In general, when the hammer pattern appears, successful trading can be guided by the current market situation. If the downward movement was significant and the market is oversold, it is recommended to open long positions after verifying the signal.

Tips For Using Hammer Pattern

Basically, the hammer and inverted hammer patterns are easy to identify on the chart. However, they are paired and correspond to the hanging man and shooting star candlestick patterns.

In order not to confuse these patterns one more time we will repeat a simple but very important rule - the hammer and inverted hammer candlesticks are formed only and only on a declining (bearish) trend, they predict only the change of the downtrend to an uptrend, they signal the possibility to open a long position, and nothing else.

Despite the fact that the candlestick signals are considered strong, try to confirm them with a simple technical indicator (RSI, MACD, Volumes, etc.) before placing a trade.

It is highly recommended to trade with loss limitation. Stop Loss is set a little below the shadow of the pattern, and Take Profit is a little above the last local maximum.

Waiting for the confirmation of the signals by the light-colored candlestick after the signals, the trader risks not having enough time to enter the market.

Experienced traders using this system open an order 45-50 seconds before the end of the formation of a light candle - confirmation, but at the first opportunity, they move the Stop Loss to the breakeven.

And lastly, even though the hammer is considered to be a strong reversal formation, it is really strong in a warmed (active) market with visibly oversold assets.

Conclusion

Japanese candlesticks are strong reversal patterns, signaling the change from a downtrend to an uptrend. The strength of the patterns depends on various factors (body color, shadow length, and the nature of the preceding and following patterns).

Therefore, to minimize risks when trading by candlesticks, one should use confirming signals from indicators, analyze the trend direction and use stop orders.

It should be remembered that after the appearance of the hammer, there is often a slight increase in the market, followed by a pullback to the support level, through which the candlestick passes. If the level is not broken out, the price bounces from it getting a new impulse to move up.