The World Economy has yet to Face its Biggest Inflation Challenge | Daily Market Analysis

Key events:

United States - Labor Day

Canada - Labor Day

UK Composite PMI (Aug)

UK Services PMI (Aug)

Eurozone Retail Sales (MoM) (Jul)

Historically September is not the best month for stock markets, and according to statistics in September the markets are going down rather than up. Well, that's just the way it is.

For now, the beginning of the month is pretty cheerful.

▪️ The DXY index, the dollar relative to other currencies, is at its highs. It's already 110.20.

▪️ Yields on 10 Year bonds of various countries are bursting into the sky. Soon both the Bank of England and the Fed will "please" us with new greetings - strong rate hikes.

▪️ By the way, Japanese 10 Year bonds skyrocketed in yields. And we all well remember that the debt of Japan - is "only" some insignificant 9,5 trillion dollars, and it is about 270% of the country's GDP.

Still, the markets are reacting to all this without much enthusiasm.

In recent days, the S&P 500 has strolled from 4,200 to almost 3,900. At least the futures for this morning are almost there.

By the way, recently Biden signed an executive order to block chip shipments to China.

It brings us to NVIDIA (NASDAQ: NVDA), AMD (NASDAQ: AMD), and Intel (NASDAQ: INTC). Their quotes have been beaten down for a long time now. And lately, their drop has intensified. So, it looks like we are getting to the point when these stocks are a great bargain.

What is going on in Europe?

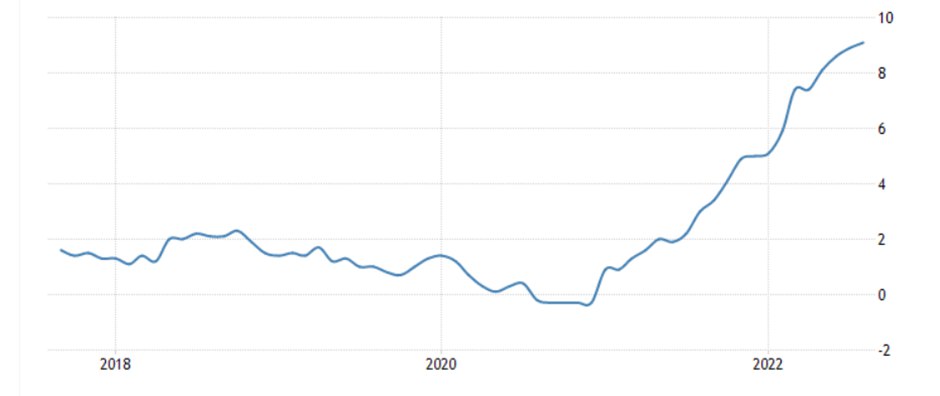

There is still no light. Against the background of another jump in energy prices, as well as rising food prices, inflation in the single currency area in Europe set a new record in August - 9.1%.

(The chart above is showing an increase in the EU inflation rate)

Recall that in July overall inflation in the euro area was 8.9%. Against this background, Sven Jari Stehn, chief economist for Europe at Goldman Sachs, predicts a 75 basis points increase in the ECB rate.

It looks like the ECB has no other options. But it might bump the euro up a bit temporarily.

As noted, nine countries in the euro area recorded double-digit inflation. In Lithuania and Latvia, the figure exceeded 20%. France was one of the few countries where the price index fell to 6.5%.

What are the dangers of further price increases?

Companies are forced to revise their spending plans. As a result, we could face a wave of layoffs and a slowdown in the economy. The news is not good for the markets, hence the fall in European stocks. At the end of Friday's trading session:

▪ the STXE 600 PR.EUR index (^STOXX) was down 1.12%;

▪️ energy company securities STXE 600 OIL+GAS PR.EUR (SXEP.Z) lost 2.11%;

▪️ the EUR/USD broke below 0.9900 for the first time since Dec 2020;

▪️ as far as the debt market is concerned, German 10 Year bonds have jumped more than 12% in the last 5 days.

(The EUR/USD chart showing the recent bearish movement)

The situation, by the way, could get much worse if Germany's state lender refuses to lend German utility Uniper SE (ETR: UN01) another €4 billion. Uniper still has an investment grade credit rating only because the rating agencies expect Berlin to continue to support it.

As Fitch Ratings notes, investor concerns about the deteriorating economic outlook have affected the conditions of the primary market for debt financing. This is evidenced by the decline in new high-yield bond issuance in Europe in the 2nd quarter.

What to expect next?

Higher interest rates from the ECB and worsening forecasts for volume and profit margins in the 2nd half of 2022 will hit not only the creditworthiness of companies but will also create problems for debt reduction, debt service, and refinancing. Against this backdrop, the market could face a wave of downgrades.

In summary, the coming months in Europe promise to be quite interesting.