Why Invest in Oil Stocks: Top Companies to Pay Attention To Right Now

The unprecedented surge in the value of stock assets in 2021 was replaced by a fall amid high inflation and the strengthening of monetary policy by the world's central banks. By way of comparison, here is an example: in 2021, the U.S. broad market index S&P 500 was up 26.9%, in 2022 it fell by 15.3%.

In this environment, many investors stop investing in growth stocks when investing in company prospects. They are beginning to invest in value stocks, i.e., companies with already built and steadily operating businesses that are generating returns.

Among economic sectors, the oil and gas sector feels the most confident against the background of historically high world prices for energy resources.

Why Invest In Oil Stocks?

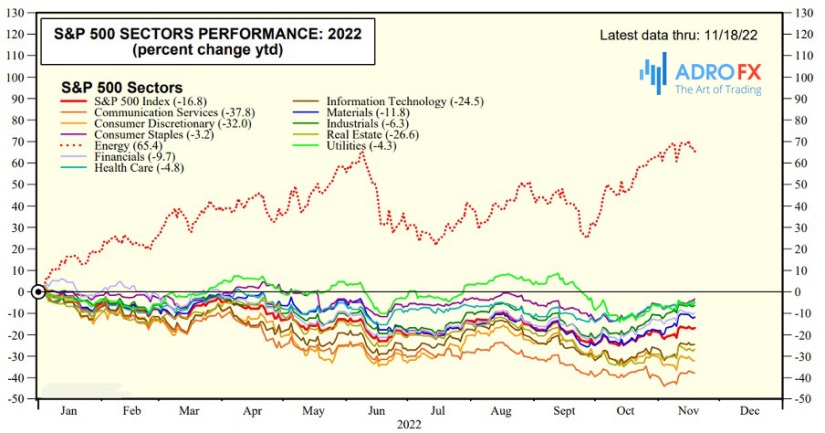

Of the 11 S&P 500 sectors, only one has gained since the beginning of the year: the energy sector is up 65.4%:

Over the past year, the energy sector, which is based on oil and gas companies, is up 54.6%, while its closest pursuer, the real estate sector, was up 46.2%. Of course, after a long period of growth, there may be a tangible decline. However, as long as geopolitical tensions remain high in the world and there is a war in Ukraine, the cost of energy resources will remain at fairly high levels.

There are a number of reasons why you should invest in oil. Generally, the sustainability and cost-effectiveness of oil and gas projects is the main reason for new investors.

Well, oil and gas projects offer some of the most attractive tax incentives for investment. It can be very lucrative if done right. However, the wrong move can result in a total loss of a lot of funds. So, you have to be knowledgeable, and well-informed, to embark on such an investment.

One way to do this is to consider the advantages and disadvantages of investing in the oil sector along with its feasibility.

Advantages and Disadvantages of Investing in the Oil Sector

The undeniable advantage of investing in oil is diversification because economic cycles and oil cycles often have a different vector.

For example, wars and crises, which generally weaken the world economy, can cause explosive growth in the oil trade. There are many other similar nuances.

In addition, investing in oil stocks has enormous growth potential. For example, if a company opens several new fields and starts production there, its capitalization will increase manifold, as well as the trader's earnings. In addition, one well can bring dividends for many decades.

If we talk about the disadvantages of such an asset as oil, the first thing that comes to mind is its volatility.

The success of investments in raw materials is highly dependent on sharp price fluctuations, especially when investing in companies with small capitalizations. Market giants withstand "ebbs and flows" without catastrophic consequences for themselves. Smaller companies burst into packs during financial crises, taking investors' capital.

Another disadvantage is the lack of flexibility in managing this asset. If we are talking about stocks, shares of oil companies, especially small ones, are not too actively traded. So, in case of force majeure, it will be difficult to convert them into funds quickly.

The undoubted disadvantage of investing in "paper oil" is the difficulty of analyzing the market. The oil industry is one of the most secretive. Companies are reluctant to share inside information. Some data is available only to trusted partners, and after publication, such information immediately changes quotes and priorities.

What Should An Energy Company Be Like To Be Successful And Attractive For Investors?

A diversified portfolio of assets, well-developed infrastructure, and bold innovative projects allow you to be one step ahead of companies in the energy sector.

The oil industry is now facing the need to adopt an energy transition for its operations and business models. Companies also need to think about their role in reducing greenhouse gas (GHG) emissions and meeting the goals of the Paris Agreement.

This is a major challenge for upstream. The lack of investment in production leads to a decline of 8% per year, which exceeds the level of demand reduction. Thus, investment in production is still necessary, especially in the context of the energy transition, but the type of resources that are developed and how they are extracted will change significantly. Those companies that have low-cost resources, tight control over costs, and environmental performance will be able to be successful.

But the basic question amid rising greenhouse gas emissions is a relatively simple one: should today's oil and gas companies only be seen as part of the problem, or can they be crucial in solving it?

Answering this question, the IEA notes that there is not a single oil company that will not be affected by the transition to clean energy, so every part of the industry must consider how to respond.

The energy community is increasingly talking not about the "oil" sector, but about the "energy" sector. Such a transition takes companies out of their comfort zone but allows them to manage the risks of the transition. Some major oil and gas companies are becoming "energy" companies that supply a diverse range of fuels, electricity, and other services to consumers.

The IEA believes it is also important for companies to ramp up investments in low-carbon hydrogen, biomethane, and advanced biofuels because they can provide the energy benefits of hydrocarbons without net carbon emissions. Within a decade, these low-carbon fuels will require about 15% of total investment.

Oil Stocks to Consider Right Now

● Exxon Mobil

Exxon Mobil (NYSE: XOM) is an American oil giant that is among the largest companies involved in the production and processing of hydrocarbons.

Exxon Mobil Corporation shares are among the U.S. blue chips, as well as included in the calculation of such stock indices as the Dow Jones Industrial Average, Dow Jones Global Titans 50, and others.

This explains their high popularity among traders and a very significant level of liquidity. However, at the same time, the volatility of the instrument remains at a fairly moderate level: daily fluctuations in the chart rarely exceed 6-7% of the opening price, and the average change for the trading day is at the level of 3-4%.

One of the most attractive advantages of XOM is its unrestrained dividend pump. The company has a 32-year history of increasing dividends. Payments are made once a quarter.

So, what affects Exxon Mobil's stock price?

One of the biggest risks to Exxon's future is the ongoing global shift toward low-carbon energy sources. Exxon notes that the transition from coal to oil took about 100 years. In other words, while the world is transitioning to things like solar and wind power, it could be a very long time before oil and natural gas disappear from view. And because wells have a limited lifespan, depletion suggests that additional drilling will be needed in the coming years.

That's why Exxon has largely chosen to stick with oil and natural gas and not follow its European counterparts in building a renewable energy business. Exxon's approach does not please Wall Street today, but while it does not fit the current worldview, it is not outlandish.

One way or another, the company is moving in the right direction. Patient investors will probably be well rewarded. Indeed, investors who maintained their positions in ExxonMobil during the pandemic price plunge probably have reason to rejoice right now: only this year, XOM stock skyrocketed 82%!

According to a press release, the company expects to meet its 2025 emissions reduction plans four years ahead of schedule. In doing so, Exxon reiterated its goal of achieving zero greenhouse gas emissions for Category 1 and 2 assets in operation by 2050, as well as achieving zero emissions in the Permian Basin by 2030.

The company's strong performance will allow it to be disciplined in its plans.

Exxon Mobil's transition to a greener business model is a long-term plan for the company, but given its strong financial statistics, it could be a key factor in Exxon Mobil's continued success and be an argument to hold this stock for years to come.

● Chevron Corporation

Chevron Corporation (NYSE: CVX) is already synonymous with "big oil". With a capitalization of $353.84 billion, CVX is one of the world's oil giants. It operates in many countries around the world in the segment of exploration and production, as well as refining and marketing of energy and chemical products.

The former includes exploration, field development, production, and sales of crude oil and natural gas, while the latter covers refining crude oil and refined petroleum products. With third-quarter earnings growth and the company's position strengthened by a surge in fuel prices, Chevron stock will be one of the best investment options in the energy sector this year.

As the chart shows, this has been a successful year for CVX. An analysis of the 2022 price trend shows that CVX has strongly outperformed the sector average over the past nine months. The company has increased its 2026 oil production targets by 3.5 million barrels per day. Despite inflation and consumers' difficulty in buying fuel, Chevron's price will continue to rise.

The company plans to expand production in Kazakhstan by mid-2023 and the Gulf of Mexico and is working on prospective projects in Mexico, Brazil, and the eastern Mediterranean. Chevron will now focus on downstream, which will increase eranings and accelerate free cash flow growth.

The 60% year-over-year rise in one of the largest stocks in the world signals a systemic shift in the economy that is likely to have long-term implications. A significant shift in demand in the energy sector occurred after the pandemic and against the backdrop of the Ukrainian conflict. In addition, it is worth considering that this sector attracts investors as an inflation hedge.

The company is growing rapidly, and its large-scale differentiated operations in the Permian Basin are up 15% year-over-year, giving CVX some cost advantages. As a major energy producer, Chevron gets extra gains from production in the Permian Basin.

Production growth in the Permian Basin is planned to grow from 608,000 bpd in 2020 to more than 1 million bpd by 2025 with a return of more than 30%, equivalent to $4 billion in free cash flow growth by 2026.

High commodity prices have also contributed to Chevron's revenue and cash flow growth. At the same time, CVX is focusing on cost optimization and has earmarked $10 billion for greenhouse gas reduction projects through 2028. Amid the heated global geopolitical situation, stocks of such companies have maintained a bullish trend and are showing some of the fastest growth in the sector in 2022.

Despite the rapid increase in share price over the past 52 weeks, the valuation can be considered fair, because the growth rate remains at a very high - for a company of this size - level. Analysts evaluated the company's investment performance based on industry benchmarks. Financial returns estimate and earnings revisions confirm CVX's excellent potential and the company's fundamental strength relative to others in the sector.

As for Chevron's growth outlook, CVX boasts excellent financial strength and a high dividend. The company is now focused on reducing carbon emissions, capital expenditures, and financial discipline, so it's safe to focus on the company's ratings when buying shares.

In addition, Chevron has an A+ dividend stability rating because it has been paying dividends continuously for 34 years. This has been made possible by its high operating cash flow of nearly $40 billion, excellent lucrativeness, and stable underlying growth metrics.

Despite the cyclical nature of the energy sector and rising inflation, bullish sentiment amid rising energy prices and the upward leverage of Brent crude compared to its downside resiliency mitigates potential risks associated with price volatility and the cyclical nature of the industry.

Chevron stock is trading near historic highs, so invest in it with some caution. The industry in which Chevron operates is subject to many cyclical fluctuations, including inflation, recession, and economic factors affecting the economy. In addition, CVX must consider the ESG risks associated with carbon dioxide emissions. As society becomes more carbon-conscious, over time, taxes on emissions can negatively affect demand.

Once fuel prices fall and geopolitical issues abroad are resolved, energy prices may normalize. It is worth noting that oil prices may decline once supply chain issues are resolved, demand for raw materials decreases, the economic recession begins, or tensions ease in Europe.

What to Expect from the Energy Sector Next

Statistics of commodity exchanges and brokers show that investors show increased interest in shares of oil companies. If we consider the previous crisis periods, we can see that during the last fifteen years petroleum products have fallen in price. For example, before 2008 the price of Brent exceeded $180 per barrel. In 2011-2013 the price of the same oil grade fluctuated in the range of $120-140, while now the quotes are at $87.

So far, the situation in the fuel market is ambiguous. Oil reserves continue to fall, and gas has become more expensive than petroleum products. Analysts point out that a similar situation usually takes place in winter, but this year the raw materials market was unstable even before the heating season. After the energy crisis, we should expect global stagflation and higher prices for resources and goods produced with their use.

Looking a little further beyond the 2023 horizon, the prospect of an energy transition might confuse the investor. Will the global economy abandon oil in favor of greener fuels or electric vehicles? The results of the big COP26 climate summit show that even coal, which has been regularly "buried" in public space for the past 10 years, has not yet been abandoned. For better or worse, technological, and economic constraints prevail over altruism in the energy sector, so no rapid transformation can be expected.

Conclusion

Winter is coming, and the companies listed above are among the best energy companies that are in high demand, withstand price competition, and offer excellent financial sucess. Demand for fuel is not going away anytime soon, so we rate these companies' prospects as a "strong buy." Oil and gas prices are rising the fastest, and with shortages in Europe and elsewhere, we believe this trend will continue.

Demand for oil and natural gas imports from the U.S. and countries outside of the eurozone remains strong, so you'll still have time to join in if you missed an opportunity to buy the stock while it was trading at a steep discount. As inflation dictates the market, companies like CVX and XOM will continue to pass on their costs to consumers, thereby boosting earnings and growth momentum. That means their stock can be a great addition to your portfolio.