What Is Darvas Box Theory and How Does It Work in Trading?

Have you ever wondered how some traders consistently pinpoint high-potential stocks while others struggle to keep pace? The answer might lie in the strategic use of methods like the Darvas Box Theory. Developed decades ago by Nicolas Darvas, a self-taught trader, this technique has become a cornerstone of technical analysis, helping traders spot breakout opportunities and manage risk effectively. By focusing on price movements within defined ranges, Darvas created a structured, visual tool for identifying key entry and exit points, revolutionizing the way traders approach the stock market.

In this article, we’ll dive deep into the Darvas Box Theory, unraveling how it works, its historical significance, and how you can apply it to enhance your trading strategy. Whether you're a seasoned trader or just starting out, mastering this technique could give you the edge you need to succeed in the markets.

What Is Darvas Box Theory? A Time-Tested Trading Strategy

The Darvas Box Theory is a technical analysis method designed to identify potential trading opportunities based on price movement patterns. Conceived in the 1950s by Nicolas Darvas, this strategy simplifies stock analysis by segmenting price fluctuations into "boxes." Stocks tend to move within these defined ranges, and traders can capitalize on breakouts to make profitable trades. By systematically tracking these price boxes, traders can determine optimal entry and exit points, improving their decision-making process.

Nicolas Darvas, a professional dancer who later became a highly successful investor, developed this theory to navigate the stock market as a part-time trader. Drawing on his observations and quantitative analysis, Darvas devised this box-based system to overcome the volatility of stock prices. His book, "How I Made $2,000,000 in the Stock Market," popularized the theory, showing traders how disciplined, data-driven strategies can lead to substantial financial gains.

At its core, the Darvas Box Theory posits that stock prices move in predictable ranges, forming boxes that highlight trends and potential breakouts. By focusing on these price ranges and ignoring market noise, traders can generate more reliable buy and sell signals, making this method a valuable addition to any trading strategy.

How Does Darvas Box Theory Work? A Step-by-Step Breakdown

Understanding how the Darvas Box Theory works requires a closer look at its systematic approach to price analysis. This section will break down the process of creating and utilizing Darvas Boxes, highlighting the key steps involved in tracking and interpreting stock price movements. By examining how these boxes are formed and the criteria used to define them, you’ll gain insight into the practical application of this trading strategy. Let's explore the mechanics of how Darvas Boxes are constructed and how they signal potential trading opportunities.

Box Formation

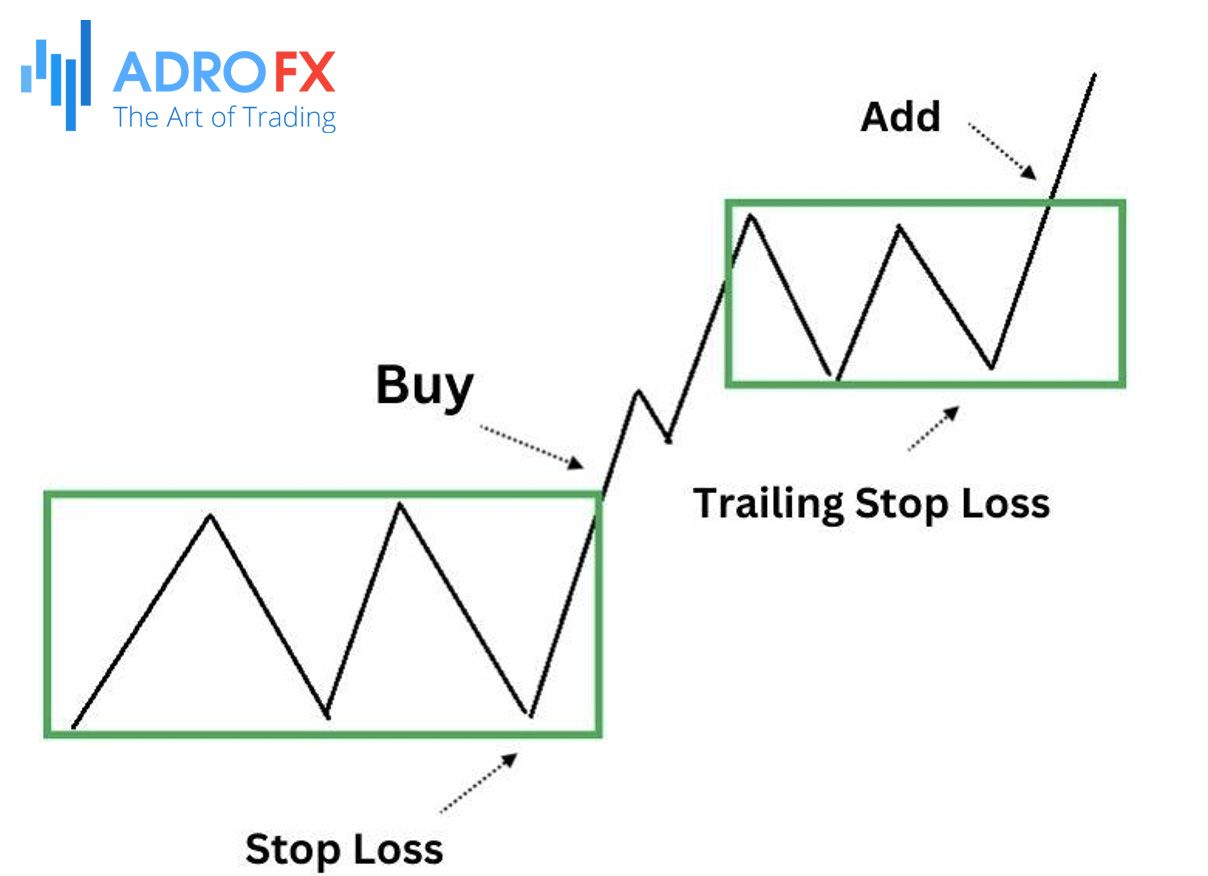

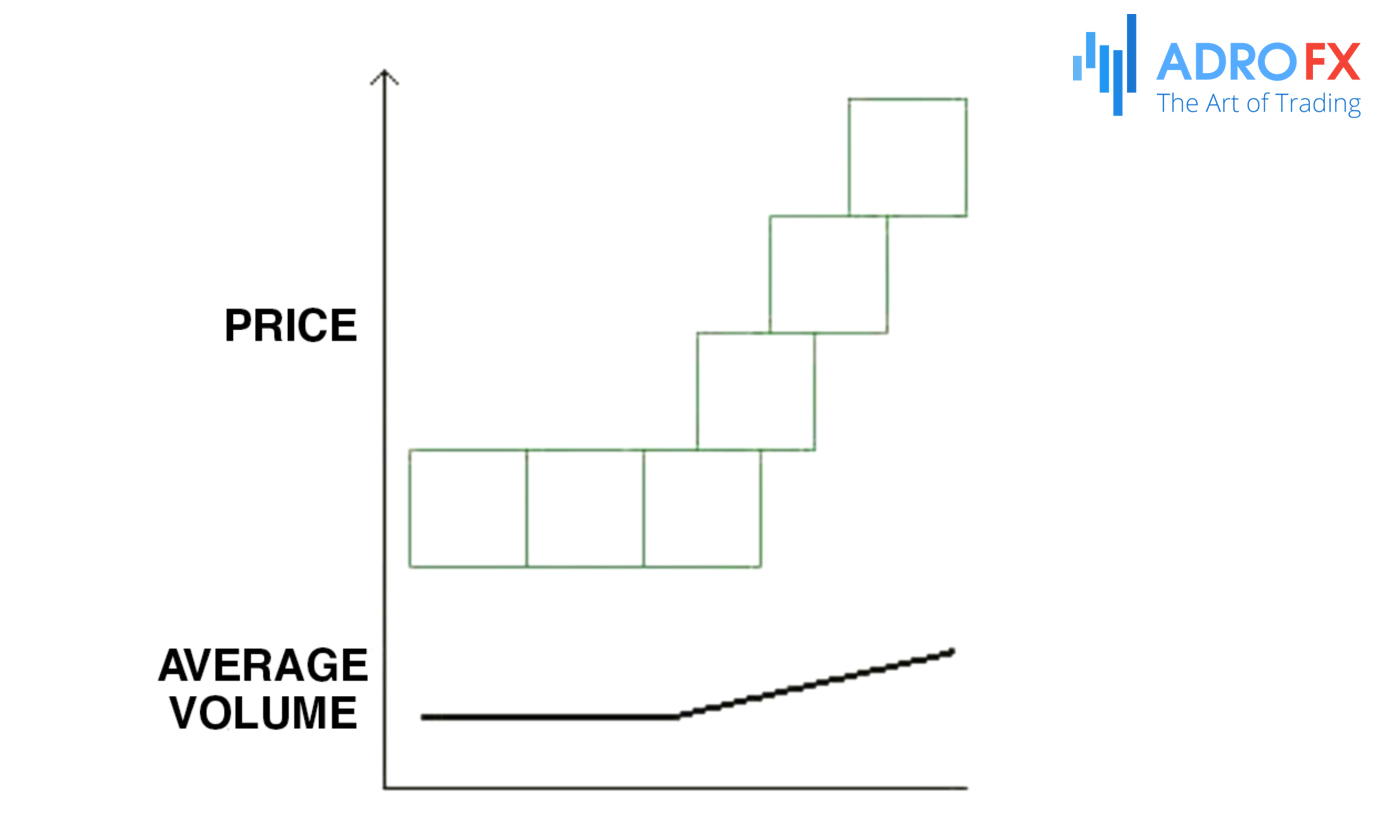

The Darvas Box Theory operates by creating a series of "boxes" that represent specific price ranges in which a stock trades. To form a box, you first identify a period during which the stock price fluctuates within a certain range. This range is marked by a high and a low price, creating the top and bottom of the box. As the stock price moves within this range, the box adjusts to encapsulate the price fluctuations. When the price breaks out of this range, it signals a potential trading opportunity. Essentially, each box represents a period of consolidation or stability in the stock's price, helping traders to monitor significant changes.

Criteria for Boxes

To create a Darvas Box, several criteria must be met. Firstly, a stock must exhibit a clear pattern of highs and lows, forming a recognizable range. The upper boundary of the box is defined by recent highs, while the lower boundary is set by recent lows. The box is updated when the stock price surpasses the previous high (forming a new box) or falls below the previous low (indicating a potential breakdown). The theory emphasizes that boxes should be formed based on significant price movements, avoiding minor fluctuations that do not impact the overall trend.

Trading Signals

Trading signals in the Darvas Box Theory are primarily derived from the price's interaction with the box boundaries. A key signal is the breakout, which occurs when the stock price exceeds the upper boundary of the box. This breakout is considered a bullish signal, indicating a potential buying opportunity. Conversely, if the price falls below the lower boundary, it generates a bearish signal, suggesting a possible exit or sell opportunity. By monitoring these signals, traders can make informed decisions about when to enter or exit trades, aligning their actions with the observed price trends.

Also read: Future-Proof Forex Trading: Best Strategies for 2024 - 2025

Key Components of the Darvas Box Theory: Understanding Price Patterns

To fully grasp the Darvas Box Theory, it’s essential to understand its core components and their roles in the trading strategy. This section delves into the elements that make up the theory, including the significance of high and low price points, the impact of volume analysis, and the concept of breakouts. By dissecting these components, you’ll learn how they contribute to the overall effectiveness of the Darvas Box Theory and how they can be used to enhance your trading decisions. Let’s explore each component in detail and see how they interact to provide valuable trading signals.

High and Low Points

The high and low points are crucial in forming Darvas Boxes. The high point represents the peak price the stock has reached within a specific period, while the low point is the lowest price. These points define the box’s boundaries and help in determining the stock's price range. The significance of these points lies in their ability to capture the stock's trading range, allowing traders to set their buy or sell thresholds based on the observed highs and lows. Accurate identification of these points ensures that the boxes effectively represent the stock’s price movement.

Volume Analysis

Volume analysis plays a supportive role in the Darvas Box Theory. Although the theory itself focuses on price movement, incorporating volume can provide additional insights. A high trading volume during a breakout can reinforce the validity of the signal, suggesting stronger momentum and increasing the likelihood of a successful trade. Conversely, a breakout on low volume may signal a less reliable move, prompting traders to be cautious. Volume analysis helps traders gauge the strength of price movements and improve the accuracy of their trading decisions based on Darvas Box signals.

Breakouts

Breakouts are a fundamental component of the Darvas Box Theory. A breakout occurs when the stock price moves beyond the upper or lower boundary of the box, signaling a potential change in the trend. An upward breakout, where the price exceeds the upper boundary, suggests a bullish trend and may indicate a good entry point for buying. A downward breakout, where the price falls below the lower boundary, indicates a bearish trend and may signal a selling opportunity or exit point. The importance of breakouts lies in their ability to highlight significant price movements and trends, enabling traders to capitalize on market opportunities.

The Advantages of Using Darvas Box Theory in Trading

The Darvas Box Theory offers several notable advantages that make it a compelling choice for traders seeking a structured approach to the markets. From its straightforward methodology to its focus on objective signals, this theory simplifies the trading process while enhancing risk management. In this section, we will explore the key benefits of using the Darvas Box Theory, highlighting how its simplicity, objectivity, and risk management features contribute to more effective trading strategies.

Simplicity

One of the primary advantages of the Darvas Box Theory is its simplicity. The theory offers a clear and straightforward approach to trading, making it accessible even for those new to the stock market. By focusing on price ranges and box formations, traders can easily identify key entry and exit points without getting overwhelmed by complex indicators or algorithms. This simplicity helps traders stay focused on essential price movements and makes the trading strategy easier to implement and follow.

Objective Trading

The Darvas Box Theory is renowned for its objective nature. The rules for creating boxes and identifying breakouts are well-defined, minimizing subjective decision-making. This objectivity reduces the influence of emotional biases and helps traders make more disciplined and consistent trading decisions. By relying on specific price levels and predefined criteria, the theory ensures that trading signals are based on quantifiable data rather than personal intuition, enhancing the reliability of the trading strategy.

Risk Management

Effective risk management is another key advantage of the Darvas Box Theory. The theory helps traders manage risk by providing clear criteria for entering and exiting trades. By setting Stop Loss levels based on the lower boundary of the box, traders can limit potential losses if the price moves unfavorably. Additionally, the focus on breakout points helps in identifying high-probability trades, reducing the likelihood of poor investment decisions. This structured approach to risk management contributes to more controlled and predictable trading outcomes.

Limitations and Market Considerations for Darvas Box Theory

While the Darvas Box Theory provides valuable insights and a systematic approach to trading, it's important to consider its limitations and the contexts in which it may be less effective. Understanding these limitations helps traders make more informed decisions and adapt their strategies as needed. In this section, we will discuss the scenarios where the theory might fall short, the need for adaptability in varying market conditions, and how using complementary tools can enhance its overall effectiveness.

Market Conditions

While the Darvas Box Theory offers a valuable trading approach, it may have limitations under certain market conditions. The theory relies on price ranges and box formations, which may not be as effective during highly volatile or erratic market conditions. In markets characterized by rapid price swings or low liquidity, the boxes may not accurately capture the true price trends, potentially leading to false signals or less reliable trading opportunities. Traders should be aware of these limitations and consider adjusting their strategies based on current market dynamics.

Adaptability

Another consideration when using the Darvas Box Theory is its adaptability to different market conditions. While the theory provides a solid framework for trading, it may require adjustments to accommodate various market environments. For instance, in trending markets, the theory’s box formations may need to be modified to better align with prevailing trends. Traders should be prepared to adapt the theory’s rules and criteria to suit different market scenarios, ensuring that the strategy remains effective and relevant.

Complementary Tools

To enhance the effectiveness of the Darvas Box Theory, it can be beneficial to use it alongside other trading tools and strategies. Combining the Darvas Box with technical indicators such as moving averages, Relative Strength Index (RSI), or volume analysis can provide additional insights and improve decision-making. Utilizing complementary tools helps in validating Darvas Box signals and offers a more comprehensive view of the market, leading to more informed and balanced trading decisions.

Also read: Power Hour Stocks: Unveiling the Secrets of Peak Market Activity

How to Apply the Darvas Box Theory in Your Trading Strategy

Applying the Darvas Box Theory to your trading involves a structured approach to analyzing stock prices. To start, select a stock with clear price movements and ample trading volume, as these factors are crucial for effectively utilizing the theory. Begin by monitoring the stock over a defined period to identify significant highs and lows. These price points will form the boundaries of the Darvas Box.

Once you’ve determined the high and low points, plot these on a chart to create the box, with the upper boundary representing the recent high and the lower boundary indicating the recent low. As the stock price fluctuates, update the box to reflect these changes, ensuring that it accurately represents the current trading range.

The next step is to observe the stock for any breakouts from the established box boundaries. When the price breaks above the upper boundary, it signals a potential buying opportunity. Conversely, a breakout below the lower boundary suggests it might be time to sell or exit the position. This approach helps traders capitalize on significant price movements and manage their trades effectively.

Risk management is also a key component of using the Darvas Box Theory. To protect against substantial losses, set Stop Loss orders slightly below the lower boundary of the box. This strategy limits potential losses if the price moves in an unfavorable direction.

Incorporating the Darvas Box Theory into your trading can be enhanced by combining it with additional technical indicators. These indicators can provide confirmation of breakout signals and offer a more comprehensive view of the market. By staying updated with recent price movements and carefully monitoring volume during breakouts, you can make more informed trading decisions and improve your overall trading strategy.

Darvas Box Theory vs. Other Popular Trading Strategies

When comparing the Darvas Box Theory with other trading strategies, its strength lies in its simplicity and focus on price ranges. Unlike more complex methods that involve numerous indicators and sophisticated calculations, the Darvas Box Theory provides a clear and rule-based approach to trading. This straightforward methodology makes it accessible to traders who prefer a more direct method of analyzing stock movements.

Other trading strategies, such as moving average crossovers or momentum trading, offer different perspectives and tools. For instance, moving average strategies use averages over time to identify trends, while momentum trading focuses on stocks experiencing significant price momentum. While these methods can provide valuable insights, they often require more detailed analysis and can be influenced by various market factors.

The Darvas Box Theory, on the other hand, is highly objective, relying on specific price levels and predefined criteria to generate trading signals. This objectivity helps reduce emotional bias and ensures that trading decisions are based on clear data. However, it’s important to acknowledge that the theory may have limitations in highly volatile markets, where price movements can be erratic and less predictable.

In summary, while the Darvas Box Theory offers a valuable and straightforward approach to trading, it is beneficial to complement it with other strategies and indicators. By integrating various methods, traders can gain a more comprehensive understanding of market conditions and make well-informed trading decisions.

Conclusion: Master the Markets with Darvas Box Theory

The Darvas Box Theory offers a straightforward and effective approach to trading by using price ranges to identify potential opportunities. Its simplicity, objectivity, and risk management features make it a valuable tool for traders. By understanding how to apply the theory and considering its advantages and limitations, traders can enhance their decision-making and improve their trading strategies.

While the Darvas Box Theory is a powerful tool, it’s important to use it in conjunction with other strategies and indicators to ensure a well-rounded approach to trading. As markets evolve, adapting and refining your trading strategies will help you stay ahead and make more informed decisions.

Ready to take your trading to the next level? Explore more trading strategies and put the Darvas Box Theory to the test by signing up for an AdroFx demo account. Practice with real-time data and discover how this innovative approach can enhance your trading success.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.