U.S. Stock Indices Plunge During the Last Week | Daily Market Analysis

Key events:

- USA – Core Durable Goods Orders (MoM) (Jan)

- USA – Pending Home Sales (MoM) (Jan)

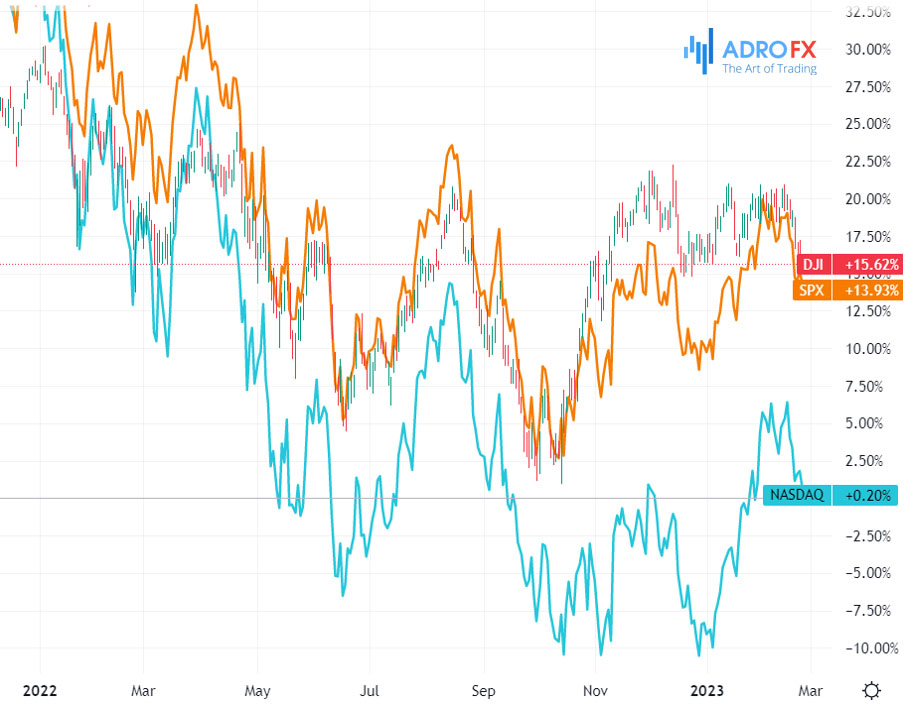

U.S. stock indices tumbled Friday on reports of continued high inflation in the country.

The Dow Jones Industrial Average fell 336.99 points (1.02%) to 32816.92 points. Microsoft Corp (NASDAQ: MSFT) shares were the leaders among the index components, falling 2.2% besides Boeing.

The Standard & Poor's 500 index value decreased by 42.28 points (1.05%) to 3,970.04 points over the day. By the end of the session, the Nasdaq Composite index was down 195.46 points (1.69%) to 11,394.94 points.

As a result of the last week, Dow Jones lost 3%, which was the biggest fall since last September. At the same time, the index was negative for the fourth week in a row. The S&P 500 was down 2.7% from Monday to Friday and the Nasdaq fell 3.3%.

Shares of Boeing Co (NYSE: BA). were down 4.8% for the day on news of a new suspension of Dreamliner 787 deliveries due to documentation problems.

Apple Inc (NASDAQ: AAPL) was down 1.8%, and Intel Corp (NASDAQ: INTC). - by 1.8% and Tesla (NASDAQ: TSLA) by 2.6%.

At the same time, U.S. personal spending rose 1.8 percent in January from the previous month, the nation's Commerce Department said Friday. It's the biggest rise since March 2021. Americans' incomes rose 0.6 percent.

Analysts on average had predicted a 1.3 percent increase for the former and a 1 percent increase for the latter.

The consumer price index (PCE index) rose 0.6% in January relative to the previous month (the biggest gain in six months) and rose 5.4% year-over-year. In December, it was up 0.2% and 5.3%, respectively.

The PCE Core Index, which does not include the cost of food and energy, increased by 0.6% for the month (in December - 0.4%). In annual terms, the growth of the indicator, which is closely watched by the Federal Reserve System when assessing inflation risks, accelerated to 4.7% compared to 4.6% in December. At the same time, experts had expected a smaller rise of 0.4% and 4.3%, respectively.

Continued high inflation could prompt the Fed to raise interest rates to higher levels and not lower them for a longer period of time.

"The PCE Core data was very disappointing," notes Federated Hermes Chief Analyst Philip Orlando. "Inflation is resilient, and it's not declining as fast" as expected, he told MarketWatch. This, he said, makes investors nervous that "the Fed may have to get even more aggressive than we thought a month or two ago."

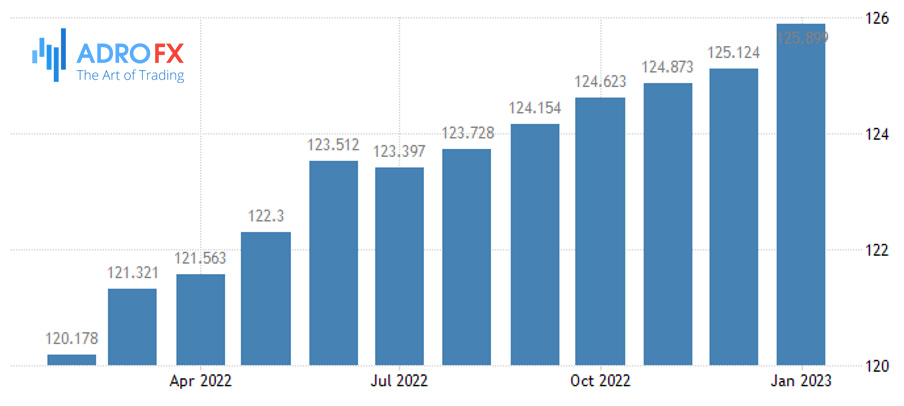

New home sales in the U.S. jumped 7.2 percent in January from the previous month to an annualized rate of 670,000, according to the Commerce Department. That's the highest rate since March 2022. Analysts on average had expected an increase of just 0.7%, Trading Economics reported.

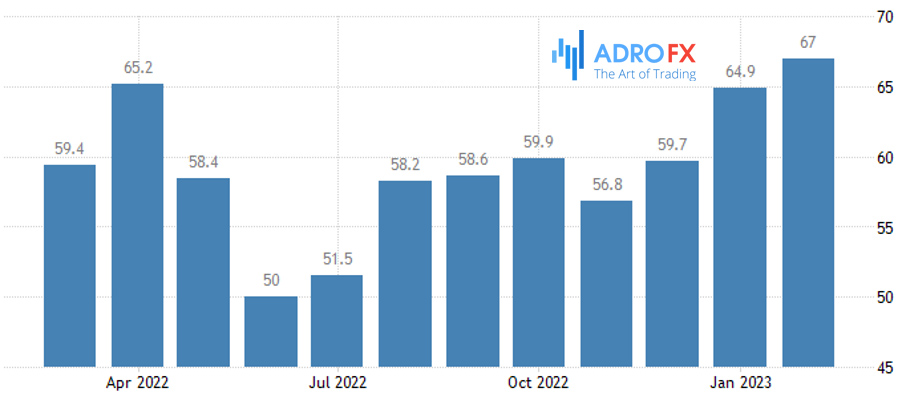

The U.S. consumer confidence index rose to 67 points in February, up from 64.9 points the previous month, according to final data from the University of Michigan, which calculates the index. The level is the highest in thirteen months. Experts did not expect a revision from the previously announced level of 66.4 points.

US Michigan Consumer Sentiment

Inflation expectations for the medium term (next year) among the population rose to 4.1% in February from 3.9% a month earlier. Americans began to expect higher inflation for the first time since October 2022.