Unwrapping the Santa Claus Rally: Navigating Market Surges and Seasonal Trends in Trading

The holiday season not only brings festive cheer and goodwill but also carries with it a phenomenon known as the Santa Claus rally in the financial markets. To truly understand the essence of this rally and its implications, we must embark on a journey that intertwines the iconic figure of Santa Claus with the dynamics of stock markets. Santa Claus, an emblematic character associated with joy and gift-giving, takes center stage during Christmas, becoming the unofficial patron of the festive season in the United States. Beyond the realms of festive tradition, Santa Claus plays a role in the financial markets, giving rise to the Santa Claus rally - a period marked by an upward surge in stock prices as Christmas approaches. This article explores the origins of the Santa Claus rally, its historical context, and its multifaceted impact on various financial assets. Join us as we unravel the mysteries behind this seasonal market phenomenon and examine its significance for traders and investors alike.

What Is the Santa Claus Rally?

To grasp the essence of the Santa Claus rally and its significance, it's crucial to delve into the iconic figure of Santa Claus and his association with the Christmas season. Santa Claus, an emblematic character linked to Christmas in the United States, is widely recognized as the unofficial patron of the festive season.

Santa is commonly associated with positive elements, particularly the joy of giving and receiving gifts, especially among children. Major retailers, such as Macy’s and Target, strategically leverage Santa Claus as part of their marketing campaigns during this festive period.

In financial markets, the Santa Claus rally refers to a phenomenon where stocks experience an upward surge in the days leading up to Christmas. This rally is often driven by the perception that both stocks and cryptocurrencies tend to perform well during this time, prompting traders to actively engage in asset purchases and contributing to increased market activity.

Historical Perspective of the Santa Claus Rally

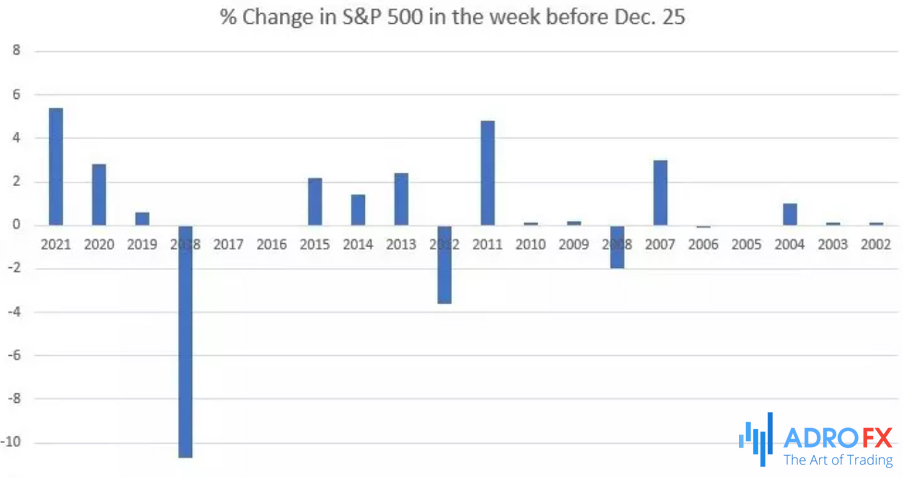

The concept of the Santa Claus rally originated in the 1970s when astute investors observed a recurring trend of significant stock rallies preceding Christmas. Their observations were grounded in the historical performance of the S&P 500 index, which exhibited an average rally of over 1.3% during the Santa rally period. Additional statistics reveal that the SPDR S&P 500 index has participated in a rally during 18 out of 27 instances since its establishment in 1993.

Commencement of the Santa Claus Rally

Unlike conventional seasons with defined start and end dates, the Santa Claus rally lacks a specific timeframe. Some analysts posit that this festive market rally typically spans from November through January, aligning with the holiday shopping season. The period is marked by substantial consumer spending, particularly following the Black Friday event.

Data compiled by the CME Group indicates that the S&P 500 historically records an average return of approximately 1.42% during this period, with December itself averaging around 1.37%. Certain traders speculate that the Santa Claus rally initiates approximately a week before Christmas, contributing to heightened market activity and investor optimism during this festive stretch.

When Does the Santa Claus Rally Conclude?

Building upon the preceding discussion, a common inquiry arises regarding when the Santa Claus rally comes to an end. As previously noted, the commencement of the Santa Claus rally lacks a specific date, and similarly, there is no predetermined conclusion. Some investors posit that it typically wraps up shortly after Christmas, marked by a notable decline in market volume.

In certain instances, the Santa Rally might conclude even a day before Christmas as traders anticipate the unwinding of the festive season.

Is the Santa Claus Rally Genuine?

A frequently debated question revolves around the authenticity of the Santa Claus rally - whether buying and holding during this period consistently leads to positive returns. Despite proponents who may argue in favor, the reality is more nuanced. The Santa Claus rally does not guarantee success due to the complex drivers influencing financial markets. Various factors, such as global crises or specific events like the 2008 Global Financial Crisis and the 2020 developments related to COVID-19, can significantly impact market performance.

Effect of the Santa Claus Rally on the Market

Delving into the impact of the Santa Claus rally on stocks and other financial assets reveals its historical association with the stock market. However, this correlation extends beyond stocks to encompass other assets, notably cryptocurrencies. Generally, cryptocurrencies tend to perform well when stocks are on the rise, and vice versa.

A closer examination of the crypto market highlights a trend where Bitcoin often reaches its all-time highs before and after the Christmas period. Notable instances include the significant surge to nearly $20,000 in 2017 and the subsequent major all-time high in 2021, approaching $70,000.

In contrast, the forex market maintains its usual trading patterns during the Santa Claus rally, exhibiting no distinctive characteristics specific to this period. As a result, the influence of the Santa Claus rally varies across different financial markets and asset classes.

Santa Claus Trading Strategy

While the idea of a Santa Claus rally might suggest a straightforward "buy and go away" strategy, it's crucial to recognize that this approach doesn't guarantee positive returns every year, as discussed earlier. Consequently, we advise traders against solely relying on the Santa rally and instead recommend adhering to their established trading strategies.

Whether you identify as a scalper, swing trader, or algorithmic trader, maintaining consistency with your existing strategies is paramount. Opportunities for successful trades exist throughout the holiday season, and aligning with your proven approaches can enhance your chances of success.

It's essential to exercise caution when trading during the Christmas holiday, primarily due to the low trading volumes characteristic of this period. With many institutional investors away from the market, low volume poses risks, especially when dealing with low-volume stocks and cryptocurrencies. Traders should remain vigilant about potential risks, including susceptibility to popular pump-and-dump schemes that may take advantage of the lower liquidity. Staying informed and executing trades judiciously is key to navigating the market dynamics during the festive season.

Conclusion

In conclusion, the Santa Claus rally, with its roots in the festive season and Wall Street, continues to captivate the attention of traders and investors each year. While historical trends suggest a propensity for upward movements in stock prices during this period, the Santa Claus rally is by no means a foolproof strategy. As we've discussed, market dynamics are influenced by a myriad of factors, and relying solely on seasonal trends can be perilous. Traders are advised to approach the holiday season with a balanced perspective, leveraging their existing strategies and adapting to the nuances of low-volume trading. As we navigate the festive stretch, it becomes evident that the Santa Claus rally, while intriguing, requires a judicious approach. The holiday season may bring joy and celebration, but in the financial markets, cautious and informed decision-making remains the key to success.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.