Track the Pulse of the Market with the Money Flow Index Indicator - Guide 2021

Trading volume is the principal measurable indicator in determining price levels in the market. The trading volume increases at the highest activity of traders and can influence the price trend, either strengthening it or changing its direction.

Actually, the main reason for studying this parameter is an objective analysis of the market situation at the current moment. Most traders prefer the Money Flow Index (MFI) indicator, as it perfectly copes with the above tasks.It is included in the list of standard indicators MT4, but its usefulness is not lost.

In this article, we will learn how to use the Money Flow Index indicator in forex trading, and discuss how to read its data. Also, we will provide you with the Money Flow Index indicator strategy.

Calculating the Money Flow Index Indicator

By its appearance, the MFI can be easily confused with the RSI. It is still the same broken line that moves in the range of values from 0 to 100. And the calculation algorithm is similar, only instead of moving average, we take data including volumes.

If we try to give a more or less understandable definition of the meaning of the indicator, it is possible to say that it shows how attractive the currency pair is. That is the degree of intensity of investing into it. Only the indicator dynamics are important, its value at a certain moment in time has no special importance.

Thus, the indicator shows how attractive the currency at any given moment is to the investor, so it is definitely worth including it in any trading strategy.

The Money Flow Index technical indicator uses the notion of Typical price - the quotient of dividing the sum of the maximum, minimum, and closing price by 3. It is believed that the typical price gives a more complete characteristic of the process occurring with an instrument than the closing price. The basic concept in the calculation of the Money Flow Index is Money Flow, which is determined as the product of the typical price of the period taken and the trading volume for the specified period.

Money Flow(i) = Tp(i)*Volume(i), where Money Flow(i) - the amount of cash flow for the period, Tp(i) - the typical price for the period, Volume(i) - the trading volume for the period.

The next step is attributing the current money flow either to Positive Money Flow or Negative Money Flow. If the current typical price is higher than the previous one, the Money Flow is positive, if the typical price is lower - the cash flow value is attributed to the negative one.

At this stage, the Money Ratio is calculated as the quotient of the sum of positive cash flows for the specified period divided by the sum of negative cash flows for the same period.

Money Ratio = ∑(Positive Money Flow(i))/∑(Negative Money Flow(i)).

The final stage of the indicator calculation is the calculation of the Money Flow Index as the difference of 100 and the quotient of the division of 100 by the sum of 1 and the money relation.

Money Flow Index = 100 - (100/(1+Money Ratio).

It should be noted that the Money Flow Index technical indicator does not use the averaging model in its calculation; the period chosen is only a time interval during which the positive and negative cash flows are distinguished for their further comparison. Therefore, the Money Flow Index indicator is synchronous with the price, and in some situations, it is even ahead of it.

If an asset grows in the current period, the product of the typical price of the period by the trade volume is added to the value of the positive cash flow, and the Money Flow Index value increases.

If the price of an asset decreases, the product of the typical price by the trading volume is added to the negative cash flow value, and the Money Flow Index value decreases.

Using the MetaTrader 4 Money Flow Index Indicator

The Money Flow Index technical indicator is available in the standard toolkit of the Metatrader 4 platform, so you do not need to search for it and download it yourself from the Internet.

To install it, you need to drag and drop the MFI on the trading pair chart of your choice. The tool can be found in the main menu "Insert" of your trading terminal or the "Navigator" panel.

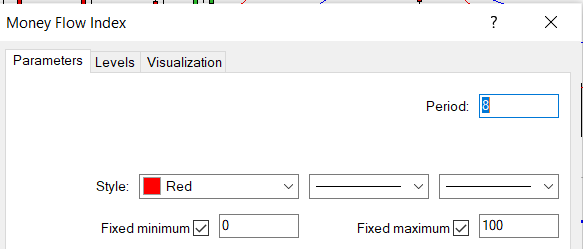

When you launch the indicator, a window will open for tool setup. Take a look at the example shown in the picture below:

The only thing you can change in the settings of this indicator is the period selection. That is the only indicator that will affect the tool's readings.

The standard MFI period is calculated as 14 bars. If you are new to the Forex market and indicators of this type are new to you, there is no need to reconfigure the tool. The standard settings were recommended by the developer Bill Williams himself, so there is no point in changing them without an urgent need.

If you are an experienced trader, you can experiment with the period value. The smaller the indicator period, the higher the sensitivity of readings. However, be careful, because in this case, the probability of false signals increases dramatically.

If you sharply increase the number of bars in the settings, the indicator will start filtering out market noise and reduce the number of signals. In this case, there is a high risk that the tool will miss an important market signal. That's why we recommend you stick to the average values - 14-20 units.

When you have changed the period, save the settings by pressing "Ok". The MFI is now ready to run.

How to Read the MFI Indicator

There are three ways to read the signals of the Money Flow Index technical indicator for opening positions:

1. Divergence

A "divergence" is understood as a difference in direction between the price chart and the indicator chart over a certain period, which are determined by local extrema (maximums or minimums). It is believed that the divergence indicates a trend reversal soon. Thus, the formation of divergences between the price chart and the indicator chart is used to open new positions.

There are two types of divergences: bullish divergence and a bearish one.

Bullish divergence implies a situation when the price chart forms the next minimum, which is lower than the previous minimum, and the corresponding MFI chart forms the next minimum, which is higher than the previous minimum.

In this case, the price of the financial instrument (currency, stock, commodity, etc.) is decreasing while the value of the positive cash flow is greater than the value of the negative cash flow. That is, at this time the market is dominated by buyers. The downtrend is weakening, which will most likely lead to an upward price reversal. Generally, it is due to large cash inflows (buying) compared to cash outflows.

Bearish divergence implies a situation when the price chart forms another maximum, which is higher than the previous maximum, and the corresponding indicator chart forms another maximum, which is lower than the previous maximum.

In this case, the price of a financial instrument is rising while the positive cash flow is lower than the negative cash flow. That is, the market is currently dominated by sellers. The uptrend is weakening, which will most likely lead to a downward price reversal. This is mostly due to diminishing cash inflows compared to cash outflows.

2. Overbought/oversold

The second important type of signal is the work on the overbought and oversold levels. Thus, the MFI indicator values are located in the range from 0 to 100. At that, by default, in the MetaTrader in the indicator settings, the overbought zone is between 80 and 100 and the oversold zone is between 0 and 20. A value of 80 is called overbought and a value of 20 is called oversold.

If the indicator curve passes through the 80 level from bottom to top, the market is considered to be overbought (they say that the market is overheated). If the indicator curve has crossed from top to bottom the level of 20, the market is considered oversold. The trend is likely to change its direction soon. The state when the price is in the overbought and oversold zones, by themselves, are not signals for entry into the market, because this state can last for a long time. Signals are given only on exit from the overbought/oversold zone.

3. Searching for technical analysis figures on the indicator chart

The same methods of technical analysis are used for the Money Flow Index technical indicator chart as for the price chart. For example, you can mark the trend lines in the tool window and enter the market on the trend break. Or find a technical figure on the indicator chart, as in the example below:

The tool line has formed a "Head & Shoulders" pattern. The strengthening factor, in this case, is finding the pattern in the overbought area. On the breakdown of the imaginary neckline, it is possible to open a sell order.

Trading with the MFI Indicator

Let us now look at the example of the trading strategy based on the MFI and the MACD trend indicator.

This approach is suitable for placing trend positions. The MFI indicator will show the moment of the market reversal in the opposite direction, and the MACD algorithm, in turn, will show the direction of the new trend.

You can trade on the standard settings of the indicators. The time frame of the chart should be H4. Despite the fact that due to the high interval of the chart signals will come very rarely, the strategy will still bring a good profit since all trades will be placed in the direction of the trend. It means that the stronger and longer is the new trend - the more profit you can get. Profits from one trade can reach up to 100 pips or more.

Add both indicators to your chart. It is best to choose a volatile currency pair among the major assets. For example, EUR/USD or GBP/USD.

Signals for placing a buy order:

The MFI indicator line has left the oversold area, breaking through the bottom level from bottom to top. That is a signal of the development of a new uptrend.

A new green bar has formed on the MACD histogram above the zero mark.

If both conditions coincide, we should wait for the signal candle to close and place a buy order.

Many traders open a position as soon as they see a green bar on the MACD bar chart, without waiting for the signal candle to finish rendering. It is a big mistake, as MACD can re-draw its signals and the bar color can drastically change in case of a sharp change in the price direction. Therefore, you should open a position only after the signal candle closes and you can be sure that the trend is really moving upwards.

Signals for placing a sell order:

The MFI instrument curve has left the overbought zone, breaking the upper level from top to bottom.

The MACD histogram has changed the color of the bars from green to red. At the same time, the red bar formed in the negative zone below the zero level.

If the signals coincide, open a sell position after waiting for the signal candle to finish rendering.

Take Profit and Stop Loss are set according to the usual rules - at the boundaries of price levels or local extrema. It is important that Take Profit should exceed Stop Loss by at least 1.5 times. If you want to maximize your profit from the market, replace the Take Profit with the Trailing Stop after the trade has reached a breakeven point.

MFI Forex Indicator – Conclusions

The MFI can also be combined with other indicators, such as Stochastic, RSI, MACD, and Alligator. To increase your profitability and minimize your losses, we recommend following some simple rules:

Always stick to money management: the amount of one trade should not exceed 3% of the current deposit;

Work only on the trend market, avoiding flat situations;

Try to open trades during European and American trading sessions. During this period, the charts of assets, especially currency pairs, form clear trends with predictable movement;

To sift out false signals, use not only indicators but also readings of the higher time frame, which should be about 4-5 times greater than the main one. For example, if we take H1 as the basis, then H4 can be considered as the high one;

Work on strategies based on 2-3 indicators. If you load 4-5 instruments on the chart at once, their indications will often contradict each other - confusion will occur. If you work with only one instrument (for example, MFI), the signals will not always be accurate.

Therefore, the MFI can be used as an additional indicator, combining it with several other instruments. It is recommended to perform the initial testing of all strategies on a demo account. Once the positive statistics are accumulated, you can move to trading with real money.

About AdroFx

AdroFx is an international brokerage company, offering a wide range of online trading services in currencies, stocks, cryptocurrencies, and precious metals. Founded in 2018, the company is officially registered in Saint Lucia.

The company is distinguished by one of the best trading conditions on the market, minimal spreads, market order execution, and leverage up to 1:500. The broker is perfectly suited for strategy testing and automated trading systems due to micro accounts, ECN/STP order execution, and the absence of restrictions on using instruments, Expert Advisors and trading strategies.