Top Trend Indicators That Tell You the Direction of the Trend

As the Wall Street classics say, successful trading is the art of reading market sentiment in order to accurately predict future price direction and move in the trend. The forex market also fits into this concept.

There is a lot of speculation, but dry and stubborn statistics say that traders who follow the trend have much more chances to benefit from the price fluctuations. And so, in theory, forex trend indicators are the magic hand of Midas, which will make all our trades golden. Following trends is hunting for a smaller piece of the pie, but the chances of getting it are much higher. At least in theory.

What Are Trend Indicators and Why Are They Needed?

Trend indicators in forex are tools for measuring the strength and direction of a price trend. If the market is in a strong uptrend, the trend indicator will give buy signals, while in an apparent bear market a sell signal will follow.

Because it always follows the price, the accuracy is proportional to the length of the time frame - the higher the time frame, the more accurate the indicators and the more chances to "ride" a powerful momentum.

Advantages and Disadvantages of Trend Indicators

Speaking about the benefits of using trend indicators, we can name the following ones:

- simple and clear use;

- versatility;

- convenient scaling (from intraday trading to long-term trading).

The disadvantage is that all technical indicators lag behind the real price because they use past price data to display current values. Even "fast" trend indicators like the EMA are also based on old market data, so they do not give an accurate picture of the forex market.

Nevertheless, no trading strategy is complete without the use of technical trend indicators. Because without them, it is impossible to obtain all of the necessary data in an easy-to-understand graphical form. Without them, it will not be possible to instantly assess the entire perspective of the market and make the right decision.

SuperTrend

This is a hybrid indicator because it is based on the signals of two fairly well-known tools: ATR and CCI. ATR is an indicator of the average true range, which determines the range of minimum and maximum price fluctuations, as well as closing prices. As a result - indicates the current market volatility. CCI is an indicator of the oscillator family. The indicator helps to calculate the oversold and overbought areas of the trading instrument.

When the trend changes, the indicator SuperTrend uses color signaling: green - when changing from downtrend to uptrend, and red - on the contrary, the downtrend. You can use the SuperTrend indicator when entering the market, after its correction. If the indicator has changed color to green, you must wait for the first downward correction and then open trades to buy the asset. And to sell (color change to red) wait for the first upward correction and sell the asset on it.

SuperTrend is also a good indicator of short-term resistance and support levels. But this factor should be used with great caution in trading.

Smoothed Repulse

Quite an exotic indicator, which also uses color signaling. It needs to be studied and described like the Ichimoku indicator. According to the few comments of traders, Smoothed Repulse is suitable for scalping. So, it is recommended to use it in low time frames.

The main signals are:

Buy: open a long position if the indicator line changes color to light green.

Exit: close all orders, if, during an uptrend, the green indicator line changes color to silver.

Sell: open a short position if the indicator line changes color to orange-red.

Exit: Close all sell orders, if, during a downtrend, the orange-red line of the indicator changes color to silver.

TEMA

TEMA indicator is a Triple Exponential Moving Average. It can be used instead of the classic Moving Average (EMA) for smoothing the price data. TEMA works on the same principle as DEMA (Double Exponential Moving Average) - a double smoothing, but with additional processing.

First, we calculate the DEMA, and then we get the error of price deviation from the DEMA values. Then we add the Exponential Moving Average value to DEMA and obtain TEMA as a result. Thus, the values of the next indicator smooth out the values of the previous indicator.

It is commonly known that the Moving Average lags behind the price. Therefore, the less lagging from the price - the better. And the TEMA indicator shows the forthcoming price change earlier than others.

It is worth considering that the lag directly depends on the selected period. The larger the period - the greater will be the lag. It is believed that the TEMA indicator often gives false signals for small periods.

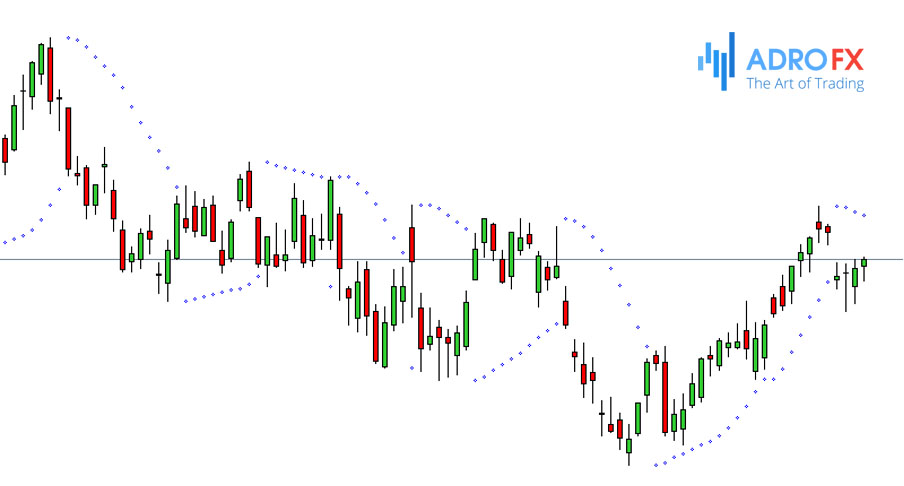

Parabolic SAR

Indicator SAR (Stop And Reverse price) - is designed to determine the tolerance within which the price movement is possible. And as a result, it remains in the current trend.

That is, the Parabolic is designed to determine the stop price and reversal points. Therefore, the indicator plots dotted lines on the instrument charts. If the market is dominated by an uptrend - the points will be located under the candlesticks and form a support line. If the trend is downtrending - the dots will be displayed above the candlesticks and form a resistance line.

In fact, each SAR marker indicates the level that the price must reach in order for the trend to reverse.

In addition to the direction of the trend, the Parabolic also shows, to some extent, the strength of the trend. Thus, if the current trend is accelerating - the distance between the indicator points and the price chart is increasing. And if the trend fades - the markers approach the current price values.

When trading with Parabolic, it is recommended to use time frames from 1 to 4 hours.

We should place a sell order if:

- Parabolic has drawn 4 points in a row, which form a declining line - a signal to sell;

- Stop Loss is set 3 to 5 above the first point;

- A trade is closed at the formation of the opposite signal.

Inverse conditions are necessary for the long position.

Heikin-Ashi

Heikin-Ashi is a useful indicator of the family of price oscillators. To determine the trend and its strength, the indicator uses Heikin-Ashi values instead of "net price". This is an additional signal line that is used for the following purposes:

To use it as a signal line, on crossovers with the oscillator.

To smooth values and filter out some false signals, oscillator values tend to fluctuate quickly (nervousness) in the background of a natural lag.

Heikin-Ashi is developed based on the standard Japanese candlesticks, but the methodology of construction of the candlesticks is unusual. And visually, the opening-closing points of the Heikin-Ashi candlesticks do not always correspond to the same points on the charts of "classic" Japanese candlesticks.

The opening price of a Heikin-Ashi candlestick (HA candlestick) is the smooth value of price fluctuations in the range between the opening and closing of the preceding HA candlestick. Thus, the opening and closing prices are first added and then divided by 2. The indicated prices are taken from the previous HA candlestick.

The closing prices of the HA candlestick are the average of all indicators of a usual candlestick. That is the minimum, maximum, and opening and closing prices of the time frame. We divide them by 4 and obtain the closing price of the HA candlestick.

The maximum price is obtained by comparing the maximum of a Japanese candlestick with the opening and closing price of an HA candlestick. The minimum price is obtained by comparing the minimum of a normal candle with the opening and closing price of the candlestick. To be more informative, HA candlesticks are colored differently from ordinary Japanese candlesticks. During the analysis, you should also take into account the shadows of candlesticks.

With the Heikin-Ashi pullbacks, the trend is easy to recognize. To do this, you need to draw a trend line and underline the pullbacks in the trend. The lower shadow indicates where to set the Stop Loss. And Take Profit is usually set near the support/resistance level.

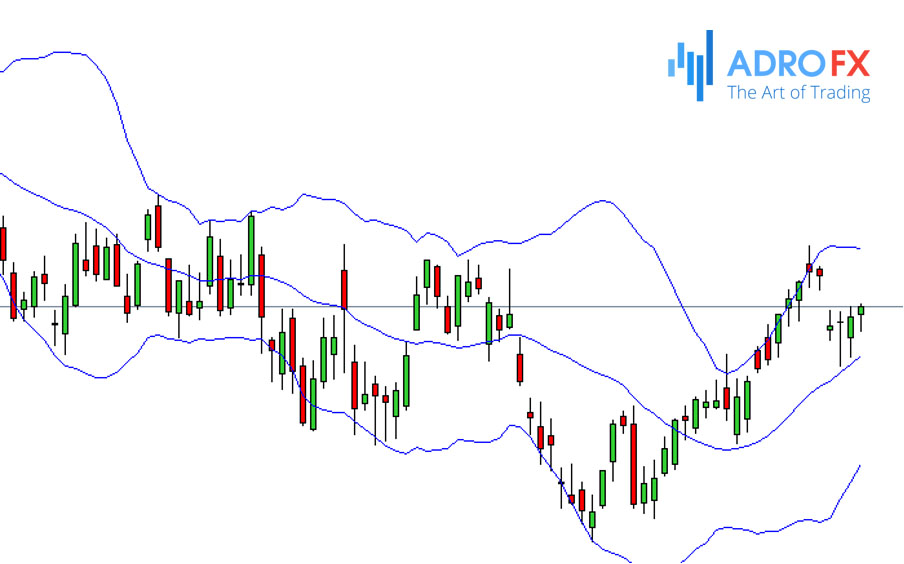

Bollinger Bands®

Bollinger Bands® is an indicator that helps to assess market volatility. It allows you to determine not only the direction of the trend but also the volatility and range of fluctuations. That is the direction of the trend and nature of trading.

The indicator consists of three main bands. The middle line is a Moving Average (MA). The extreme lines are also MA, but they are displayed taking into account the deviation.

The distance between bands depends on the price behavior. If the market volatility increases, the corridor becomes wider. And when the market volatility falls, the corridor narrows.

The most popular is trading when the price crosses the center line of the indicator. When the price crosses from the bottom to the top of the Moving Average - you open long positions. And if the price crosses from top to bottom - you should short.

Another method of trading - buying on reversals. Considering that extreme lines are support and resistance levels - trades are opened when the price rebounds from one of them and goes to the opposite one.

When the price touches the lower band and then reverses, long positions are opened. When the price touches the upper band and then reverses downwards, a short position is opened.

It is not recommended to use this tool in markets with low liquidity.

MACD

MACD (Moving Average Convergence and Divergence) is used in the analysis to evaluate and predict fluctuations in prices in the markets.

It is used for checking trend strength and direction, as well as for finding pivot points. It belongs to the family of oscillators, and, in fact, is an improved version of the two Moving Averages.

The MACD indicator is built based on two lines - a solid line (also known as the MACD line) and a dashed line (also known as the Signal line), which is usually a brighter color.

The MACD line is built based on two average indicators of fluctuations in the rate of the traded instrument. It is more mobile, and in a small time interval, it quickly reacts to price changes. The Signal line reacts much more slowly to price changes but covers a longer time interval.

Trading with the MACD indicator is based on crossovers of the MACD line and the Signal line. Thus, when the MACD line descends below the Signal line (dashed line), it is a signal to sell. And in the case when the MACD line rises above the Signal line - this is a signal to buy. There are also used as buy/sell signals when the MACD line crosses the zero line downwards or upwards.

For example, we buy when the bar chart columns begin to go below the zero line and then close above the Moving Average. The trade is closed when the bar chart columns cross the Moving Average in the opposite direction. A short position requires opposite conditions.

In hourly time frames (and lower), the MACD indicator gives a lot of false positives. It is recommended to use it in daily charts or higher.

TRIX

The TRIX indicator (TRIple eXponential average) is an oscillator of overbought and oversold areas. It differs from the MA by having fewer false signals.

When calculating TRIX, it excludes values with smaller periods than the period of the indicator, thus smoothing the resultant line and eliminating short-term market fluctuations. As a result, it does not allow you to make unnecessary movements during trading.

The TRIX indicator is displayed in a separate window of the terminal and consists of a line and level 0. If the TRIX line is above zero – the market is in an uptrend. And if it is below the trend is falling. If the TRIX line is above level 0 and continues to rise – the uptrend is strengthening, and if it is below 0 and continues to fall - the downtrend is strengthening.

TRIX is a momentum indicator, so it is recommended to use it in case of pronounced trend movements. During a flat period, TRIX can give out a lot of false signals. That is if the TRIX line fluctuates near zero for a long time – it usually indicates uncertainty in the market. At such moments, it is better not to take active actions. It is better to conduct an analysis.

To place a sell order:

- The TRIX line has broken out the zero mark from top to bottom;

- We set the Stop Loss 3-5 points above the local extremum;

- If the signal is reversed, the trade is closed.

For the long position, the opposite conditions are required.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is an oscillator that follows the price and ranges from 0 to 100. Originally, its 14-period variant was used, and later 9- and 25-period indicators became popular.

It is important to remember that the shorter the period of calculation – the more sensitive the RSI indicator becomes, and produces more false signals. So when setting it, you need to be careful.

Trading strategies with RSI are based on looking for divergences when the price forms a new maximum, but the indicator fails to surpass its previous maximum. When such divergences occur, we can say that there is a high probability of a price reversal. If the RSI subsequently falls below the last trough, the so-called "failed swing" is complete and indicates that a price reversal is imminent.

To open sell trades:

- The RSI has broken out the top-down overbought level (70).

- Sell on the next candle after the breakout.

- We set Trailing Stop on the level of the local maximum of the price, which preceded the opening of the position. That is, the Stop Loss will automatically follow the price at a certain distance.

- We set Take Profit in 2,5 times further (in points) than Stop Loss.

- If the opposite signal was formed, and Take Profit or Stop Loss has not yet been triggered - the trade is closed manually.

For long positions, opposite conditions are required.

Stochastic Oscillator

A Stochastic oscillator is compared to some kind of price speed indicator.

It shows the ratio of the closing price of the current period to the maximum or minimum for a certain period. That is, its main purpose is to determine trends and price turns, and their changes by tracking the distribution of closing prices in the extreme series of maximums and minimums of the market. Stochastic values range from 1 to 100.

Experts divide the Stochastic indicator into 3 types:

Fast Stochastic (pure %K) is determined by diagnosing its values on the lack of smoothing by averaging method, it is used quite rarely because it is too volatile by itself.

Slow Stochastic (slow %K) - values smoothed by an averaging method.

Full Stochastic (universal) - the most flexible and advanced. It is the average value of the above-mentioned oscillator types. Sometimes it can coincide with their values.

Stochastic oscillators display two lines: %K, and %D. The %K line compares the lowest low and the highest high of a given period to define a price range, then displays the last closing price as a percentage of this range. The %D line is a Moving Average of %K. The main line is solid, while the signal line is dashed.

More often Stochastic is used for searching for divergences and trend analysis. If the Stochastic rises above 80% - the market is overbought. And if it falls below 20% - the market is in an oversold area.

To open long positions:

- Both Stochastic lines have entered the oversold area;

- The lines have crossed in this zone;

- The oscillator has broken out the oversold level from bottom to top;

- We buy at the next candle, after the breakout;

- We set the Trailing Stop on the level of the local maximum of the price, which preceded the opening of the trade. This means that the Stop Loss will automatically follow the price at a certain distance.

- Take Profit is set in 2,5 times further than Stop Loss.

- If the opposite signal was formed, and Take Profit or Stop Loss has not yet been triggered - the trade is closed manually.

- For sell orders, the opposite conditions are required.

Can I Earn a Substantial Income Using Only Indicators

When learning the forex trading basics, many traders make the mistake of basing their strategies on technical indicators, while in fact, they should only supplement them. Up-to-date information on price and market sentiment is contained in the naked price chart and candlestick patterns. An indicator is a check and reassessment.

Therefore, we advise most traders to focus on candlesticks and candlestick patterns, testing their hunches on 2-3 of the simplest and most reliable indicators (SMA, RSI, MACD, Stochastic). Amateurs believe that the more indicators, the more accurate the data.

In fact, the quantity increases the number of contradictory trading results, and the harder it is to sift out the necessary ones. To put it simply, it is not necessary to complicate what is already complicated, otherwise one can get confused.

Conclusion

Keep in mind that there are no indicators that are not wrong. Any strategy requires confirmation of its signals. When building your own system, it is recommended to use several indicators. Also, you should not forget about money management. You should never risk more than 2% of your capital in a single trade. Such an approach will protect you from ruin and allow you to earn consistently.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.