Tech Stocks Soar Led by Nvidia Ahead of Earnings, Gold Prices Rally on Fed Rate Speculations, and Focus on China's Currency Safeguarding | Daily Market Analysis

Key events:

- USA - Core Durable Goods Orders (MoM) (Jul)

- USA - Initial Jobless Claims

The closing of Wednesday witnessed a pronounced surge in US stocks, prominently propelled by the escalating value of Nvidia (NASDAQ: NVDA) shares ahead of the company's quarterly financial disclosures. Nvidia's chips enjoy widespread utilization for artificial intelligence (AI) computing purposes.

The shares of Nvidia displayed a notable ascent of 9%, building upon a prior 3.2% increase during the standard trading session. The company proceeded to forecast third-quarter revenue that exceeded the expectations of Wall Street analysts. The ripple effect was felt among other tech enterprises during the after-hours trading phase. Microsoft (NASDAQ: MSFT), for instance, experienced an uptick of around 2%.

Investors with a bullish outlook have been nurturing hopes that Nvidia's favorable announcements could bolster the ongoing strong surge in tech stock values. Considering the cumulative movement, Nvidia's stock has surged by over 220% within the current year.

The upcoming impact of Nvidia's statements during their conference call, pertaining to their financial figures and the AI landscape, is anticipated to significantly influence the sentiment prevailing in the market.

Nvidia is an integral component of the widely recognized Magnificent Seven cluster of mega-cap stocks, which includes luminaries such as Apple (NASDAQ: AAPL) and Tesla (NASDAQ: TSLA). These companies have been instrumental in driving the substantial upswing witnessed by the S&P 500 index throughout the present year.

At present, investors are closely fixated on the ongoing developments in China, particularly the measures undertaken by Beijing to safeguard its domestic currency. Of particular concern is the USD/CNY pair's proximity to the 7.30 mark. Chinese authorities are attentive to this point, given its potential implications. The People's Bank of China (PBoC), backed by an array of effective tools, is inclined to ensure that the rate of depreciation of the Chinese Yuan (CNY) remains controlled. Despite this, there's a consensus among many foreign exchange traders that the pace of CNY weakening will continue to moderate. Still, given the declining interest rates and managed volatility, the Yuan retains its appeal as a suitable choice for funding carry trades.

The upcoming Jackson Hole conference will host Bank of Japan (BoJ) Governor Ueda, who might partake in the comprehensive panel discussion scheduled for Saturday. Governor Ueda's most recent public address was during the ECB's Sintra conference in June, prior to the Yield Curve Control (YCC) adjustment made at the July BoJ meeting. This prominent platform will provide his initial opportunity to delve into the YCC modification and its ramifications for Japan's interest rates and foreign exchange markets.

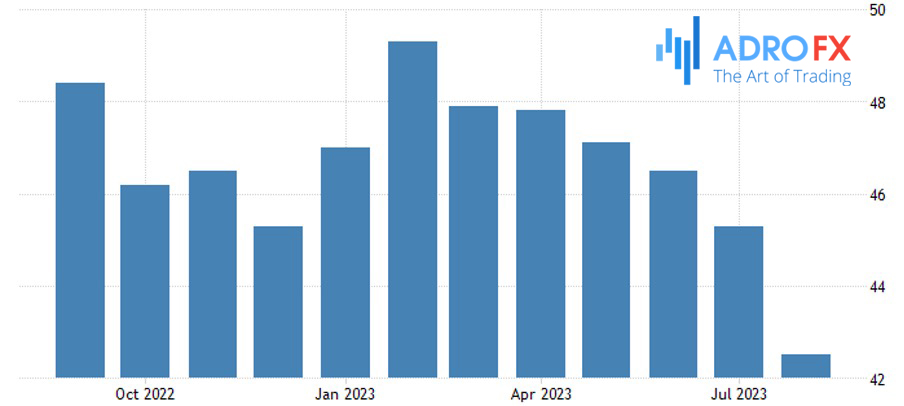

Apart from that, during the month of July, the UK's Purchasing Managers' Indices (PMIs) witnessed a more substantial decline than originally predicted. The services PMI, which measures the performance of the services sector, contracted from 51.5 to 48.7, plunging beneath the consensus projection of 51.0. Concurrently, the manufacturing PMI experienced a decline from 45.3 to 42.5, in contrast to the consensus forecast of 45.0.

This downturn marked a notable development: the services index dipped below the pivotal threshold of 50, indicating a contraction in this sector. Furthermore, the manufacturing PMI has regressed to levels reminiscent of those seen during the initial COVID-19 lockdown in May 2020.

Today gold prices ascended to a peak not seen in two weeks. This rise was catalyzed by underwhelming US business activity data, which in turn prompted speculation that the Federal Reserve could find itself constrained in its capacity to continue elevating interest rates.

Marking the fifth consecutive session of gains, gold prices further rebounded from their earlier dip in August, which had led to a five-month low. This recovery was reinforced by the retreat of the dollar and a pullback in Treasury yields from recent pinnacles. Notably, spot gold comfortably reclaimed its foothold above the significant threshold of $1,900 per ounce.

However, despite the positive trajectory, traders maintained a sense of caution due to the imminent commencement of the Jackson Hole Symposium later in the day. This symposium is anticipated to provide additional insights into the monetary policy stance of the United States, thereby holding the potential to influence market dynamics.