Tech Rebound Stalls as Alphabet Slumps | Daily Market Analysis

Key events:

- USA - Core PCE Price Index (MoM) (Jun)

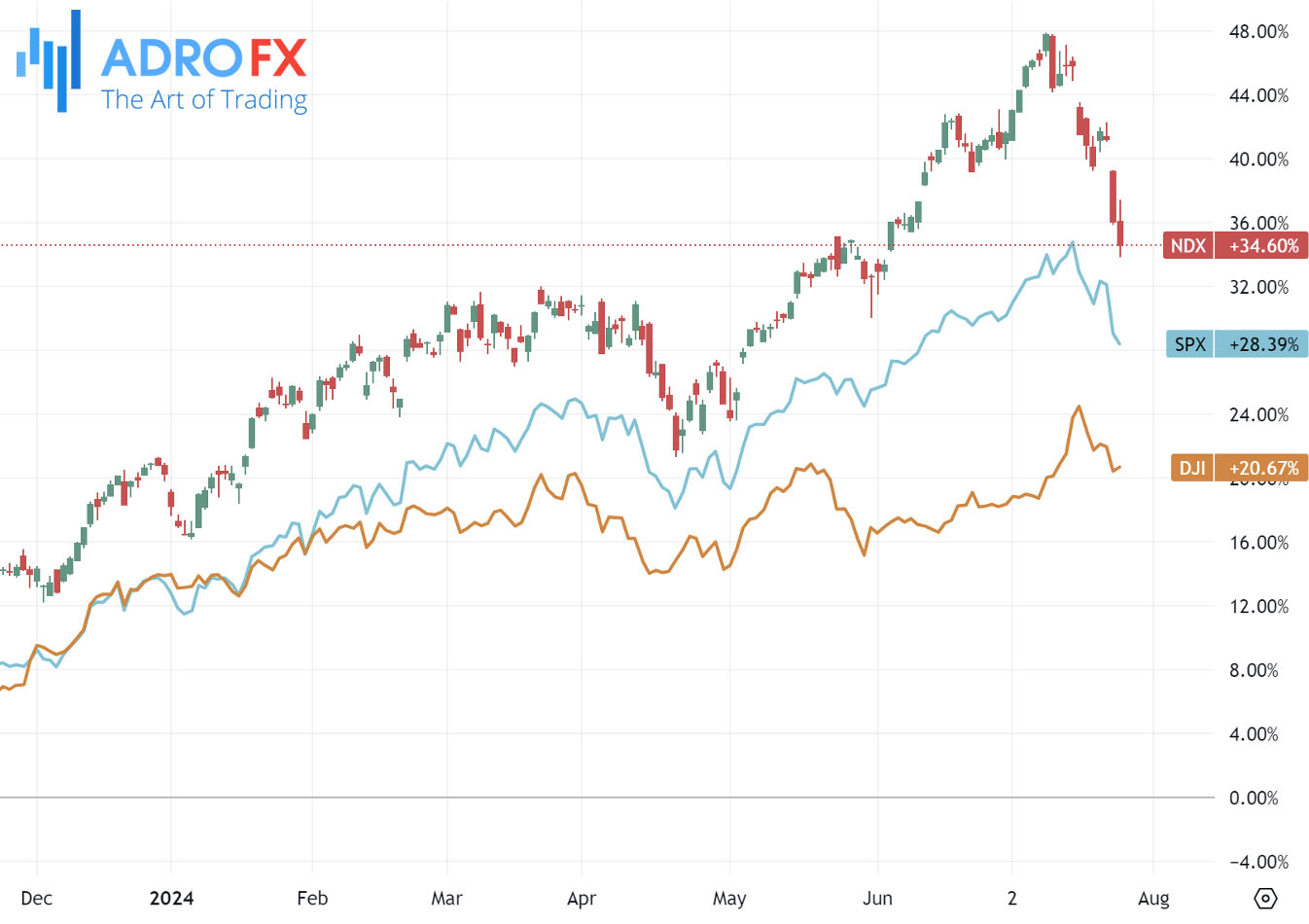

The S&P 500 closed lower on Thursday, giving up earlier gains as a slump in Alphabet led to a halt in the tech sector's rebound. This occurred despite growing optimism that the Federal Reserve might deliver multiple rate cuts this year.

The Dow Jones Industrial Average rose 81 points, or 0.20%, while the S&P 500 fell 0.5%, and the NASDAQ Composite slipped 0.9%.

Alphabet Inc. Class A (NASDAQ: GOOGL) fell over 3%, putting pressure on the tech rebound amid concerns about increased competition in its search business from OpenAI's Search GPT.

OpenAI announced Thursday that it is testing an AI-powered search engine, signaling a direct challenge to Alphabet's Google.

International Business Machines (NYSE: IBM) rose more than 4% after reporting growing demand for its AI offerings and raising its annual cash flow guidance. "Management highlighted that the GenAI book of business has grown to over $2B since Watsonx launched a year ago, ahead of expectations in our view," RBC noted in a recent report.

Gold prices experienced a positive shift during the Asian session on Friday, ending a two-day decline and rebounding from a two-week low reached the previous day. This recovery came in the wake of unexpectedly strong US macroeconomic data, including Thursday's Advance US Gross Domestic Product report, which showed a resilient economy. Additionally, details indicated that inflation slowed in the second quarter of 2024, bringing stability to financial markets and reducing reliance on safe-haven assets.

Gold remained resilient below its 50-day Simple Moving Average, supported by speculation that the Federal Reserve might start a rate-cutting cycle in September. This anticipation kept the US Dollar below the two-week high seen on Wednesday, attracting buyers to gold. However, gold's rise is limited as traders await the US Personal Consumption Expenditures Price Index release later on Friday for more insights into the Fed's policy decisions. This data will influence USD demand and provide new direction for gold.

The NZD/USD pair edged higher during the Asian session on Friday, breaking a six-day losing streak that had brought it to its lowest level since early May, around 0.5880. However, spot prices struggled to maintain strength above 0.5900 as traders awaited significant US inflation data before making directional bets. Positive sentiment in equity markets weakened the safe-haven US Dollar, benefiting the risk-sensitive New Zealand Dollar. Nonetheless, ongoing concerns about China's economic slowdown continued to challenge antipodean currencies, including the Kiwi. Additionally, expectations of an early interest rate cut by the Reserve Bank of New Zealand, following weaker CPI data from last week, limited gains for the NZD/USD pair.

The Australian Dollar ended its nine-day losing streak against the US Dollar on Friday, following the People's Bank of China's unexpected rate cuts. This move boosted the outlook for major metals consumers, leading to higher prices for commodities like coal and copper. As a significant exporter of energy and metals, Australia’s currency is highly responsive to changes in commodity prices. The Aussie Dollar also benefited from hawkish sentiment surrounding the Reserve Bank of Australia’s policy stance, with the RBA expected to delay easing its policy tightening due to ongoing inflationary pressures and a tight labor market.

The Japanese Yen gained ground after the release of the Tokyo Consumer Price Index data by the Statistics Bureau of Japan on Friday. The JPY was supported as traders potentially unwound carry trades ahead of the Bank of Japan's two-day policy meeting, concluding on Wednesday. During the meeting, the board will discuss the possibility of raising interest rates and provide details on reducing its extensive bond purchases. Japan's top currency diplomat, Masato Kanda, informed the G20 on Friday that foreign exchange volatility adversely impacts the Japanese economy. Kanda emphasized the necessity of closely monitoring the economy and taking appropriate measures, as reported by Reuters.

The GBP/USD pair saw an increase near 1.2860 amid a weaker Greenback, breaking a three-day losing streak during the Asian trading hours on Friday. However, the upside potential for the pair seemed limited as market participants anticipated the Bank of England would cut interest rates in August.

The BoE is expected to reduce the bank rate to 5% at its meeting next week, with inflation forecasted to remain close to the central bank's target, according to a majority of economists in a Reuters poll. Furthermore, UBS analysts projected that the BoE would implement the first 25 basis points (bps) cut in early August, followed by another 25 bps cut in November, bringing the interest rate to 4.75% by the end of 2024. UBS analysts cited recent economic data as the primary reason for this anticipated rate cut.