Support and Resistance Levels Explained

Support and resistance levels are the basic concepts of technical analysis. Strategies based on technical analysis are built on psychological and mathematical patterns of previous periods. One such pattern is resistance and support levels, which determine the marks of the most probable change in price direction or confirmation of trend continuation.

They can be used both by new traders and experienced investors.

In this article, we will learn what support and resistance lines are, how to draw them correctly, as well as how to apply this knowledge to real trading.

Basic Notions

Before you can start adding support and resistance levels to the chart, you need to understand what these tools are. They are essential indicators of a collision between upwardly oriented players, the bulls, and downwardly oriented players, the bears. Traders pushing prices up or down will sooner or later encounter a level where the other group is equally opposed.

Support is the level that "defends" the price, that is, prevents it from falling lower. Resistance is the line that keeps the price from going up, resisting its rise.

Determined by price fluctuations, a resistance line can turn into a support line and another way around.

Support is drawn on two or more lows and resistance on two or more highs.

Once the price touches a point of extremum on the chart, it is possible to start outlining the line, and the second extremum makes it possible to draw the support or resistance line completely. Extremes are rarely repeated, so if the difference between them is insignificant, the line is drawn roughly in the middle between them. In case the difference between marked extrema is big, the price scope between these points is marked for the line, and traders are directed by it when drawing lines.

It's more effortless to determine the resistance and support levels in a sideways trend (flat). With strong price changes, the possibility of incorrectly specifying support and resistance lines is very high.

Resistance and support can be strong and weak. The strength is defined by the time frame and the number of price touches of the line. The higher the time frame, the more touches, and the stronger the resistance or support line are. More significant than the number of touches is the length of the time frame.

Generally speaking, the support and resistance lines show the lines where the probability of price correction increases.

The Notion of a Trend

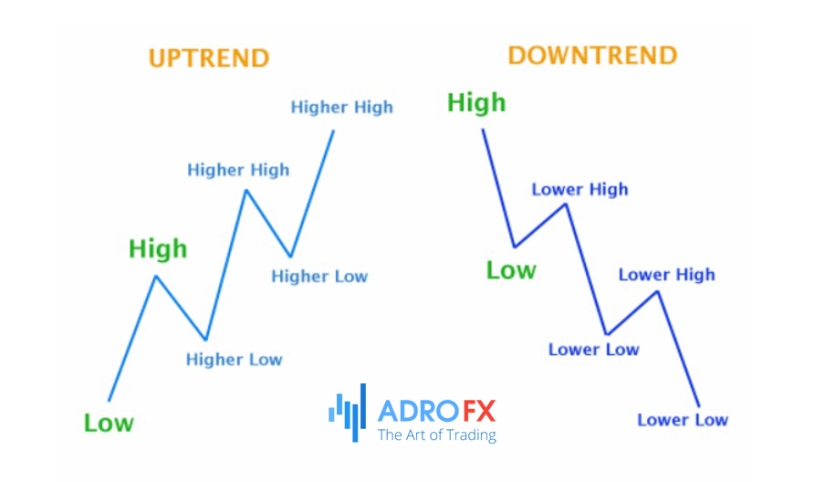

One of the indicators used to calculate support and resistance levels is trend strength. A trend is a price movement up or down over a long time period. The price of an asset can fluctuate, but if its minimums are consistently going up, the trend is upward, if the maximums are going lower, the trend is downward. On the stock market, a visually identifiable trend is used to assess long-term investments and the likelihood of success of short-term speculation.

How to trade using trend? The following algorithm is used for this purpose.

The trend line is determined by the price of the asset.

How the trend line behaves when it contacts the support and resistance lines is examined. If the uptrend line breaks out a strong resistance line at the second or third try, then there is a considerable probability of further price growth. Conversely, the price of an asset is more likely to move down if it breaks out a strong support level.

What Affects the Support and Resistance Levels

While drawing support and resistance lines, you should take into account psychological and fundamental factors. In the general case, the price can not rise or fall all the time. After breaking out the significant levels of support and resistance, the probability of a psychological phenomenon increases - traders' remorse, when many players reconsider the further tendency of asset price development. This occurs under the influence of the following factors:

fundamental – the indicators of the market or particular security do not provide a basis for further price movement;

psychological – as prices go up and down, people start questioning the validity of further moves;

profit fixing – achievement of certain price points gives players a reason to fix their profits by watching the further development of the situation.

If a large enough number of traders "repent" and close their positions, the price returns to the support or resistance level - and a trend reversal may take place.

Correct Support and Resistance Levels

Oddly enough, there is no generally accepted opinion about what support and resistance lines should be named correct, nor are there any clear, specific descriptions of the relationship between extremums and lines. Nevertheless, most traders believe that resistance and support levels are horizontal lines drawn at maximum and minimum price levels.

It is considered that on an uptrend, resistance lines are drawn on the maximums of impulse movements, and supports are formed on the minimums of corrective movements. The next low overlaps with the next maximum and, accordingly, turns the resistance level into a support level. On the downside, the high coincides with the previous low, and the support level turns into a resistance level.

Some traders are sure that support and resistance lines can be oblique, drawn through highs and lows, in fact, they are trend lines.

Also, support and resistance lines can be drawn through supply price pivot points, TD-points, which are extrema surrounded by lower extrema. The maximum point is the one, above which prices have not moved for a particular time, and the minimum point is the one below which prices have not been for a certain period.

Over time, each trader decides for themselves what is the best way to draw the support and resistance lines for their purposes. Some traders are limited to determining the lines that are close to circular values, that is, ending in zero.

The method of determining resistance and support levels based on the previously formed reversal levels is also used. It is believed that if the price bounced from a certain level, it will bounce from this level again. In this case, the trader must carefully analyze the dynamics of price and draw the lines manually.

Each method can determine the support and resistance levels correctly or it can lead to mistakes – it only depends on the trader's skills.

How to Draw Support and Resistance Levels

Let's consider the basic principles of drawing the support and resistance lines.

Finding at least two points of minimum (maximum) for the support (resistance) line. Very often these points are close to the significant round numbers of the traded asset. Such closeness can be explained by the work of the authors of trading algorithms and traders, for whom it is more convenient to be guided by visual values.

The drawing of lines directed into the future through these points. They may be of three types: horizontal, with a positive or negative slope. On one chart there may be several such lines.

Analysis of the significance of the obtained lines of support and resistance.

The most important is the third step. On it, the received charts are considered from the following positions.

Scale – the higher the time frame is, the more important the support/resistance line is: the hour line is more important than the minute line, but it has less value in comparison with the week line.

Length – the longer the resistance line and the support line on the chart, the more important it is for the trader as a signal of a trend reversal or trend development.

A number of touches. The credibility of the support and resistance lines increases as the number of lows and highs on which they are based increases.

Trading volume – if the areas of contact of asset prices with the support or resistance lines are accompanied by increased trading activity, it means that the lines are perceived as indicators by many traders.

Only after the analysis of the lines' significance concerning the above-mentioned points, you can begin using them in trading strategies.

How to Apply Support and Resistance Levels in Live Trading

There are quite a few methods of working with support and resistance lines. Even though there is a vast array of educational information available on the Internet, learning how to use support and resistance lines can only be achieved through practice.

First off, it is trading on a pullback and breakout. This method assumes that if the price meets strong support or resistance, it is likely to reverse. If the trend is strong, then the price can cross any level and develop further. This approach involves placing orders only in the direction of the current trend.

Trading on the levels of support and resistance can be carried out in a horizontal price channel. In this case, trades are opened when the price approaches the upper boundary of the channel, counting on resistance line crossing or rebound and fall of price. It is not the price points, but price support and resistance lines that are taken into consideration to a greater extent. Which trend will prevail must be defined by auxiliary tools on the chart - the behavior of bars, candlesticks, and so on.

Not all resistance and support levels are strong. The "strength" of a level refers to the accuracy of its signal: a breakout means the continuation of a strong trend, while a reversal means the beginning of a new movement in the opposite direction. False breakouts are not uncommon in the market. To avoid them, use the following recommendations.

Step 1: Watch the time frames

Look for extrema in daily and higher time frames. If they at least partially coincide with extrema in lower time frames, they can be considered strong. Market makers are often active in M5-M15 time frames. Based on the Depth of the Market and the logic of private traders, you can determine the approximate accumulation zone of stop orders. Market makers pull the price to the necessary zone with large volumes and trigger stops, obtaining an asset at the best price.

Step 2: Determine the number of touches

The more exact touches of the level, the better. Note that the level must be drawn on exact touches without "pulling wishful thinking".

An example of incorrect level drawing:

Here an attempt to build a resistance level was unsuccessful. The mistake is that there is no second extremum on the line of the first one on the chart. After touching the line, the price does not reach the resistance at first and then breaks it out with a strong upward candle. The second breakout kind of hints at the continuation of the uptrend - the price breaks out the level and moves away from it by an uptrend candlestick with a big body. But the breakout is false because there is no distinct resistance level on the chart, and the price can stop at any point of the offer.

Support and Resistance Levels in Forex Trading

In the forex market, strategies based on support and resistance lines may be considered basic. In particular, trading within the price corridor is applied in case of price bounces - buying on a bounce from the upper boundary and buying on the approach to the lower one. In this case, stop orders are set either above or below the boundaries.

Trading along the lines is useful in distinctly determined trends. For instance, if you are in a downtrend, you should monitor the upward correction to the previous support level and the new resistance level. If we talk about uptrend, the correction to the previous resistance and the new support should be monitored.

Still, breakout trading is one of the most popular strategies in the forex market. It requires defining support and resistance levels as precisely as possible. In this strategy pending orders are placed just above or just below resistance levels.

Support and Resistance Levels in Cryptocurrency Trading

Cryptocurrency trading using support and resistance lines is challenging during periods of increased volatility and rapid upward or downward trends.

There are two main strategies - level breakout and reversal from support and resistance levels.

The strategy of trading cryptocurrencies on breakout differs from other assets and is that there are too many false signals when trading cryptocurrencies. Consequently, when implementing this strategy, most trades will be unprofitable. With a distinctly defined trend, the percentage of profitable trades increases.

Cryptocurrency trading strategy on the reversal of support and resistance levels is effective during a flat market when the price of coins fluctuates insignificantly over a long period.

An example of a correct drawing of levels:

The scaled-down chart clearly shows an almost perfect flat channel that has support built on the 4th point with a slight edge at the 3rd low. Its breakout and then the transformation from support to resistance indicate the beginning of a downtrend.

Step 3: Look for confirmation from different sources

Combine several tools. For example, the coincidence of signals on horizontal levels and trend lines is a strong signal. Watch for the appearance of patterns. Open trades at the moment of exit from the flat range or at the moment of change of trend direction.

Summary

Support and resistance levels are essential when analyzing any chart, either currency pair or cryptocurrencies. The major problem in doing so is knowing how to identify levels and place lines correctly. This is a practical skill, as there is no unambiguous definition of how to determine the support and resistance lines accurately. The task of defining them can become easier due to the fact that there are numerous auxiliary tools on trading platforms to determine them. Many trading strategies are based on support and resistance lines, and their effectiveness, by the way, also depends on the trader's practical skills.

By understanding the principles of levels application, you can not only improve your trading system but also learn to understand the market better and assess its prospects.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.