Stocks, Fed Meeting, and Economic Data in Focus for the Week Ahead | Daily Market Analysis

Key events:

- Eurozone - ECB's De Guindos Speaks

- Eurozone - ECB's Enria Speaks

- Canada - BoC Gov Macklem Speaks

During Sunday's evening trading, US stock futures displayed gains after major benchmark indices concluded the week at multi-month lows. Investors are gearing up for a packed week featuring earnings reports and economic data.

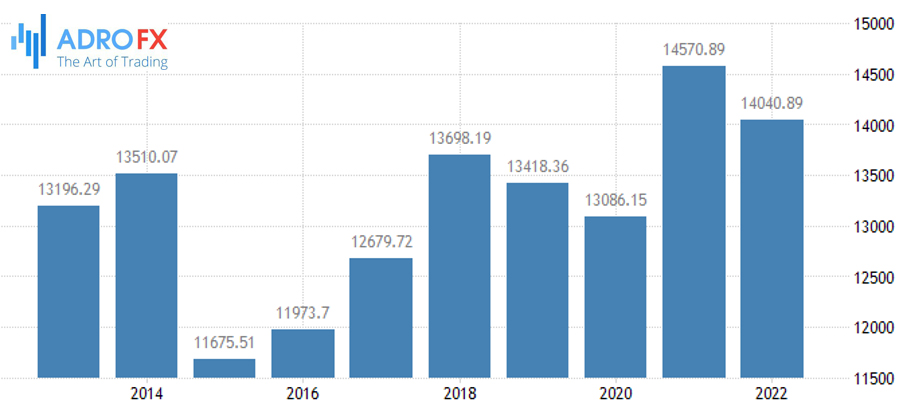

Basicallly, last week Dow Jones Industrial Average slipped by 366.7 points or 1.1% to reach 32,417.6, and the NASDAQ Composite saw an increase of 123.1 points or 1% to reach 12,718.7.

The upcoming week promises to be hectic for investors, encompassing a Federal Reserve meeting, the latest US jobs report, and earnings releases from tech heavyweight Apple. These events are expected to significantly influence the trajectory of both stocks and bonds for the rest of the year.

The Japanese yen exhibited a slight strengthening on Monday, dipping below the 150 threshold after reaching a one-year low last week.

All eyes were on the upcoming conclusion of a Bank of Japan (BOJ) meeting scheduled for Tuesday. The central bank is anticipated to potentially unveil further adjustments to its yield curve control policy as it grapples with the challenges posed by high inflation and a significantly weakened yen.

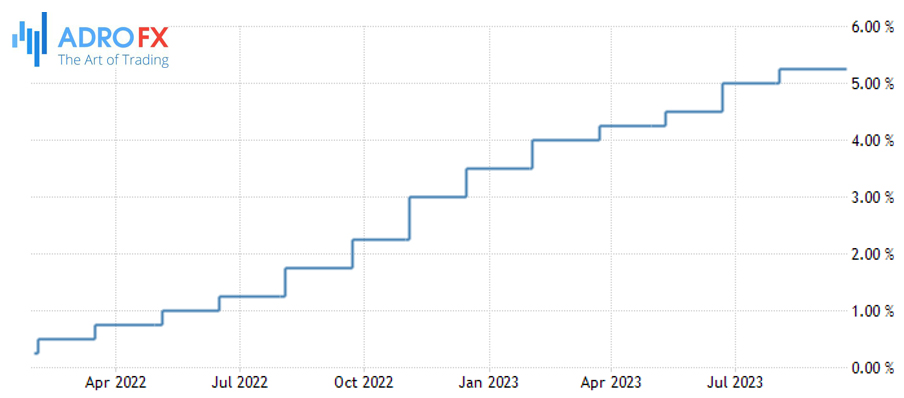

Investors will be closely monitoring the Federal Reserve's policy meeting on Wednesday, keen to grasp policymakers' perspectives on the state of the economy and their outlook for interest rates. The prevailing consensus suggests that the Fed has completed its tightening cycle, given Chair Jerome Powell's statement that rising long-term yields have reduced the need for further rate hikes. However, some still anticipate the possibility of another hike when the central bank convenes again in December.

Should the Fed indicate its intention to maintain rates at current levels through the next year, it could strengthen the case for further upside in Treasury yields. The recent surge in yields to levels not seen in over 15 years has contributed to a substantial S&P 500 selloff. The index has retreated over 10% since reaching a yearly high in late July, although it remains up by nearly 8% for the year.

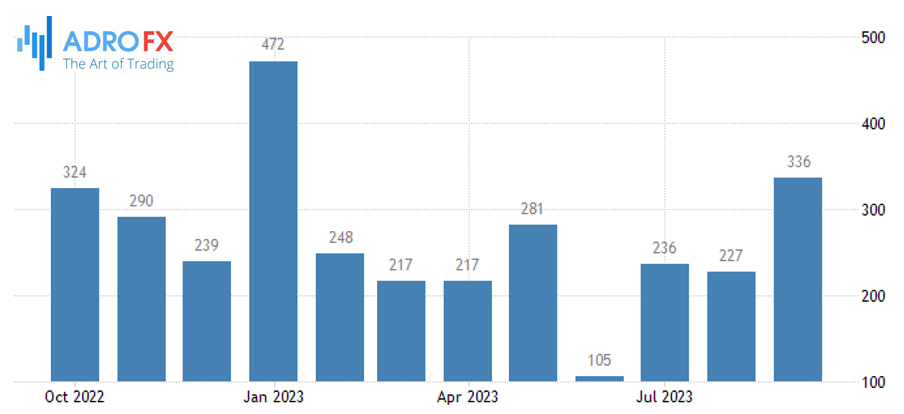

A pivotal piece of economic data this week is Friday's nonfarm payrolls report for October. Following September's impressive addition of 336,000 jobs, economists anticipate more moderate job growth at 182,000, which would still reflect a robust labor market. The unemployment rate is projected to remain at 3.8%, while wage growth is expected to ease to 4% year-on-year, marking a post-pandemic low. This development further bolsters the Fed's perspective that inflationary pressures are subsiding and that there is no need for additional interest rate hikes.

Leading the lineup of corporate earnings this week is Apple, set to report on Thursday. Apple, the largest company by market value, has been instrumental in propelling equity indices higher this year, alongside other megacap US tech and growth firms. The third-quarter earnings season has witnessed disappointments from some Big Tech giants, with shares of Alphabet and Tesla slumping following their respective reports. The tech-heavy Nasdaq 100 index is down 11% from its peak, but it still boasts a nearly 30% gain for the year.

Consumer spending trends will also be in focus, with notable companies reporting including McDonald's on Monday, Caterpillar and Pfizer on Tuesday, Mondelez on Wednesday, and Starbucks and Eli Lilly on Thursday.

The Bank of England is gearing up for its penultimate meeting of the year this Thursday. During this session, officials will deliberate on deciding whether to resume raising interest rates. In September, the Bank of England chose to keep rates on hold after embarking on 14 consecutive hikes. However, the upcoming meeting is expected to maintain the rate at its current level of 5.25%, marking a 15-year high.

Simultaneously, policymakers are likely to leave the possibility of further rate increases open, while emphasizing the need for rates to stay around current levels for an extended period. This stance remains unchanged despite increasing indications of economic stagnation. In August, the Bank of England's quarterly forecasts projected minimal economic growth of just 0.5% for 2023 and 2024. Governor Andrew Bailey has previously characterized the outlook as "very subdued."

After a series of record-setting rate hikes, the European Central Bank decided to keep interest rates unchanged during its recent session. As the ECB gears up for its final meeting of the year, it will closely watch upcoming data on inflation and gross domestic product due on Tuesday. Preliminary figures for consumer price inflation are expected to reveal a slowdown in the headline rate to 3.2% in October, edging closer to the ECB's 2% target.

Nevertheless, persistently high energy costs continue to pose an upside risk. Simultaneously, GDP data expected the same day is likely to indicate a 0.1% contraction in the Eurozone economy during the third quarter, translating to an annual growth rate of just 0.2%. During her recent remarks, ECB President Christine Lagarde hinted at a consistent policy stance moving forward and pushed back against expectations of rate cuts.