S&P 500 Rises on Tesla and Apple Surge, NZD/USD Retracement Amidst Fed Meeting Anticipation | Daily Market Analysis

Key events:

- Eurozone - CPI (YoY) (Apr)

- USA - Chicago PMI (Apr)

- USA - CB Consumer Confidence (Apr)

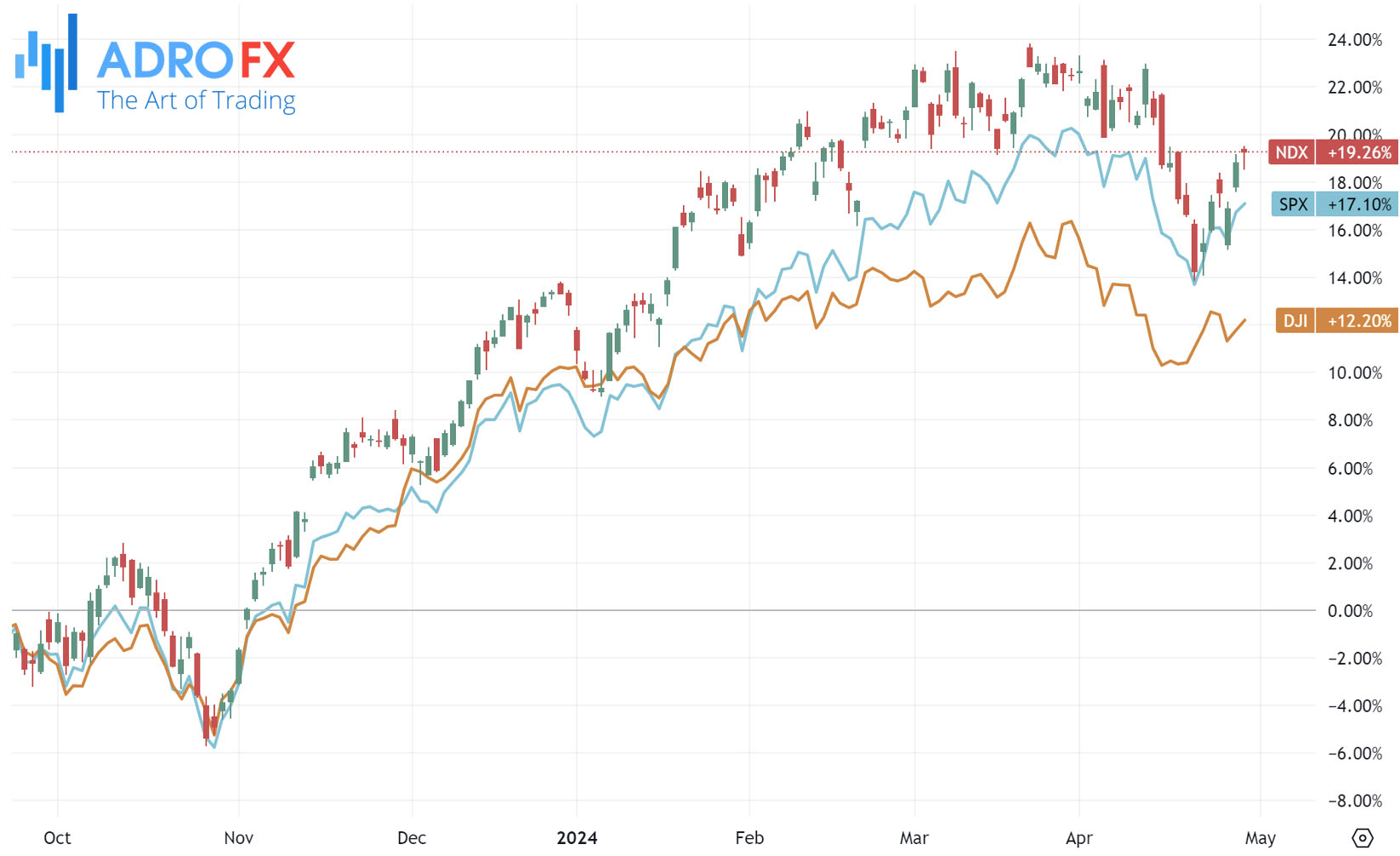

Monday saw a positive close for the S&P 500, buoyed by notable performances from Tesla and Apple as the quarterly earnings season continues its momentum, just on the eve of the impending Federal Reserve meeting.

The S&P 500 index edged up by 0.3%, accompanied by a 0.4% rise in the NASDAQ Composite, while the Dow Jones Industrial Average climbed by 0.4%, adding 146 points to its tally.

Tesla (NASDAQ: TSLA) witnessed a remarkable surge of 16% in its stock value following reports that the electric vehicle powerhouse received tentative approval from Beijing authorities to introduce its driver assistance software in China. This development leverages mapping and navigation technology from Chinese tech behemoth Baidu (NASDAQ: BIDU), as indicated by various media sources.

This breakthrough marks yet another milestone in Tesla's relentless pursuit to expand the adoption of its cutting-edge self-driving software. Analysts on Wall Street perceive this as a pivotal aspect of Tesla's growth trajectory.

During the Asian session on Tuesday, the NZD/USD pair experienced a retracement of its recent gains, hovering around the 0.5950 level. This pullback can be attributed to the resurgence of the US Dollar, which dampened the strength of the NZD/USD pair. The USD's resurgence followed hawkish remarks from US Federal Reserve officials, signaling a lack of immediate necessity for rate cuts.

Meanwhile, the ANZ Business Confidence for April showed a decline to 14.9 from the previous month's reading of 22.9, marking the third consecutive month of decrease and hitting its lowest point since September last year. This data indicates a significant weakening of the economy, likely influenced by the Reserve Bank of New Zealand's decision to raise interest rates.

Furthermore, the easing tensions between Israel and Iran and the optimism surrounding peace talks between Israel and Hamas in Cairo have boosted investor confidence in riskier currencies like the New Zealand Dollar. This optimistic sentiment may help limit the NZD/USD pair's losses.

In the Asian session on Tuesday, the Japanese Yen continued to weaken against the US Dollar, further retreating from its one-week low reached the previous day around the mid-154.00s. Despite potential intervention by Japanese authorities on Monday, the cautious stance of the Bank of Japan towards further policy tightening remains a key factor in undermining the JPY.

Additionally, cooling inflation in Tokyo and easing concerns about geopolitical tensions in the Middle East are exerting downward pressure on the safe-haven JPY.

The Australian Dollar extended its corrective decline following the release of lower-than-expected domestic Retail Sales data on Tuesday. Retail Sales, being a leading indicator directly linked to inflation and growth prospects, could influence the Reserve Bank of Australia's stance on interest rates.

However, the Australian Dollar may find support from higher-than-anticipated domestic inflation data released last week, raising expectations of a delay in interest rate cuts by the RBA. Moreover, Commonwealth Bank, Australia's largest mortgage lender, has revised its forecast for the timing of the first interest rate cut by the RBA, now projecting only one cut in November, according to reports from the Financial Review.

The Federal Reserve is gearing up for its two-day meeting commencing on Tuesday, with expectations leaning towards an unchanged decision on interest rates. Attention is keenly focused on Federal Reserve Chairman Jerome Powell's statements. Additionally, there's growing speculation that any rate cuts may not materialize until September or even the fourth quarter, given the persistently high inflation rates and the resilience exhibited by US consumer spending.