Should We Expect More Surprises From Economic Data? | Daily Market Analysis

Key events:

- Eurozone – CPI (YoY) (Feb)

- Eurozone – ECB Publishes Account of Monetary Policy Meeting

- USA – Initial Jobless Claims

The economic data that came out in recent days gave us some nice surprises and investors are now trying to figure out what that means in terms of Fed policy. Quotes are pricing in an eventual rate hike above 5% in the U.S. and around 4% in Europe, with traders in the debt markets no longer expecting a rate cut in 2023.

So have we avoided a recession, and how will the global economy cope with high interest rates? The answers to these questions are crucial to your portfolio in 2023.

The macroeconomic data released recently surprised us nicely, with improved Retail Sales, Housing Market Statistics, and PMI indices.

And here's why.

Financial conditions in the U.S. softened significantly between November and early February. Easing financial conditions are usually associated with improvements in macroeconomic data with a delay of 1-2 months.

The chart above provides evidence of this: the NAHB housing market index (blue curve, right) responded to softening financial conditions (orange curve, left) with a slight time lag, just as it did in 2021 and 2022.

Easing financial conditions resulted in lower interest rates and improved credit availability, which helped homebuyers and led to improved sentiment in the housing market.

Companies and consumers have been helped by the easing of financial conditions through increased availability of debt, rising stock prices, and a weaker dollar, resulting in improved PMIs.

Should we expect more pleasant surprises in economic data?

When it comes to indicators like the PMI, the time lag is quite small, while other indicators like the labor market and industrial production tend to react later, so we may still get positive news in March...But there is one "but".

Financial conditions have tightened sharply again in the past two weeks. And March's releases cover February's data, and the support for January's seasonal factors may disappear.

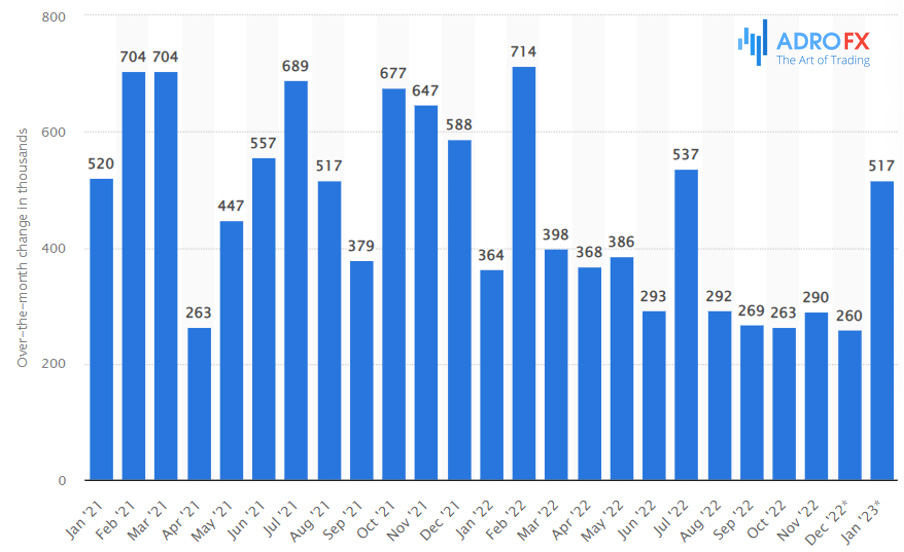

For example, the Non-Farm Payrolls data were supported by a much smaller than usual number of layoffs after the holidays. Because of the disappearance of this seasonal factor in February's data, which will be released on March 10, we may be left without a pleasant surprise.

Investor uncertainty is now evident. While in December they were laying in quotations a 40-50% probability of recession in the near future, at the beginning of February they were no longer expecting the Fed's rate cuts in 2023.

What about the market?

At the end of yesterday's trading session:

- The S&P 500 Index was down 0.3%,

- Dow Jones Industrial Average down 0.71%.

- Crude Oil futures Apr 23 (CL=F) fell 0.49%,

- The dollar index rose 0.39%.