Russian Invasion of Ukraine | What Investors Should Know

On February 24, at five o'clock in the morning, like Nazi Germany, the army of the Russian Federation invaded the sovereign and the independent state of Ukraine. The open confrontation against Ukraine's statehood was called a "special military operation" by Russian President Putin, which triggered a mixed reaction from financial markets, including the currency, stock, and cryptocurrency ones. First of all, the reaction took place in the safe-haven assets (gold, Swiss franc, and US dollar), which showed considerable gains. In this article, we will provide valuable insight into the conflict between Russia and Ukraine, see what was the reaction of the markets and learn how investors should act in this situation.

Long Story Short: What Russia Demands, and Where it All Goes

After 14 days of full-scale war unleashed by Russia against Ukraine, it is already possible to draw sufficiently objective conclusions about its root causes, actions of the parties, and the nearest consequences.

It should be mentioned that even the participants in the talks, the third stage of which began two hours ago in Belarus, hardly have exhaustive information about the real state of affairs.

So, why did the war begin?

There are many reasons, but the main one is purely subjective and therefore difficult to justify logically. It cannot be explained by anything other than Vladimir Putin's personal motives.

His motives are far beyond political and economic relevance and boil down to abstract "gathering of lands"/a special path/personal messianism/ implantation of Soviet, and therefore "correct", values.

The purpose of the Russian Federation at the moment is to legitimize war crimes, starting with the annexation of Crimea, and in parallel to present the outcome of the Ukrainian campaign as a "victory" to its internal consumer, the Russian population.

What is happening now in Ukraine is nothing but a crisis for Russian tacticians, who have already discredited themselves.

The plan of the Kremlin "elites" is striking in its artlessness, straightforwardness, and absurdity. The displacement of the current Ukrainian government in favor of political refugees or simply fringe politicians like Oleg Tsaryov is obviously unfeasible because they are not accepted in Ukraine. All other things being equal, this should have been shown by sociology, which should have been done on the eve of the military campaign. But now it is obvious that either no one did the measurements of public opinion, or the necessary results were drawn to please the first person.

All should be wondering if there is a Plan B?

No, but the situation is heating up. While Putin was assiduously nurturing his blitzkrieg plan, which turned out not to be fully verified, and the Soviet Union, new but according to old values, in his dreams was only "two days away" from the capture of Kyiv, the absence of "plan B" brought the Kremlin to a deadlock. There was an urgent need for another dose of propaganda to its people, who in 12 days had become exactly twice as impoverished because the ruble had already stepped into another historical record.

What does this have to do with Yanukovych? Ukraine can be a real symbol of the Soviet Union, you just have to make a real mausoleum out of it, and try to sell it to the West.

Viktor Yanukovych's "second coming" is being discussed in all seriousness, which once again demonstrates the utmost disconnection of the Russian side from Ukrainian reality and the ultimate loss of foreign policy reference points. They are trying to put Yanukovych back on the agenda as the "legitimate" and the only Ukrainian president. At first, it seemed like nothing more than a joke to everyone. But after Yanukovych's flights were discovered in the airspace of Belarus, and Kremlin spokesmen - from Ramzan Kadyrov to Ilya Kiva - began to copy-paste texts about the lack of any alternative to such an outcome, it became clear that this was Plan B.

This plan is even less tenable and feasible than a two-day blitzkrieg. The Ukrainians of Kherson, Melitopol, and other cities and towns have already proved in practice that even if you occupy their land, you will not conquer their people. The fate of the forcibly imposed ruler is predetermined.

But what is the position of the West?

Once again, it is impossible not to note the ambiguity of U.S. statements. The further the war in Ukraine develops, the longer it lasts, and the more civilians suffer in this war, the stranger some of the White House's statements become. Thus, against the background of rumors about Yanukovych, the White House, apparently completely underestimating the level of support and faith in the current president of Ukraine Volodymyr Zelensky, suddenly began to speculate about what would happen in the case of his physical elimination. Against the backdrop of Russian propaganda and the flight of a Russian government flight to the United States, according to the official version, behind the expelled diplomats, rumors of a possible attempt to negotiate between the terrorist country and the United States are growing. These rumors are fueled by continued U.S. and NATO silence on requests to close the skies and at least issue air defenses and aircraft. What is the likely outcome of the campaign? The Kremlin has already lost.

Let us now move to the market's reaction to the events in Ukraine so we can understand how investors should behave in order to minimize potential losses.

Markets` Response to the Events in Ukraine

Amid the threat of a Russian invasion, leading global stock indices lost value over the first three days of last week and continued until the outbreak of war and the introduction of the first package of sanctions by the West.

For most investors, the sanctions seemed too mild, and in addition, after the worst expectations were realized, some market participants decided that the quotes reached attractive enough levels for buying. The prospect of the negotiation process between Ukraine and Russia encouraged the markets, pushing them even higher on Friday.

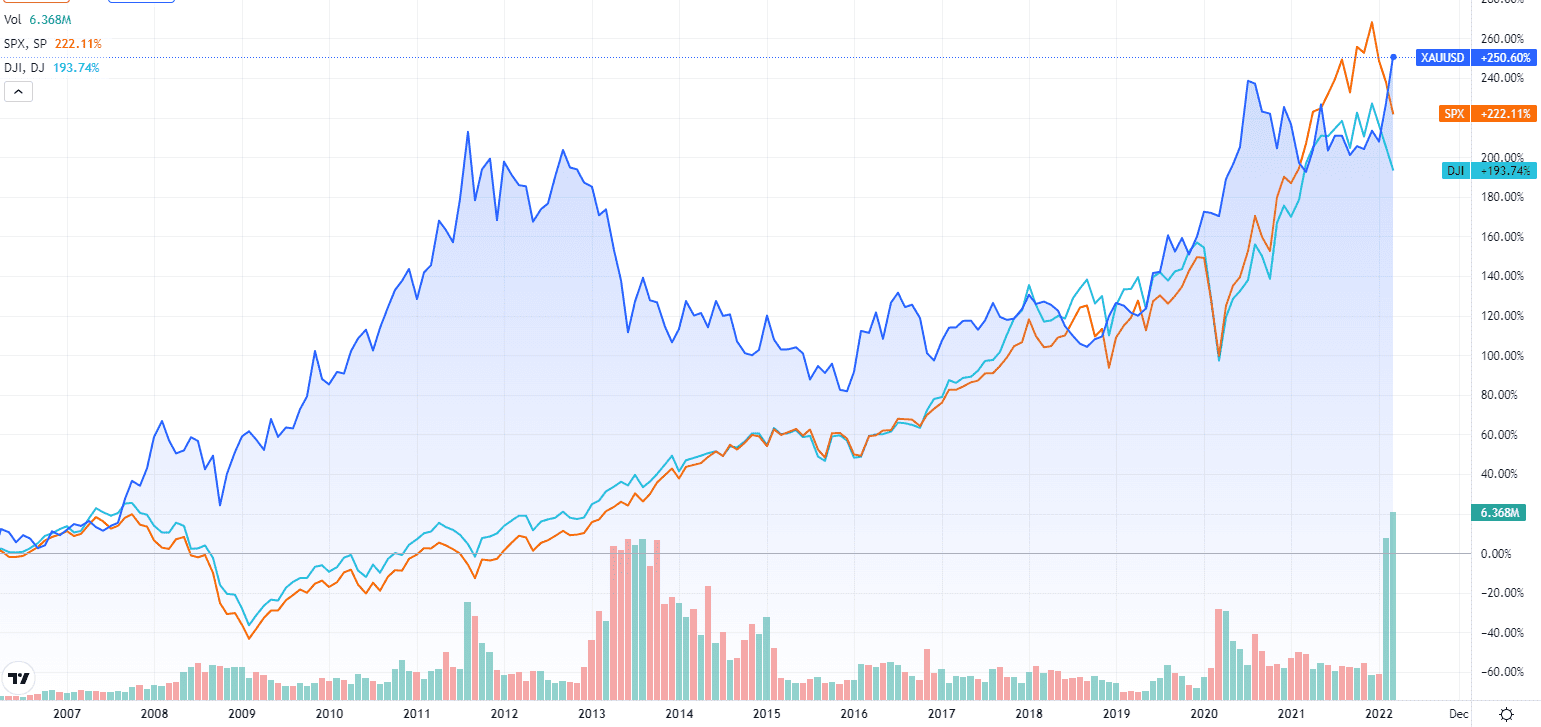

The world's leading stock indices ended the week with mixed dynamics. The U.S. S&P 500 and Nasdaq Composite rose 0.8% and 1.1%, respectively. At the same time, the European Euro Stoxx index fell 1.6% and the global FTSE All-World fell 0.7%. The DXY U.S. Dollar Index and the U.S. Ten-Year Treasury Bond Index were still up slightly, to 96.6% and 1.96%, respectively. The EMBIV Emerging Market Eurobond Index fell 2.1% to 100.7. The Russian RTS Index fell 32.7% over the week.

Commodities reacted to the war with near-unanimous gains except for lead (0%), copper (-1%), and iron ore (-1%). Once again, natural gas (+18%) and thermal coal (+9%) showed the biggest gains.

Analysts note that markets are now faced with great uncertainty about further developments. Attempts by market players to place in assets with the expectation of further recovery in their value may be extremely premature. Over the weekend, Western countries finally decided to apply tougher sanctions against Russia, including disconnection from the payment information system SWIFT, which could cause serious losses not only to Russia but also to the global economy. However, the possible limited application of SWIFT disconnection only to some Russian banks would significantly limit the effectiveness of these measures.

As of today, commodity markets continue to rally due to geopolitical events. Investors' attention is focused on whether Western countries will reduce energy imports from Russia. On the one hand, this idea is quite popular in the USA. On the other hand, many European allies of the United States are much less willing to take drastic measures due to their markets' greater dependence on Russian energy sources. Reuters reports that the U.S. is ready to go it alone if necessary, regardless of what European leaders decide.

Exxon Mobil and Chevron executives said Monday they were ramping up crude production as U.S. gasoline prices rose to $4 a gallon amid expectations that President Joe Biden and Congress would ban Russian oil imports, but the companies warned not to expect new supplies overnight. That fuel price is putting pressure on broad market stocks. Bloomberg reports that U.S. airlines, whose fuel costs account for a significant share of direct costs, are unlikely to raise fares enough to fully offset jet fuel costs, which are at their highest level in more than a decade.

Possible Consequences of Russia`s Invasion

By market close on February 24, U.S. stock markets had soared in the hope that the crisis would slow the willingness of the Fed and other central banks to raise rates. But the war in Ukraine is not just another economically and financially insignificant conflict... Today's crisis designates a geopolitical quantum leap. Its long-term importance is hard to overstate.

A global stagflationary crisis is now very likely. Analysts are already wondering if the Fed and other major central banks can get a soft landing... Don't count on it. War will cause a tremendous unfavorable supply shock to the global economy... The shock will decrease growth and further boost inflation at a time when inflation anticipations are already becoming unmanageable.

The short-term impact of the war on the financial market is already clear. In the face of a massive stagflationary shock, global stocks are likely to move from their current correction range (-10%) into bear market territory (-20% or more). Yields on safe-haven government bonds will fall for a while and then rise... Oil and gas prices will rise further, well above $100/bbl, as will prices for many other commodities since Russia and Ukraine are major exporters of raw materials and food. Safe-haven currencies, such as CHF, will skyrocket, and gold prices will continue to grow.

The economic and financial consequences of the war, and the resulting stagflationary shock, will of course be greatest in Russia and Ukraine, and then in the EU because of its heavy dependence on Russian gas. But even the U.S. will suffer. A jump in the world price of Brent crude oil would have a big impact on U.S. crude oil prices (WTI). Yes, the U.S. is now a minor net energy exporter, but the macro distribution of the shock will be negative... A small cohort of energy companies will see higher returns, and households and businesses will undergo a huge price shock.

Given these dynamics, even the strong U.S. economy will suffer a sharp slowdown, leaning toward recession. Tightening financial conditions and the resulting impact on business, consumer, and investor confidence will worsen negative macroeconomic effects around the world.

It is tempting to think that the Russia-Ukraine conflict will have only minor and temporary consequences. After all, Russia is only 3% of the world economy (Ukraine is even less). But the Arab states, which imposed an oil embargo in 1973, and revolutionary Iran in 1979, had an even smaller share of world GDP. ...The consequences of the Ukrainian crisis - and the broader geopolitical depression it portends - will be anything but temporary.

What Can We Learn from the World History

The history of the second half of the 20th century confirms that military and geopolitical events caused a serious correction in the U.S. market only if they led to a recession.

● Even "the biggest geopolitical catastrophe of the century" - the collapse of the Soviet Union - is no exception. On "Red Monday" of the August 1991 putsch, American stock indices fell by 4% but quickly recouped their losses on Mikhail Gorbachev's return to power - which was short-lived, as it turned out. The ensuing dissolution of the Union was not noticed by the world markets.

● Nor did the U.S. market notice the Soviet invasion of Afghanistan in late December 1979, and the S&P 500 rose 5.6% the following month. Exactly three months later, though, the index fell by nearly 8%, but it had nothing to do with the USSR: "Silver Thursday" - the textbook disaster of the Hunt brothers' attempt to take over the global silver market - occurred in the United States.

● In the month after the most serious escalation of the Cold War between the USSR and the United States - the 1962 Cuban Missile Crisis - the S&P 500 rose 8.7%. The reason is that the conflict over the Soviet missiles placed on the "unsinkable aircraft carrier" in Cuba, which threatened a nuclear war of the superpowers, was then resolved surprisingly quickly. Western historiography tends to regard it as a net victory for the United States and a humiliation for the USSR. Modern revisions pay more attention to Nikita Khrushchev's bargaining with John F. Kennedy and the secret agreement to withdraw American missiles from Turkey and Italy - as well as to the fact that the US grossly underestimated the seriousness of the US threat perception by the USSR leadership.

● One month after the U.S. entry into World War II as a result of the Japanese attack on Pearl Harbor in 1941, the index dropped 3.4 percent, but a year later still came out in the positive. This is more of a reminder that back then the global economy was just beginning to take shape, and a single country could still afford to sit on the doping of government orders, curb unemployment, and put an end to the Great Depression at the same time. In the second half of the 20th century, the U.S. market did not recover in one year only after two big shocks, the Suez Crisis of 1956 and the oil embargo of 1973.

● The Suez crisis over control of the Suez Canal ended Britain and France's status as world powers, triggered the first financial crisis of the modern type, and formalized the transition to a bipolar world. But the U.S. economy even then was more affected by the "Eisenhower recession" than by any external factors.

● The only geopolitical crisis that truly brought down the world's largest economy was also not directly related to the USSR. After the Organization of Arab Petroleum Exporting Countries cut off exports to countries that supported Israel in the Doomsday War in October 1973, oil quadrupled in price in six months, US GDP fell 2.5%, and the economy plunged into a prolonged recession and then stagflation. A year after the embargo, companies in the S&P 500 Index lost more than a third of their capitalization, and the index recovered only more than three years later.

What Investors Should Do

First, it is short-sighted to get rid of all stocks when there is a high probability that the current crisis will be resolved by something other than war, harsh sanctions, and multilateral economic losses. Especially when you remember that the likelihood of a rise is always higher after a sell-off. This is also demonstrated by the simplest analysis of the behavior of the S&P 500 one year and five years after the 10 worst daily declines: in almost all cases, the investor would remain in the black.

Second, investing only in stocks is strange, too, given that the likelihood of a high-risk scenario remains. The legendary Benjamin Graham advised increasing equity stakes to 75% of your portfolio in times of overall rising pessimism, and when markets are too optimistic, to reduce them to a maximum of 25%.

Third, the dollar is not a panacea, but an option. The currency market is now in the middle of a "dollar smile," reflecting the widespread observation that the dollar appreciates against other currencies from both deep crises and booming growth in the U.S. economy. In this sense, a bad compromise on Ukraine would be worse than a bad outcome.

Fourth, consumer expectations (now the worst in a decade, as the latest University of Michigan poll showed) are themselves a factor in market dynamics. And they do not coincide, but follow geopolitical crises, as they did during the American hostage crisis in 1980 and after the Iraqi attack on Kuwait ten years later.

All things considered, holding more cash now is a sensible option: it's a rare asset class for which high rates are directly advantageous, and in a situation of extreme uncertainty, when you have to seize the moment, they will give you more room to maneuver. This is confirmed by BofA data: the share of cash in managers' portfolios increased from 5% to the maximum of 5.3% since May 2020.

Investing in Gold

No doubt that the easiest way to invest in gold is to buy bars and coins offered by dealers around the world. In this case, the value of the invested capital correlates 100% with the prices. Analogs can be derivative products, which carry their risks. Here are a few examples:

● Exchange-traded funds and bonds whose basis is gold. The SPDR Gold Shares ETF is the most liquid exchange-traded fund in the gold market. The iShares Gold Trust and GraniteShares Gold Trust ETN also allow you to invest in gold because these products include contracts for the metal.

● Shares of mining companies tend to rise faster than gold prices in bullish markets, but they sell off more aggressively in bearish markets. At the same time, these companies are dependent on the debt they invest in mines and also suffer from non-systemic risks inherent in individual management decisions and specific projects. Geopolitical tensions have peaked for decades, and there is a non-zero likelihood that mining companies will be nationalized. While China is a major supplier of gold, North America has its own leaders in Newmont Goldcorp and Barrick Gold.

● The VanEck Gold Miners ETF and VanEck Vectors Junior Gold Miners ETF portfolios include stocks of leading gold mining companies. While these funds diversify the risk of owning individual mining companies' securities, their purchase is an investment in gold mining, not in gold itself.

● Trading Gold with CFD

CFD - Contract for Difference. It is an agreement between two parties to the transaction for the payment of the difference between the quotes valid at the beginning and the end of the contract. Technically it happens in the following way: a trader from any place of the world opens an account at the broker, gets verified, and after depositing his account opens a position for buying or selling. The broker receives the commission. The CFDs are linked to the XAU quotes. As with certificates, the trader is not entitled to receive the physical metal.

Advantages of CFD trading:

1. Small entry threshold. For example, the XAU/USD AdroFx contract specifies the minimum position volume of 0.01 lots and a margin percentage of 1% corresponding to leverage of 1:100. The lot size is 100 units.

If the XAU/USD price is $2050, for the purchase of the minimum volume of 0.01 lots 2050*100*0.01*0.01 = 20.50 USD.

2. Minimal commissions. There are no exchange fees, only spread, swap, and small fixed commission for each lot executed in the ECN-account.

3. Ability to open short positions. With the AdroFx broker on CFD XAU, you can capitalize on investments, not only on the price rise but also on its decline. While geopolitical and economic risks fuel gold prices, the U.S. central bank contributes to pricing. The U.S. central bank's focus on tightening monetary policy will result in higher interest rates and the higher opportunity cost of holding the metal. Gold competes for investment capital with other assets.

While gold is an industrial commodity, it is market sentiment and investment demand that drives price movements. Rising U.S. interest rates should support the dollar, which usually plays against gold. However, the current geopolitical environment is far from normal, and gold is likely to make new record highs. The market will likely consolidate around $1,900 for some time. However, the sideways trend will pave the way for a breakout of the August 2020 highs of $2063 and a move to new highs as inflation continues to increase (as does the sanctions pressure on Russia).

While gold is an industrial commodity, it is market sentiment and investment demand that drives price movements. Rising U.S. interest rates should support the dollar, which usually plays against gold. However, the current geopolitical environment is far from normal, and gold is likely to make new record highs. The market will likely consolidate around $1,900 for some time. However, the sideways trend will pave the way for a breakout of the August 2020 highs of $2063 and a move to new highs as inflation continues to increase (as does the sanctions pressure on Russia).

Risk-Off Currencies

As we know, during periods of heightened geopolitical risks, some currencies are at risk of sizable losses as the markets tend to reverse risk-on trades that are in search of yield.

Commodity currencies are usually the first to feel the pinch during periods of increasing geopolitical risk. The Aussie Dollar, the Canadian Dollar, and the Kiwi Dollar fall into this category. The respective economies are highly dependent on favorable trade terms to support positive sentiment towards higher interest rates, causing yield differentials. Risk-off periods see investors move capital into the safety of the Swiss, the Yen, the USD, and even the EUR.

While a prolonged crisis ultimately weighs on demand, it’s also worth assessing the influence of a regional conflict that can impact the supply of raw materials to economies that are sheltered from such crises. For the Canadian Dollar, while geopolitical risk-driven trades would be considered a negative for a commodity currency, crude oil supply disruption due to a conflict in the Middle East, for instance, could be considered a positive.

Conclusion

All in all, we urge you to stay calm today, no matter what. Avoid emotional action - it will not help, and the situation can change very quickly.

Don't forget that the market often reacts in advance. As soon as there are signs that the hot phase is over, the recovery process may begin. At least a partial recovery. It may not happen immediately, but by not taking rash emotional actions today, you can protect yourself from future losses. Yes, it is possible to win, but the risks are too high today.

The "perfect storm" in the markets may come and go for a few days. However, in the context of the world markets, we can remember that sometimes stocks behave illogically. Today we will see sharp declines in the world stock markets. Nevertheless, maybe after some very short time, we will see a nice bounce of the markets. No need to bet too aggressively on further declines. We will look for moments to close positions in safe-haven assets. We stay with you and share our thoughts, ideas, and conclusions. Take care of yourself and your loved ones!