The Role of Supply and Demand in Commodity Trading

Commodity trading is a critical component of the global economy, involving the buying and selling of raw materials such as agricultural products, energy resources, and metals. These commodities are essential to numerous industries and play a significant role in the economic stability of countries around the world.

At the heart of commodity trading lies the fundamental economic principle of supply and demand. The balance - or imbalance - between supply and demand determines the price and availability of commodities, influencing market dynamics and trader decisions. Understanding how these forces interact is crucial for anyone involved in commodity trading, from individual traders to large corporations.

This article aims to provide a comprehensive overview of the role of supply and demand in commodity trading. We will explore the basic principles, delve into the factors that affect supply and demand, and examine how these elements interact to shape commodity markets.

Supply and Demand Basics

Supply and demand are the cornerstone concepts of economics, influencing the price and quantity of goods in a market. In commodity trading, these principles are especially pertinent due to the finite nature of most commodities and the variability in their production and consumption.

- Supply Definition and Influences

Supply refers to the total amount of a commodity that is available for sale in the market at a given price. Several factors influence supply, including production levels, technological advancements, government policies, and external events such as weather conditions or natural disasters.

- Demand Definition and Influences

Demand represents the quantity of a commodity that consumers are willing and able to purchase at various price levels. Demand is shaped by economic conditions, population growth, consumer preferences, and the availability of substitutes or complementary goods.

Factors Affecting Supply and Demand

The supply of a commodity is directly influenced by its production levels. For agricultural commodities, these levels can vary based on decisions related to planting, the yields of harvests, and various farming practices. Additionally, weather conditions and natural disasters play a crucial role in shaping supply.

- Production Levels

For example, droughts can lead to reduced crop yields, while hurricanes have the potential to disrupt oil production.

- Technological Advancements

Improved technologies can enhance the efficiency of production processes, leading to increased supply levels. For instance, new drilling techniques have the potential to increase oil extraction rates.

- Government Policies and Regulations

Government interventions such as subsidies, tariffs, and environmental regulations can alter supply dynamics. Policies promoting renewable energy, for example, may reduce the supply of fossil fuels.

- Economic Health

The demand for commodities is influenced by various factors, starting with the overall health of the economy. During economic booms, consumer spending and industrial demand for raw materials typically rise, while recessions usually lead to a decrease in demand.

- Population Growth and Consumer Preferences

Population growth also plays a critical role in shaping demand. As the global population increases, so does the need for commodities like food, energy, and metals, especially in emerging markets with growing middle classes.

- Availability of Substitutes and Complementary Goods

Changes in consumer preferences can also alter demand patterns significantly. A growing preference for electric vehicles, for example, increases the demand for lithium and cobalt, which are essential for batteries. Furthermore, the availability of substitutes can reduce the demand for a specific commodity, while complementary goods can enhance it.

The Interaction of Supply and Demand

The interaction of supply and demand plays a pivotal role in determining the equilibrium price and quantity in commodity markets. At the equilibrium point, the quantity of a commodity that producers are willing to supply equals the quantity that consumers are willing to purchase, resulting in a stable market price. However, this balance is dynamic and can shift due to various factors, leading to changes in both supply and demand curves.

- Shifts in Supply and Demand Curves

Shifts in supply and demand curves are caused by a multitude of factors. On the supply side, changes can stem from variations in production costs, technological advancements, and external events such as natural disasters or government policies.

- Impact on Market Equilibrium

These shifts impact market equilibrium by altering the equilibrium price and quantity. For example, a technological breakthrough in oil extraction could increase supply, shifting the supply curve to the right. Conversely, a new environmental regulation could decrease supply, shifting the supply curve to the left.

- Price Elasticity

The price elasticity of supply and demand is another crucial concept in understanding market dynamics. Price elasticity measures how responsive the quantity supplied or demanded is to changes in price. Commodities like luxury goods often exhibit high elasticity, while necessities such as basic food items tend to have low elasticity.

Market Responses to Supply and Demand Changes

Market responses to supply and demand changes can vary significantly between the short term and the long term. In the short term, supply and demand are often inelastic because it takes time for producers and consumers to adjust to new conditions.

Short-term Responses

If there is a sudden increase in demand for oil due to an economic boom, oil producers may not be able to ramp up production immediately, leading to a sharp rise in prices. Conversely, a sudden drop in demand might not immediately decrease supply, causing prices to fall rapidly as excess inventory accumulates.

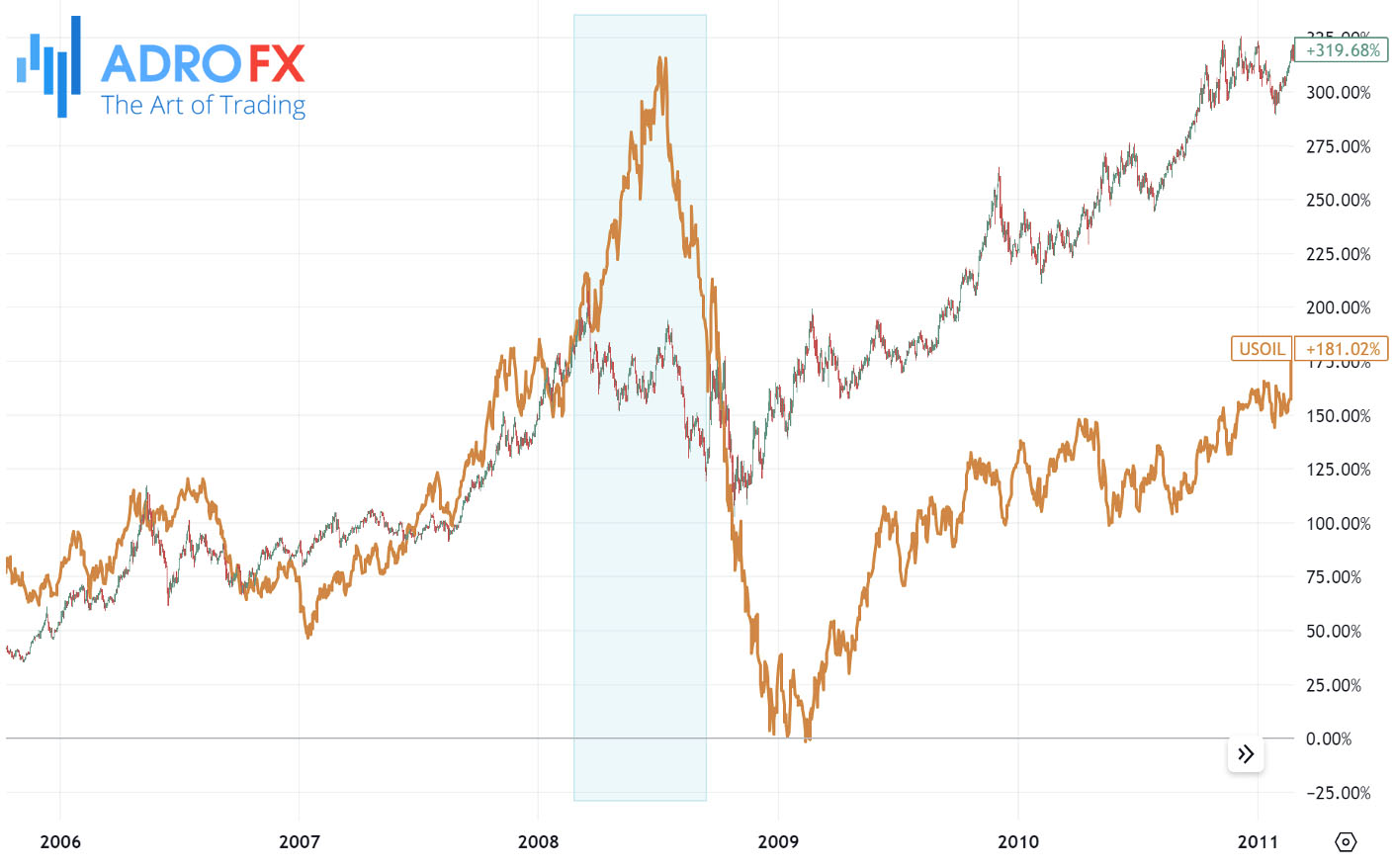

Historical Example: 2008 Oil Price Surge

In 2008, the world saw a dramatic surge in oil prices, peaking at over $140 per barrel in July. This spike was driven by several factors, including rising demand from rapidly growing economies like China and India, geopolitical tensions in oil-producing regions, and a lag in the ability of supply to keep pace with the increasing demand. The short-term inelasticity of oil supply, due to the time and investment needed to increase production capacity, led to this significant price surge.

Long-term Responses

In the long term, both producers and consumers have more flexibility to adapt. Producers can invest in new technologies or expand capacity, and consumers can find substitutes or change their consumption habits. This greater adaptability usually results in more moderate price adjustments compared to the short term.

Historical Example: 2020 COVID-19 Pandemic

The COVID-19 pandemic caused unprecedented disruptions in global supply chains and demand for commodities. For instance, the demand for oil plummeted as lockdowns and travel restrictions reduced transportation needs. In April 2020, oil prices even briefly turned negative for the first time in history, as storage capacity ran out and producers were forced to pay buyers to take oil off their hands. Over the long term, the oil market began to stabilize as production cuts were implemented and demand slowly recovered with the easing of lockdown measures.

Role of Speculation

Speculation also plays a significant role in commodity markets, often amplifying price movements. Speculators buy and sell commodities based on their expectations of future price changes, rather than actual supply and demand. While speculation can provide liquidity and help discover prices, it can also lead to increased volatility. Large influxes of speculative capital can drive prices up or down sharply, sometimes detached from underlying market fundamentals.

Futures Contracts and Hedging

Futures contracts and hedging are critical tools for managing the risks associated with commodity price volatility. Futures contracts allow traders to lock in prices for future delivery, providing certainty and reducing the risk of adverse price movements. For example, a wheat farmer can sell futures contracts to guarantee a selling price for their crop, protecting against the risk of a price drop at harvest time. Similarly, a bakery can buy futures contracts to lock in wheat prices, ensuring stable costs for their raw materials.

Historical Example: Commodity Prices During the Financial Crisis

During the 2008 financial crisis, the prices of many commodities, including oil and metals, experienced significant volatility. The crisis led to a sharp decline in economic activity and demand for raw materials. However, those who had hedged their positions using futures contracts were better able to manage the financial impact. For instance, airlines that had locked in fuel prices with futures contracts were shielded from some of the price spikes, while those who had not hedged faced much higher operational costs.

Challenges and Considerations in Commodity Trading

Challenges and considerations in commodity trading are numerous and can significantly impact market participants. One of the primary challenges is the inherent volatility and market risks associated with commodities. Prices can be highly volatile due to factors such as weather events, geopolitical tensions, and sudden changes in supply and demand. Traders need to be prepared for this volatility and develop strategies to manage risk effectively.

Information asymmetry is another significant challenge in commodity trading. Not all market participants have access to the same information, which can lead to imbalances and potentially unfair advantages. For instance, large institutional traders might have access to more sophisticated data and analysis tools compared to small traders, influencing their ability to make informed decisions.

External factors, such as political instability and global pandemics, can also profoundly affect commodity markets. Political events, such as conflicts or trade sanctions, can disrupt supply chains and affect the availability and prices of commodities. The COVID-19 pandemic, for example, caused unprecedented disruptions in global supply chains, leading to significant price volatility in many commodities.

Moreover, commodity traders must navigate regulatory environments that can vary widely across regions and over time. Government policies on trade, tariffs, and environmental regulations can all impact commodity markets, sometimes unpredictably.

In conclusion, while commodity trading offers opportunities for profit, it also requires a deep understanding of market dynamics, effective risk management strategies, and the ability to adapt to a constantly changing environment. By staying informed and employing sound trading practices, traders can better navigate the complexities of commodity markets.

Risk Management and Trading Strategies

In the world of commodity trading, having a robust strategy is crucial for navigating the complex and often volatile markets. Here are some effective strategies traders can employ:

Fundamental analysis involves using supply and demand data to make informed trading decisions. Traders examine factors such as production levels, weather conditions, technological advancements, and government policies that affect supply. On the demand side, they consider economic conditions, population growth, and consumer preferences. By understanding these fundamental factors, traders can anticipate market movements and make strategic trades.

Technical analysis focuses on identifying patterns and trends in price movements. Traders use charts and other tools to analyze historical price data, looking for patterns that can indicate future market behavior. Techniques such as moving averages, relative strength index (RSI), and candlestick patterns help traders predict potential price movements and determine optimal entry and exit points for trades.

Risk management techniques are essential for protecting investments and ensuring long-term success in commodity trading. Diversification is a key strategy, spreading investments across various commodities and markets to reduce risk. By not putting all their capital into a single commodity, traders can mitigate the impact of adverse price movements in any one market.

Hedging strategies involve using financial instruments like futures contracts to offset potential losses in the physical market. For example, a farmer can hedge against the risk of falling crop prices by selling futures contracts, ensuring a fixed selling price regardless of market fluctuations. Similarly, a manufacturer can hedge against rising raw material costs by purchasing futures contracts.

Conclusion

In commodity trading, the interplay of supply and demand is fundamental. Understanding these dynamics is crucial for making informed trading decisions and navigating the complexities of the market. Traders must continually educate themselves on market conditions, employ both fundamental and technical analysis, and implement robust risk management strategies.

Staying informed and adaptable is key to success in the ever-changing commodity markets. By keeping abreast of market developments and refining their trading strategies, traders can enhance their chances of achieving financial success and stability. As the commodity markets evolve, so too must the approaches and tactics of those who trade within them.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.