Record S&P 500 Close Boosted by Broadcom Surge Amid Rate Cut Bets and Inflation Slowdown | Daily Market Analysis

Key events:

- Japan - BoJ Interest Rate Decision

- USA - Fed Monetary Policy Report

- USA - Michigan Consumer Sentiment

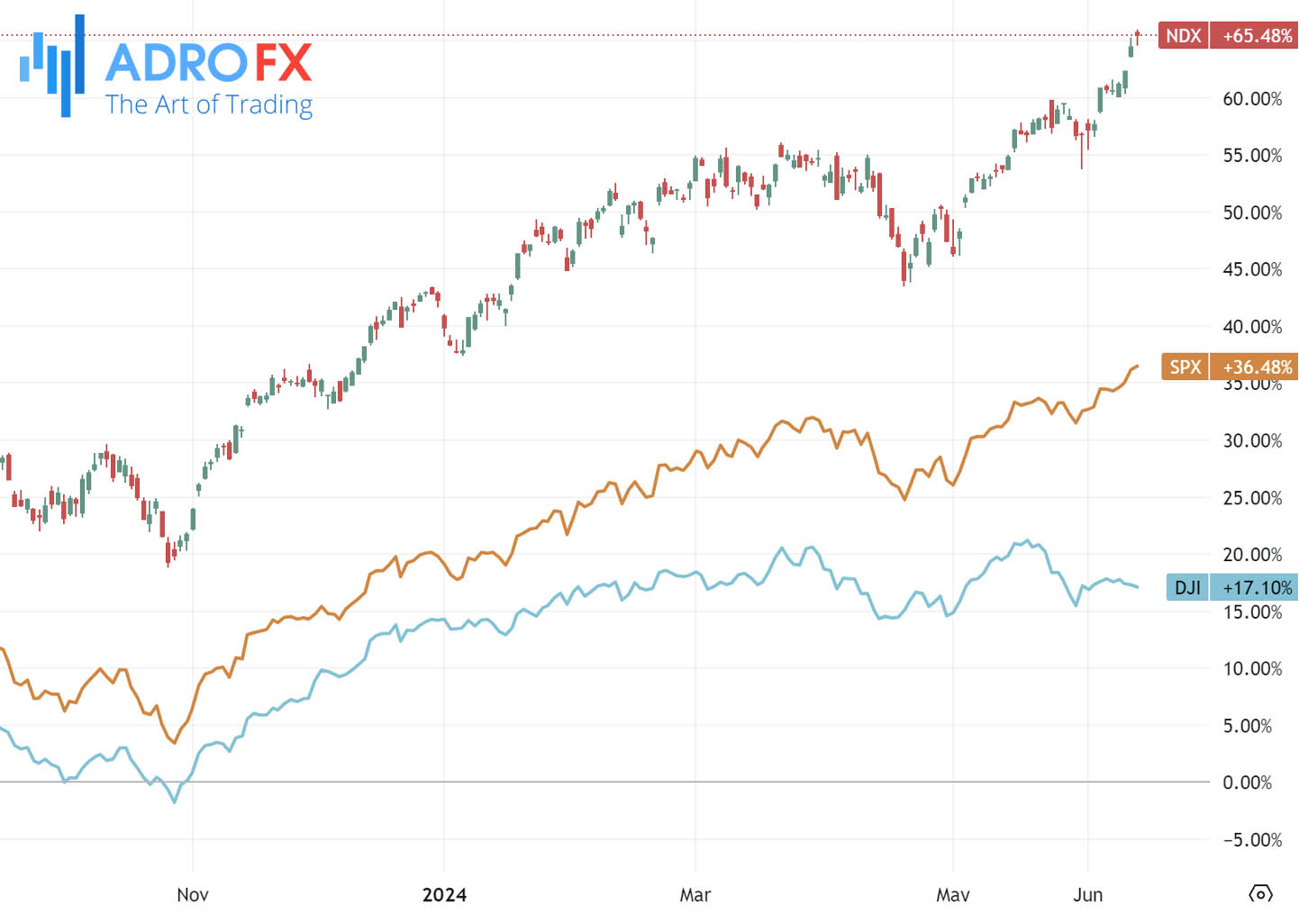

The S&P 500 achieved a new record close on Thursday, spurred by a significant rise in Broadcom, which boosted semiconductor stocks, and buoyed by growing expectations of rate cuts this year amid indications of easing inflation. The S&P 500 rose by 0.2% to a record high of 5,432.40, while the NASDAQ Composite advanced 0.3%. Conversely, the Dow Jones Industrial Average declined by 65 points, or 0.2%.

Meanwhile, the Japanese Yen weakened as the Bank of Japan kept its interest rate at 0% during its Friday meeting. The BoJ announced a cut in bond purchases to increase flexibility in managing long-term interest rates. Policymakers are expected to finalize a strategy for reducing bond buying over the next one to two years at their upcoming policy meeting.

Reports from the Nikkei suggest that the BoJ is contemplating a reduction in its Japanese government bond holdings. The BoJ currently targets approximately ¥6 trillion (around $38.5 billion) in monthly bond purchases and plans to buy between ¥4.8 trillion and ¥7 trillion worth of bonds each month.

The US Dollar Index, which gauges the dollar's value against six major currencies, edged up despite disappointing economic data on Thursday. The US Producer Price Index was lower than expected, and Initial Jobless Claims were higher than forecasted. Nevertheless, the USD's strength is attributed to the Federal Reserve's hawkish outlook.

Weekly jobless claims data indicated that the number of Americans filing new claims for unemployment benefits surged to a 10-month high last week, raising hopes in financial markets that the Federal Reserve might begin cutting interest rates by September.

The Federal Open Market Committee has revised its forecast, now anticipating only one rate cut this year instead of the three projected in March. This updated outlook indicates a more aggressive stance on inflation control and economic stability, which has contributed to the USD's strength.

The USD/CAD pair is struggling to build on the prior day's gains, oscillating between minor increases and decreases, and trading below the mid-1.3700s during Friday's Asian session.

Crude oil prices have seen some buying on dips and are poised for significant weekly gains. This is driven by OPEC+ commitments to keep production levels low to sustain prices, easing fears of increased supply. OPEC+ clarified that any production hikes would depend on oil prices and maintained its annual demand growth forecast, citing better prospects with the eventual lowering of global interest rates. This support for crude oil benefits the Canadian dollar, acting as a headwind for the USD/CAD pair.

The Australian Dollar has rebounded from Friday's losses, likely due to improved risk appetite. This positive sentiment comes from a Reuters poll of 43 economists, all of whom predicted that the Reserve Bank of Australia would keep interest rates steady in June. A substantial 90% of economists expect stable rates in the next quarter, with a potential 25 basis-point cut to 4.10% by the end of 2024. Additionally, 63% of economists foresee rates dropping to 4.10% or lower by year-end, while 35% expect no change.

The EUR/USD pair is trading flat around 1.0735 early Friday during the Asian session. The pair's upside potential may be limited due to uncertainties surrounding the European parliamentary elections. Investors will seek more direction from ECB President Christine Lagarde's speech.

The European Parliament election has exposed divisions in several member states. In France, following a loss to the far-right National Rally, President Emmanuel Macron has dissolved parliament and called a snap election, which could increase the far-right's influence in the country's parliament, according to the European Council on Foreign Relations.

The combination of political uncertainty in Europe and potential rate cuts from the European Central Bank might put pressure on the Euro against the US Dollar. The ECB cut interest rates by 25 basis points during its June meeting, a move widely anticipated by market participants. This adjustment lowers the ECB’s key rate to 3.75% from a high of 4% since September 2023. While financial markets have priced in one more cut this year, economists polled by Reuters last week expect two additional cuts towards the end of 2024.

Investors are now looking ahead to the preliminary US Michigan Consumer Sentiment index, scheduled for release on Friday, which will offer further insights into consumer confidence and the economic outlook.