Overbought vs Oversold: A Trader's Guide

Technical analysis of the forex market includes many different concepts and definitions, one of which is overbought and oversold. These terms have existed on the market since the very inception of technical analysis and are very important tools in the arsenal of any trader. They are used on all world exchanges and are still relevant.

What is a Trading Range?

A trading range is a space between the upper and lower trend line. According to the VSA, when market trends are within a range, they will continue that way until a buy or sell is attempted.

Applying VSA principles allows the trader to analyze the price movement at the top or bottom of the trading range. Remember, this is very important because you can make meaningful observations about these areas, especially when the price is heading toward support and resistance lines respectively.

The area above the resistance trend line is usually called overbought, while the area below the support trend line is known as oversold. Remember, they can be more reliable indicators compared to traditional methods.

In addition, a data value can also be found in the center of the range. A move in either direction has no vulnerability and the price, in theory, can go anywhere.

Take into account that creating an imbalance between supply and demand can appear because of the accumulation or distribution at the highs and lows. Once this action is accomplished, the move will head toward the edges of the current trend channel. The vulnerability of a reversal can be seen in holding the trend at the edges of the trading range. Meanwhile, there are chances of an opposite movement increasing in areas of overbought or oversold. However, there is a possibility of an unexplained phenomenon.

The trendline boundary can offer resistance in both directions. If resistance is broken out in one direction and passes through the line, it is also possible for the resistance line to be broken out back with a return to the previous trading range.

This can be triggered by the actions of specialists and market makers. If there was an active effort to get above the upper trend line (resistance), then professional traders might have bullish (optimistic) intentions. Remember, this should be the case when the price can break out of the line for the first time.

Although the price comes close to the line again from the opposite direction, it remains necessary for you to break the trend line. However, if the specialists and market makers remain optimistic, there will be no way to go back.

The determining factor is when the line will be based on the amount of trading volume. There is a need to break the trend line in advance, where the manifestation of any low price volume passing near the line will be an indication that it is not worth breaking anything at that point. This can also happen with a lower trend line.

Many forex traders believe that engaging in trading is all about buying on an uptrend and selling on a downtrend. Several factors can determine where the trade will end in profit and where it will not, similar to overbought and oversold conditions.

The Essence of Overbought and Oversold Market Conditions

Any trading style implies an orientation to these strategically important levels because they show where the price will go next. To understand the formation of overbought and oversold conditions, we need a good understanding of fundamental analysis (the formation of supply and demand).

We need to find the moment when the interests of buyers and sellers merge, then these groups of players act in the same direction. The trading activity under such conditions will be enclosed in a fairly narrow framework. This creates a market imbalance, which depletes one of the parties, and then the price mechanics starts working, which favors one of the groups - the one that outweighs at the moment.

The important point is to "not get caught" by the catching of market imbalance. At this point, it is necessary to use not only the basics of technical analysis (using various indicators), but it is also very important to use fundamental analysis to figure out all aspects of market consistency.

What is Oversold?

It is a rather relative term for when an asset is trading below its true value. It may be the result of negative news or forecasts for a particular company or an entire industry, or a general market decline.

Sellers open short positions, expecting to earn on the fall in quotes, and buyers, on the contrary, are active and begin to push the price up. It is considered that the fall of the price when the market is oversold has already laid the potential for its rebound and subsequent growth.

However, market entry into the oversold area does not always mean an immediate upward price reversal. This condition can last for quite a long time, and it is even possible that there will be no price rebound at all. The point is that oversold is a subjective term. Because traders and analysts use different technical indicators, where some see an oversold asset, others see the potential for its further decline. That's why cautious traders usually wait for the price to level off and start moving up.

What is Overbought?

This term is used when security is thought to be trading at a level above its real (intrinsic or fair) value. This occurs either after a short period of impulsive upward price movement or after a fairly sustained move in the same direction (rally).

Sellers and buyers would behave differently in this situation if you compare it to oversold conditions. There are not many sellers who want to close the trade and take a profit, but buyers don't want to buy at the current price, which they believe is too high. The assumption here is that the market will correct the price shortly - this belief is often the result of technical analysis of the share price history.

As a rule, overbought security is a good candidate for sale, because the signal of the overbought asset most often indicates a change in the trend to the opposite. Although it is not uncommon for price pullbacks to occur, the old trend continues.

Thus, overbought is also a subjective notion, as traders and analysts use different indicators. For example, investors use P/E (price/earnings ratio) to see if a stock is overbought, while traders use technical indicators such as the Relative Strength Index (RSI) more often.

How to Determine Overbought and Oversold Areas?

Determining overbought and oversold areas in forex trading is easy enough. But it is difficult, but not impossible, to use it in stable earnings. First of all, a trader needs to understand the market, and why these two phenomena are formed in the first place. To do this, one needs to know how prices are formed and what influences them. The art of trading consists in researching and anticipating the change of trend which in reality is not given to everybody. As for overbought and oversold trends, they can be identified by the following signs:

- A sharp change in price, the so-called impulse, which is very pronounced on the chart;

- The formation of high bars or candlesticks;

- The development of a jumping trend, changing to short-term downward retreats.

And more accurately identifying these areas help forex overbought and oversold indicators. There are many such indicators on the market, but the most popular are:

- Stochastic;

- Momentum;

- MACD;

- RSI;

- Bollinger Bands.

They all have their own algorithm for determining this phenomenon, but basically, they use different methods of smoothing based on changes in the candle parameters (closing and opening levels, highs and lows of a certain reporting period). In a simple interpretation: if the indicators show some peak values, this just implies that the market is overheated in some direction.

Stochastic Oscillator - this is the most famous indicator of overbought and oversold areas, which represents some values, which in turn are divided into zones from 0 to 100%.

This indicator gives four possible signals:

- The first signal to buy is given when the price falls below 20% and then rises. To sell, it is the other way around, first, the price should go above 80% and then go down;

- The second signal is to buy if the line %K rises above %D and vice versa, if %K falls below %D;

- The third signal is a divergence between the price and the indicator values;

- The fourth and most interesting signal is the overbought and oversold, occurring at levels above 80% and below 20%.

Momentum is the simplest technical indicator to determine overbought and oversold conditions. It shows the average rate of price change over a certain period of time. Momentum is essentially a future indicator that draws future peaks and troughs of a currency.

MACD is a trend indicator, created based on moving averages. It not only shows average prices but also future trends. It is used in two variations. The first form is used in the trend, and the second is an oscillator, which determines the levels.

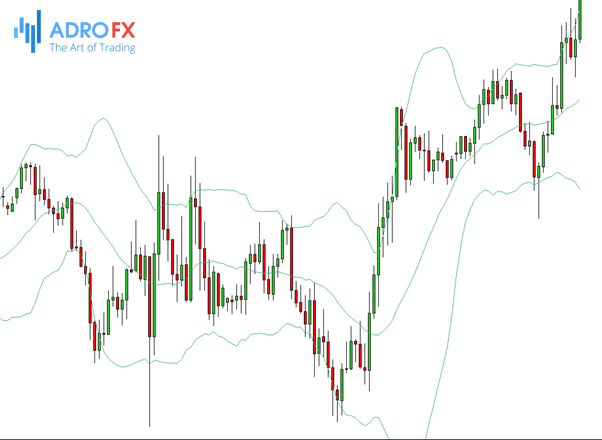

Bollinger Bands - is an indicator created on the basis of three Moving Averages, which cover the price on the price chart. This oscillator is often used to identify overbought and oversold areas, these zones are marked on the chart as a breakout of the indicator lines.

We can elaborate on RSI as a certain classic, familiarity with which is necessary for every trader.

RSI Indicator

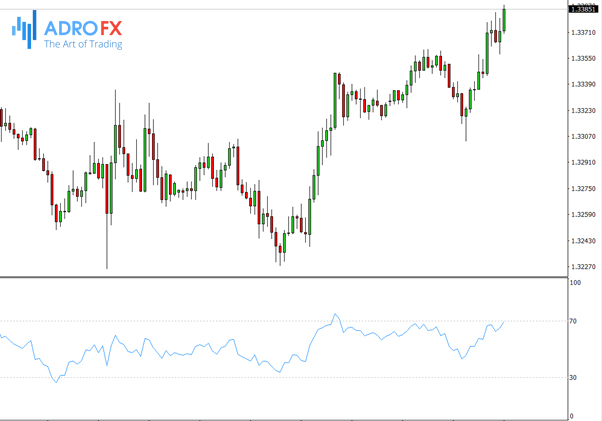

The Relative Strength Index (RSI) is a technical indicator that determines the strength of a trend and the probability of its change. The oscillator has gained popularity due to its simplicity. The RSI indicator, like all other technical tools, was originally created for the stock markets, but eventually became popular in the forex market. Mainly because it can determine the overbought and oversold areas.

The creator of the RSI indicator is trader Welles Wilder, who published his work with the indicator in an economic magazine in 1987. A little later, the author also wrote a book called "New Concepts in Trading Systems". It describes all the technical tricks and secrets of the indicator, which we will talk about below.

All the designations of the RSI oscillator are in the zone from 0 to 100. According to the author's description, the indicator works best in extreme zones 30 and 70. It is considered that if the scale of the indicator exceeds 70, one should expect a fall, as it is an overbought area, and if the scale falls below 30, one should expect a rise. Mr. Wilder recommended using the indicator with a 14-day setting, which is still fixed as standard in many trading platforms.

And although this analysis tool was used for futures and stock markets, it has found its application in the forex market, but because of the volatility of the latter. it is recommended to use RSI in higher time frames.

How to Trade Using an RSI Indicator

There are various ways to trade with the RSI indicator. In most cases, it all depends on the trading system and the settings of the indicator. But today we will look at the most basic, classic ones. It is very important to note that exceeding the extreme levels of indicators 30 and 70 does not mean that you have to open trades right away. The indicator only gives overbought and oversold signals, which suggest a future change in the trend, but does not explain when.

- The main signals of the RSI indicator:

- Overbought and oversold signals;

- A buy/sell signal arising from the crossover of indicator extrema;

- Technical analysis signals that work perfectly with the indicator;

- Signals from graphical figures;

- Divergence.

We have already covered the basic signal of the RSI overheating in one direction or another, so let's move on to the crossovers, which also give signals for placing orders. For example, if the RSI curve falls below 30 and then crosses up again, it creates a buy signal. Conversely, a new crossing of the overbought area at 70 gives a sell signal. It is worth noting that during a strong trend, overbought and oversold signals should not be considered, as they only confirm the strength of the trend. In such cases, you need to monitor the market and wait for a new signal to form.

Also on the indicator, RSI can draw trend lines and horizontal levels, which serve as an additional signal for entering the market.

In addition to horizontal levels and trend lines on the RSI indicator histogram, it is often possible to see the figures of technical analysis: wedges, rectangles, head and shoulders, etc. These figures may not show up at the price, but they are still good signals for trading.

The last signal of the RSI indicator for price prediction is divergence, which is the divergence between the price and the indicator line. Divergence is a very strong reversal signal, which is not very common.

Readings of Overbought/Oversold

There are classic signals which are listened to by both cautious players who close positions before the correction of a trend and speculators who seek to earn on a short distance. The general principle is the same:

A "buy signal" (the line on the chart, moving upwards, crosses the boundary of the oversold area);

a "sell" signal (the line, moving down from above, has left the overbought area).

The most often used indicators for determining the reversal are RSI and Stochastic Oscillator.

Both the Relative Strength Index and the Stochastic have both strengths and weaknesses, so it is best to use them in combination with other tools designed to find optimal buy and sell points. Finally, there are times when an asset (or even a whole market) remains overbought or oversold for a long time and a reversal still does not occur.

Therefore, it is important to remember that in markets with a strong trend, signals obtained with RSI or Stochastic can sometimes be premature or even false.

How to Maximize Your Profits?

In order to maximize profits from a trade, using overbought and oversold conditions is very important. You can get the best return on a trade, especially if you try to buy at the reversal of a downtrend, or when you place a short position right at the beginning of a downtrend. You can also develop your personal strategy based on them. Do your thorough research to fully understand the actions of the overbought and oversold oscillators and, based on that, you can develop your own personally.

Conclusion

The basic principles of trading are based on the notions of overbought and oversold conditions formed by smoothing indicators. Each trader decides for himself whether to use these signals or not. The reasonability of using the market skewed in one direction or another in terms of technical indicators is disputed on many informational thematic platforms.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.