Nasdaq Hits Record High While Gold Peaks Amid Fed's Hawkish Tone | Daily Market Analysis

Key events:

- Eurozone - ECB President Lagarde Speaks

- USA - Fed Governor Kroszner Speaks

- USA - Fed Waller Speaks

- USA - FOMC Member Williams Speaks

- USA - FOMC Member Bostic Speaks

- USA - Fed Vice Chair for Supervision Barr Speaks

- UK - BoE Gov Bailey Speaks

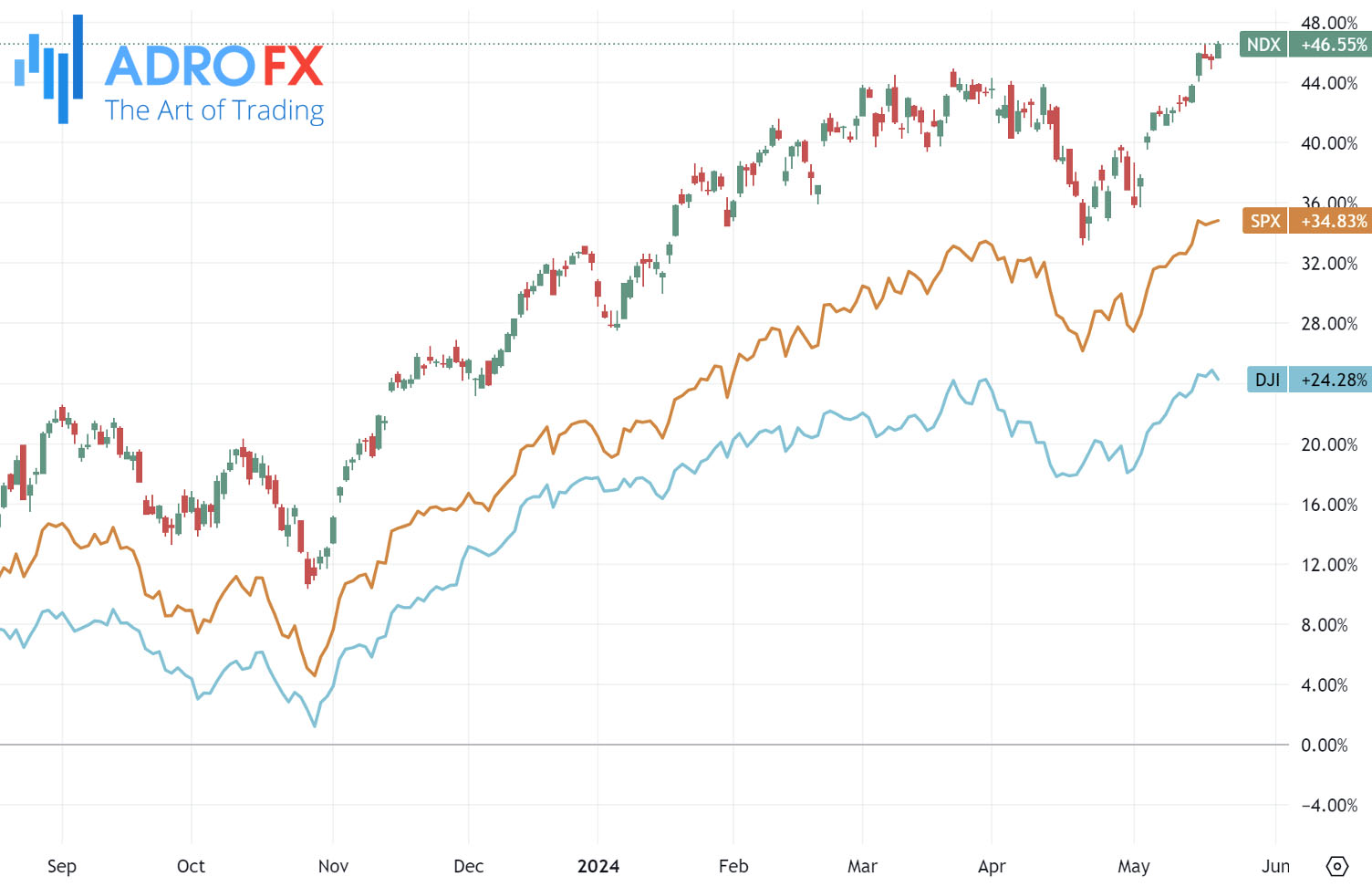

Monday saw the Nasdaq reaching an unprecedented high, while gold soared to its peak as investors grappled with hawkish statements from the Federal Reserve alongside signs of moderating US inflation.

The Nasdaq, driven primarily by gains in the chip sector, outpaced the other major US stock indices, fueled by the performance of Nvidia Corp (NASDAQ: NVDA) ahead of its eagerly anticipated earnings report slated for Wednesday.

Meanwhile, the S&P 500 eked out a modest uptick, contrasting with the blue-chip Dow, which slipped below the 40,000 mark after breaching it for the first time in its history during Friday's close.

Comments from Federal Reserve officials mirrored the central bank's cautious stance on inflation containment and the timing of interest rate adjustments.

Fed Vice Chair Philip Jefferson cautioned against premature conclusions regarding the longevity of the inflation slowdown, echoing sentiments expressed by Vice Chair Michael Barr, who emphasized the need for further assessment of restrictive monetary policy. Atlanta Fed President Raphael Bostic echoed similar sentiments, indicating a prolonged period before the central bank gains confidence in a sustainable decline in price growth.

Market sentiment remained jittery as investors awaited further insights from the Fed throughout the week, particularly the release of meeting minutes and speeches from various officials.

Despite a modest softening in consumer inflation figures for April, numerous Fed representatives underscored the necessity for the central bank to have a greater degree of certainty in the trajectory of inflation before contemplating interest rate adjustments.

Tuesday witnessed a continued decline in the Australian Dollar, potentially influenced by prevailing risk aversion sentiments. However, the AUD/USD pair saw a slight uptick following the release of Westpac Consumer Confidence data during the early Asian trading hours. The index showed a 0.3% month-over-month decrease in May, marking the third consecutive monthly decline but at a slower pace compared to April's 2.4% drop.

Support for the Australian Dollar could materialize following China's announcement of a comprehensive plan to bolster its struggling property market. Measures include relaxing mortgage rules and encouraging local governments to purchase unsold homes, potentially boosting sentiment in Australian markets given the close trade ties between the two nations.

Meanwhile, the momentum of gold prices stalled on Tuesday after hitting a record high earlier. The lack of significant catalysts in a relatively quiet session, coupled with ongoing geopolitical tensions, higher bets on US Federal Reserve interest rate cuts, and strong demand from central banks and Asian buyers, might constrain the precious metal's upward movement.

In the currency markets, the GBP/USD pair continued its rally near 1.2710 during the early Asian session on Tuesday. Investors are awaiting fresh cues, with various Federal Reserve speakers scheduled to address the market later in the day. Attention will also be on the UK CPI inflation data and the release of the FOMC Minutes on Wednesday.

The US Dollar traded steadily on Tuesday amid the absence of major economic data releases from the US and the UK. Fed officials have maintained caution regarding the timing of potential easing measures, emphasizing the need to keep rates higher for an extended period to ensure inflation remains on the desired trajectory. The upcoming release of the FOMC minutes is anticipated to shed light on the future interest rate path.

Conversely, the possibility of an interest rate cut by the Bank of England at its June meeting remains open. BoE Governor Andrew Bailey highlighted the bank's data-driven approach, particularly focusing on UK wage growth and consumer price inflation. Expectations for a softer UK CPI inflation reading in April might fuel speculation of rate cuts, potentially weighing on the Pound Sterling.

Later on Tuesday, Richmond Fed President Tom Barkin and New York Fed President John Williams, both members of the Fed’s rate-setting committee, are scheduled to address the market.

Speculation persists regarding the potential commencement of rate cuts by September, contingent upon the evolution of inflationary pressures and economic indicators.