The most searched investments from around the world

The year 2021 marked the recovery of the global economy from the pandemic. Virtually all financial assets rose in value, from commodity futures to corporate stocks. The U.S. stock market closed 2021 at its historical growth level, thereby confirming its status as the most beneficial option for passive investment income.

The stock market results are certainly noteworthy. More and more investors are wondering what are the most popular investments in 2022.

To answer the first question, it's worth noting that investing in stocks is very affordable. Today you don't need to have an account in a US bank or be a professional stock exchange member to buy stocks of companies. It is enough to have a brokerage account at an international broker.

In this article, we will learn the most searched investments this year. Also, we will get an insight into the influence of COVID-19 on the market.

The most searched for stocks around the world

Since our main goal when buying stock from any company is to capitalize on this position, we should choose only promising and reliable brands and organizations. When forming a portfolio, it is important to consider the current situation on the stock market, as well as expert commentary. This strategy allows you to evaluate the potential of investments, minimize risks and increase future earnings.

We have highlighted the most searched-for companies for you to pay attention to in 2022. First, we will start with the most popular one - Tesla.

Tesla shares dominate in 82 countries

According to the Money.co.uk study, Tesla is the most-Googled investment opportunity, making up 15% of today’s stock market-related searches. It’s a global phenomenon—Tesla leads the search standings in 82 countries. Amazon and Apple rival Tesla in popularity, but don’t seem to have the same global appeal—the two tech giants accounted for 13% and 12% of global searches, respectively, and each dominated searches in 13 countries.

Some believe that Tesla is a manufacturer of expensive and trendy toys for millionaires. Others believe it is a company designed to save the planet from environmental disaster. In any case, everyone, or almost everyone, has heard of Tesla.

The Tesla Company was established in 2003, at its origins were General Motors engineers, engaged in the development of electric cars. Tesla currently designs and manufactures electric cars, high-capacity batteries, and solar panels.

Tesla's CEO, the controversial Elon Musk, joined the company in 2004, right after investing $6.3 million in Tesla stock in its first round of investments. In June 2010, Tesla went public, raising $226 million in an IPO and issuing 13.3 million shares at $17 each.

From that moment the history of Tesla's stock price climb began, which in early 2022 renewed its historic high, reaching $900! Earlier, on August 11, 2020, the company announced a 1:5 stock split, which happened on August 31.

In 2022, the company plans to deliver 50% more cars. The company's engineers will also focus on developing the Optimus robot, which will do monotonous and boring work instead of humans.

Investors should pay attention to statements made by Elon Musk about various innovations at the company. According to the company's analysts, revenue could reach $76.8 billion (+43%) and earnings per share are expected to be in the range of $9.73 (+44%). The company also plans to launch electric car production lines at new gigafactories in Austin and Berlin.

Experts believe the electric-car maker's stock could rise in value even more, to $1,800 per security, if it starts selling more electric cars in China in 2022.

In doing so, the company will introduce new large, high-performance batteries - they have a longer lifespan and lower production costs. Tesla stock is worth $856 today and could rise to $1,200 or more. For investors who invest for the long term, that would be a promising asset. But before investing, you need to keep an eye on what's going on at the company.

Tesla recently announced its new car with a record low price of $25,000 in 2023. If the company really succeeds, it will blow away all its competitors and improve its financial performance.

There is no doubt that Tesla Motors is one of the most incredible companies that has made a real breakthrough in the technology market. Today, most analysts believe that Tesla stock will rise in value and break through the $3,000 ceiling by 2025. However, none of the experts give a 100 percent guarantee that it will be able to maintain its leadership in the electric car market. There are other fundamental factors to consider when making a final forecast: competition, the COVID-19 pandemic, and customer tastes.

Other popular stocks among investors

Apple Inc (APPL)

Apple stock is the most popular investment asset for large and novice investors. For example, Warren Buffett keeps 45% of his investment portfolio in Apple stock.

It's worth noting that the company's stock has shown excellent growth in 2021, and this even though the company lagged behind the plan of sales of new phones due to a disruption in the supply of new chips for the iPhone 13. Thus, with the hardware supply chain restored, the stock will have an additional positive fundamental that contributes to its growth.

Sustained stock growth in 2022 will allow the company to reach a capitalization of $3 trillion, making Apple the first company in history with that level of market value.

Meta Platforms Inc (FB)

Mark Zuckerberg's business model is built around social media. The company's main earnings consist of income from the sale of advertising on social platforms such as Facebook and Instagram. However, the renaming of the company from Facebook to Meta indicates that the company will take a new vector of development.

At the same time, the business model will not change dramatically: the company will continue to support social networks and benefit from them. But the introduction of metaverses in the real world will give an additional impetus to the shares because the company will become one of the first to provide ready-made solutions in this area. In turn, this will diversify the company's revenues, improve its financial performance, and thus the stock's growth in 2022.

NVIDIA Corporation (NVDA)

The American graphics card manufacturer has held a leading position in its sector for several years. The growth of the cryptocurrency market in 2021 positively affects the company's income from mining video cards sales. Nvidia has adapted to market demand and provides ready-made solutions just for mining cryptocurrency. This allows the company to increase earnings quarterly, and the shares show growth as good as cryptocurrency.

Bank of America Corp (BAC)

The global economic recovery has pulled the cost of all goods and services up. This, in turn, triggered a rise in inflation in every country and forced some central banks to act around the world. The Federal Reserve is no exception, as it began the process of winding down the program of quantitative easing (QE) and is making plans to raise rates in 2022.

This economic situation will be to the advantage of representatives of the banking sector. Rising rates will allow them to increase business margins and make loans at higher interest rates. Investing in Bank of America stock is already showing positive results, and a rate hike from the Fed will only strengthen their position in 2022.

Procter & Gamble Co (PG)

Procter and Gamble products are used all over the world. The company shows year-over-year growth in revenue and net income, and its products are in the category of essential products, which allows the company to show positive results even in crisis years. The company is also active in the development of vaccines against coronavirus and sells many products to the medical sector of the economy.

Moreover, Procter and Gamble pay one-third of its net earnings to dividends. Thus, this makes the company one of the best investments for dividend stocks.

Pfizer Inc. (PFE)

Many experts expect 2022 to be the last year of coronavirus impact on the population. However, the number of vaccinated worldwide is still at extremely low levels. At the end of 2021, only 48% of the world's population is vaccinated. Continued vaccination will allow Pfizer to grow its net earnings .

At the end of the year, the company increased net earnings by 80% due to vaccine sales. Maintaining the trend for the next year will allow the stock to continue its uptrend.

These companies are already showing steady growth, and some of them are paying dividends to their investors. The U.S. stock market continues to be a leader in terms of investment returns. If you are considering equity investments as a novice investor, this structure of your investment portfolio will allow you to reduce risks and diversify your capital.

The best investment returns

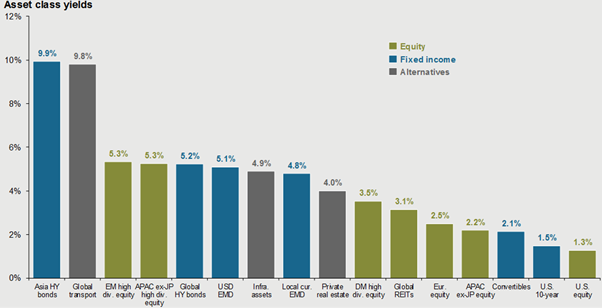

The US could have better returns than the UK, despite searching for stocks in similar companies

In terms of investment availability and prominence, the U.S. stock market delivers the highest returns: for example, the S&P 500 index gained 25.8% over the year. Among European stock markets, some showed a comparable result, but the average result was less impressive due to the weakening of national currencies against the dollar: the pan-European STOXX 600 index was up 20.9% in euros. The biggest disappointment came from Chinese stocks, which along with U.S. stocks are in demand by investors.

How COVID-19 has influenced the stock market

As a year of lockdown and pandemic control, 2020 led to phenomenal growth in the shares of technology services, e-commerce, and fintech, enabling life and business processes "at a distance," pharmaceutical and biotech companies.

Tech and streaming services boomed throughout the pandemic

The coronavirus pandemic and the total lockdown in many countries radically, initially for a short time, changed the trends and habits of most people, which also affected the sharp reversal of supply and demand for goods and services. It was clear from the start that the main changes would affect four areas that directly affect consumers: entertainment, food, communication, and work. As a consequence, the number of subscribers to streaming video services worldwide has exceeded 1 billion people. The magic of this number masks the dramatic changes the film and video industry is undergoing due to the COVID-19 pandemic.

The Motion Picture Association report shows that total revenue in the industry fell by 18% in 2020 compared to 2019 - to $81 billion. In particular, global box office receipts from the distribution of films in cinemas fell by more than $30 billion compared to the previous year and amounted to only $12 billion. At the same time, revenue streaming video services increased by almost $15 billion to $62 billion, and the number of subscribers to streaming services in the world (which now, as stated, more than 1 billion people) grew by 26%. In the United States, their number grew even faster: the number of subscriptions to streaming video services in this country increased by 32% to 309 million.

Three American companies and two Chinese companies are among the top five leading streaming services in the world in terms of the number of subscribers. First place in the world is Netflix, with more than 200 million subscribers by the end of 2020. Amazon Prime Video comes in second with 150 million subscribers. Third and fourth places go to China's Tencent Video and iQIYI (owned by Baidu), which each has about 120 million subscribers.

Perhaps the most curious is the fifth line, where Disney+ is entrenched. The service in 2020 managed to increase its user base by 258% immediately to 95 million people, and in early March 2021, that figure passed 100 million. Overall, it was Disney + that helped The Walt Disney Company to achieve a gain of $ 17 million for the first quarter of the fiscal year 2021, which ended January 2. In the two previous quarters, Disney had recorded losses - $4.7 billion and $710 million, respectively, and before that, the company had not had a quarterly loss since 2001. Even longer since 1980. Disney also did not know an annual loss, and now for fiscal 2020, which ended Oct. 3, 2020, the loss was $2.8 billion. The company's losses were caused by the closure of its theme parks due to lockdowns around the world.

Netflix, the leader of the streaming video services segment, does not have such an extensive offline business, so it does not care about the crisis either. The streaming sector leader has nearly $25 billion in revenue in 2020, up nearly $5 billion from a year earlier. Its net income in 2020 reached $2.8 billion, up from less than $1.9 billion in 2019.

Well, another curious trend spotted by MPA in the U.S. market: 55% of American adults began watching more content on streaming services, while only 46% of them increased their viewing of paid TV channels. So it all comes out: video services are the new mainstream.

Moreover, the growth of fintech has been fueled by high liquidity. In 2020, central banks brought almost $8 trillion to financial markets. Significant amounts of additional injections were also approved for 2021, which, on the one hand, was a factor supporting financial markets and, on the other hand, increased fears about the risks of inflation and correction of quotes.

At the same time, the statements of American companies for Q4 2020 showed a recovery of income growth (compared with the same quarter of 2019) of companies from the S&P 500 index: 80% of companies that managed to report, exceeded the optimistic forecasts.

The leaders of the U.S. financial industry - Bank of America, Citigroup, JP Morgan Chase, and Wells Fargo at the end of 2020 lost in capitalization. However, they started 2021 with growth: for example, the shares of Bank of America by the end of February went up by 19%. Fitch Ratings recently revised its outlook on the sector from "negative" to "stable," noting that the fundamentals were better than expected and the second half of the year could lead to a slight increase in lending activity.

According to Deloitte, banks could write off about $318 billion in borrower defaults by the end of 2022. The current moment may suit investors with a medium-term horizon - bank stocks are still cheap but don't expect a rapid recovery in the sector either. The Charles Schwab Financial Company believes that U.S. financial sector securities can show better market dynamics - compared to the S&P 500 Index. The sector now has attractive valuations compared to historical averages and other sectors, and the likely release of high loan loss reserves will support earnings growth.

While classic banking follows the phases of the economic cycle, fintech does not pause in development and is benefiting from the trend toward remote consumption right now. In 2020, payment companies' quotes appreciated at a high rate on the wave of growth in e-commerce and demand for other online services. PayPal, Ayden, and Square were among the leaders, with share price gains of 2-3 times. Non-banks and fintech startups were raising new venture rounds and preparing for IPOs. After such explosive growth, current forecasts look modest. Thus, the average forecast of the pool of experts for PayPal is the growth of 18%, the maximum forecast - growth of 41%. The similar capitalization growth potential of classic payment companies actively developing their technological component - Visa with an average growth forecast of 15% and Mastercard with the forecast of 10%.

Obviously, the pandemic and the crisis have contributed to the development of fintech - during the quarantine period, bank customers, being unable or unwilling to visit banks in person, began to use online and digital channels more actively. Accordingly, banks have to develop these areas, and this, in turn, will lead to an increase in investment in fintech in the future, and not only in the near future.

Electric cars became the world’s new obsession

The economic downturn caused by the COVID-19 pandemic seems to have had little effect on the electric car market. While global vehicle sales as a whole fell by 16% in 2020, sales of electric vehicles set another record. More than 3 million new electric vehicles were registered last year, including cars, trucks, and buses. That's a 41% increase over 2019. The share of electric vehicle sales in 2020 rose 70% to a record 4.6% of all vehicle sales.

As noted in the report, there were 11.2 million electric vehicles worldwide at the end of 2020, including 10.2 million cars, 0.4 million light-duty trucks, and 0.6 million buses. Electric cars were most actively bought in Europe, which for the first time surpassed China in this indicator.

General Motors

Concern General Motors (GM) at the end of 2020 announced its plans to switch to green transport technologies. Over the next five years, the company plans to invest $27 billion in the production of electric cars and drones, reorient more than 60% of its development department towards this area, and by 2025 produce electric cars in the amount of up to 40% of the total production range. Already at the end of 2020, the company introduced seven new electric vehicles expected to be released in 2022-2023 at the virtual exhibition CES (USA).

Caterpillar Inc.

Caterpillar for many decades since its founding has been a technology leader, subtly feeling the needs of the market, picking up or independently developing advanced technology for their machines. In 2017, the largest electric dump truck with a massive 700 kWh battery pack went into production; in late 2019, an electric 26-ton excavator was introduced. By the way, the world's environment benefits from each such unit that switches from diesel to electric propulsion, about as many as 60,000 cars on the roads at the same time. In December 2020, at the Consumer Electronics Show CES (in the US), the company unveiled powerful drone dozers that can operate in remote quarries without an operator.

BMW

BMW is also stepping up the production of electric cars to occupy its niche market. Their share of sales has grown from 2.6% in 2016 to 8.3% in 2020. For the most part, these are expensive premium cars. According to statements by company representatives, their share is expected to reach 50% of all sales by 2030.

It is obvious to everyone that the future of the global automotive industry belongs to electric cars. The drivers of the industry's development are environmental problems related to pollution. At the same time, electric cars are not only an environmentally friendly mode of transport but also additional opportunities for saving funds.

Stock searches for pharmaceutical companies increased by over 800% in the past three years!

The most stable dynamics on this background were shown by stocks of biotech and pharmaceutical companies, which actively took up the development of vaccines and tests.

Since February 1, 2020, shares of Pfizer are up 41%, Johnson & Johnson is up 12.38%, AstraZeneca is up 23.8%, UnitedHealth is up 75.5%, Abbott is up 42.2%, and Moderna is up 636.8%.

In an interview with CNBC, Moderna CEO Stephane Buncel conceded that the coronavirus pandemic is entering its final stage. Speaking about the near end of the coronavirus pandemic, the head of the American biopharmaceutical company noted that "this is a reasonable scenario."

As CNBC notes, some studies show that while the Omicron strain is more infectious, it is not considered as dangerous as Delta. "There's an 80 percent chance that as Omicron or the SarsCov-2 virus specifies, we will see less and less dangerous viruses," Stephan Bansel said.

With the possible end of the pandemic comes the risk of a correction in both individual healthcare stocks and the sector as a whole. For example, shares of Moderna have already lost about 70% since last year's high, and 40.5% since the beginning of this year, according to trading data.

Now the contracts for mass purchases of vaccines from the largest companies in the sector are mostly limited to one or two years. Therefore, in 2023 we can expect a significant drop in revenues from sales of coronavirus vaccines from these companies, provided that the pandemic burden on the health care system will subside. However, this point, in our opinion, is already largely accounted for in the shares of Pfizer and Moderna

According to Refinitiv, the Dow Jones US Health Care Total Return index is down 8.01% since the beginning of 2022 and 3.83% over the past six months. The decline of the index occurs against the background of weak dynamics of the securities of the largest companies in the sector. However, experts see no reason for a more powerful correction of the entire sector in the near future.

As usual, large companies with a broad portfolio of drugs, i.e. those less dependent on the Covid agenda, were the most resistant to the current decline: Pfizer, AstraZeneca, Johnson & Johnson, and Eli Lilly. They should be seen as the long-term beneficiaries of defeating the pandemic, because these companies have something to offer the market, in addition to vaccines and anti-viral cocktails.

Still, some pharmaceutical companies will benefit from the end of the pandemic.

Experts believe that it is best to look at classic pharmaceutical companies, manufacturers of low-cost drugs, companies with low value, which have passed the pandemic story. A great example is the French company Sanofi, which is now one of the most undervalued.

In many ways, the expectation of a reduced impact of the pandemic on the health sector is already reflected in the prices. At the same time, we recommend paying attention to the companies involved in the production of COVID-19 drugs. In particular, Merck & Co. and Pfizer may become the market leaders in oral antiviral drugs in 2022.

Tips for investors in 2022

-

Buy stocks of companies hit by the pandemic and inflation. Goldman Sachs predicts that U.S. GDP growth will accelerate to an average of 4.5% in the first quarter of 2022 before slowing in the second half of next year. Increased vaccination rates and the creation of new drugs against the coronavirus will contribute to further recovery from the pandemic. Judging by shipping prices and recent comments from company representatives, the supply chain situation has stopped deteriorating. In addition, energy prices and inflation should peak in 2022.

All of this in the short term should boost shares of cyclical companies, including those that will benefit from the opening of the economy and have previously faced rising production costs. Goldman Sachs is already seeing some signs of rotation in the market. In particular, stocks of companies whose supply chains are linked to China, corporations in the consumer and chemical sectors have already begun to outperform the S&P 500 Index. This trend will continue as investors' confidence in reducing these risks grows.

-

Avoid companies with high labor costs. The strongest wage growth in 20 years is happening right now, so stocks of companies vulnerable to rising labor costs will remain under pressure in the coming years. For example, in hospitality and entertainment, stocks of companies with low labor costs have performed better than similar companies with higher costs for much of the year.

Wages in the U.S. are projected to continue to rise above 4% for the next few years because of high labor demand and limited supply. High earnings potential and the dominance of large-cap companies make them less vulnerable to wage growth, the analysts wrote.

-

Among fast-growing companies, choose currency generators ones. "Quality" companies with a high return on equity, strong balance sheets, and solid earnings growth have looked better than the market in a rising rate environment before - such as from mid-2014 to 2016 and 2017 to mid-2019.

One of the big themes for investors and directors right now is the trade-off between earnings and lucrativeness. It will become even more relevant in 2022 as rates rise. Right now, the markets are pricing high-growth companies with different earnings margins about the same.

But investors should consider the sensitivity of stocks to changes in interest rates. For example, growth stocks, whose valuation is driven more by future cash flows, are more susceptible to rising rates if the company is not bringing much returns or has low earnings. Peloton stock is down 45% after worsening its 2022 sales forecast.