Interest Rate Parity: Theoretical Foundations and Practical Applications in Forex Trading

Forex traders must understand the concept of interest rate parity (IRP), which links currency value fluctuations to interest rate differentials between countries. By examining the interest rate differences between two nations, investors can forecast future exchange rates. The theory is based on the relationship between the spot exchange rate and the forward exchange rate of two currencies. The core idea is that the forward exchange rate equals the spot exchange rate, adjusted by the ratio of the home country's interest rate to the foreign country's interest rate. However, like other financial theories, the IRP formula can be modified to solve for different variables, leading to various interpretations. When IRP holds true, traders cannot profit from borrowing in one currency, converting to another, and later converting back at a profit.

The Concept of Interest Rate Parity

Interest rate parity (IRP) is a fundamental theory in forex trading that connects currency value fluctuations to interest rate differentials between countries. By analyzing the differences in interest rates between two nations, investors can forecast future exchange rates.

IRP is based on the relationship between the spot exchange rate and the forward exchange rate of two currencies. The core idea is that the forward exchange rate is equal to the spot exchange rate, adjusted by the ratio of the home country's interest rate to the foreign country's interest rate. This relationship helps maintain equilibrium in the forex market and prevents arbitrage opportunities.

How It Works

- Spot Exchange Rate

The current exchange rate at which a currency pair can be bought or sold. - Forward Exchange Rate

The agreed-upon exchange rate for a currency pair at a future date. - Interest Rate Differential

The difference between the interest rates of the two countries.

The IRP theory posits that the forward exchange rate should reflect the spot exchange rate adjusted for the interest rate differential. This adjustment ensures that investors cannot gain an arbitrage profit by borrowing in a low-interest-rate currency, converting to a high-interest-rate currency, and then converting back at a favorable rate.

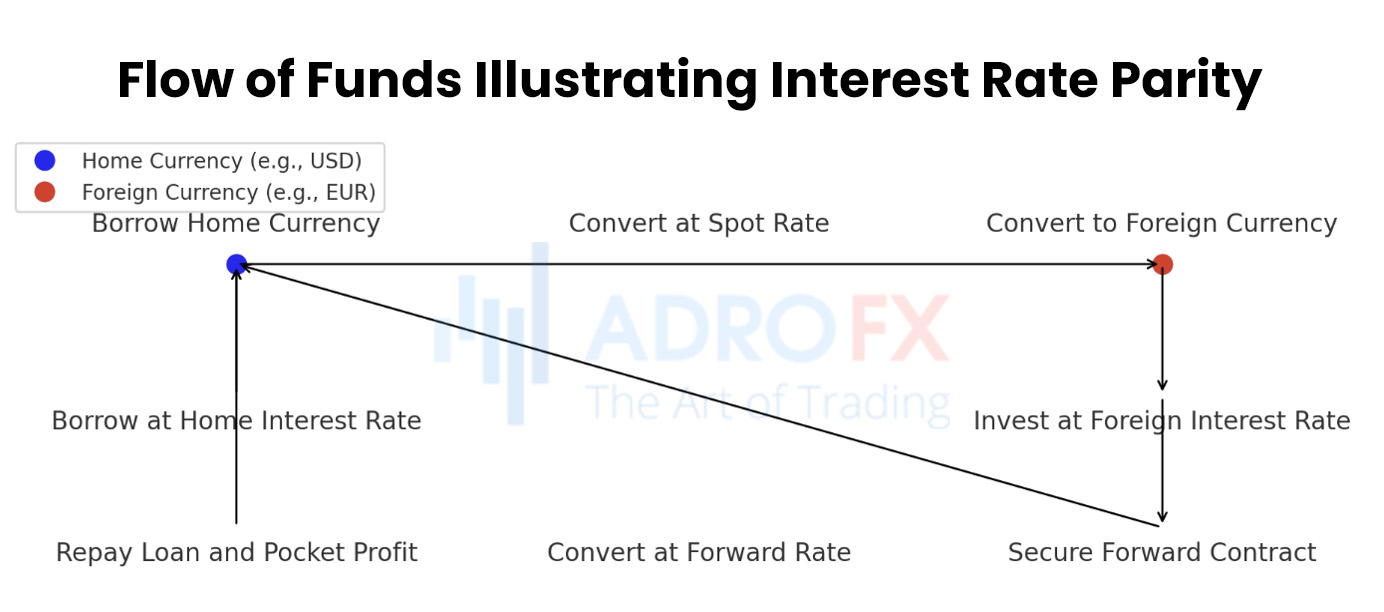

Visual Representation of IRP

To better understand this concept, refer to the infographic below, which illustrates the flow of funds from one currency to another, demonstrating the IRP process in action.

Why Is Interest Rate Parity Important?

Interest rate parity is crucial because if the IRP relationship does not hold, traders can exploit arbitrage opportunities for risk-free profits. If the forward exchange rate deviates from the IRP equilibrium, arbitrage becomes possible. For example, if the forward exchange rate is higher than the IRP-predicted rate, an investor can borrow funds in the home currency, exchange them at the spot rate, invest in the foreign currency at its interest rate, and secure a forward contract. Upon the contract's maturity, the investor converts the funds back to the home currency and repays the loan, pocketing the arbitrage profit. This scenario shows how deviations from IRP can create profitable opportunities without risking personal capital, only using borrowed funds.

Interest Rate Parity and Exchange Rate Movements

Interest rate parity is essential for predicting exchange rate movements. According to the IRP equation, changes in interest rates influence future spot rate forecasts. If a foreign country's interest rate remains stable while the home country's interest rates increase, the local currency is expected to appreciate against the foreign currency. This expectation will impact the predicted exchange rate, highlighting the importance of IRP in forex trading strategies.

The Mechanism of Interest Rate Parity

Consider a hypothetical example where the spot exchange rate is 0.80 Australian dollars for every Canadian dollar (AU$0.80/CA$1). This means you can exchange CA$1000 for AU$800. If the interest rate in Australia is 4%, an investment of AU$800 at 4% for a year will yield AU$832. However, instead of exchanging your currency directly in Australia, you could invest in Canada where the interest rate is 6%. In this scenario, the forward exchange rate is used, calculated based on the interest rate differential. The formula is (0.80 x 1.04) / (1 x 1.06), equaling 0.785. Investing CA$1000 in Canada at 6% results in CA$1060 at year’s end. You can then exchange CA$1060 at the forward rate of 0.785, resulting in AU$832. Thus, you end up with the same amount.

Forward Exchange Rates

Understanding forward rates is essential for applying IRP in arbitrage. Forward exchange rates predict future prices, while spot exchange rates reflect current prices. Banks provide forward rates for periods ranging from a few days to several years, quoted with a bid-ask spread similar to spot rates. The swap point refers to the difference between the spot and forward rate. A positive difference is called the forward premium, while a negative difference is the forward discount. Currencies with lower interest rates typically trade at a forward premium against currencies with higher interest rates.

Covered Interest Rate Parity

In covered interest rate parity (CIRP), forward exchange rates must account for interest rate differences between two countries, preventing arbitrage opportunities. This means investors cannot profit from borrowing a low-interest currency and investing in a high-interest currency. In CIRP, the cost of hedging risk offsets the higher returns from investing in a high-interest currency.

Uncovered Interest Rate Parity

Uncovered interest rate parity (UIRP) reflects the difference in interest rates between two countries and predicts changes in exchange rates. Theoretically, if the interest rate differential is 4%, the currency of the country with the higher interest rate should depreciate by 4% relative to the other currency. Since the adoption of floating exchange rates in the 1970s, currencies from high-interest-rate countries have often appreciated instead of depreciating, contrary to UIRP predictions. This anomaly has been studied extensively. Some theories suggest the carry trade, where traders borrow low-interest currencies and invest in high-interest currencies, may explain this phenomenon. Selling the borrowed currency impacts the foreign exchange market.

Covered vs. Uncovered Interest Rate Parities

There are significant similarities between covered and uncovered interest rate parities. The key difference is that uncovered IRP does not involve arbitrage through forward contracts, while covered IRP does. In an uncovered scenario, exchange rates adjust naturally, influencing the predicted spot rate. Covered IRP applies when no-arbitrage conditions are met using forward contracts. In covered IRP, traders are indifferent to investing in local or foreign interest rates because the forward exchange rate maintains currency balance.

The Formula for Interest Rate Parity

When working with the interest rate parity (IRP) formula, it is crucial to understand the associated terminology. Spot exchange rates represent the current exchange rates, while forward exchange rates indicate a future exchange rate. The swap point is the difference between a spot rate and a forward rate. If this difference is positive, it is called a forward premium; if negative, it is called a forward discount. Typically, a currency with a lower interest rate trades at a forward premium relative to a currency with a higher interest rate. The equations for IRP differ for uncovered and covered scenarios. Uncovered IRP relates to the spot exchange rate, while covered IRP pertains to the forward exchange rate.

Example of Covered Interest Rate Parity

Consider British Treasury bills offering an annual interest rate of 2%, while Japanese Treasury bills offer 1%. A Japanese trader wanting to benefit from the British interest rate would exchange yen for pounds to purchase the British Treasury bill. To do this, the trader sells a one-year forward contract on the pound. With covered IRP, this transaction would yield a 1% return, maintaining the no-arbitrage condition.

Conclusion

Interest rate parity stands as a pivotal concept in the realm of forex trading, offering a structured framework that links interest differentials between countries to exchange rate movements. It provides traders with insights into how interest rate changes influence currency values, guiding predictions of future exchange rates. The theory's practical applications include arbitrage strategies that capitalize on temporary misalignments between spot and forward exchange rates, thereby promoting market efficiency by swiftly correcting price differentials. In both covered and uncovered scenarios, IRP imposes constraints on potential profit opportunities, ensuring that market participants cannot exploit interest rate differentials without corresponding adjustments in exchange rates. This principle underscores the importance of understanding not only the mathematical formulas behind IRP but also its broader implications for global financial stability. As global financial markets continue to evolve, mastering IRP remains crucial for forex traders seeking to navigate dynamic economic landscapes effectively. It equips them with a nuanced understanding of how interest rates shape currency valuations, empowering informed decision-making and risk management strategies. By adhering to IRP principles, traders contribute to maintaining market equilibrium, fostering stability, and enhancing the efficiency of international capital flows in the ever-changing forex landscape.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.