Inflation Cools in Europe, US Dollar Under Pressure | Daily Market Analysis

Key events:

- UK – GDP (QoQ) (Q4)

- UK – GDP (YoY) (Q4)

- Eurozone – CPI (YoY) (Mar)

- USA – Core PCE Price Index (MoM) (Feb)

- Canada – GDP (MoM) (Jan)

- Eurozone – ECB President Lagarde Speaks

The latest CPI figures from Spain and Germany show that headline inflation in Europe decreased significantly in March due to the base effect of comparing war months. In Germany, inflation fell from 9.3% to 7.8%, and in Spain, it halved from 6% to 3.1%. However, when energy and food prices are excluded, the inflation picture is not as positive. Core inflation in Spain only decreased slightly from 7.6% to 7.5% this month, and core inflation in the Eurozone is expected to reach a new record high. If core inflation continues to rise, the ECB will likely take action to combat it, causing the euro to appreciate further.

Meanwhile, the U.S. dollar remains under pressure despite hawkish comments from the Federal Reserve, due to banking stress and soft economic data. The U.S. GDP data for Q4 showed that the U.S. economy grew 2.6%, slightly less than expected, while gross domestic income fell 1.1%, the largest decline since the pandemic. US corporate profits also fell by 2% in Q4, the most in two years, with profit margins decreasing from 15% to 14%.

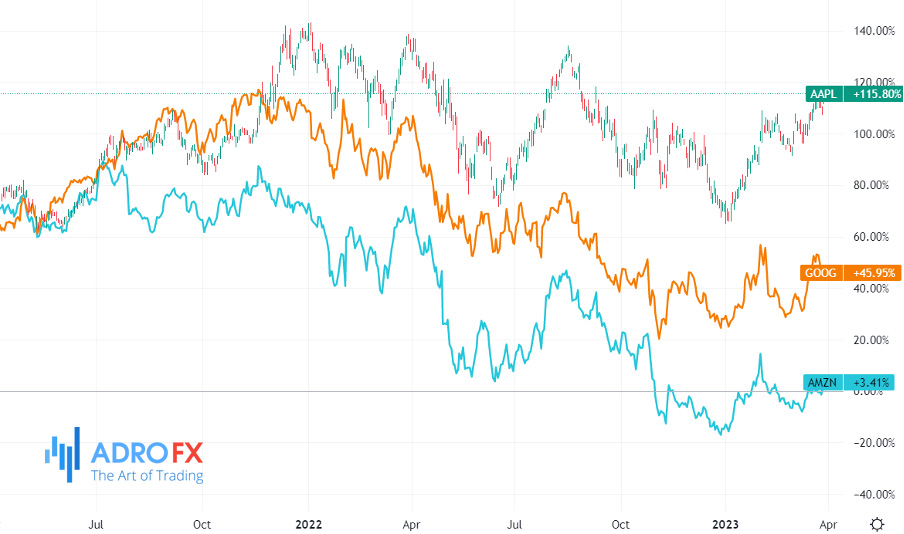

Despite the soft economic data, stock indices continue to be supported by soft yields. Technology stocks such as Apple, Microsoft, and Google have led the market, with the FAANG stocks rallying almost 30% since the start of the year. However, the actual stock rally is sensitive to yields, and a rise in yields could cause equity gains to crumble. Furthermore, higher yields could also be a headache for banks and equities.

Today's focus will be on the flash HICP figures for March in the euro area. The ECB primarily considers core inflation, which is expected to remain high.

The U.S. will release the February PCE data, which is the Fed's preferred inflation gauge. While core inflation may have eased on a monthly basis, it is expected to remain around 4.7% y/y. If the data is in line with expectations or lower, it could keep the Fed hawks at bay and lead to a further relaxation of the dollar.

In the dollar-yen pair, quarter-end flows are contributing to a weaker yen and a stronger dollar-yen, with the pair testing a significant resistance zone at around 133, including the 50-DMA and the minor 23.6% Fibonacci retracement from the October to January retreat.

Given the reduced Fed expectations and growing pressure on the Bank of Japan to end its no-longer-adopted easy monetary policy under new Governor Ueda, the dollar-yen pair doesn't have much positive potential. Price rallies could present interesting selling opportunities, with a possible fall toward the 125/127 range.