The Impact of Regulatory News on Crypto Markets

Cryptocurrencies, digital or virtual currencies that use cryptography for security, have revolutionized the financial world. Since the inception of Bitcoin in 2009, the cryptocurrency market has grown exponentially, encompassing a wide array of digital assets, including altcoins, stablecoins, and tokens linked to decentralized finance (DeFi) projects. These digital currencies offer a new way to conduct transactions, store value, and develop decentralized applications, posing a significant challenge to traditional financial systems.

The significance of cryptocurrencies in the financial world extends beyond their market capitalization, which has reached trillions of dollars. They offer a decentralized alternative to traditional currencies, potentially reducing the control of central banks and financial institutions. Cryptocurrencies also promise faster, cheaper cross-border transactions, increased financial inclusion, and new forms of investment opportunities. However, the market is highly volatile and susceptible to various factors, with regulatory news being one of the most influential. Regulatory actions and announcements can trigger sharp price movements, influence market sentiment, and shape the long-term development of the crypto space.

Understanding Regulatory News in the Crypto Space

Regulatory news encompasses any announcements, changes, or actions taken by governmental or regulatory bodies that impact the cryptocurrency market. These can include new laws and legislation, policy changes, enforcement actions, and official guidelines or advisories. Key regulatory bodies influencing the crypto markets include the US Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Financial Crimes Enforcement Network (FinCEN), the European Securities and Markets Authority (ESMA), and the Financial Action Task Force (FATF).

The cryptocurrency market has seen several major regulatory events that have significantly impacted its development and growth. Understanding these events provides insight into how regulatory news can shape market dynamics. For example, the collapse of the Mt. Gox exchange in 2014 led to increased scrutiny and calls for regulatory oversight of cryptocurrency exchanges. China's comprehensive ban on initial coin offerings (ICOs) and later on cryptocurrency exchanges in 2017 caused a significant market downturn and emphasized the impact of regulatory actions from major economies. The US SEC's crackdown on ICOs between 2017 and 2018 shaped the regulatory approach towards crypto fundraising activities in the US, while Japan's introduction of a comprehensive regulatory framework for cryptocurrencies in 2017 provided a model for other countries and demonstrated how clear regulations could support market growth and investor protection. The announcement of Facebook's Libra project (now Diem) in 2019 prompted a global regulatory backlash, highlighting the challenges facing large-scale crypto projects. The European Union's proposal of the Markets in Crypto-Assets (MiCA) regulation in 2020 aims to create a unified regulatory framework for cryptocurrencies, providing legal certainty, fostering innovation, and protecting consumers across the EU.

These examples illustrate how regulatory news can have immediate and profound effects on the cryptocurrency market. By understanding the historical context, investors and stakeholders can better anticipate and navigate future regulatory developments.

Direct Impacts on Crypto Markets

Regulatory announcements have a profound effect on the immediate price movements of cryptocurrencies, often causing significant volatility. When news about regulatory changes breaks, market participants react quickly, buying or selling assets based on the perceived implications of the news. Positive regulatory news, such as the approval of a cryptocurrency exchange-traded fund (ETF) or the legalization of cryptocurrencies in a major market, can lead to rapid price increases as investor confidence grows. Conversely, negative regulatory news, such as a ban on cryptocurrency trading or stringent new regulations, can trigger sharp sell-offs and steep price declines.

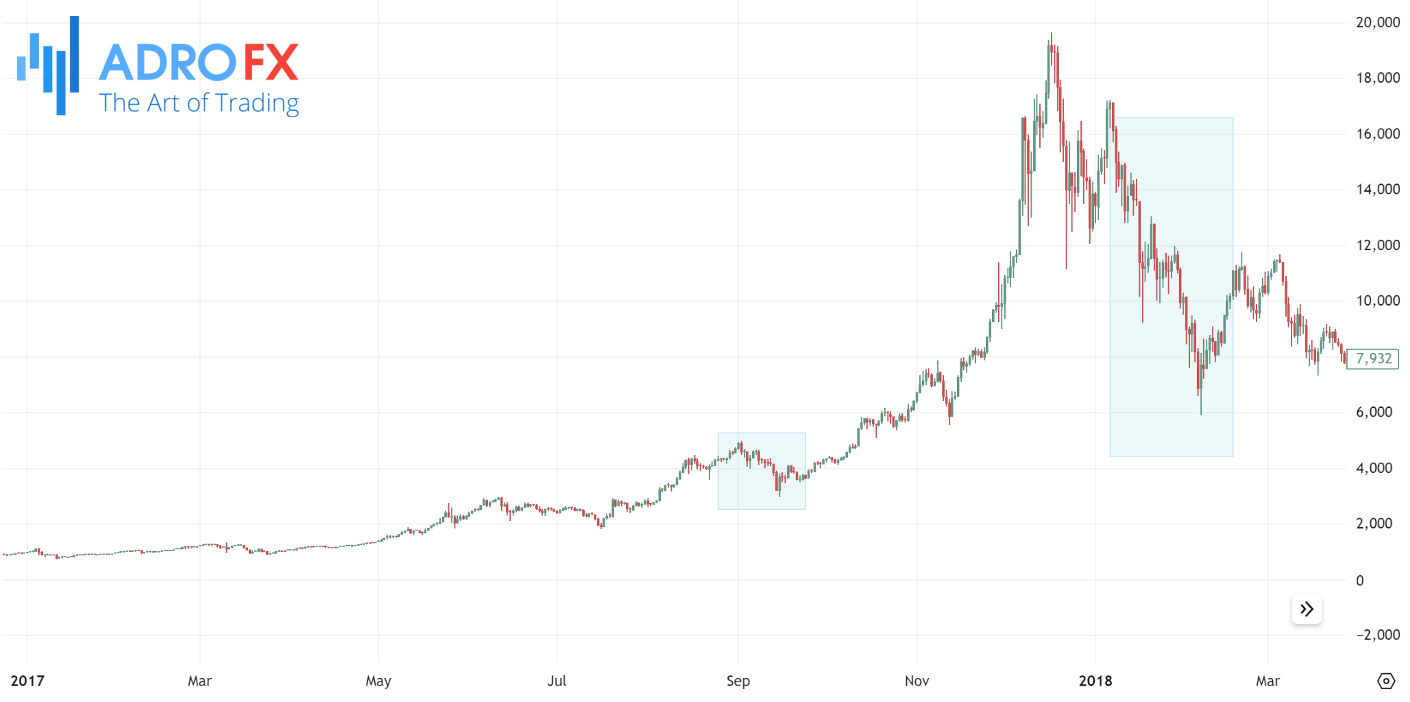

Case studies provide concrete examples of how regulatory news impacts the market. For instance, when China announced a crackdown on cryptocurrency exchanges and initial coin offerings (ICOs) in 2017, the market saw a dramatic drop in prices. Bitcoin's price fell from around $4,600 to $3,000 in a matter of weeks. Similarly, the US SEC's announcement of a delay in approving Bitcoin ETFs in 2018 caused a temporary market slump, demonstrating how regulatory uncertainty can lead to investor caution and market downturns.

Regulatory news also significantly influences market sentiment, shaping investor confidence and broader public perception. When regulators announce supportive measures, such as recognizing cryptocurrencies as legitimate financial instruments or implementing protective regulations, investor confidence tends to rise, leading to increased market participation and investment inflows. On the other hand, news of regulatory crackdowns or legal challenges can erode confidence, causing investors to withdraw from the market and leading to decreased trading volumes.

The media plays a critical role in amplifying the impact of regulatory news. News outlets, social media platforms, and financial analysts disseminate information rapidly, often framing regulatory news in ways that influence public perception. Positive media coverage of regulatory developments can boost investor morale and attract new participants to the market. In contrast, negative coverage can exacerbate fears and uncertainties, leading to more pronounced market reactions. Understanding the interplay between regulatory news, media representation, and market sentiment is crucial for investors seeking to navigate the volatile crypto landscape.

Long-term Impacts on Market Development

While regulatory news can cause immediate market fluctuations, its long-term impacts are equally significant in shaping the development and maturation of the cryptocurrency market. Regulatory clarity is essential for fostering market stability. Clear and consistent regulations provide a framework within which businesses and investors can operate confidently, knowing the rules and protections in place. This regulatory stability attracts institutional investors and mainstream financial institutions, which are often cautious about entering markets with ambiguous or volatile regulatory environments. As a result, clear regulations contribute to the overall maturity and stability of the crypto market, reducing volatility and promoting sustainable growth.

Effective regulation can create a safer and more mature crypto market by addressing key issues such as fraud, market manipulation, and consumer protection. For instance, requiring exchanges to implement robust anti-money laundering (AML) and know-your-customer (KYC) protocols can help prevent illicit activities and enhance market integrity. Regulatory oversight can also lead to the development of industry standards and best practices, further contributing to the market's credibility and reliability.

Regulatory frameworks have a dual impact on innovation and adoption within the cryptocurrency and blockchain sectors. On one hand, well-designed regulations can encourage innovation by providing a clear legal foundation for new technologies and business models. For example, regulatory sandboxes allow companies to test innovative solutions in a controlled environment, fostering experimentation and development without the risk of immediate regulatory penalties. Supportive regulations can also attract investment in research and development, driving advancements in blockchain technology and expanding the potential use cases for cryptocurrencies.

Conversely, overly restrictive regulations can stifle innovation and hinder the adoption of cryptocurrencies and blockchain technology. Excessive regulatory burdens, such as high compliance costs or stringent operational restrictions, can discourage startups and smaller companies from entering the market. This can limit competition and reduce the diversity of technological solutions available. Moreover, restrictive regulations can push innovation to more permissive jurisdictions, leading to a fragmented global market and hindering the cohesive development of the crypto ecosystem.

Regulatory developments also impact the adoption rate of cryptocurrencies by influencing public perception and trust. Positive regulatory endorsements can enhance the legitimacy of cryptocurrencies, encouraging wider acceptance and use among businesses and consumers. For instance, the adoption of cryptocurrency-friendly regulations in countries like Switzerland and Singapore has positioned them as global hubs for blockchain innovation and investment. Conversely, negative regulatory actions can deter adoption by creating uncertainty and fear among potential users and investors.

Regional Differences in Regulatory Approaches

Regulatory approaches to cryptocurrencies vary significantly across different regions, reflecting diverse attitudes, priorities, and legal frameworks. A comparative analysis of regulatory environments provides insights into the distinct approaches taken by major markets such as the USA, EU, and China, among others. While some jurisdictions have embraced cryptocurrencies and blockchain technology with open arms, others have adopted a more cautious or restrictive stance.

In the United States, regulatory agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) play key roles in overseeing the crypto market. The regulatory landscape is characterized by a patchwork of federal and state regulations, with agencies grappling to define the legal status of cryptocurrencies and establish regulatory frameworks for exchanges and other crypto-related businesses. Regulatory clarity remains a significant challenge, contributing to uncertainty and volatility in the market.

The European Union introduced the world's first comprehensive cryptocurrency regulations in May 2023, known as the Markets in Crypto-Assets Regulation (MiCA). The European Securities and Markets Authority is currently in a consultation process with the public on several measures. Any company issuing or trading cryptocurrency will need a license, and from January 2026, all service providers will have to obtain the names of senders and beneficiaries, whatever the amount being transferred. Further, any self-hosted wallets holding over 1,000 euros will need to undergo wallet ownership verification for transactions. The collapse of FTX highlighted the urgent need for imposing rules to better protect European investors and prevent misuse of the crypto industry for money laundering and terrorism financing.

In contrast, China has implemented some of the most stringent regulations on cryptocurrencies, including bans on cryptocurrency trading, initial coin offerings (ICOs), and crypto mining activities. The Chinese government views cryptocurrencies as a threat to financial stability and capital controls and has taken aggressive measures to curb their use and proliferation. China's regulatory crackdowns have had a significant impact on the global crypto market, causing price volatility and disrupting industry trends.

Case studies provide valuable insights into the specific regulatory approaches taken by different countries and their impact on the global crypto market. For example, China's crackdown on crypto exchanges and ICOs in 2017 triggered a massive sell-off and contributed to a prolonged bear market. In contrast, El Salvador's adoption of Bitcoin as legal tender in 2021 marked a significant milestone for cryptocurrency adoption, illustrating the potential for regulatory decisions to shape market dynamics and influence investor sentiment on a global scale.

Strategies for Investors and Stakeholders

Navigating the complex and evolving regulatory landscape requires careful risk management and strategic planning for investors and stakeholders in the cryptocurrency market. Given the inherent uncertainty and volatility associated with regulatory changes, adopting proactive risk management strategies is essential for safeguarding investments and mitigating potential losses.

One key strategy for investors is to stay informed about regulatory developments and remain adaptable to changing market conditions. By monitoring news updates, regulatory announcements, and policy changes, investors can anticipate potential risks and adjust their investment strategies accordingly. Building a diversified portfolio that includes a mix of cryptocurrencies, stablecoins, and traditional assets can help spread risk and mitigate exposure to regulatory uncertainty.

Despite the challenges posed by regulatory changes, they also present opportunities for savvy investors to capitalize on emerging trends and market shifts. Identifying opportunities created by new regulations, such as the legalization of cryptocurrencies in certain jurisdictions or the introduction of regulatory frameworks for crypto assets, can provide a strategic advantage. Investors can leverage regulatory developments to make informed investment decisions, identify undervalued assets, and position themselves for long-term growth.

Additionally, engaging with regulatory authorities and participating in industry advocacy efforts can help shape regulatory policies and promote a favorable regulatory environment for cryptocurrencies. By advocating for clear and sensible regulations that support innovation while protecting investors and consumers, stakeholders can contribute to the long-term growth and sustainability of the crypto market.

Conclusion

Regulatory news significantly shapes the cryptocurrency market, influencing investor sentiment, market volatility, and industry trends. Understanding its impact is vital for investors and stakeholders to navigate effectively.

Throughout this article, we explored how regulatory changes impact crypto markets, from immediate price fluctuations to long-term market development. Different types of regulatory news, such as new laws and policy changes, affect market dynamics and investor confidence.

Regional differences in regulatory approaches also play a crucial role. Case studies illustrated specific countries' regulatory decisions and their effects on market sentiment and industry trends.

It's essential for investors to adapt to regulatory environments. Regulatory clarity fosters a safer market, while uncertainty leads to volatility. Staying informed, adopting proactive risk management strategies, and leveraging opportunities from regulatory changes are key for navigating the crypto landscape.

Looking ahead, regulatory trends will continue evolving as governments address digital assets' challenges and opportunities. Balancing innovation and investor protection will likely be regulators' focus.

The long-term implications include increased market maturity, stability, and mainstream adoption. Integration into traditional financial systems, the rise of central bank digital currencies, and the evolution of decentralized finance will shape the future.

In conclusion, regulatory news remains a significant driver of the cryptocurrency market. Understanding its implications is crucial for navigating challenges and seizing opportunities. With vigilance, adaptability, and proactivity, participants can thrive amidst regulatory changes, fostering growth and innovation in the crypto space.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.