How to Use Trailing Stop to Protect Yourself from Losses and Take Profits

Trailing Stop is an effective tool for flexible trading risk insurance. It allows a trader to gain maximum profit by changing the level of Stop Loss automatically.

It can be used independently as a risk insurance tool and as an element of a strategy.

Below you will learn what is a Trailing Stop, how to use it, what are the strategies for using it, what are the advantages and disadvantages of this tool and recommendations on trading with this risk insurance tool.

What Is a Trailing Stop

Trailing Stop is a tool, which allows you to automatically change the level of Stop Loss with a lag of the specified number of points.

Trailing Stop in simple words is an effective tool, which changes the point of fixing losses depending on the current market situation.

Basically, the essence of the Trailing Stop is the following - if the market dynamics at the moment are positive (for example, we have a bullish trend and open a long position), then the Stop Loss gradually moves up. But if the price changes direction, it remains at the same value until the position is closed.

How to Set a Trailing Stop in MetaTrader 4?

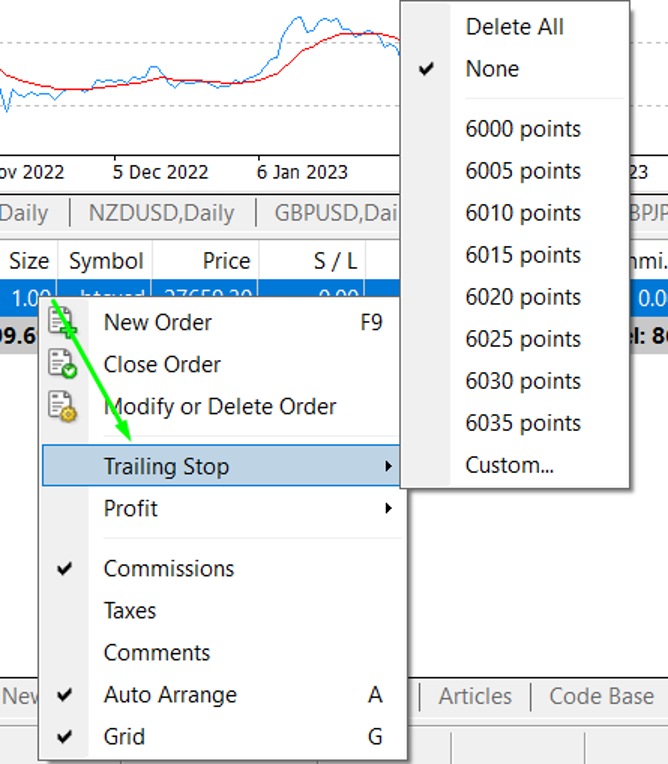

Learning how to set a Trailing Stop in MT4 is very simple. To do this, you need to right-click on an open position and in the context menu point to the "Trailing Stop":

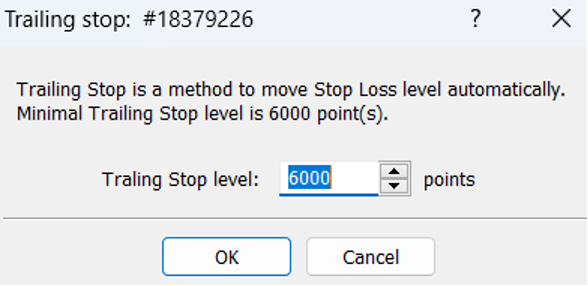

Then a new menu will appear, where you can select one of the options for the duration of the lag before the Stop Loss is moved. If none of the existing options suits you, you can set your own:

To disable the function, you need to select "None" in the same context menu.

The mechanism of the Trailing Stop in MetaTrader is quite simple. The terminal compares the current price with the set value of the Trailing Stop. If the market moves against the trader, the Stop Loss value does not change. But if the dynamics are positive, it moves after the price.

Some traders recommend placing a Trailing Stop at the level of a few pips. But it is not a good idea because the price can fluctuate in a much larger range, especially in volatile markets.

The value is set according to the situation, the desired level of risk, and the trading experience.

Trailing Stop EAs

There are many advisors to set Trailing Stops. This tool can be prohibited by some brokers, but this problem can be solved. To do this, you need to install a virtual Trailing Stop on your computer, which does not work on the server side of the broker, but at the trader.

In the custom Trailing Stop, you can specify the settings when the stop is moved in steps (that is, as soon as the price passes a certain number of pips).

There is an option to enable virtual Trailing Stop only when the price reaches breakeven. Before that, regular Stop Loss orders are used. But this method is not suitable for scalping.

The position maintenance can be carried out with the help of Trailing Stop Advisors.

Compression Strategy

The greater the total profit of a trade, the smaller the number of points required to shift the Stop Loss. Consequently, a smaller pullback is needed for it to work. It is good to use this strategy when trading in a channel, trading news, or together with breakout trading systems.

Evaluating Volatility

The first thing to do is to place an indicator that measures the degree of volatility of the market. After that, we look at changes in its readings. If the volatility rises, the distance between the price and the Stop increases. If it falls - on the contrary. This strategy performs poorly during times of high volatility, for example before or after an important news release.

Trailing Parabolic SAR

Trailing Stop by Parabolic is not a unique phenomenon, it is just one of many possible variants when the Trailing Stop is calculated by the indicator.

As for the settings, there are only 2:

- DistancePoints – it is a step of stop shift;

- AllowLoss – if it is enabled (true), the Trailing Stop will be executed even if the trade has not yet moved to breakeven.

Common Mistakes Using Trailing Stop Expert Advisors

Robots are just tools, the main work is done by the trader, and to get a stable profit, you need to set everything up properly, taking into account many nuances.

- Excessive profit expectations. You should not be greedy, otherwise, the trade may last much longer than you think, or even close to zero. In a difficult situation, it's better to open 2 trades and take 50 pips at once than to wait for one to bring in 150 pips at once.

- Applying the robot in all situations indiscriminately. No matter how good a Trailing Stop EA is, you have to remember that trading during important news releases, in a lower time frame, and flat conditions is the least effective way for such robots, and they can even bring losses.

- The step is too short for moving stops. In such cases, the proper operation of a Trailing Stop can be damaged by a set spread, market slippage, and restrictions by a broker if the company considers that the client is scalping.

- Lack of a complete picture of the market. The robot is not an analyst and all it can do is rely on the data of several technical indicators, it does not see the whole situation, so without the trader's control in case of a trend breakout or sideways movement, the expert advisor will not get oriented and most likely will mess up all the account.

How to Apply a Trailing Stop Manually

There are many variants of the Trailing Stop application in trading strategies, so you do not need to be committed to any particular method. Make sure to practice working with Trailing Stop on a demo account and develop your comfortable style and strategy.

You may use the following ideas as a basis:

- A conservative trading strategy following the trend. Each asset has average volatility for the period. If the average volatility for the day is 60 pips and the price has moved 10 pips since the beginning of the day, then there is a possibility of a further move of 50 pips.

What to do:

Wait for the beginning of a strong move. Signals: rebound from resistance/support, reversal patterns, etc.

You open a position and set the Take Profit value at "+50" points. Set a static Stop Loss.

Monitor the trade. When the price passes 25 points, close 50% of the position. The remaining 50% you leave in the market, securing with a Trailing Stop of 10 points. Stop Loss is moved to breakeven level - the level of opening of the position. This is needed in case Trailing Stop does not work due to a lack of connection between the server and the platform.

The first half of the position has already been closed in profit. The second half can be closed in the best-case scenario at Take Profit. In the worst case with a profit - "25 - 10 = 15" points.

This approach is conditioned by the rules of risk management and psychology, which recommend not to "squeeze the maximum out of the trend", but to be content with the average result to cover possible losses, leaving a part of the position in the area with an increased risk.

- Swing trading pullback strategy. Swing trading is trading along the trend with opening trades at the moment when the correction is over. The question is whether the correction is really a correction. Or is the price reversal the beginning of a new trend? And the second question: will there be a next extreme, or will price draw a "double top/double bottom"?

What to do:

At the end of the correction, open a trade and set a Trailing Stop above/below a fixed length. For example, the depth of correction - 25 pips, Trailing - 10 pips.

If the correction turns out to be a new trend, your loss is 10 pips. The Trailing Stop will work as a Stop Loss here. If the price returns to the previous extremum and then retraces and turns into a new trend (double-top/double-bottom pattern), the trade will close with a 15 pips profit. If the main trend continues, the trader's profit is the price move along the trend.

Pending orders can be used in this strategy. For a long position - Buy Limit, for a short position - Stop Limit, to which a Trailing Stop order can be applied.

How to Calculate a Trailing Stop

There are several ways to determine the Trailing Stop length:

- Refer to the resistance and support levels. For example, on the trending movement of the current price, you see that the average depth of a correction is 20 pips. Set a Trailing Stop at a distance of 25 pips so that the trade remains hedged, but the correction does not catch it.

- Use the Fibonacci retracement levels. Set the Trailing Stop just below the nearest retracement level. If the correction is not deep, the price will bounce from the level in the direction of the trend and the trade will remain in the market. It is possible to set a Trailing Stop over the level - the question is in the chosen strategy.

- Use the volatility indicator ATR. The length of the Trailing Stop is calculated as k * ATR, where k is a multiplier. The theory recommends taking k = 2 for quiet markets with moderate volatility. But it is better to select the multiplier manually adapting it to the volatility of the asset and to the trading system.

- Focus on the local extremums. This method is suitable for intraday strategies with a target profit of 20-30 pips and 4-digit quotes. The idea is that the price is more likely to stay inside the channel formed by the extrema than to go out of it.

The logic of the Trailing Stop calculation is similar to that of Stop Loss.

Pros and Cons of Using Trailing Stops

Let us briefly summarize the advantages and disadvantages of using a Trailing Stop in trading. Let us start with the positive aspects:

- The ability to further increase profits with reduced risks;

- It is insurance against sharp trend reversal;

- No need to stare at the monitor and watch the market for a long time. As soon as something goes wrong, the position is closed automatically;

- The ability to use it on different assets;

- This feature is already built into MetaTrader and can be used in any time frame you like.

But nothing in the world is perfect, and Trailing Stop has its disadvantages, too:

- The Trailing Stop is a script, so it is capable of running solely on the trader's computer. In addition to the fact that you constantly have to keep it enabled, interruption of Internet or electricity can drain your deposit. The problem is solved by installing the terminal on a VPS server;

- This method is dangerous to use for a beginner during strong market volatility. At this time strong pullbacks within the long-term trend are possible. As a result, the trader might miss the profit;

- Trailing Stop should be placed manually after each open trade. And if the order is pending, then only after its triggering. This is inconvenient, but the problem can be solved using robots, in which this mechanism can be written.

Nuances of Working with Traling Stop

When using a floating stop, you need to take into consideration the following nuances:

- The need for an individual approach. The trader needs to manage the Trailing Stop based on the market situation. All of the strategies described above are great only under certain conditions. Therefore, you need to choose a Trailing Stop on your own, based on the conditions of the trade and the type of currency pair. For example, the more volatile it is, the greater the value the price must pass to change the stop order. This is done to insure against significant corrections;

- Even if the computer is turned off or the Internet is lost for some reason, the old stop order will still remain. It just will not change its position until you restart the terminal. This feature can be used in your strategies if, for example, you have to turn off your computer;

- First set the Stop Loss at a safe level, according to your strategy. After the Trailing Stop triggers, it will cancel itself. The number of Trailing Stop pips should be further determined flexibly;

- To insure against Trailing Stop disabling during force majeure like computer shutdown, power off, internet... - always set Stop Loss, because it will trigger from the broker's side. Even if you turn off the terminal, Stop Loss will be executed. So when setting a Trailing Stop, always place a regular Stop Loss first.

Conclusion

Keep in mind that you can make a profit when using a Trailing Stop, but it's not guaranteed. It all depends on trading experience, which is what professionalism is all about. There are situations where Trailing Stop is useless or dangerous, for example, during a flat market, when the price regularly returns to its initial value and can activate a stop order at an inopportune moment. That's why its use is possible only during trending markets.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.