How to Use Stochastic Indicator for Forex Trading

The Stochastic Oscillator is the full name of one of the most popular technical indicators, which is included in 80% of all existing trading strategies, if not more. It is a favorite tool for determining trend reversal points, both for beginners and experienced pros.

And all thanks to its simplicity and high efficiency. In this article, we will learn how to configure the indicator for profitable trading, and what strategies to choose.

What is a Stochastic Oscillator

Before we proceed to the analysis of trading strategies, we should first understand what the Stochastic indicator is. Without knowing its formula and algorithm, which is used for its calculation, you will not be able to make a full-fledged analysis. You must learn to understand and feel the market, and not just blindly follow the signals and recommendations of computer programs.

The Stochastic Oscillator is an indicator of technical analysis, which shows the % correlation of the closing price and the maximum extrema over a certain period of time.

In simple words, Stochastic allows you to determine when the trend reverses and prompts you when to open a position.

Stochastic is versatile. It can predict both currency pairs and shares with equal efficiency. That's why it is widely used in forex trading, stock markets, and futures trading. Even the cryptocurrency market can be analyzed with the help of this indicator.

Thanks to its algorithm Stochastic is able to calculate the following key moments for the successful opening of trades:

- Local highs and lows of the price;

- Divergence and convergence;

- The beginning and the end of a trend or the beginning of correction against it.

It is not for nothing that many beginners see it as a kind of "Holy Grail" of trading. And if you learn to use it correctly, then the ratio of profitable and loss-making trades will greatly shift in favor of the former.

The indicator is based on a simple pattern, whereby in a bullish trend the price is fixed at the level of the local maximum, and in a bearish trend - on the contrary, at the level of the minimum.

Before we get into the peculiarities of its application, we should remember its origins.

The History of Creation

This indicator is considered one of the oldest - it was created in the 50s of the last century. Its creator is the famous trader, economist, and just a good man - George Lane.

When creating it, he based Momentum, that is, how much the amplitude of the price changes. It is calculated as the difference between the price now and the price a certain time ago. According to Lane, when Momentum changes, the price changes immediately thereafter.

Calculation Formula

All calculations are made automatically in a fraction of a second, as soon as you put the indicator on the chart in the working terminal of your computer. But imagine, George Lane calculated everything manually. How much hard work it was!

On the scale of the indicator Stochastic presents two lines %K and %D. They are calculated as follows:

%K = (Current closing price - Local minimum for the selected time period) / (Local maximum for the selected period - Local minimum for the same time interval). *100.

%D = it is a classical indicator of the Simple Moving Average SMA, which is taken for a certain time period %K.

In other words, there are two lines on the scale, where

%K is fast,

%D - slow.

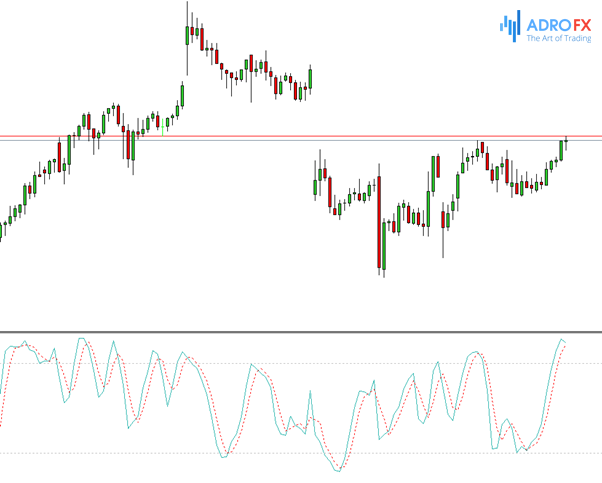

Visually on the chart, they move approximately next to each other on a scale from 0 to 100. The %K shows the closing price in relation to the specified time interval and %D is the classical MA.

A complete indicator is constructed based on three parameters:

- Period to build %K;

- Smoothing factor;

- Period for %D determination.

But the modern variant of the indicator is an averaged instrument between the first two parameters.

How to Use the Stochastic Indicator

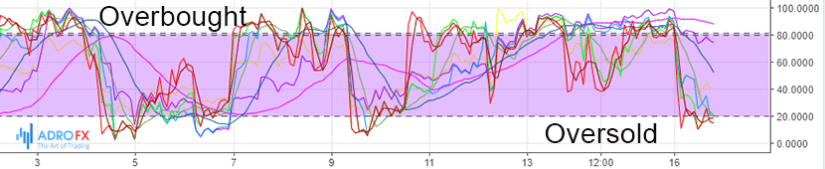

Two lines are moving on a scale from 0 to 100, up and down. But to be fully effective, one should also consider the overbought and oversold areas:

- Overbought - 80 to 100;

- Oversold - from 0 to 20.

These levels are recommended by the creator, but a trader can change them in the settings according to their individual trading strategy.

Due to the fact that it is an oscillator by definition, in contrast to classic instruments such as Moving Average, Bollinger Bands, and others, which have lagged signals, Stochastic, on the contrary, shows leading indicators. This is exactly why it is valued by experienced professionals.

It is believed that when the price hits a critical zone, it is just a preliminary signal of change in trend, but not the final one. If the trend is strong, Stochastic lines may stay in the critical oversold/oversold areas for a long time. And only their exit from them with a subsequent change in the trend will be a signal to buy or sell, respectively.

George Lane himself said that a strong signal will be the exit of the line from the overbought/oversold area.

Indicator Setting

Most trading strategies are based on the basic settings of the Stochastic. It is not recommended for beginners to change them, as they have been included in the program since the creation of this indicator by smart people. They can be changed only when the trader has gained enough experience and knowledge to be able to correct these important aspects independently. The signals will also directly depend on them.

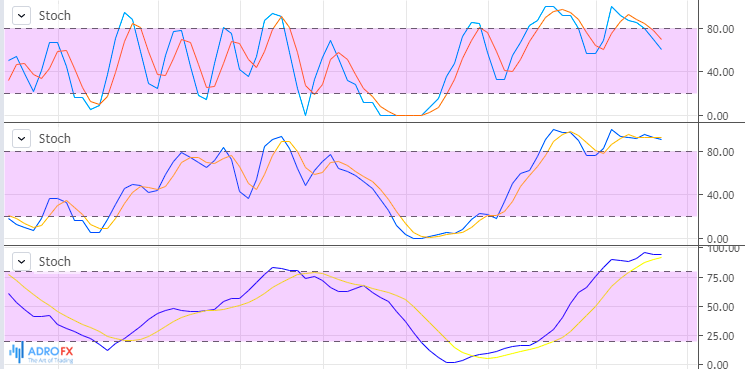

The settings of this indicator are quite complex, so not to get lost in them, it is necessary to remember that there are three versions: Full, Fast, and Slow.

Typically, Stochastic parameters are indicated on the chart or in trading strategies by three numbers. For example, in 5:3:3. The first and last correspond to all of the above versions. But the second is only the Full version.

Depending on the platform you will be analyzing, the settings panel can be different. We will look at the most popular and widespread terminal, MT4, as an example.

When you open the settings, you will see four tabs:

- Parameters;

- Colors;

- Levels;

- Visualization.

The first is the most significant for us. Here the values of periods are set, it's the main indicator setting, from which in the future will depend on how often and accurately the trading signals for trades opening will be generated.

%K - number of periods;

%D - period of Moving Average;

Slowing - level of smoothing, i.e. roughly speaking it is a level of sensitivity of indicator;

MA method - a type of Moving Average (there are several of them - simple, exponential, linear weighted, smoothed, each depends on what price is involved in the calculations);

Price field - what prices will participate in calculations - low/high, close/close.

In the "Colors" tab you can individually color the display of instrument lines on the chart. "Levels" are the boundaries of overbought and oversold areas. By default, they are at 80 and 20, respectively. They are recommended by the indicator's creator. But it is possible to change them for others. For example, some professionals increase them to 90 and 10 in order to reduce the number of false signals or, conversely, to increase the number of potential trades.

Choice of a Time Frame

The Stochastic Oscillator is a universal indicator, which is ideal for all trading assets and time frames. But depending on the selected time frame, it is necessary to change the settings.

The basic parameters are 5:3:3. You can change the first digit to 7, and the readings will be approximate. This will be suitable for short-term trading on 5-15 minute charts.

For the higher time frames 1-4 hour H1 or H4, as well as for the daily charts, it is necessary to set a higher period for the %K line, approximately 9-21. And for the analysis of the weekly chart, the Stochastic (21:7:7) is perfect.

The lower the value of the periods, the more signals the indicator will generate. But be careful, because along with it the number of false signals increases. That is, those in which trades with a higher degree of probability will close in losses.

In Picture 3 above there is a clear example of the difference in Stochastic readings at the settings 5:3:3; 14:3:3; 21:7:7. The slowest settings, which are the last, will react only to the strongest fluctuations. Accordingly, market noises are smoothed out, and signals will be clearer and more reliable. What cannot be said about the first type.

What timeframe to choose? Every trader will choose it for themselves. There are many successful strategies for both low and high time frames. But George Lane himself used the daily and weekly time frame in the creation of his technical masterpiece.

It is best to use Stochastic with settings from 10:3:3 to 21:14:14. This is the optimal range for beginners.

How to Use the Stochastic Indicator and Its Signals

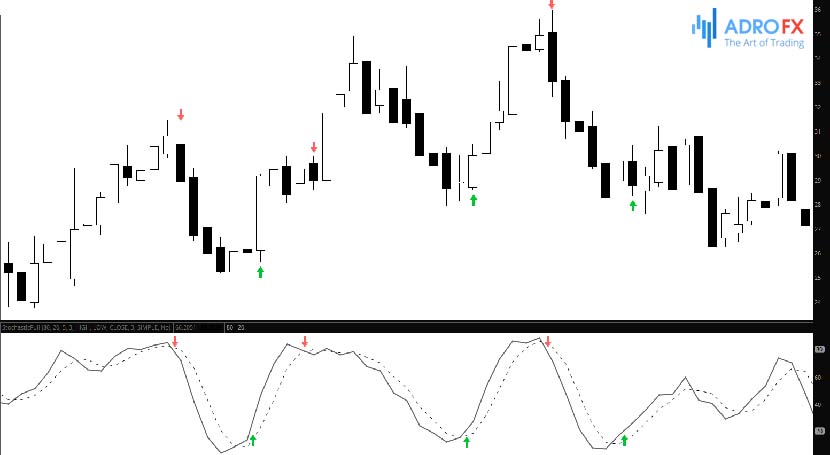

This technical tool of market analysis can generate different types of trading signals. But the most common ones are:

- Entering the critical areas of overbought and oversold;

- The crossover of the lines %K and %D with each other. The important thing is in what zone relative to the scale this crossover occurred;

- Divergence.

Earlier in the article, it was already mentioned about the moment when the market is in a strong trend. At this point the Stochastic indicator is powerless. All of the above types of signals will be useless, because Stochastic lines will prevail in one of the critical zones, constantly crossing each other. Beginners often confuse this by opening positions that end up being unprofitable.

And now let us analyze the other types of trading signals when it is necessary to open a position. The first is the exit from the critical overbought and oversold areas. That is - the intersection with lines 20 and 80.

Long positions are placed after the close of the candlestick, in which there was a downward crossover of the %K with the 20 lines. Short - when the line 80 is crossed in the downward direction.

That is, when the price leaves the overbought area, the uptrend is more likely to end, and then sellers will come to the market, which will lead to the change of the trend to the opposite downtrend.

The next type of signal is the intersection of lines %K and %D. But it is not worth paying attention to all intersections. But only on those that occur in the overbought and oversold areas. Thus, market noises and false signals will be eliminated at least somehow.

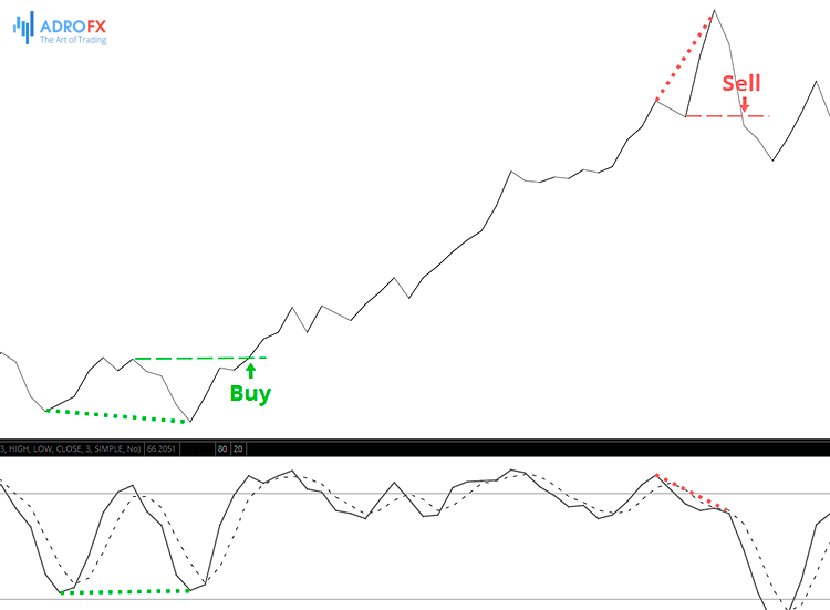

Divergence and Convergence

Since Stochastic refers to the oscillator indicators, all of them have quite strong trading signals - divergence. This word frightens newcomers, but it is loved by experienced professionals. And this is because trades based on divergence have a very high chance of success.

What is divergence? It is a discrepancy between indicator readings and what we see on a chart.

Let us assume that the price is making a new high and the Stochastic is falling, at the same time it is making a new low. For clarity, it is advisable to connect them with a single solid line.

When such a line is found, it is assumed that Stochastic is right. It means that the price will really turn in the direction forecasted by the indicator.

Experienced professionals recommend combining the Stochastic with any trend indicator, which will serve only as a filter, in order to avoid losses. A great combination is Stochastic and the Simple Moving Average. But we will talk about that a little later.

Stochastic Trading Strategies

The oscillator can be used as an independent indicator. But it is better to complement it with others, thus creating combinations that will filter out each other's false signals. This will improve the quality of trading.

Two Stochastics

One of the most popular and time-tested trading strategies, which is particularly popular among experienced professionals.

It is recommended for medium-term trading, for which the four-hour and daily time frames will be optimal. Its main task is to open two Stochastics on the chart at the same time, but with different settings, which should be changed in the parameters, as already mentioned above in the article.

For the first indicator and the most basic one, we change the settings to 21:9:9, and for the second auxiliary - 9:3:3.

The trade is opened only when a simultaneous coincidence of readings of two indicators has occurred. This allows you to perfectly filter out false signals, which will produce a faster Stochastic 9:3:3.

Stochastic and MACD

The MACD is a favorite technical indicator for many traders because it combines an oscillator and a trend indicator. It is equally successful whether trend-following or flat-lining, owing to its versatility.

If you combine these two indicators at the same time, you can increase the effectiveness of your trading.

In this strategy, the MACD is used to identify trends and the Stochastic is used for accurate entries. Important - trade only within the current trend.

When the MACD histogram is above zero, the market is in an uptrend. And when it is below it is in a downtrend. When the histogram crosses the zero level downwards it means that the trend changes from bearish to bullish and vice versa.

Stochastic and Bollinger Bands

Another strategy involves combining the Stochastic with another equally popular indicator - the Bollinger Bands.

It is a versatile independent indicator, which is a powerful tool in making a profit in the forex market. Its main task is to determine the corridor of price movement. It is considered that the price stays within this channel 80% of the time. Correspondingly, when the price approaches its lower boundary, it is more likely to bounce from it, as if from a support level, and go upward. And vice versa, from the upper boundary the price will go downward.

To avoid false signals, these moments must coincide with the simultaneous crossing of Stochastic lines in the critical overbought and oversold areas.

Stochastic Oscillator, RSI Relative Strength Index, and Moving Average MA

Another successful trading strategy is versatile and can be used in any time frame. Except for too short 1-5 minutes.

We set up the indicators as follows:

- For Stochastic, change the settings to 14, 3, and 3;

- For the RSI, we put the period of 14, the critical levels of 70, 50, and 30;

- We add two Exponential Averages with periods of 5 and 10.

We place buy orders when the following signals coincide:

- Both Stochastic lines are looking up, but have not yet reached the overbought area.

- The RSI line is also above its midpoint of 50.

We place sell orders at the same time when the following signals coincide:

- Stochastic oscillator lines are directed downward but have not yet reached oversold;

- RSI is below 50.

Tips for Using Stochastic Oscillator

It is believed that the indicator works well in a flat market, like all oscillators. The sideways trend must have its own corridor, not just a horizontal solid price.

To filter the false moments it is better to use Stochastic in addition to other trend indicators and try to open positions only in the direction of the probable trend because the profit of small fluctuations can eat the spread, especially on exotic pairs.

And do not stop there. Study technical analysis in its entirety, because it is not limited to indicators. Chart and candlestick analyses are very effective. Study the methodology of Price Action, learn how to properly build support and resistance levels, and learn the basic reversal combinations of Japanese candlesticks.

Always check the indicator signals in higher time frames. Apply this approach to identify more accurate trading signals.

Conclusion

Since Stochastic is an oscillator by nature, it works on the principle of wave theory and momentum movement of the market. When used competently, it can become a powerful tool for making stable earnings in the forex market.

But it is important to correctly set the settings depending on the time frame in which the chart is analyzed. And for beginners, it is better to avoid short-term trading because Stochastic does not show the best results due to significant market noise.