How does copy trading work?

Copy trading is one way to minimize the risk in your investment strategy. If you are new to the world of forex or don't have time to dive into the nuances of trading, copy trading may be a perfect solution. But how can you choose one account out of dozens or even hundreds? That can be a real challenge!

No worries, we have you covered! Here are five steps to pick the best account to copy.

Step 1: Choose a copy trader

Before you start copying the trades of professionals, you need to decide on a provider and choose the one you think is right for you and your goals. Let's find out what points you should pay attention to so you can get the most out of copy trading and not be disappointed with your choice.

Step 2: Analyze the work of a copy trader

1. Copied trader's profile

The Allpips copy trading platform is an incredibly handy tool for choosing the perfect provider because here you get lots of information at your fingertips once you click on a specific trader profile.

2. Copiers and APUs

The very first thing that catches your eye is the number of traders copying. It gives you an idea of how popular a trader is. However, you have to be wary of accounts with a very high number of subscribers. Consequently, it is best to choose the golden mean.

3. Trader statistics

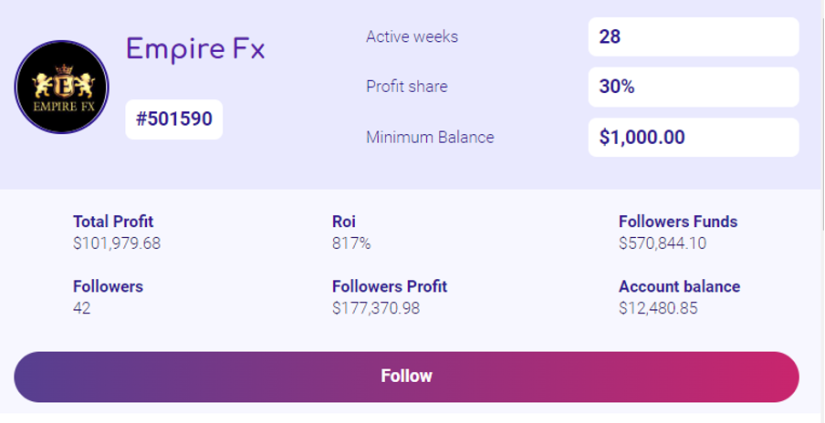

To learn more about this or that trader, you should go to the Follow Traders tab on the platform and click on the account that appeals to you the best. Here is what the provider`s profile looks like:

When choosing a provider to follow, you need to consider the trading performance of the account under research:

Profit is the main parameter that reflects the level of professionalism of the trader. You can view the profit for the day, week, month, or all time. It is much more reliable to analyze long periods because they show the real picture.

Active weeks – this indicator reflects how long the trader has been trading. However, it is not uncommon to find diamonds among beginners showing impressive results.

Profit share – any trader charges a commission, the amount of which is set by themselves. As you see, there is no need to pay some predefined fee, the provider`s reward is determined only by the profit made. In most cases, it can be from 10% to 40%.

Minimum balance – the required account balance to start following the underlying trader. As a rule, it`s around $100 and above. Pay attention that when subscribing to a particular trader, you set copy ratio, and if you are going to increase it (by default, it`s 1,0), make sure to raise your capital accordingly.

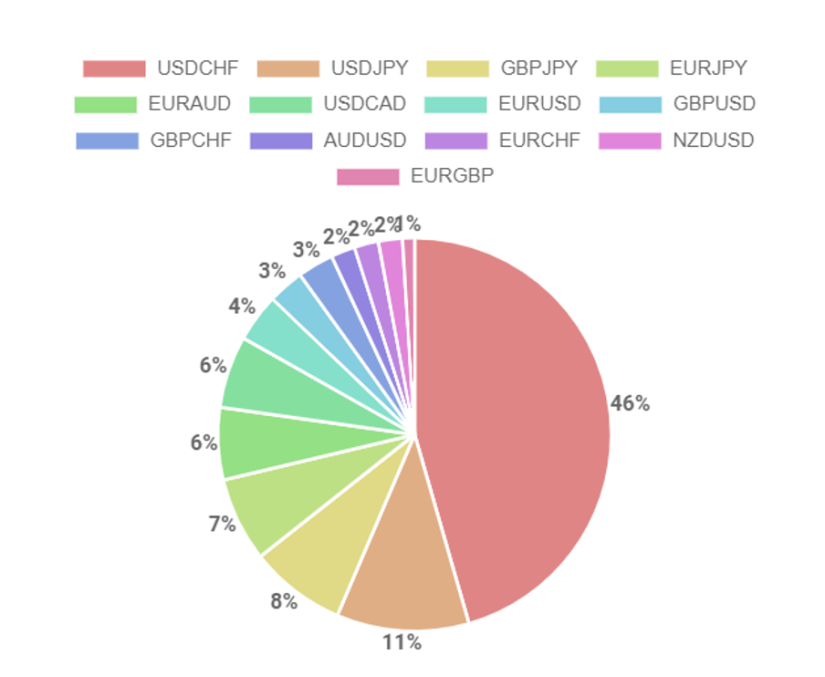

Also, in the trader`s profile, you can see such statistics as the most traded assets:

4. Average return

Some copied traders mention expected monthly returns based on backtesting and previous performance of the strategy. As a rule, copy trading brings up to 50%-60% depending on the situation in the market (as you know, the price may fluctuate differently), the trader`s strategy, and the chosen financial asset, of course. That is why you should pay attention to providers that trade multiple assets. In such a way, there will be more trading opportunities and fewer risks due to diversification.

Still, we must remind you that prior results cannot guarantee the same results in the future but can be one of the indicators to assess the trader`s professionalism.

5. Risk assessment

As you know, assessing potential risks is not an easy thing. Hence we hope you do not mind some simple tips to consider. First of all, pay attention to the stats chart. For example, if there are some big profits on the profile, it may indicate that this provider trades aggressively. Also, check which assets are traded by the underlying provider. Most professionals will agree that trading only one currency pair is not the best decision, and you might want to reduce risks by not putting all the eggs in one basket.

Step 3: Decide how much you want to invest

Determining the amount of investment is one of the essential decisions. The minimum threshold depends on the chosen provider since they all have different requirements. It is better to divide the funds between several traders – it will help reduce potential risks.

Step 4: Compare Copied Portfolios

By now, you should have at least several traders in mind, the ones that suit you more than the others. Of course, you can go through them thoroughly (check the trading history, pay attention to the traded assets) and pick one. Or you can test them all, reducing the ratio to 0,5 and keeping just one after some time. Or you can copy trades from several accounts at the same time. The decision is yours.

Step 5: Copy current trades

As soon as we are done with the choice of provider, you are good to start trading. Now you need to deposit your account, set the copy ratio and click the Follow button. From that very moment, all the copied trader`s activity will be duplicated on your account.

1. Add more funds

Pay attention that you can add more funds to your trading account anytime you think it`s needed or if you want to increase copy ratio when satisfied with the results.

2. Automatic fix

Copy trading is similar to automated trading since it is a passive income, and there is no need to watch the charts or control the current positions. All the orders are opened and closed automatically. By the way, it is not advised to adjust them manually. Just let the provider`s strategy do the job and watch your profit grow.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any trader's needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all of the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.