High-Frequency Trading (HFT) - Overview, Advantages, Risks

Everyone who is interested in financial markets, of course, knows about the existence of different trading methods. Some of them are quite popular, while not much is known about others, in spite of the fact that they have existed for more than one decade.

An example of this is HFT trading, which is an abbreviation of high-frequency trading, and the method itself implies fast trading in which orders are opened and closed in a fraction of a second. Today we will learn more about this trading system, as well as will go through its risks and benefits.

What Is High-Frequency Trading?

High-frequency trading is one of the main methods of algorithmic trading in the financial markets. This method involves the use of software that allows trading positions to be opened and closed almost instantaneously.

High-frequency trading presupposes a sufficiently powerful computer and a good Internet connection. Any lag or other delay can cause you to fail to meet the terms of the forex strategy and take a loss.

The history of this method goes back to the late 1990s when the SEC gave the American Securities Commission the go-ahead to use electronic forex trading platforms. Essentially, high-frequency trading was a method of scalping the market. The trades were opened for a few seconds.

Over time, of course, the time to hold positions decreased even more. Now it is only a fraction of a second. This is how high-frequency trading differs from other methods of working with financial assets.

Today the average position holding time for such traders is no more than 22 seconds. At the same time, a large number of orders are placed. High-frequency trading is mainly used so that the trader could not carry his positions over to the next trading day and still attain quite good yield.

High-frequency trading presupposes opening trades in large volumes. Targets are usually very small (taking into account the fact that trades are held for fractions of a second). Sometimes a return on one trade can be as little as a few cents. That is why large volumes are important here for getting sufficient yield.

It is worth immediately noting that this method of trading carries rather high risks. The matter is that it does not imply the accumulation of positions. High-frequency trading means opening and closing positions within a few seconds, sometimes even a fraction of a second. Correspondingly, there are high risks of losses.

It can be said that high-frequency trading is a kind of scalping strategy, moreover, quite aggressive. When opening trades with large volumes you must realize that in case of long position holding, the losses may be huge.

Basically, HFT trading is competition only between such scalpers. Return on one trade will be really insignificant, at least if you compare it even with those who trade intraday, but not scalping.

HFT trading is especially popular with those who have a faster channel of Internet access. Due to this the trader, firstly, can receive the necessary information faster than others, and secondly, he can send an order to open a trade faster than others.

That is, if you have weak Internet, which is characterized by lags and other delays, it is better not to deal with this type of trading.

HFT-Based Trading Systems

High-frequency trading involves the use of several rather interesting strategies with which you can generate substantial income. One of them is providing liquidity.

What does it mean? The trader provides liquidity, and their earnings are the difference in the forex spread between the bid and ask prices. Another strategy is statistical arbitrage. Using this method, you can benefit from the correlation of assets. This strategy can be used for trading on exchanges of different countries and on trading floors of the same country.

Search for liquidity. According to this method, a trader tries to find large volumes or hidden bids from other traders. One more method is arbitrage on delays. This technique is suitable in situations where you have access to information and have a time advantage, which can be realized through faster processing of orders.

Arbitrage on the news. This strategy is interesting for those who use news feeds in their work. As you can already guess from the name, here the trader is the first to receive some Forex statistics and immediately sends orders, working practically ahead of the market.

Arbitrage at the expense of reducing delays. This method involves revealing the imperfection of the equipment of submitting orders.

Who Implies High-Frequency Trading?

Theoretically, any person versed in computer technology and trading can create a robot that would analyze the market and make trades. But due to the fact that it's quite expensive, not every trader will undertake it.

Another limitation is the need to have the technology for direct access to the exchange and know a high-level programming language. And that is even more problematic for most private investors.

In addition, the process is not limited to the creation of the robot. It must be maintained, and technical conditions for its functioning must be created, and that is an additional cost.

That is why in most cases this type of trading is used by large companies. They have the technical and financial capabilities to do this:

Proprietary trading organizations are financial companies for which trading with different assets is the main kind of activity. It is due to the earnings that they exist.

They invest only their own funds in trades, choosing different financial markets;

Brokers having their own subdivisions for trading with high frequency and speed. Most often they are subsidiaries of brokers.

The trading is also done with the company's capital and the client and the proprietary trading are two separate lines of business;

Hedge funds: they capitalize on applying arbitrage strategies. For this purpose, such funds select suitable financial instruments and use the nuances of their pricing.

Besides the above-mentioned organizations, high-frequency trading is very popular among banks and investment institutions. They all have the following features in common:

- Solid capital that is invested in trades;

- Trading with own funds, not clients';

- Good financial performance: HFT is practiced only by successful companies.

As a rule, the algorithms used by organizations for high-frequency trading are kept secret. They are not in the public domain and they cannot be used by anyone.

However, it is important to note that such algorithms have recently become more accessible to individual users in terms of cost. But beginners should understand that they will have to deal with significant price jumps, which can sometimes be unexpected.

The best option is to gain skills during intraday trading and then switch to high-frequency trading.

Pros And Cons of High-Frequency Trading

This type of trading is primarily beneficial to those who use it in their activities. As we have already told, they are large companies, banks, hedge funds, and so on.

Due to the large number and high frequency of transactions, HFT allows these categories of market participants to obtain the maximum profit in the process of trading.

In addition, many experts agree that trading at high frequencies has a positive effect on the liquidity of many assets. And this makes them more attractive to many players, including private ones.

Also, high-frequency activity eliminates the factor of so-called missed opportunities. Its essence is that players do not have the opportunity to enter the terminal in order to place a profitable order.

Here is a specific example. For example, trader A has a share of a conventional corporation, and trader B plans to buy it at $10.

If they "find" each other in time, the deal will be closed, and the value of the stock will be the market value or close to that value. If there is no deal, Player A will have to decrease the price of the stock to sell, for example to $9.

This value will no longer be a market price. And it means that the price equilibrium will be broken. Thus, high-frequency trading speeds up these "encounters" of buyers and sellers, which balances the market.

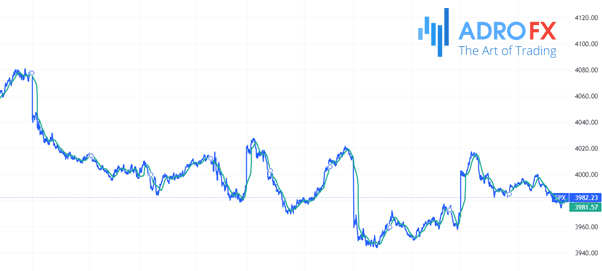

You can analyze how such activity deals with pricing inefficiencies with the charts below. The blue line is the price of futures on the S&P 500 stock index, and the green curve is the volume of trades made:

Ideally, they should correlate with each other. If you look at the one-minute chart, you can see that this is actually the case.

At the same time, this type of trading has its opponents. More precisely, they are critics who give the following arguments in favor of their positions:

- Artificial increase in volatility, market noise, and the formation of a false surge of supply or demand in the market. These three factors are especially dangerous to other market participants who do not use high-frequency trading in their activities;

- Securing a gain from a price that does not exist in reality. To clarify this point, let us assume that the EUR price is $1.1020.

At some point, the value decreases to 1.0020 on the platform in London. It takes about 0.5 seconds for this change to "reach" the exchange in New York.

That is, within a few moments there is a difference in price. It is used by HFT players who have time to place lots of orders and close them within those 0.5 seconds.

This has a negative effect on the market, and in addition, the ethics of such trading is highly questionable;

- Numerous facts of fraud, are possible because private players don't know the nuances of this type of trading. That is why opponents of high-frequency trading insist on its restriction and even prohibition;

- The impact of frontrunning: many HFT robots place trades moments before the big players enter the game. As a result, the balance in the market is disturbed and HFT players are left to benefit;

- Robots compete with each other. While private traders do not seek to compete with them, there is a serious struggle within high-frequency trading.

As a result, the implementation of complex schemes often results in reduced liquidity of assets;

- Large costs. The infrastructure required for high-frequency trading is expensive, but it is not always justified.

For example, to build the fiber optic line that connected Chicago and New York City, they had to make a hole in the mountains. And all the work cost $300 million.

And all this in order to reduce the execution time of a single transaction by three milliseconds.

Thus, the HFT activity has its advantages and disadvantages. That is why it is impossible to say unequivocally that it is a good or a bad option.

High-Frequency Trading: Potential Risks

It is important for those who are planning to connect their activity with this type of trading to understand that this type of business carries significant risks. Let us list the main risks:

- Technical malfunctioning of devices or trading networks. Even insignificant faults can lead to losses instead of expected returns.

For example, in 2012, the hedge fund Knight Capital lost over $450 million in one hour because of a technical error made by the developers when updating the algorithm. It made loss-making trades for more than 40 minutes, and it was only possible to find this fact due to automation after a large negative balance was formed on the account.

Since then the legislation regulating the risks in high-frequency trading has been updated, but such risks can not be excluded completely; - The possibility of artificial manipulation of the market, which leads to unexpected financial finals for other, smaller players. For instance, such a fact was revealed in 2009 when one of the funds manipulated the value of securities on the NASDAQ;

- Lack of confidence in the market by individual traders. Not every player will dare to continue trading and taking risks on the floor, where the share of high-frequency trading is high.

Here it is important to understand that all existing risks can be divided into those related to HFT traders and those related to other market participants. In the second case, we are talking about the very fact of existence of this type of trading.

What Are the Prospects for Such Trading?

The peak of popularity of high-frequency trading is gradually passing. Therefore there are doubts that it will develop in the future. The volume of companies providing HFT services is gradually decreasing. And this is in a situation where technology is constantly advancing.

Although, technology is one of the reasons why this type of trading is gradually losing popularity. The fact is that their development is gradually limited by traders' possibilities and laws of physics. And their constant development requires new investments that stop paying for themselves.

Another problem is possible errors, which, as you understand, can lead to serious losses of capital. It cannot be said that systems are released to the market without prior testing. However, this does not always save the day. Even a minor mistake by the one who prepares the software can lead to a significant loss of funds.

Now it is difficult to say how this market will develop further. Some players who used to do HFT are already switching to longer-term forecasting. Others still think there is a lot of funds to be made here and are betting on HFT. Perhaps there will be some kind of technological breakthrough ahead. However, there is still no sign of it at this time.

Conclusion

Thus, high-frequency trading has occupied its own niche in the market. At different periods the interest in this type of trading has either increased or, conversely, decreased dramatically.

But the fact is that it exists and is in demand by a certain category of market participants. And some enthusiasts are even confident that it is high-frequency trading's future in exchange trading.

Despite the criticism, it is proved that HFT helps to maintain liquidity, increase trading volumes and narrow the spread between the bid and ask prices. And all this increases the efficiency of pricing of many assets that are traded on the market.

On the other hand, this type of trading in most cases is available only to large institutional players. They are the ones who attain the most gain , and most often at the expense of smaller market participants.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.